- Home

- »

- Next Generation Technologies

- »

-

U.S. Music Streaming Market Size, Industry Report, 2030GVR Report cover

![U.S. Music Streaming Market Size, Share & Trends Report]()

U.S. Music Streaming Market (2025 - 2030) Size, Share & Trends Analysis Report By Service (On-demand Streaming, Live Streaming), By Platform (Apps, Browsers), By Content Type, By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-224-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Music Streaming Market Trends

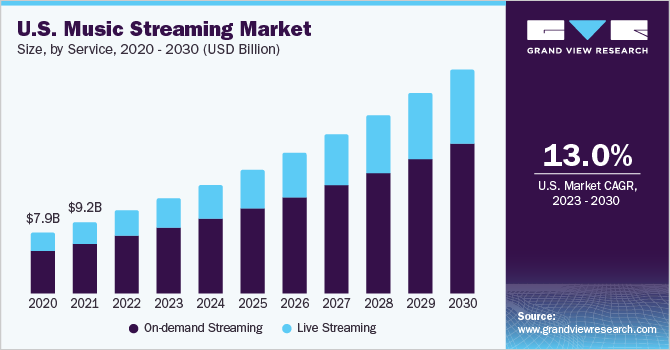

The U.S. music streaming market size was estimated at USD 11.05 billion in 2024 and is projected to grow at a CAGR of 13.4% from 2025 to 2030. This growth is primarily driven by the widespread smartphone adoption, high-speed internet penetration, and shifting consumer preferences from music ownership to on-demand access in the country. U.S. consumers are increasingly favoring personalized playlists, offline listening, and seamless cross-device experiences, transforming music consumption into an "on-tap" activity rather than owning physical or digital copies, which is further driving the U.S. music streaming industry expansion.

The integration of music streaming services with smart devices has played a pivotal role in the U.S. market’s growth. U.S. consumers are increasingly using voice-controlled devices such as Amazon Echo, Google Nest, and Apple HomePod to access music streaming services, making music consumption more convenient and hands-free. The seamless integration between streaming platforms and smart devices has become a significant driver in attracting new users, especially as smart home ecosystems grow. As the demand for connected living experiences rises, music streaming via smart devices is expected to present lucrative growth opportunities in the market.

Furthermore, exclusive content and artist collaborations are becoming a key differentiator in the U.S. music streaming industry. Services such as Apple Music and Tidal have successfully attracted U.S. users by offering exclusive album releases, early access to music, and behind-the-scenes content from top artists. These partnerships provide listeners with unique experiences that are not available on other platforms, increasing subscriber loyalty and driving user engagement. As artists continue to leverage streaming platforms for exclusive content, this trend is expected to be a major growth driver in the U.S. music streaming industry expansion.

Moreover, social media’s influence on music streaming is a growing trend in the U.S. Consumers in the U.S. regions are discovering music through these platforms, often leading to an uptick in streams for trending songs. Music streaming services such as Spotify AB and Apple Music have integrated social sharing features, allowing users to share their favorite tracks across social media, further promoting music discovery. This integration between social media and music streaming is reshaping how people engage with and consume music in the U.S.

Companies in the U.S. music streaming industry are forming strategic partnerships with artists, record labels, and tech companies to enhance their content offerings and expand their reach. Collaborations with U.S. artists enable platforms to provide exclusive content, early releases, and special events, attracting new subscribers. Such strategies are expected to significantly contribute to the growth of the U.S. music streaming industry in the coming years.

Service Insights

Based on service, the on-demand streaming segment led the market with the largest revenue share of 69.12% in 2024, driven by consumer demand for convenience, instant access, and personalization. Users can select any track, album, or playlist at any time, creating highly tailored listening experiences. The proliferation of smartphones, high-speed internet, and smart devices has made it easy for Americans to access vast music catalogs on the go. The shift from owning music to renting access, combined with features like curated playlists, offline listening, and improved audio quality, continues to fuel the dominance of on-demand streaming platforms in the U.S. market.

