- Home

- »

- Healthcare IT

- »

-

U.S. Mobile Clinics Market Size & Share Analysis Report, 2030GVR Report cover

![U.S. Mobile Clinics Market Size, Share & Trends Report]()

U.S. Mobile Clinics Market (2023 - 2030) Size, Share & Trends Analysis Report By Vehicles (Mobile Medical Van, Mobile Medical Bus), By Services (Maternal Health, Neonatal & Infant Health), By Design Layout, And Segment Forecasts

- Report ID: GVR-4-68040-038-4

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

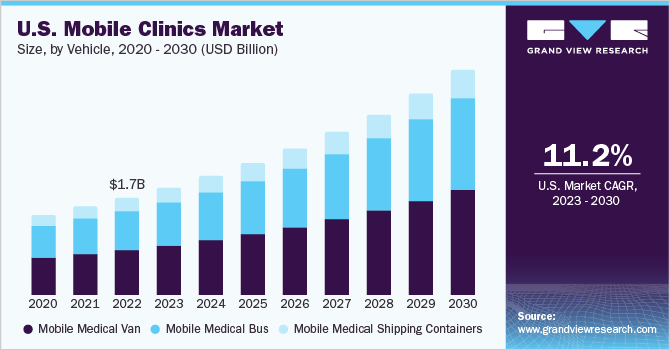

The U.S. mobile clinics market was valued at USD 1.66 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 11.2% from 2023 to 2030. This is attributed to the increasing need for preventive care such as vaccinations, screenings, dental checkups, maternal healthcare, bloodmobiles, and chronic disease management. According to a study published by International Journal for Equity in Health, mobile healthcare units witness around 3,500 visits every year. The COVID-19 pandemic has significantly impacted the U.S. mobile clinics market. The increased demand for cost-effective and accessible primary care solutions, combined with the acceleration of telemedicine adoption, has increased the demand for movable healthcare units. The government has increased funding for these clinics to address the primary care needs of communities during the pandemic.

For instance, in December 2021, the North Carolina Department of Health and Human Services announced funding of USD 4.4 million for 15 moveable healthcare units capable of providing screening treatment, assessment recovery support, and primary care services. The pandemic has also led to a shift towards preventive care in movable healthcare units and changes in operating procedures, such as the adoption of stricter infection control measures and remote patient monitoring technologies.

The U.S. healthcare sector is significantly changing as a result of increasing treatment costs and the rising prevalence of chronic diseases. This drastic change has increased the demand for enhanced healthcare accessibility and outcomes. Mobile health units play a vital role in providing healthcare facilities in areas that are cut off from essential medical aid due to climatic and geographical factors.

According to a study published by Ohio University, around 30 million U.S. citizens were uninsured and almost 20% of the population avoided essential care due to the high cost of treatment. Mobile health units provide hospital-level treatment at sliding scale rates or for free to such type of population.

Mobile clinics are vehicles that are customized to provide healthcare facilities to underserved communities. The presence of various reimbursement policies coupled with government and philanthropy funding is driving the market growth.

For instance, according to a study published by International Journal for Equity in Health, around 45% of the respondents reported funding for the development of mobile clinics from federal bodies whereas 52% of the respondents reported philanthropic funding. Moreover, funding from public and private insurance companies is expected to fuel the market growth over the forecast period.

Vehicles Insights

The mobile medical van segment accounted for the largest market share of 46.9% in 2022 owing to the rising awareness about the benefits of medical vans, such as convenience, affordability, and quality of care. For instance, according to MoveMobility Inc. in July 2021, mobile medical vans witnessed 6.5 million visits in the U.S.

The mobile medical bus segment is anticipated to grow at the fastest CAGR of 11.5 % over the forecast period. This growth is attributed to the versatility and mobility of medical buses. For instance, according to a study conducted by National Quality Forum in 2020, around 60 million Americans constituting 19% of the total U.S. population live in rural areas.

This population faces significant healthcare disparities coupled with transportation challenges and geographic isolation. Medical buses can travel to remote areas and serve a large number of patients, making them an effective solution for addressing critical conditions in rural communities.

Services Insights

The dental care segment accounted for the largest revenue share of 28.2% in 2022 owing to the lack of dental access in rural communities and the increasing prevalence of dental diseases in such areas. According to a study conducted by Rural Health Information Hub, as of March 2022, around 67% of rural America comes under Dental Health Professional Shortage Areas.

The OPD segment is expected to witness the fastest CAGR of 12.2% during the forecast period. The rapid expansion of the segment is attributed to its cost-effectiveness of the segment. Movable OPD clinics offer affordable outpatient care services, making them accessible to patients who cannot afford treatment otherwise.

