- Home

- »

- Communication Services

- »

-

U.S. Mobile Value Added Services Market Size Report, 2033GVR Report cover

![U.S. Mobile Value Added Services Market Size, Share & Trends Report]()

U.S. Mobile Value Added Services Market (2025 - 2033) Size, Share & Trends Analysis Report By Solution, By End Use (Consumers, Enterprises), By Vertical (BFSI, Media and Entertainment, Telecom & IT, Retail & E-commerce, Healthcare), And Segment Forecasts

- Report ID: GVR-4-68040-646-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Mobile Value Added Services Market Summary

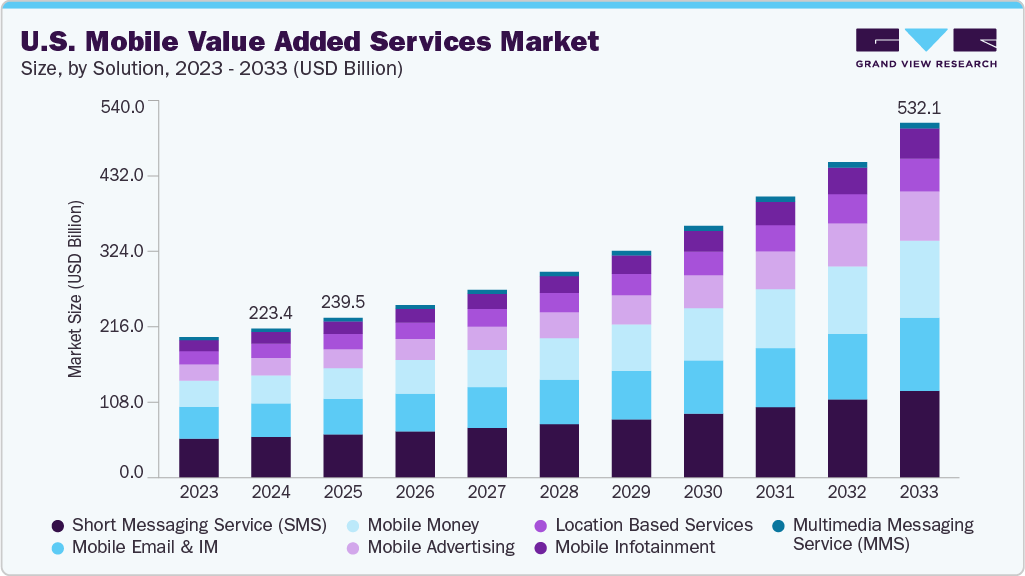

The U.S. mobile value added services market size was estimated at USD 223.39 billion in 2024 and is projected to reach USD 532.13 billion by 2033, growing at a CAGR of 10.5% from 2025 to 2033. The rollout of 5G across the U.S. significantly enhances the performance of mobile value-added services by enabling ultra-low latency, faster speeds, and greater device connectivity. This drives the adoption of advanced services such as real-time mobile gaming, AR/VR-based infotainment, and high-definition video streaming. U.S. telecom companies are actively leveraging 5G to introduce new VAS experiences, particularly targeting enterprise clients in sectors such as healthcare, logistics, and manufacturing. The high penetration of 5G-compatible devices is expected to further fuel demand for data-intensive VAS offerings.

Mobile financial services are rapidly gaining ground in the U.S. as consumers seek faster, contactless, and more secure ways to transact. Mobile wallets such as Apple Pay and Google Wallet dominate the landscape, with increasing integration into retail, transit, and peer-to-peer payment ecosystems. Telecom providers are forming fintech partnerships to embed financial VAS into mobile platforms, especially targeting underserved and younger demographics. The growing comfort with digital payments post-COVID has made this one of the most promising growth areas within the U.S. mobile value added services industry.

In the U.S., mobile advertising continues to surge, driven by the shift of media consumption to smartphones and the growing effectiveness of AI-driven personalization. Advertisers use location-based services, behavioral analytics, and programmatic ad platforms to deliver more targeted and engaging ads. Telecom carriers are capitalizing on this by offering branded VAS bundles that include sponsored content, app promotions, and real-time marketing alerts. Evolving privacy regulations are driving U.S. companies to invest in consent-based data strategies to balance personalization and compliance, thereby driving the market’s growth.

The U.S. market is witnessing strong demand for smart home VAS integrated with IoT, including remote control of appliances, home security, energy management, and health monitoring. Telecom operators are bundling these services with mobile and broadband plans, offering centralized control through mobile apps. Consumer interest in convenience, safety, and energy efficiency is pushing the adoption of such services, especially among homeowners. The expanding IoT ecosystem in the U.S. creates new opportunities for telecom companies through bundled and subscription-based VAS, thereby driving the growth of the market.

