- Home

- »

- Biotechnology

- »

-

U.S. Next Generation Sequencing Market Size Report, 2033GVR Report cover

![U.S. Next Generation Sequencing Market Size, Share & Trends Report]()

U.S. Next Generation Sequencing Market (2025 - 2033) Size, Share & Trends Analysis Report By Technology, By Product, By Application, By Workflow (Pre-sequencing, Sequencing, Data Analysis), By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-218-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Next Generation Sequencing Market Summary

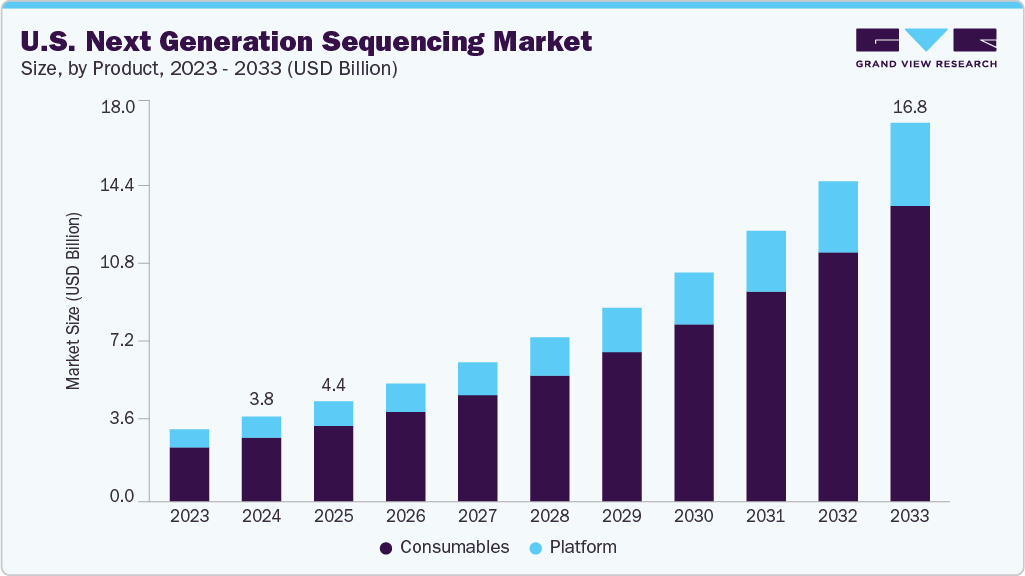

The U.S. next generation sequencing market size was estimated at USD 3.76 billion in 2024 and is projected to reach USD 16.75 billion by 2033, growing at a CAGR of 18.1% from 2025 to 2033. A robust presence of pharmaceutical, biotech entities, and research institutions drives next-generation sequencing (NGS) technology in the country. The market is propelled by increasing research and development (R&D) programs focusing on cancer, infectious diseases, and precision medicine. Moreover, genetic testing advancements are fueling NGS adoption in clinical labs for diagnosing rare conditions and guiding precision medicine.

