- Home

- »

- Automotive & Transportation

- »

-

U.S. Off-highway Electric Vehicle Market, Industry Report, 2030GVR Report cover

![U.S. Off-highway Electric Vehicle Market Size, Share & Trends Report]()

U.S. Off-highway Electric Vehicle Market (2024 - 2030) Size, Share & Trends Analysis Report By Propulsion (BEV, HEV), By Storage Type (Li-ion, Lead-Acid), By Application, And Segment Forecasts

- Report ID: GVR-4-68040-281-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

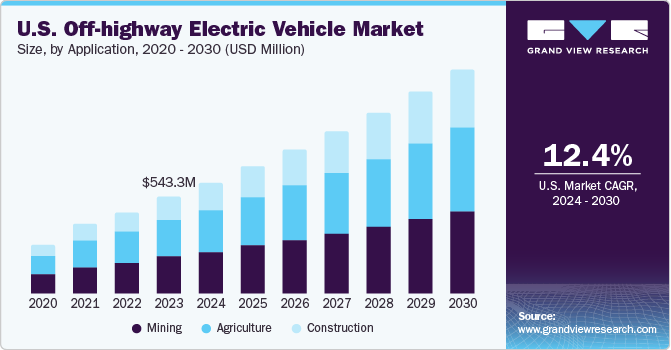

The U.S. Off-highway electric vehicle market size was estimated at USD 543.35 million in 2023 and is expected to expand at a CAGR of 12.4% from 2024 to 2030. The use of off-highway electric vehicles (OHEVS) is expected to witness significant growth due to advancements in battery technology, increasing environmental awareness, and supportive government policies. Full and hybrid off-highway electric vehicles (EV) have spurred interest in the industry as companies have to comply with environmental standards and improve their sustainability profiles.

Investment in research and development is essential to understand the growing trends and policies in the country. Battery technology has witnessed significant improvements with higher energy densities, lower costs, and faster charging times. This has made electric off-highway vehicles more viable for a range of applications where they were previously not competitive. OHEVS produces no emissions during operation, which is particularly beneficial in reducing the environmental impact of construction, mining, and agricultural activities. These vehicles operate much more quietly than the Internal Combustion Engine (ICE), a significant advantage in noise-sensitive areas or operations that run around the clock. The growth of Environmental, Social, and Governance (ESG) has been one of the most significant trends over the years. The integration of ESG reflects the broader commitment of industries and investors to sustainable and responsible business practices.

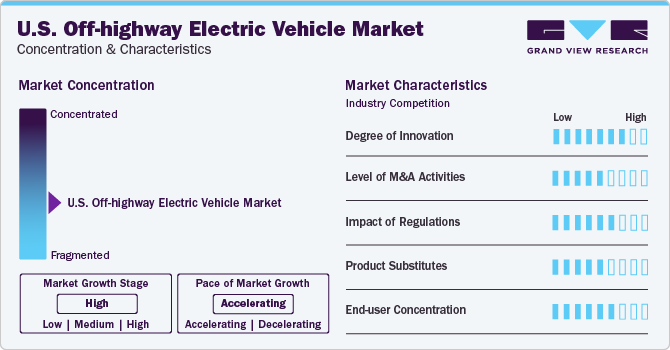

Market Concentration & Characteristics

The industry’s growth stage is high, and the pace of growth is accelerating. The degree of innovation in the industry is high due to growing trends towards sustainability, electrification, and automation. These innovations are not just limited to vehicle electrification but also encompass advancements in battery technology, autonomous operation, and integration with renewable energy sources.

The level of M&A activities is moderately high as several players in the industry try to navigate the transition towards more sustainable and efficient technologies. Mergers and acquisitions are a strategic tool for acquiring new capabilities, expanding industry reach, and adding new products to the product line. For instance, in February 2024, AB Volvo completed the acquisition of Proterra Inc.’s battery business. AB Volvo aims to accelerate its future and create a battery-electric road map.

The industry is characterized by a high-level impact of regulations due to increased global awareness about environmental sustainability. The U.S. government has implemented stricter emission standards for off-highway vehicles, which force manufacturers to invest in cleaner technologies such as EVs. Some areas in the country have initiated zero-emission zones, increasing the use of electric off-highway vehicles. For instance, by 2045, California aims to achieve a net-zero carbon emissions state.

