U.S. Motorcycle Market Size & Trends

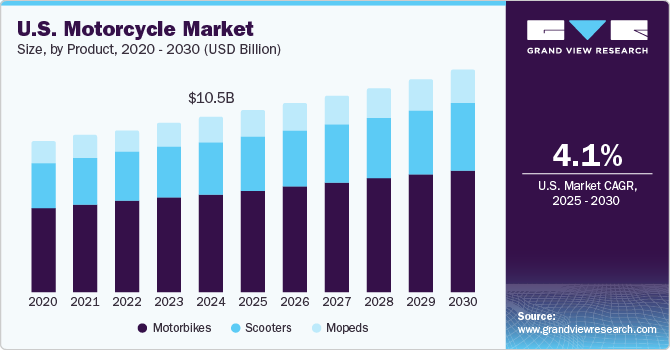

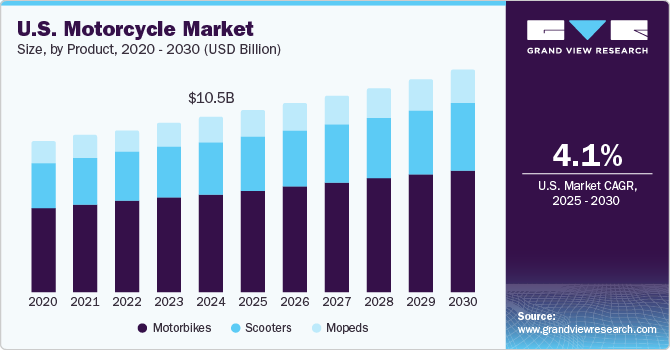

The U.S. motorcycle market size was valued at USD 10.48 billion in 2024 and is expected to expand at a CAGR of 4.1% from 2025 to 2030. The market growth is attributed to motorcycles' increasing popularity for recreational and commuting purposes. The rise of urbanization and the need for efficient and economical transportation options have boosted the demand for motorcycles. Additionally, the growing interest in adventure and sports motorcycles, along with the expansion of motorcycle clubs and events, has further fueled market growth. Advances in motorcycle technology, including electric and hybrid models, are also contributing to the market's expansion.

Rising fuel costs have made motorcycles, known for their fuel efficiency, an attractive option for cost-conscious consumers. Urban congestion and the need for efficient transportation solutions further boost the appeal of motorcycles, which can navigate traffic more easily than cars. Technological advancements, including electric and hybrid models with improved safety features and fuel efficiency, are also drawing new riders and encouraging existing ones to upgrade.

The motorcycle lifestyle, associated with freedom and adventure, continues to grow in popularity, particularly with the increase in long-distance touring and off-road adventures. The trend of customizing motorcycles to reflect individual styles is gaining momentum, driving demand for aftermarket parts and accessories. Enhanced marketing efforts by manufacturers, higher disposable incomes, and the availability of motorcycle safety courses also contribute to market growth. Additionally, supportive government policies and initiatives, such as subsidies for electric vehicles and improved infrastructure for motorcyclists, are playing a crucial role in driving the market's expansion.