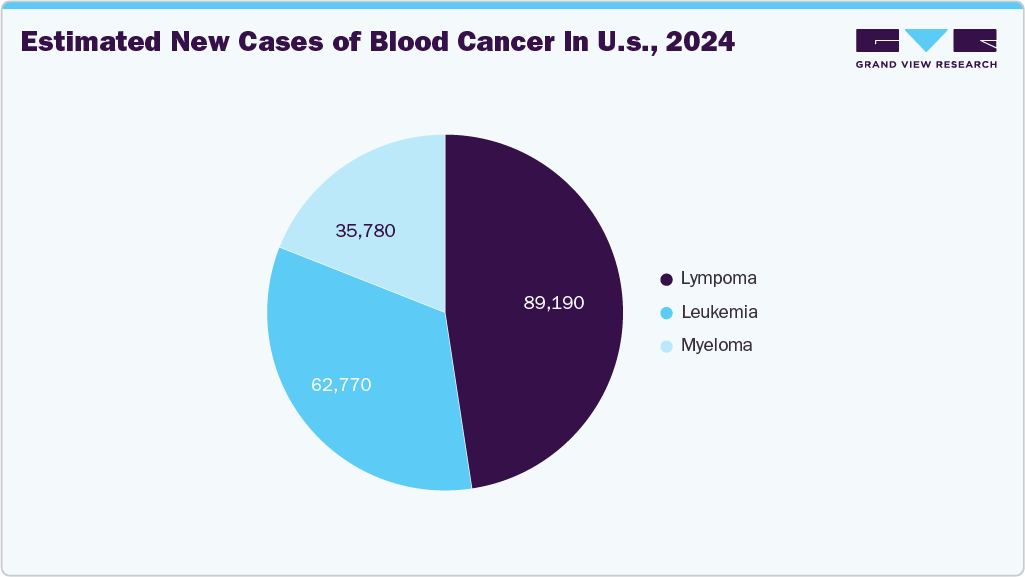

Rising Incidence of Cancer and Genetic Disorders

The increasing prevalence of cancer, hereditary diseases, and complex genetic disorders in the U.S. is a significant driver of the NGS market. Next-generation sequencing enables early detection of genetic mutations and chromosomal abnormalities, facilitating timely diagnosis and personalized treatment planning. In oncology, NGS helps identify tumor-specific mutations, stratify patients for targeted therapies, and monitor disease progression or recurrence. It provides comprehensive genomic insights for rare and inherited disorders, supporting accurate diagnosis, carrier screening, and risk assessment for family members. Growing awareness among healthcare providers and patients about the benefits of genetic testing is further fueling adoption.

Moreover, initiatives such as newborn screening programs, prenatal genetic testing, and large-scale population genomics studies are expanding the use of NGS across clinical and research settings. The increasing demand for precision medicine, coupled with rising investment in genetic and genomic research, underscores the critical role of NGS in improving patient outcomes. As the incidence of cancer and genetic disorders continues to increase, the adoption of NGS is expected to grow steadily, solidifying its position as a transformative technology in the U.S. healthcare and life sciences ecosystem.

Advancements in Sequencing Technologies

Rapid advancements in sequencing technologies are a major driver of the U.S. NGS market. High-throughput platforms have dramatically increased the speed and efficiency of sequencing, allowing laboratories to process large volumes of samples with greater accuracy and reproducibility. Innovations such as long-read, single-cell, and real-time sequencing enable deeper insights into complex genomes, transcriptomes, and epigenomes. These technological improvements enhance research capabilities and make NGS more accessible and cost-effective for clinical laboratories, biotechnology companies, and pharmaceutical firms.

In addition, continuous development in sequencing chemistry, automated library preparation, and integrated bioinformatics pipelines streamline workflows, reduce turnaround times, and minimize errors. This integration of hardware and software solutions is expanding the practical applications of NGS in areas such as precision medicine, cancer genomics, rare disease diagnostics, and infectious disease monitoring. As sequencing platforms become increasingly sophisticated and affordable, the adoption of NGS is expected to accelerate, reinforcing its pivotal role in U.S. healthcare, research, and life sciences innovation.

