- Home

- »

- Medical Imaging

- »

-

U.S. Near Infrared Imaging Market, Industry Report, 2030GVR Report cover

![U.S. Near Infrared Imaging Market Size, Share & Trends Report]()

U.S. Near Infrared Imaging Market Size, Share & Trends Analysis Report By Product (Device, Reagents), By Application (Cancer Surgeries, Gastrointestinal Surgeries), By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-235-2

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. Near Infrared Imaging Market Trends

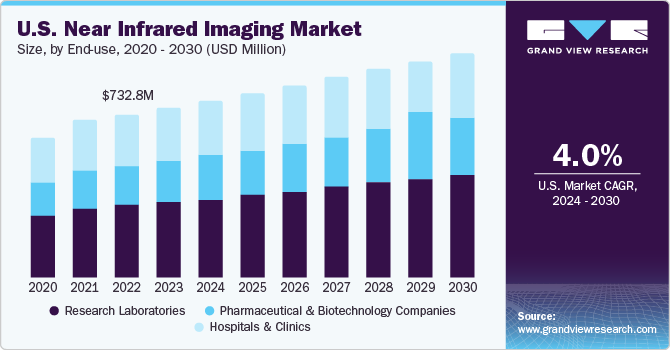

The U.S. near infrared imaging market size was estimated at USD 763.4 million in 2023 and is expected to grow at a CAGR of 4.0% from 2024 to 2030. Major driving factors of this growth include the growing geriatric population, the rising need for minimally invasive surgical procedures, and the presence of multifaceted advantages provided by near infrared (NIR) imaging. Moreover, the increasing number of surgical procedures due to a high prevalence of target disease will likely to increase opportunities for market growth over the forecast period.

The prevalence and occurrence of various diseases, including cardiovascular diseases, cancer, neurovascular disorders, and gastrointestinal diseases, are increasing, which is leading to a rise in the number of surgical procedures being carried out. In addition, trauma patients and individuals seeking cosmetic surgery are also contributing to the surge in surgical treatment options. NIR technology is used for a diverse range of surgical procedures, including plastic and reconstructive surgeries, cancer surgeries, cardiothoracic surgeries, cardiovascular surgeries, and gastrointestinal surgeries, as well as neurovascular surgeries.

The rise in surgical interventions has led to an increased use of visualization equipment for surgeries. Microsurgery has become popular due to the growing prevalence of chronic diseases caused by various factors like stress, sedentary lifestyle, and heredity. This technique involves operating under a microscope, allowing surgeons to work on very small structures like blood vessels and nerves. Microsurgery is beneficial for complex reconstructive operations, nerve repair, blood vessel repair, and tissue transfers. Compared to laparoscopic surgery, microsurgery has been shown to decrease complications, hospitalstays, and recurrence rates while improving sperm concentration in varicocele treatment.

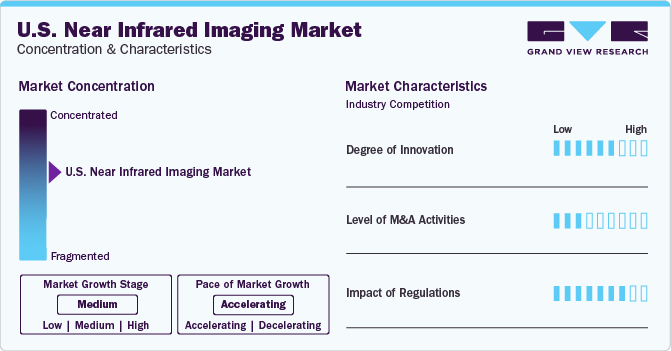

Market Characteristics & Concentration

The introduction of new near-infrared (NIR) devices caters to a wide range of consumer needs and preferences, leading to an expansion in market size and overall demand. By launching specific NIR systems for various medical conditions, effectiveness can be enhanced, unmet needs can be met, and more patients seeking advanced treatments can be engaged. This approach not only benefits patients but also contributes to the growth of industries by attracting a larger customer base.