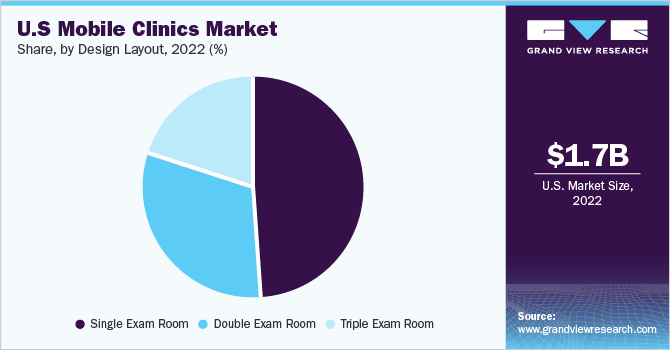

Design layout Insights

The single exam room segment dominated the U.S. mobile clinics market with a revenue share of 49.2% in 2022 owing to the increasing footfall in outpatient consulting. A single exam room offers individualized and effective patient evaluation. Moreover, technological advancements in the field of movable healthcare such as wearable devices, artificial intelligence, and machine learning are expected to fuel segment growth over the forecast period.

The double exam room segment is expected to be the fastest-growing segment with a CAGR of 11.5% during the period from 2023 to 2030. This outstanding growth is attributed to the rising adoption of this segment among the increasing geriatric population in rural areas in the U.S. According to U.S. Census Bureau, adults with age more than 65 years and older account for the nation’s 16.9% population.

Key Companies & Market Share Insights

Major players are engaging in various strategic initiatives such as acquisitions, partnerships, expansions, and collaborations. Key players adopt these strategies to acquire the untapped customer base and strengthen their position in the market. For instance, in June 2021, Benco Dental and ADI Mobile Health entered an agreement of acquisition. The goal of this acquisition is to couple ADI’s manufacturing and Benco’s Interior design expertise to provide a complete solution for its customers. Some prominent players in the U.S. mobile clinics market include:

-

Matthews Specialty Vehicles

-

Farber Specialty Vehicles

-

ADI Mobile Health

-

MinFound Medical Systems Co., Ltd

-

Medical Coaches

-

Odulair LLC.

U.S. Mobile Clinics Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 3.84 billion

Growth rate

CAGR of 11.2% from 2023 to 2030

Base year for estimation

2022

Historic data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million & CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Vehicles, Services, Design Layout

Country scope

U.S.

Key companies profiled

Matthews Specialty Vehicles; Farber Specialty Vehicles; ADI Mobile Health; MinFound Medical Systems Co., Ltd.; Medical Coaches; Odulair LLC

Customization scope

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Mobile Clinics Market Segmentation

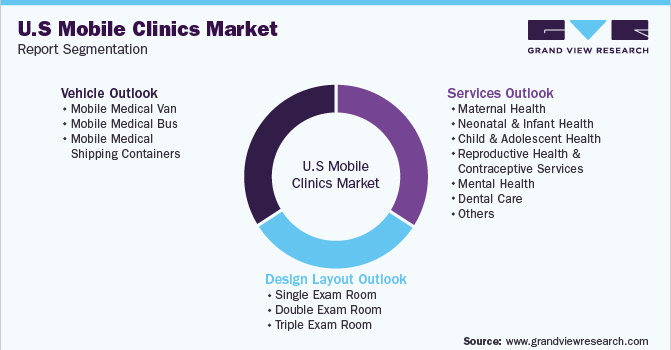

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. mobile clinics market report based on vehicle, services, and design layout:

-

Vehicle Outlook (Revenue, USD Million, 2017 - 2030)

-

Mobile Medical Van

-

Mobile Medical Bus

-

Mobile Medical Shipping Containers

-

-

Services Outlook (Revenue, USD Million, 2017 - 2030)

-

Maternal Health

-

Neonatal & Infant Health

-

Child & Adolescent Health

-

Reproductive Health & Contraceptive Services

-

Mental Health

-

Dental Care

-

ENT

-

Geriatric Care

-

OPD

-

Diagnosis/Screening

-

Emergency Care

-

Others

-

-

Design Layout Outlook (Revenue, USD Million, 2017 - 2030)

-

Single Exam Room

-

Double Exam Room

-

Triple Exam room

-

Frequently Asked Questions About This Report

b. The U.S. mobile clinics market size accounted for USD 1.66 billion in 2022 and is anticipated to reach USD 1.83 billion in 2023.

b. The U.S. mobile clinics market is expected to grow at a CAGR of 11.2% from 2023 to 2030 to reach USD 3.84 billion by 2030.

b. The mobile medical van segment accounted for the largest U.S. mobile clinics market share in 2022, based on vehicles. This is attributed to the rising awareness about the benefits of medical vans, such as convenience, affordability, and quality of care.

b. Some of the key market players positively influencing the U.S. mobile clinics market are Matthews Specialty Vehicles, Farber Specialty Vehicles, ADI Mobile Health, and MinFound Medical Systems Co., Ltd.

b. Key factors contributing to the growth of the market include increasing awareness about preventive care, the cost-effective nature of the market, technological advancement, and rising government support in the form of funding.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.