The live streaming segment is expected to witness at the fastest CAGR of 14% from 2025 to 2030. Live streaming is gaining rapid traction in the U.S. as consumers seek real-time, interactive music experiences such as virtual concerts and artist Q&A sessions. The pandemic accelerated the adoption of live streaming, making it a key channel for artists to reach fans without geographical barriers. The integration of real-time engagement tools, such as live chat and tipping, enhances fan interaction, while investments in high-quality streaming infrastructure ensure seamless experiences. These factors, along with the desire for exclusive, time-sensitive content, are propelling the growth of live music streaming in the U.S.

Platform Insights

Based on platform, the apps segment accounted for the largest market revenue share in 2024, owing to their portability, ease of use, and integration with smart devices and social media. Americans increasingly prefer apps for their exclusive features, frequent updates, and AI-driven recommendations. The ability to listen offline, receive personalized suggestions, and connect with other services (like smart speakers or fitness trackers) makes apps the go-to choice for music consumption on mobile devices.

The browsers segment is expected to witness at the fastest CAGR from 2025 to 2030. Browser-based music streaming is gaining traction in the U.S., particularly among desktop users who enjoy listening while working or multitasking. The main drivers are accessibility, no need for downloads, and seamless integration with productivity tools. As streaming services continue to offer robust web platforms alongside apps, the convenience of accessing music directly from browsers without additional software appeals to users seeking flexibility and minimal device clutter, thereby driving segmental growth.

Content Type Insights

Based on content type, the audio segment accounted for the largest market share in 2024, owing to the long-standing popularity of music as an audio-based medium. The rise of podcasts and spoken word content within music apps, along with high-fidelity and lossless audio options, further boosts user engagement and time spent on platforms. Audio’s versatility and ability to fit into various activities, from commuting to exercising, are expected to contribute significantly in the coming years.

The video segment is expected to witness at the fastest CAGR from 2025 to 2030. Video streaming in music, such as music videos and live performances, is expanding in the U.S., as platforms integrate visual content to enhance user engagement. The appeal of exclusive video releases, artist interviews, and behind-the-scenes footage attracts users seeking a richer multimedia experience. The trend toward merging audio and video content, as seen with YouTube Music and similar services, is driving the growth of video segment within the U.S. music streaming industry.

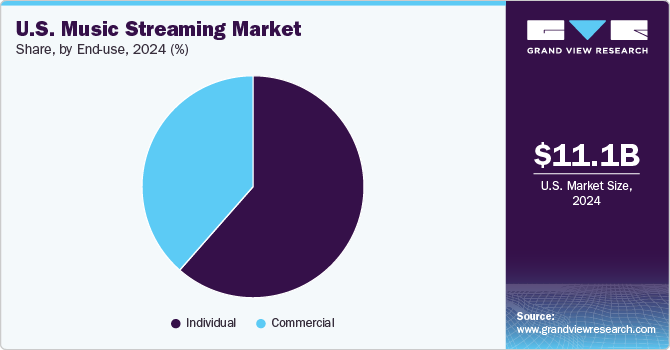

End Use Insights

Based on end use, the individual segment accounted for the largest market share in 2024. Individual users are the primary adopters of music streaming in the U.S., driven by the desire for personalized experiences. Advanced recommendation algorithms, curated playlists, and mood-based selections cater to unique tastes and preferences. The ability to discover new music and customize listening sessions makes streaming a highly personal activity, leading to high engagement and retention rates among American consumers.

The commercial segment is expected to register at the fastest CAGR from 2025 to 2030. The commercial segment, including businesses such as restaurants, gyms, and salons, is expanding rapidly in the U.S. as enterprises leverage music streaming to enhance customer experience. Data analytics and insights help businesses select music that matches their brand and clientele, while licensing solutions ensure legal compliance. The use of streaming to create tailored atmospheres and improve customer satisfaction is a key growth driver in this segment.

Key U.S. Music Streaming Company Insights

Some of the key players operating in the market are Spotify AB and Apple, Inc., among others.

-

Spotify AB is a music streaming service provider that provides users with access to millions of tracks and episodes of music and podcasts. Available on various devices, the company allows users to choose what they want to listen to or be surprised by curated content. Users can also explore collections from friends, artists, and celebrities or create personalized radio stations. The company operates on a freemium model, offering both free (ad-supported) and subscription-based (ad-free) access. Spotify USA, Inc. caters to users in the United States, while Spotify AB serves users in all other markets.