The U.S. Near Infrared Imaging market is heavily regulated by the Food and Drug Administration (FDA), which sets strict standards for the safety and efficacy of imaging devices. This has resulted in a highly competitive market, with companies investing heavily in research and development to bring NIR systems to industry.

Few of the market near-infrared imaging companies have been involved in mergers and acquisitions to increase their share in the market and provide innovative solutions to the consumers that are anticipated to boost the market growth during the forecast period.

Product Insights

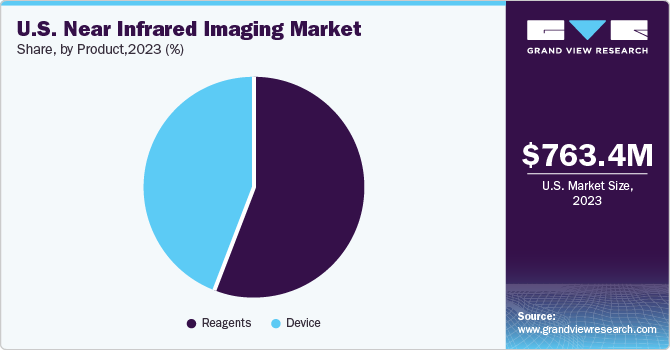

Based on product, reagents dominated the market with the largest share of 56% in 2023 and are projected to grow at the fastest CAGR over the forecast period. This growth can be attributed to the higher detection efficacy in biological systems, strong tissue penetration features, and in-depth imaging trends shown by reagents. Reagents are utilized for various image-guided interventions in clinical practices, offering several applications such as real-time cancer detection. Moreover, several research institutes focus on innovative imaging detection technique development using these reagents, contributing to better treatment outcomes in patients and thereby increasing the growth of this segment For instance, in January 2023, researchers at Rice University developed a new fluorescent dye for non-invasive brain imaging.

The devices segment is expected to expand at a significant CAGR from 2024 to 2030 owing development of NIR systems for surgical use. These devices include near-infrared fluorescence and near-infrared fluroscence& bioluminescence imaging systems. These devices offer radiation-free and non-invasive imaging, thereby increasing their demand during the forecast period.

Application Insights

Based on application, preclinical imaging held the largest market share of 25% in 2023. The driving factors contributing to this growth include increasing preclinical studies for targeted disease sectors such as cancer, inflammation, and infectious disease. The adoption of advanced reagents with tissue penetration features escalates its use in preclinical studies. Moreover, NIR imaging studies for detecting raw materials as API in clinical studies. For instance, in June 2023, the study a research article titled “Indocyanine Green-enhanced Fluroscenece to Assess Bowel Perfusion during Robotic-assisted Rectal Surgery.”

The cancer surgeries segment is anticipated to grow at the fastest CAGR from 2024 to 2030. owing to the significance of NIR imaging in cancer detection. NIR systems are utilized intraoperatively during cancer surgery to visualize tumor cells, vascular organs, blood flow, and other critical structures with precision. These systems accurately outline the tumor structure, aiding in its effective resection. Moreover, the high prevalence of cancer surgeries further contributes to the growth of this segment. For instance, According to the Clinical Research Cancer article, over 700,000 people undergo cancer surgery each year in the U.S.

End Use Market Insights

Based on the end-use market, hospitals and clinics dominated the market with a share of 44% in 2023. This growth can be attributed to the higher prevalence of cancer surgeries and plastic surgeries. Furthermore, NIR is used in these healthcare settings to detect bedsores to prevent surgical errors, contributing to the growth of this segment. Increasing funding in research & grants specific to the development of infrared technology for hospital use is anticipated to fuel the market growth over the forecast period.