With the rise of hybrid and remote work models in the U.S., enterprises increasingly rely on mobile VAS for employee communication, collaboration, and data access. Services such as secure messaging, mobile CRM, video conferencing, and cloud integration are being adopted across industries, including finance, education, and healthcare. U.S. telecom providers are partnering with software vendors to deliver customized enterprise VAS that support productivity and compliance. This trend will continue as organizations prioritize flexibility, security, and mobile-first strategies in their digital transformation efforts.

Solution Insights

The Short Messaging Service (SMS) segment dominated the market in 2024 and accounted for the largest share of 27.5%. The segment’s growth is driven by its high penetration level and consumer and enterprise communication effectiveness. Despite the rise of internet-based messaging apps, SMS is critical in areas such as two-factor authentication (2FA), appointment reminders, transaction alerts, and emergency notifications. American businesses increasingly use Application-to-Person (A2P) SMS for marketing, customer service, and delivery updates, especially in sectors such as healthcare, retail, and financial services.

The mobile advertising segment is expected to witness the fastest CAGR over the forecast period. The segment’s growth is driven by the country's high smartphone penetration and shift in consumer behavior toward mobile-first media consumption. Brands prioritize mobile channels to deliver hyper-targeted, real-time ads using advanced data analytics, location services, and AI-driven personalization. Major U.S. telecom providers have invested in ad tech platforms and partnerships to monetize user data through mobile ads, thereby driving the segment’s growth.

End Use Insights

The consumer segment dominated the market in 2024. Consumer adoption of mobile value-added services in the U.S. is being driven by the increasing reliance on smartphones for everyday activities such as shopping, entertainment, banking, and communication. The proliferation of OTT platforms, mobile gaming, and on-demand content is fueling demand for infotainment services, while mobile wallets and health monitoring apps are becoming mainstream. U.S. consumers, especially younger demographics, expect personalized, real-time, and interactive mobile experiences, prompting service providers to bundle value-added features such as loyalty rewards, location-based alerts, and smart home integration. The expanding 5G infrastructure and affordable data plans further enable seamless access to high-bandwidth VAS, reinforcing consumer engagement and usage.

The enterprises segment is expected to witness the fastest CAGR over the forecast period. In the U.S., enterprises increasingly adopt Mobile VAS to improve customer engagement, streamline operations, and support hybrid work models. From A2P messaging for customer service to mobile advertising, workforce management tools, and cloud-based collaboration platforms, enterprises leverage VAS to enhance business agility and responsiveness. Retail, healthcare, and finance sectors are leading adoption, using VAS for personalized marketing, remote consultations, mobile banking, and secure communications.

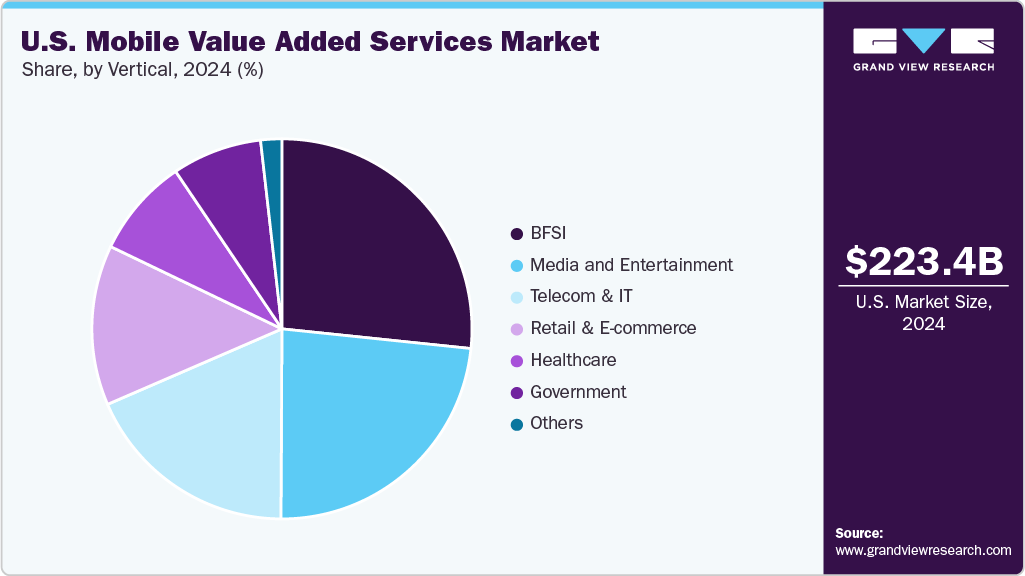

Vertical Insights

The BFSI segment dominated the market in 2024. The BFSI sector is a major adopter of mobile value-added services, utilizing tools such as mobile banking, digital wallets, AI-driven chatbots, and advanced fraud detection systems. According to a study conducted by the American Bankers Association, in 2024, more than half of U.S. consumers prefer mobile apps over any other method for managing their bank accounts. The survey revealed that 55% of banking customers primarily use mobile apps on their smartphones or other devices, while 22% favor online banking through a laptop or desktop computer. Thus, increasing use of mobile banking services by U.S. consumers can be attributed to the segment’s growth.