-

Apple, Inc. (Apple Music) is Apple's subscription-based music streaming service, offering users access to over 100 million songs. Subscribers can listen ad-free, both online and offline, and enjoy features like Spatial Audio for an immersive listening experience and lossless audio for high-fidelity sound. The platform includes original content such as exclusive interviews, live concerts, and radio shows. A unique feature, Apple Music Sing, allows users to sing along with real-time lyrics. Apple Music is accessible across all Apple devices, as well as on other platforms, making it a versatile option for music lovers.

Tidal and YouTube Music are some of the emerging market participants in the U.S. music streaming industry.

-

TREBEL is an emerging player in the U.S. market, known for its unique free music streaming model that allows users to download songs for offline play without a subscription fee legally. It has shown rapid growth, with over 12 million monthly listeners and more than 100% year-over-year growth. TREBEL’s business model combines advertising and multi-modal monetization, targeting users who are unwilling or unable to pay for premium services, making it an emerging player in the market.

-

Audiomack is another emerging player gaining traction, particularly with growth in Latin music streams. The company is expanding its licensing deals to cover more countries. Audiomack’s focus on music discovery and regional expansion positions it as a fast-growing platform in the U.S. and global markets.

Key U.S. Music Streaming Companies:

- Spotify AB

- Apple, Inc. (Apple Music)

- Amazon.com, Inc. (Amazon Music)

- Deezer SA

- Audiomack

- TREBEL

- Music Choice

- iHeartMedia, Inc.

- YouTube Music

Recent Developments

-

In April 2025, Deezer SA introduced a range of new features to enhance user personalization and sharing. Key updates include customizable music recommendations, a revamped Favorites tab, personalized playlist covers, monthly listening insights through “My Deezer Month,” and universal sharing links that allow users to share songs across platforms like Spotify, Apple Music, and YouTube Music.

-

In December 2024, the redesigned app introduced features like customizable presets, a live radio dial, real-time trending content, and on-screen lyrics. It also offers exclusive editorial content, enhancing the personalized listening experience.

-

In August 2024, Amazon.com, Inc. (Amazon Music) launched Maestro, an AI playlist generator currently in beta for selected U.S. customers on iOS and Android. Additionally, Amazon Music is introducing AI-generated "Topics" tags for podcasts, allowing listeners to discover related content by tapping on these tags beneath episode descriptions. Users can find these tags on popular podcasts like The Daily, SmartLess, and This American Life by updating to the latest version of the Amazon Music app and navigating to the podcast section.

U.S. Music Streaming Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 12.64 billion

Revenue forecast in 2030

USD 23.69 billion

Growth rate

CAGR of 13.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

April 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Platform, service, content type, end use

Country scope

U.S.

Key companies profiled

Spotify AB; Apple Inc. (Apple Music); Amazon.com Inc. (Amazon Music); Deezer SA; Audiomack; TREBEL; Music Choice; iHeartMedia Inc.; YouTube Music

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Music Streaming Market Report Segmentation

This report forecasts revenue growth at the regional level and provides an analysis of the latest technology trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. music streaming market report based on service, platform, content type, and end use:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

On-demand streaming

-

Live streaming

-

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Apps

-

Browsers

-

-

Content Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Audio

-

Video

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Individual

-

Commercial

-

Frequently Asked Questions About This Report

b. The U.S. music streaming market size was valued at USD 11.05 billion in 2024 and is expected to reach USD 12.64 billion in 2025.

b. The U.S. music streaming market is expected to grow at a compound annual growth rate (CAGR) of 13.4% from 2025 to 2030 to reach USD 23.69 billion by 2030.

b. The on-demand streaming segment accounted for the largest revenue share of around 69% in 2024 and is expected to dominate the market over the forecast period. The on-demand music stream allows the users to listen to songs on the Digital Service Provider's website (DSP) without any limited time or playing capacity.

b. Some key players operating in the U.S. music streaming market include Amazon.com, Inc., Apple, Inc., Deezer SA, Google LLC, iHeartMedia, Inc., Pandora Media, Inc., SoundCloud Global Limited & Co. KG, Spotify AB, Tencent Music Entertainment Group, Tidal

b. The growing adoption of digital platforms and the widespread utilization of smart devices that allow users to see music videos and listen to podcasts along with audio files is driving the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.