The pharmaceutical & biotechnology companies segment is projected to witness growth at a significant CAGR from 2024 to 2030. NIR technology is employed for various purposes such as identifying raw materials, verifying the quality of lyophilized materials, monitoring tablet coating and content, overseeing fermentation and cell culture, and conducting in-line and on-line process monitoring in pharmaceutical & biotechnology companies These applications of NIR systems in this sector will likely to increase their demand over the forecast period.

Key U.S. Near Infrared Imaging Company Insights

Leading U.S. near-infrared imaging companies include Stryker, PerkinElmer, Inc., Li-Cor, Inc., PerkinElmer, Inc., Leica Microsystems, and Intuitive Surgical among others.

These Companies focus on developing and upgrading existing technologies to enhance patient outcomes and significantly increase healthcare effectiveness Moreover, M&A activities undertaken by market players, innovative product launches and regional product expansion initiatives further leverage the growth of the market.

Key U.S. Near Infrared Imaging Companies:

- Stryker

- PerkinElmer, Inc

- Li-Cor, Inc.

- PerkinElmer, Inc.

- Leica Microsystems

- Intuitive Surgical

- Avantor®

- ICG Pharmaceutical

- Veranova

- CalBiotech

Recent Developments

-

In July 2023, Nikon In October 2023, as per the research article published in the Journal of Imaging concluded that Near-infrared fluorescence imaging can be a potential tool for the detection of glioblastoma in preclinical models.

-

June 2022, Stryker Endoscopy Latam Franchise announced the launch of the +FOCO Campaign to offer an informative session about fluoresce dye i.e. INDOCIANINE GREEN FLURESCENCE.

U.S. Near Infrared Imaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 795.1 million

Revenue Forecast in 2030

USD 1.0 billion

Growth rate

CAGR of 4.0% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Application, end-use

Country scope

U.S.

Key companies profiled

Stryker; PerkinElmer, Inc;Li-Cor, Inc.;PerkinElmer, Inc.; Leica Microsystems; Intuitive Surgical; Avantor®; ICG Pharmaceutical ; Veranova; CalBiotech

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

U.S. Near Infrared Imaging Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. near infrared imaging market report based on product, application, and, end market:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Device

-

Near-Infrared Fluorescence Imaging Systems

-

Near-Infrared Fluorescence & Bioluminescence Imaging Systems

-

-

Reagents

-

Indocyanine Green (ICG)

-

Other Reagents

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Preclinical Imaging

-

Cancer Surgeries

-

Gastrointestinal Surgeries

-

Cardiovascular Surgeries

-

Plastic/Reconstructive Surgeries

-

Other Applications

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Pharmaceutical & Biotechnology Companies

-

Research Laboratories

-

Frequently Asked Questions About This Report

b. The U.S. near infrared imaging market size was estimated at USD 763.40 million in 2023 and is expected to reach USD 795.1 million in 2024.

b. The U.S. near infrared imaging market is expected to grow at a compound annual growth rate of 4.0% from 2024 to 2030 to reach USD 1.0 billion by 2030.

b. Reagents dominated the U.S. near infrared imaging market with a share of 56.12% in 2023. The segment is expected to witness a significant growth over the forecast period as reagents offer several advantages over traditional visible light dyes including high sensitivity and specific detection in biological systems. Reagents are sub-categorized as Indocyanine Green (ICG) and other reagents.

b. Some key players operating in the U.S. near infrared imaging market include Quest Medical Imaging B.V.; Stryker; KARL STORZ SE & Co. KG; Olympus; Hamamatsu Photonics K.K.; Mizuho Medical Co, Ltd.; Shimadzu Corporation; Leica Microsystem (Danaher); Medtronic (Visionsense); Perkinelmer Inc.; Fluoptics; Carl Zeiss Meditec AG

b. Key factors that are driving the market growth include increasing incidence of target diseases, such as cardiovascular diseases (CVDs), gastrointestinal, neurovascular, and cancer, is likely to boost the demand for near infrared imaging in the coming years.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."