The healthcare segment is expected to witness the fastest CAGR over the forecast period. The healthcare sector is rapidly embracing mobile value-added services for applications such as telemedicine, remote diagnostics, and AI-powered health monitoring. Mobile health (mHealth) app adoption has surged in recent years, with key growth areas including remote patient monitoring, virtual consultations, and AI-enabled medical chatbots. Hospitals and pharmaceutical companies actively deploy SMS-based medication reminders, virtual health assistants, and wearable health tracking devices to enhance patient engagement and care delivery through mobile healthcare solutions.

Key U.S. Mobile Value Added Services Company Insights

Some of the key companies in the accounting software industry include Verizon Communications Inc., AT&T Inc., and T-Mobile US, Inc., among others. These companies focus on service diversification, network infrastructure, pricing, and content partnerships. In addition, providers are gaining traction by delivering localized and affordable VAS, intensifying competition across both developed and emerging markets. Strategic collaborations and bundled service models are becoming key strategies to enhance user retention and revenue generation.

-

Verizon Communications Inc. is a major company in the U.S. mobile VAS market. It leverages its extensive 5G infrastructure to offer a wide range of advanced services, including mobile advertising, smart home integration, and enterprise mobility solutions. Through partnerships with tech and media companies, the company continues to expand its VAS portfolio to enhance customer retention and monetize data-driven solutions.

-

AT&T Inc. is pivotal in shaping the U.S. mobile VAS landscape by delivering innovative solutions across entertainment, advertising, and enterprise connectivity. The company has focused on integrating edge computing and 5G capabilities into its VAS strategy to support sectors such as healthcare, retail, and automotive. Its commitment to digital transformation and content delivery gives it a strong competitive edge in the VAS ecosystem.

Key U.S. Mobile Value Added Services Companies:

- Apple Inc.

- AT&T Inc.

- Verizon Communications Inc.

- Vodafone Group Plc

- T-Mobile US, Inc.

- OnMobile Global

- Telenity

- Comviva Technologies

Recent Developments

-

In June 2025, Trump Mobile launched T1 Mobile, a groundbreaking new cellular service aimed at providing exceptional connectivity, outstanding value, and reliable all-American support for the nation’s most dedicated workers.

-

In November 2024, NUWAVE Communications, a prominent provider of advanced communication solutions, introduced its Business Text Messaging service in collaboration with Clerk Chat. This innovative solution enables seamless integration of SMS, MMS, and WhatsApp messaging into widely used platforms such as Webex, Microsoft Teams, and Zoom, revolutionizing how businesses connect and interact with customers across various communication channels.

U.S. Mobile Value Added Services Market Report Scope

Report Attribute

Details

Revenue forecast in 2025

USD 239.51 billion

Revenue forecast in 2033

USD 532.13 billion

Growth rate

CAGR of 10.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, end use, and vertical

Country scope

U.S.

Key companies profiled

Google; Apple Inc.; AT&T Inc.; Verizon Communications Inc.; Vodafone Group Plc; T-Mobile US, Inc.; OnMobile Global; Telenity; Comviva Technologies

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Mobile Value Added Services Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. mobile value added services market report based on solution, end use and vertical:

-

Solution Outlook (Revenue, USD Million, 2021 - 2033)

-

Short Messaging Service (SMS)

-

Mobile Email & IM

-

Mobile Money

-

Mobile Advertising

-

Location Based Services

-

Mobile Infotainment

-

Multimedia Messaging Service (MMS)

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Consumers

-

Enterprises

-

-

Vertical Outlook (Revenue, USD Million, 2021 - 2033)

-

BFSI

-

Media and Entertainment

-

Telecom & IT

-

Retail & E-commerce

-

Healthcare

-

Government

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. mobile value added services market size was estimated at USD 223.39 billion in 2024 and is expected to reach USD 239.51 billion in 2025.

b. The U.S. mobile value added services market is expected to grow at a compound annual growth rate of 10.5% from 2025 to 2033 to reach USD 532.13 billion in 2033.

b. The Short Messaging Service (SMS) segment dominated the market in 2024 and accounted for the largest share of 27.5%. The segment’s growth is driven by its high level of penetration and effectiveness in both consumer and enterprise communication.

b. Some key players operating in the U.S. mobile value added services market include Google, Apple Inc., AT&T Inc., Verizon Communications Inc., Vodafone Group Plc, T-Mobile US, Inc., OnMobile Global, Telenity, and Comviva Technologies.

b. The rollout of 5G across the U.S. is significantly enhancing the performance of mobile value-added services by enabling ultra-low latency, faster speeds, and greater device connectivity. This is driving the adoption of advanced services such as real-time mobile gaming, AR/VR-based infotainment, and high-definition video streaming.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.