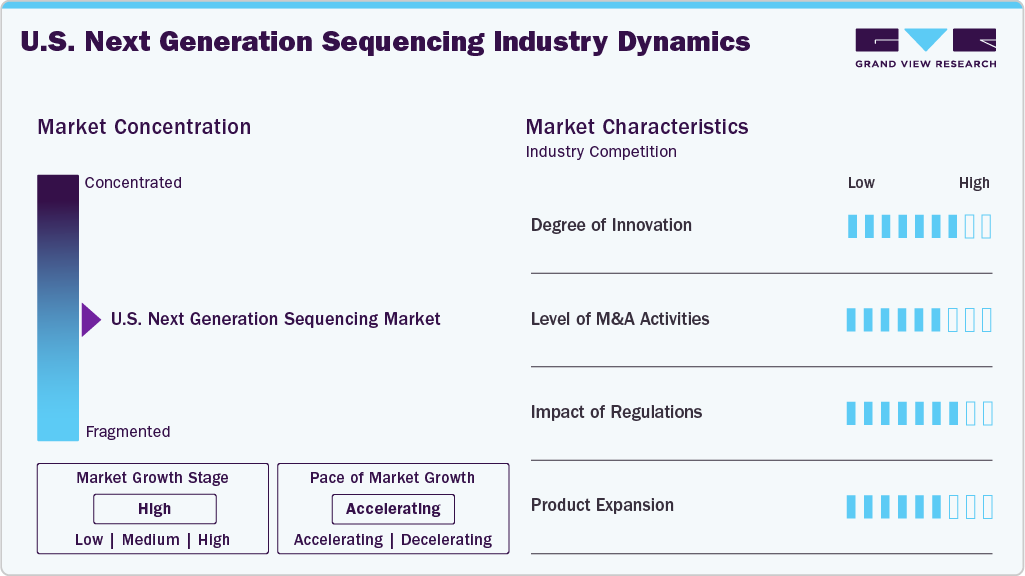

Market Concentration & Characteristics

The U.S. NGS industry demonstrates significant innovation, with companies consistently investing in R&D. Their focus is on introducing cutting-edge technologies, enhancing sequencing processes, and improving data analysis capabilities. This commitment to innovation propels the industry forward, allowing for the introduction of advanced services and solutions that meet the evolving needs of customers and the healthcare sector. For instance, in January 2024, QIAGEN Digital Insights launched its LightSpeed-enhanced CLC Genomics Workbench in the U.S., accelerating somatic cancer NGS analysis while reducing costs, reinforcing its leadership in the U.S. NGS market.

The industry is witnessing substantial mergers and acquisitions, reflecting a vibrant landscape where businesses are pursuing strategic alliances to bolster their industry standings. For instance, in January 2023, QIAGEN completed its acquisition of U.S.-based Verogen, enhancing its human identification and forensics portfolio through next-generation sequencing (NGS) technologies and strengthening its leadership in the U.S. This reflects the industry’s trend towards strategic alliances to drive growth and innovation.

Recent regulatory shifts in the U.S. NGS industry, particularly the FDA’s 2025 rule to oversee laboratory-developed tests (LDTs), are significantly reshaping the industry by increasing compliance requirements for clinical sequencing assays. While these regulations enhance test quality, patient safety, and trust, they also raise development costs and slow time to market, especially for smaller labs. CMS coverage policies tie Medicare reimbursement to FDA-approved tests, pressuring companies to pursue formal validation and regulatory clearance. Moreover, evolving data privacy laws and HIPAA enforcement are tightening how genomic data can be stored, shared, and used, especially for AI model training, further influencing R&D and commercial strategies.

Businesses are broadening their range of services to deliver all-encompassing solutions to their clients. In addition to creating sophisticated sequencing platforms, they provide extensive sequencing services to cater to the varied requirements. For instance, in November 2023, MedGenome and PacBio announced a De Novo Genome Assembly and Annotation grant. The initiative aimed to support the creation of reference genomes and further support the market expansion in the U.S. NGS industry.

Product Insights

The consumables segment held the largest market share of 75.40% in 2024. This segment's larger share and exponential growth rate are mainly attributed to its recurrent usage and high demand in NGS commercial and research applications. These consumables include sample preparation kits and kits for target enrichment. The adoption of NGS consumables has increased as most pharmaceutical companies and research institutes are utilizing NGS for several diagnostic applications and cancer research.

The platform segment of the US NGS industry is expected to witness significant growth during the forecast period. This expansion is primarily driven by the increasing adoption of advanced sequencing platforms, rising demand for high-throughput genomic analysis, and continuous technological innovations that enhance accuracy, speed, and scalability in next-generation sequencing applications.

Technology Insights

The targeted sequencing and resequencing segment held the largest market share of 48.83% in 2024. This segment is expected to witness growth in demand after the development of whole genome sequencing, as the availability of a large amount of whole genome data likely to require analysis at specific gene locations and isolated genetic expressions. Many companies in the NGS market offer targeted sequencing services. Thus, this segment is expected to grow in tandem with the WGS segment throughout the forecast period.

The whole exome sequencing (WES) segment is expected to grow significantly during the forecast period. This is driven by the increasing demand for precise genetic insights into rare and complex disease research, the growing adoption of personalized medicine, and advancements in sequencing technologies that reduce cost and turnaround time.

Application Insights

The oncology segment accounted for the largest market share of 31.62% in 2024, driven by the rising prevalence of cancer and the increasing adoption of advanced technologies to support precision medicine. Next-generation sequencing (NGS) in oncology for DNA and RNA sequencing, epigenetic profiling, and the detection of chromosomal abnormalities has become critical, as these applications contribute to more than three-fourths of global sequencing data. This growing reliance on NGS enables oncologists to gain deeper insights into the molecular mechanisms of cancer and tumor progression. According to the National Cancer Institute, approximately 2,041,910 new cancer cases are expected to be diagnosed in the U.S. in 2025, with an estimated 618,120 cancer-related deaths, underscoring the urgent need for innovative genomic solutions in cancer care.

The consumer genomics segment is projected to be the fastest-growing segment in the next-generation sequencing (NGS) industry during the forecast period. This growth is fueled by increasing public interest in personalized health, ancestry, and genetic traits, along with rising accessibility to direct-to-consumer (DTC) testing kits. Advances in sequencing technologies have significantly reduced the cost of genome analysis, making it more affordable for consumers. Moreover, growing awareness around preventive healthcare and the integration of genomic data into wellness and lifestyle planning are driving demand. Companies are also expanding their offerings with enhanced data privacy features and value-added services, contributing further to market expansion.

Workflow Insights

The sequencing segment held the largest market share of 63.90% in 2024. NGS sequencing is the most important phase of the workflow and consequently accounts for the largest share of the market. These systems can provide an accurate amount of liquid, which is important in NGS. Moreover, the system also carries out functions such as changing tubes and micro-liter plates, which helps streamline workflow. The advantage of using a robotic liquid handling system is that it enables researchers to focus on analyzing the data rather than managing the process. For instance, In March 2022, LetsGetChecked, a prominent health testing company, took over Veritas Genetics to leverage their genome sequencing services, enabling LetsGetChecked to provide more comprehensive and personalized health insights to their customers, which further supported the growth of the segment.

The pre-sequencing segment of the U.S. NGS industry is anticipated to be one of the fastest-growing segments during the forecast period, driven by the increasing demand for high-quality sample preparation, advancements in library preparation technologies, and the growing focus on improving the accuracy and efficiency of downstream sequencing workflows.

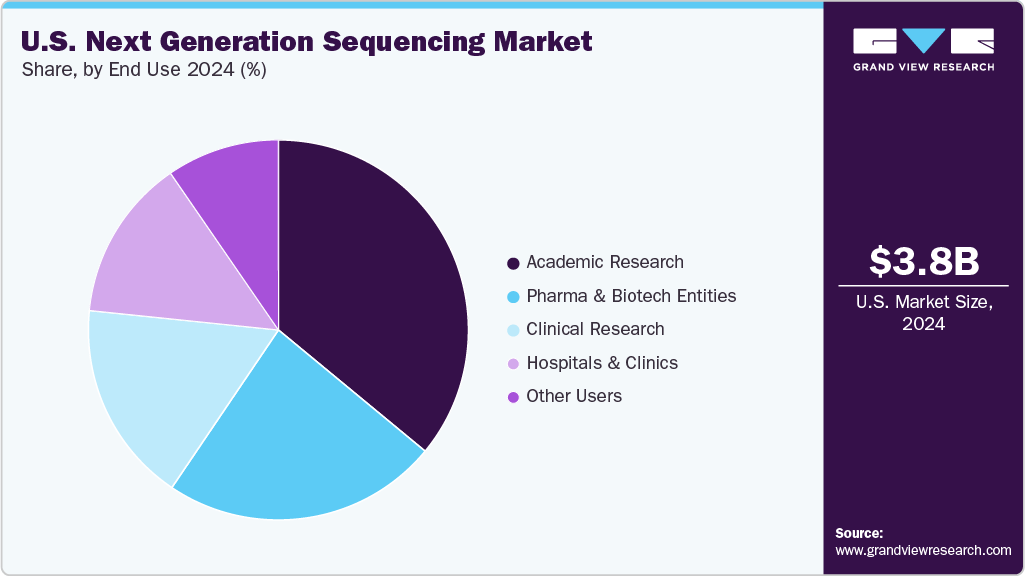

End Use Insights

The academic research segment held the highest market share of 35.99% in 2024. The application of NGS solutions in research projects that are carried out in universities and research centers can be attributed to the largest share of this segment in the market. Moreover, scholarships offered for PhD projects in NGS are anticipated to drive demand for NGS products and services, resulting in lucrative growth over the forecast period. The provision of on-site bioinformatics courses that include workshops on the practical implementation of NGS sequencing and data analysis is also expected to boost revenue generated by the academic research segment in the forecast years.

Clinical research is anticipated to be the fastest growing segment during the forecast period, due to the use of NGS in cancer research, specifically in the discovery of new cancer-related genes, the study of tumor heterogeneity, and the identification of alterations that are contributive in tumorigenesis, the segment is expected to witness significant growth throughout the forecast period.

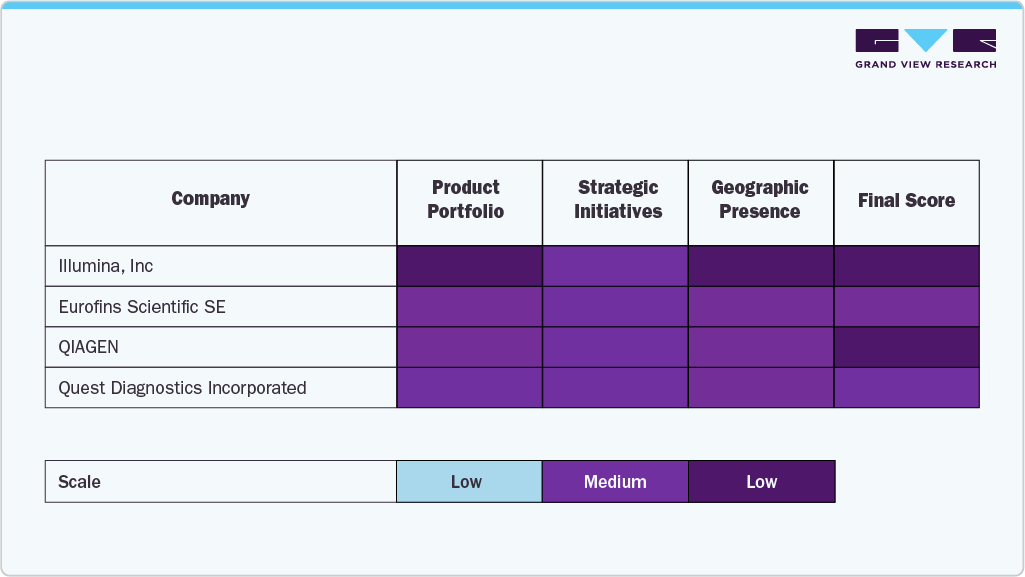

Key U.S. Next Generation SequencingCompany Insights

The U.S. next-generation sequencing (NGS) industry is dominated by well-established players that leverage robust product portfolios, strategic collaborations, and continuous research and technological innovation investments. Leading companies such as Illumina, Inc., Thermo Fisher Scientific Inc., PacBio, and F. Hoffmann-La Roche Ltd maintain significant market share due to their advanced sequencing platforms, comprehensive workflow solutions, and extensive distribution networks across research, clinical, and industrial applications.

Mid-tier and emerging players, including Eurofins Scientific SE, PerkinElmer, Inc., QIAGEN, Quest Diagnostics Incorporated, Azenta Life Sciences (GENEWIZ), and NanoString, are expanding their footprint by offering specialized sequencing services, innovative platforms, and customized solutions that cater to the increasing demand from academic institutions, pharmaceutical companies, and biotechnology enterprises.

Market leaders continue consolidating their positions by combining cutting-edge sequencing technologies with end-to-end service offerings and strategic growth initiatives. These firms have reinforced their leadership by addressing growing requirements for precision medicine, rare disease research, cancer genomics, and large-scale population studies. As demand for personalized medicine, genomic diagnostics, and translational research continues to rise, the U.S. NGS landscape will increasingly be shaped by accessibility, affordability, and data security considerations, factors critical to defining the future trajectory of the industry.

The U.S. NGS market is experiencing a dynamic convergence of established expertise and disruptive innovation. Mergers and acquisitions, strategic partnerships, and advancements in sequencing accuracy, throughput, and bioinformatics integration are intensifying competition. Companies that successfully blend technological innovation with customer-centric solutions are poised to create sustained value and drive the next growth phase in this rapidly evolving sector.

Key U.S. Next Generation Sequencing Companies:

- Illumina, Inc.