Product Insights

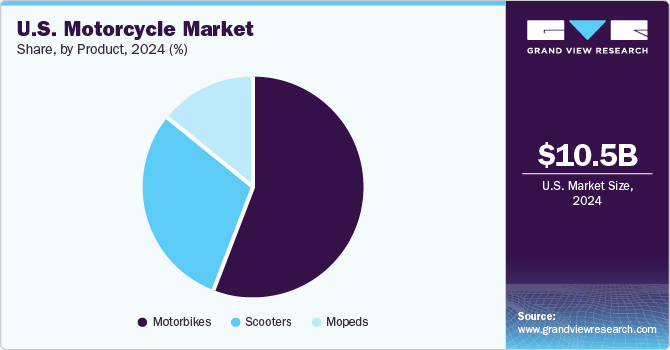

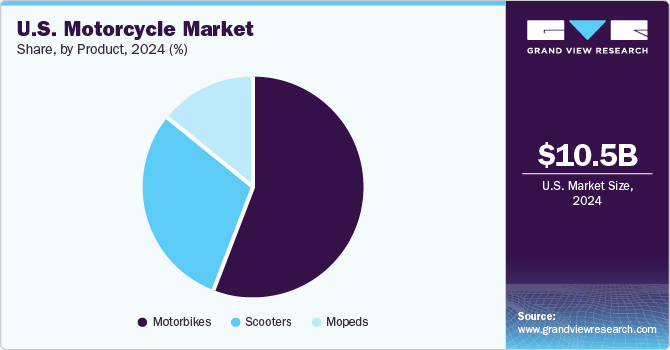

Motorbikes dominated the market with the largest revenue share of 56.0% in 2024. Motorbikes are highly versatile and cater to a wide range of consumer needs, from daily commuting to recreational riding and long-distance touring. Their relatively lower cost compared to cars and their fuel efficiency make them an attractive option for cost-conscious consumers. Additionally, the growing popularity of adventure and sports motorbikes has boosted sales, as these bikes offer both performance and the thrill of riding. The trend of customizing motorbikes to suit individual styles and preferences has also contributed to their popularity, driving demand for both new bikes and aftermarket parts. The influence of motorcycle clubs and community events further promotes the motorbike culture, encouraging more people to take up riding.

Scooters are expected to grow at the fastest CAGR of 4.3% over the forecast period. Scooters are incredibly convenient for urban commuting, offering ease of maneuverability and parking in congested city environments. Their fuel efficiency and relatively lower cost compared to other motorbikes make them an attractive option for daily transportation. Additionally, the increasing awareness of environmental issues has led to a growing preference for electric scooters, which produce zero emissions and are more eco-friendly. The rise of shared mobility solutions, including scooter-sharing services, has also contributed to the popularity of scooters. Furthermore, advancements in scooter design, including improved safety features and stylish aesthetics, appeal to a broad range of consumers, from students to professionals.

Key U.S. Motorcycle Company Insights

Some key companies in the U.S. motorcycle market include Suzuki Motor Corporation, HARLEY-DAVIDSON; Honda Motor Co., Ltd.; BMW AG. Some prominent players in the U.S. motorcycle market include:

-

Suzuki Motor Corporation is a renowned global player in the motorcycle industry, offering a diverse range of motorcycles and scooters. Their product lineup includes GSX-R Series, V-Strom Series, Hayabusa, Gixxer Series, Burgman Series, Katana, and Avenis. Suzuki's commitment to innovation and quality ensures that their motorcycles and scooters cater to a wide range of consumer needs, from daily commuting to high-performance racing.

-

Harley-Davidson is an iconic brand in the motorcycle industry, known for its distinctive cruisers and touring bikes. Their offerings include:Sportster Series, Softail Series, Touring Series, Fat Bob, Nightster, Pan America, and LiveWire. Harley-Davidson's motorcycles are celebrated for their powerful engines, distinctive design, and the sense of freedom they offer riders. The brand's rich history and loyal following make it a staple in the motorcycle industry.

Key U.S. Motorcycle Companies:

- Suzuki Motor Corporation

- HARLEY-DAVIDSON

- Honda Motor Co., Ltd.

- BMW AG

- Yamaha Motor Co., Ltd

- Kawasaki Heavy Industries, Ltd

- Ducati Motor Holding S.p.A

- KTM AG

- Polaris Inc.

- Triumph Motorcycles

U.S. Motorcycle Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 10.89 billion

|

|

Revenue forecast in 2030

|

USD 13.28 billion

|

|

Growth Rate

|

CAGR of 4.1% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Report updated

|

December 2024

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product

|

|

Country scope

|

U.S.

|

|

Key companies profiled

|

Suzuki Motor Corporation; HARLEY-DAVIDSON; Honda Motor Co., Ltd.; BMW AG; Yamaha Motor Co., Ltd; Kawasaki Heavy Industries, Ltd; Ducati Motor Holding S.p.A ; KTM AG; Polaris Inc.; Triumph Motorcycles

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Motorcycle Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. motorcycle market report based on product: