- Home

- »

- Consumer F&B

- »

-

U.S. Nutraceuticals Market Size, Industry Report, 2030GVR Report cover

![U.S. Nutraceuticals Market Size, Share & Trends Report]()

U.S. Nutraceuticals Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Dietary Supplements, Functional Food, Functional Beverages, Infant Formula), By Application, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-504-1

- Number of Report Pages: 155

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Nutraceuticals Market Size & Trends

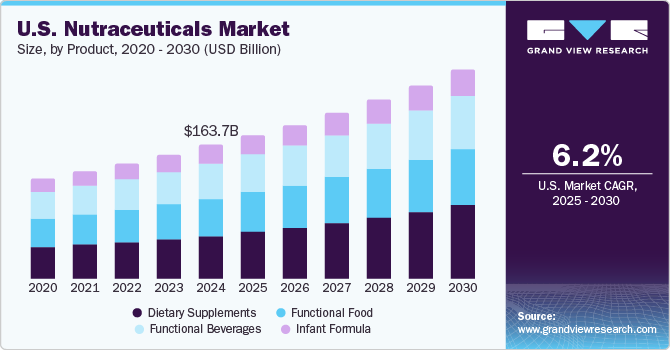

The U.S. nutraceuticals market size was valued at USD 163.7 billion in 2024 and is anticipated to grow at a CAGR of 6.2% from 2025 to 2030. The market growth is attributed to the increasing awareness of preventative healthcare and a growing interest in natural and holistic wellness solutions. This trend is supported by an aging population seeking to maintain their health and vitality, as well as a younger generation increasingly proactive in managing their well-being. Moreover, the ease of access to information through online platforms and social media has also played a significant role in educating consumers about the potential benefits of nutraceuticals, further propelling market expansion. Besides, consumers are actively researching ingredients and seeking products with specific health benefits, pushing demand for items targeting gut health, immunity, cognitive function, and energy levels.

One of the most significant demand drivers is the increasing prevalence of chronic diseases such as obesity, diabetes, and cardiovascular issues. Consumers are actively seeking ways to manage and prevent these conditions through diet and supplementation, creating a strong market for functional foods and beverages enriched with vitamins, minerals, and other bioactive compounds, such as protein-enriched snacks, beverages containing adaptogens, and functional yogurts with probiotics. The focus on gut health, driven by a growing scientific understanding of its importance to overall well-being, has also contributed to the popularity of probiotics and prebiotics in supplements and functional food products. Additionally, the demand for organic, plant-based, and clean-label products is surging, with consumers prioritizing natural, minimally processed nutraceutical ingredients and avoiding artificial additives.

The functional beverage category is experiencing particularly strong growth, driven by demand for convenient and on-the-go health solutions. Energy drinks, fortified waters, and probiotic-rich beverages are all becoming increasingly popular choices for consumers seeking a quick way to boost their well-being, replenish electrolytes, or support their gut health. The availability of innovative formats and flavors, combined with aggressive marketing campaigns, has significantly broadened the appeal of these products. Similarly, the infant formula sector is seeing steady demand, largely fueled by parents who seek optimal nutrition for their children, with an emphasis on formulas that mimic the benefits of breast milk and address specific developmental needs. Moreover, the increasing rate of working mothers and their need for convenient nutrition are also significant demand drivers for this sector.

Innovative product development and marketing strategies also play a crucial role in driving demand for nutraceuticals. Manufacturers are continually launching new and innovative formulations that are tailored to specific consumer needs and preferences. Personalized nutrition, tailored to individual genetic profiles, is an emerging trend that is gaining traction. Moreover, marketing campaigns emphasizing the scientific evidence and health benefits of nutraceuticals are resonating with consumers and driving sales. Furthermore, the rise of e-commerce has provided convenient access to a wider array of nutraceutical products, enabling consumers to easily research and purchase options tailored to their individual needs.

Product Insights

The U.S. dietary supplements market accounted for a revenue share of 39.1% in 2024. A heightened focus on preventative healthcare and self-care, fueled in part by the pandemic, has pushed consumers to actively seek ways to bolster their immunity and overall well-being. Personalized nutrition is becoming increasingly important, with consumers desiring supplements tailored to their specific needs, leading to a surge in demand for products like vitamins, minerals, and herbals in various formats (e.g., gummies, capsules, and powders). Furthermore, the aging population and the rising prevalence of chronic diseases are contributing to the demand for supplements aimed at supporting joint health, cognitive function, and cardiovascular health. The growth is also fueled by increasing e-commerce sales and the rise of social media influencers promoting specific supplements, further expanding market reach and accessibility.

The U.S. functional beverages market is anticipated to witness a growth rate of 5.6% from 2025 to 2030. Consumers in the U.S. are moving beyond basic hydration and seeking drinks with added benefits, such as improved energy levels, enhanced focus, gut health support, and post-workout recovery. This is leading to the proliferation of products like probiotic-rich kombuchas, protein-infused smoothies, electrolyte drinks, and plant-based beverages with added vitamins and adaptogens. The demand is also fueled by the "better-for-you" trend, with consumers increasingly willing to pay a premium for beverages perceived as healthier alternatives to sugary drinks. Innovation in flavors and formats is also a critical demand driver, as manufacturers are constantly introducing new concepts and ingredients to attract consumers. The convenience factor associated with ready-to-drink beverages, along with their perceived health benefits, has positioned them for continued growth and market expansion.

Application Insights

The U.S. nutraceuticals market for weight management and satiety applications accounted for a revenue share of 16.9% in 2024. Rising obesity rates, increased consumer awareness of the link between diet and health, and a growing desire for convenient, natural solutions are significant drivers. The "clean label" trend is pushing demand for products formulated with plant-based ingredients, fibers, and probiotics, often promising to promote a feeling of fullness, manage appetite, and support healthy metabolism. Beyond simple weight loss, consumers are seeking solutions that promote overall metabolic health, further broadening the appeal of these nutraceuticals and leading to innovative product formulations targeting specific needs, like gut health or blood sugar regulation. This demand is reflected in the variety of formats, from powders and capsules to ready-to-drink beverages, offering consumers flexible ways to incorporate these products into their lifestyles.

The U.S. men’s health nutraceuticals market is estimated to grow at a CAGR of 12.0% from 2025 to 2030, driven by a growing awareness among men of the importance of preventative health and wellness. This is moving beyond just physical strength and athletic performance and increasingly encompasses areas like prostate health, hormonal balance, sexual function, and cognitive health. Moreover, the demand is rising for products containing ingredients such as saw palmetto, lycopene, and various vitamins and minerals aimed at supporting these specific health concerns. Furthermore, increased stress levels and demanding lifestyles are creating a need for nutraceuticals focused on energy, mood, and stress management among men. Marketing that emphasizes both performance and overall well-being contributes to the rising consumer interest. Besides, the growing trend of personalized nutrition also impacts this sector, with men increasingly seeking tailored solutions based on their individual needs and health profiles.

Distribution Channel Insights

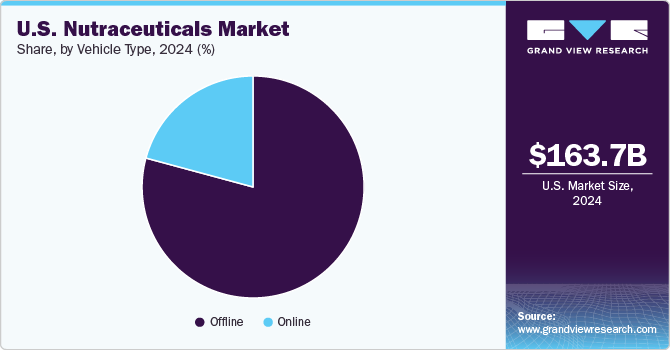

The sales of nutraceutical products through offline channels accounted for a revenue share of 79.2% in 2024, driven by established consumer habits of purchasing health products alongside regular shopping, the ease of immediate access, and the ability to physically examine products. Moreover, "wellness aisles" in major grocery and supermarket stores are also expanding, showcasing a wider selection of vitamins, supplements, and functional foods, catering to a growing health-conscious consumer base. While personalized recommendations are less prevalent than in online channels, the offline experience still benefits from trusted pharmacist consultations and staff recommendations within specialized health stores, further fueling demand. Besides, brand loyalty to established names in the brick-and-mortar space is also a strong influencer.

The online segment is estimated to grow at a CAGR of 9.8% from 2025 to 2030, fueled by increased internet penetration, convenience, and a wider product variety. Direct-to-consumer (DTC) brands are particularly thriving, leveraging targeted online advertising and social media marketing to reach specific consumer demographics. Subscription models, personalized product recommendations based on online quizzes, and transparency measures like detailed ingredient information are all strong demand drivers attracting consumers. Furthermore, online retail often provides lower prices compared to brick-and-mortar stores, making products more accessible to a broader range of customers. The ability to easily compare products and read customer reviews before purchasing also contributes to the growth of this segment, particularly among younger and tech-savvy consumers.

Key U.S. Nutraceuticals Company Insights

The U.S. nutraceuticals market is characterized by a diverse landscape of established players and emerging brands, leading to a fragmented yet competitive environment. Key companies including Abbott, Amway Corp., Herbalife Nutrition Ltd., Nestlé S.A., The Kraft Heinz Company, The Hain Celestial Group, Inc., GlaxoSmithKline plc., General Mills Inc., Danone, Monster Beverage Corporation, Reckitt and Tyson Foods, Inc. hold significant positions due to their extensive product portfolios, strong brand recognition, and robust distribution networks. These established giants often dominate specific categories like vitamins, minerals, and protein supplements, leveraging their research and development capabilities and economies of scale.

However, the market also sees the rise of smaller, more specialized players focusing on specific health concerns or using innovative ingredients, creating pockets of high growth and shifting consumer preferences. Competition is fierce, pushing companies to innovate product formulations, packaging, and delivery methods to capture consumer interest. Moreover, the rise of e-commerce and direct-to-consumer sales channels and the growing influence of health and wellness influencers also contribute to a more democratized market where newer brands can quickly gain traction and challenge established positions.

Key U.S. Nutraceuticals Companies:

- General Mills Inc.

- Danone

- Nestlé S.A.

- Amway Corp.

- Abbott

- The Kraft Heinz Company

- The Hain Celestial Group, Inc.

- Herbalife Nutrition Ltd.

- Tyson Foods

- Monster Beverage Corporation

- Reckitt

- GlaxoSmithKline plc.

Recent Developments

-

In August 2024, EZZ Life Science strategically diversified its product line with the introduction of four new functional food products. This expansion caters to both pediatric and adult consumer segments, with three offerings specifically formulated to support children's health and one targeted toward adult nutritional needs. This launch reflects EZZ's commitment to providing a broader range of health and wellness solutions within the functional food market.

-

In January 2024, Systm Foods strategically acquired Humm Kombucha, a key player in the low- and zero-sugar kombucha and gut-health beverage market. This acquisition directly supports Systm Foods' ambition to establish a leading functional beverage platform. By integrating Humm Kombucha, Systm Foods significantly bolsters its presence within the refrigerated, ready-to-drink beverage sector.

U.S. Nutraceuticals Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 173.9 billion

Revenue forecast in 2030

USD 235.1 billion

Growth rate (Revenue)

CAGR of 6.2% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution Channel

Key companies profiled

Amway Corp.; Abbott; General Mills Inc.; Danone; Nestlé S.A.; The Kraft Heinz Company; The Hain Celestial Group, Inc.; Herbalife Nutrition Ltd.; Tyson Foods; Monster Beverage Corporation; Reckitt; and GlaxoSmithKline plc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options U.S. Nutraceuticals Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. nutraceuticals market report based on product, application, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Dietary Supplements

-

Tablets

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Capsules

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Soft Gels

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Powders

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Gummies

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Liquid

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Others

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

-

Functional Food

-

Vegetable and Seed Oil

-

Sweet Biscuits, Snack Bars and Fruit Snacks

-

Dairy

-

Baby Food

-

Breakfast Cereals

-

Others

-

-

Functional Beverages

-

Energy drink

-

Sports drink

-

Others

-

-

Infant Formula

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Allergy & Intolerance

-

Healthy Ageing

-

Bone & Joint Health

-

Cancer Prevention

-

Children's Health

-

Cognitive Health

-

Diabetes

-

Digestive / Gut Health

-

Energy & Endurance

-

Eye Health

-

Heart Health

-

Immune System

-

Infant Health

-

Inflammation

-

Maternal Health

-

Men's Health

-

Nutricosmetics

-

Oral Care

-

Personalised Nutrition

-

Post Pregnancy Health

-

Sexual Health

-

Skin Health

-

Sports Nutrition

-

Weight Management & Satiety

-

Women's Health

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Supermarkets & Hypermarkets

-

Pharmacies

-

Specialty Stores

-

Practioner

-

Grocery Stores

-

Others

-

-

Online

-

Amazon

-

Other Online Retail Stores

-

-

Frequently Asked Questions About This Report

b. The U.S. nutraceuticals market was estimated at USD 163.7 billion in 2024 and is expected to reach USD 173.9 billion in 2025.

b. The U.S. nutraceuticals market is expected to grow at a compound annual growth rate of 6.2% from 2025 to 2030 to reach USD 235.1 billion by 2030.

b. The dietary supplements accounted for a revenue share of 39.1% in 2024, fueled by a heightened focus on preventative healthcare and self-care, fueled in part by the pandemic, which has pushed consumers to actively seek ways to bolster their immunity and overall well-being. Personalized nutrition is becoming increasingly important, with consumers desiring supplements tailored to their specific needs, leading to a surge in demand for products like vitamins, minerals, and herbals in various formats (e.g., gummies, capsules, and powders).

b. Some of the key market players in the U.S. nutraceuticals market are Abbott, Amway Corp., Herbalife Nutrition Ltd., Nestlé S.A., The Kraft Heinz Company, The Hain Celestial Group, Inc., GlaxoSmithKline plc., General Mills Inc., Danone, Monster Beverage Corporation, Reckitt and Tyson Foods, Inc.

b. The U.S. nutraceuticals market has experienced significant growth in recent years, driven by the increasing awareness of preventative healthcare and a growing interest in natural and holistic wellness solutions. Moreover, the ease of access to information through online platforms and social media has also played a significant role in educating consumers about the potential benefits of nutraceuticals, further propelling market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.