- Thermo Fisher Scientific Inc.

- Eurofins Scientific SE

- PerkinElmer, Inc.

- QIAGEN

- Quest Diagnostics Incorporated

- Azenta Life Sciences (GENEWIZ)

- NanoString

- PacBio

- bioMérieux

- BGI Group

- F. Hoffmann-La Roche Ltd

- ARUP Laboratories

- Novogene Co, Ltd.

- Gene by Gene Ltd.

- Lucigen Corporation

Recent Developments

-

In August 2025, Thermo Fisher Scientific received FDA approval in the U.S., strengthening its presence in the American NGS market with the Oncomine Dx Target Test for HER2-mutant NSCLC.

-

In January 2024, Illumina expanded its collaboration with Janssen in the U.S. to develop a whole genome sequencing molecular residual disease assay for the detection of multi-cancer ctDNA in clinical research.

U.S. Next Generation Sequencing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.43 billion

Revenue forecast in 2033

USD 16.75 billion

Growth rate

CAGR of 18.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, product, application, workflow, end use,

Key companies profiled

Illumina, Inc.; Thermo Fisher Scientific Inc.; Eurofins Scientific SE; PerkinElmer, Inc.; QIAGEN; Quest Diagnostics Incorporated; Azenta Life Sciences (GENEWIZ); NanoString; PacBio; bioMérieux; BGI Group; F. Hoffmann-La Roche Ltd; ARUP Laboratories; Novogene Co, Ltd.; Gene by Gene Ltd.; Lucigen Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

U.S. Next Generation Sequencing Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the U.S. next generation sequencing market based on technology, product, application, workflow, and end use.

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Whole Genome Sequencing

-

Whole Exome Sequencing

-

Targeted Sequencing & Resequencing

-

DNA-based

-

RNA-based

-

-

Others

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Platforms

-

Sequencing

-

Data Analysis

-

-

Consumables

-

Sample Preparation

-

Target Enrichment

-

Others

-

-

-

Application Outlook (Revenue, USD Million; 2021 - 2033)

-

Oncology

-

Diagnostics and Screening

-

Oncology Screening

-

Sporadic Cancer

-

Inherited Cancer

-

-

Companion Diagnostics

-

Other Diagnostics

-

-

Research Studies

-

-

Clinical Investigation

-

Infectious Diseases

-

Inherited Diseases

-

Idiopathic Diseases

-

Non-Communicable/Other Diseases

-

-

Reproductive Health

-

NIPT

-

Aneuploidy

-

Microdeletions

-

-

PGT

-

Newborn Genetic Screening

-

Single Gene Analysis

-

-

HLA Typing/Immune System Monitoring

-

Metagenomics, Epidemiology & Drug Development

-

Agrigenomics & Forensics

-

Consumer Genomics

-

-

Workflow Outlook (Revenue, USD Million, 2021 - 2033)

-

Pre-Sequencing

-

Nucleic Acid Extraction

-

Library Preparation

-

-

Sequencing

-

NGS Data Analysis

-

NGS Primary Data Analysis

-

NGS Secondary Data Analysis

-

NGS Tertiary Data Analysis

-

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Academic Research

-

Clinical Research

-

Hospitals & Clinics

-

Pharma & Biotech Entities

-

Other users

-

Frequently Asked Questions About This Report

b. The U.S. next generation sequencing market size was estimated at USD 3.76 billion in 2024.

b. The U.S. next generation sequencing market is expected to grow at a compound annual growth rate of 18.10% from 2025 to 2033 to reach USD 16.75 billion by 2030.

b. The oncology segment dominated the U.S. NGS market with a share of 31.62% in 2024. This is attributable to rising healthcare awareness coupled with increasing adoption of NGS-based cancer screening and diagnostic tools in the U.S.

b. Some key players operating in the U.S. next generation sequencing market include Illumina, Inc, QIAGEN, Thermo Fisher Scientific, Inc, BGI, Pacific Biosciences, Bio-Rad Laboratories, Oxford Nanopore Technologies, Inc, F. Hoffmann-La Roche AG, Agilent Technologies, Inc, Eurofins Scientific

b. The growth of the market is attributed to factors such as advancements in sequencing technology, increasing demand for personalized medicine, and the rise in the prevalence of chronic diseases such as cancer.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.