The industry's end-user concentration is high as construction projects in the country are on the rise. Industries such as agriculture, construction, mining, and others are the primary end users of off-highway EVs. For instance, in January 2024, the Uranium Mill Tailings Remedial Action (UMTRA) Project Adoption commenced production of three uranium mines along the Arizona-Utah border, with additional mines planned in the Mountain West region, driven by favourable market conditions for the mineral essential for nuclear energy.

Application Insights

The mining segment accounted for the largest revenue market share in 2023. The adoption of EVs in the mining industry represents a significant shift towards sustainability, efficiency, and safety. This adoption is due to the impact of environmental regulations and operational efficiency. EVs produce no exhaust emissions, significantly improving air quality in enclosed mining environments. Moreover, the reduced noise levels associated with EVs contribute to a safer and more comfortable working environment.

The construction segment is anticipated to register the fastest CAGR during the forecast period. The construction industry is witnessing a significant transformation driven by the advent and integration of off-highway electric vehicles such as excavators and loaders. Increasing construction projects are expected to propel the growth of the electric vehicle market in this segment.

Storage Type Insights

The lead-acid segment accounted for the largest revenue market share in 2023. Due to their reliability, cost-effectiveness, and technology, these batteries have been a staple energy storage solution for various applications. Lead-acid batteries have played a significant role in off-highway electric vehicles, particularly in the early stages of the industry’s shift toward electrification. These batteries are cost-efficient and recyclable, which makes them one of the leading storage types in this industry.

The Li-ion segment is anticipated to grow at the fastest CAGR over the forecast period. These batteries have a high energy density so they can store more electricity in a smaller and lighter package. This gives OHEVS a crucial advantage in performing efficiently. Li-ion batteries generally have a longer lifespan than other battery technologies. The ability to charge fast enables vehicles to return to operation more quickly, which is essential for maintaining productivity in various industries.

Propulsion Insights

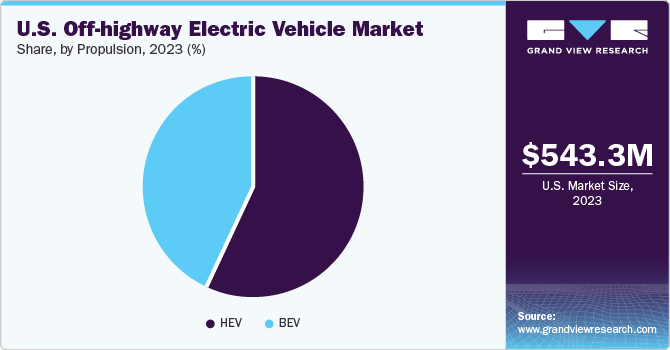

The hybrid electric vehicle (HEV) segment accounted for the largest revenue share of 57.42% in 2023. Hybrid electric vehicles have a combination of an ICE with one or more electric motors and a battery. The demand for HEVs has been increasing due to their fuel efficiency, lower emissions, and reduced dependency on fossil fuels. For instance, in January 2024, Volvo Construction Equipment (Volvo CE) launched a new electric material handler, the EW240, which has zero exhaust emissions and is a near-silent machine that can work around the clock.

The battery electric vehicle (BEV) segment is anticipated to register the fastest CAGR over the forecast period. The industry is looking for more sustainable and efficient solutions to reduce carbon emissions, and therefore, the BEV segment is gaining momentum rapidly. These vehicles are powered entirely by electricity stored in rechargeable battery packs, eliminating the need for combustion engines. In November 2022, Caterpillar Inc. developed its first battery electric mining truck and initiated a step towards a sustainable future.

Key U.S. Off-highway Electric Vehicle Company Insights

Some of the key companies operating in the market are AB Volvo, Caterpillar, Deere & Company, and J C Bamford Excavators Ltd.

-

Deere & Company produces off-highway vehicles for sectors such as agriculture, mining, and construction. Through its extensive dealer network, the company provides comprehensive parts and services support.

-

J C Bamford Excavators Ltd. has been actively focusing on developing and adopting off-highway electric vehicles in response to the growing demand for cleaner and more sustainable construction equipment.

Key U.S. off-Highway Electric Vehicle Companies:

- AB Volvo

- Caterpillar

- CNH Industrial America LLC

- Deere & Company

- Doosan Bobcat

- J C Bamford Excavators Ltd.

- Kobelco Construction Machinery U.S.A Inc.

- Komatsu Ltd.

- Mitsubishi Heavy Industries Ltd.

- Sany America Inc.

- Terex Corporation

Recent Developments

-

In November 2023, AB Volvo’s subsidiary Volvo Construction Equipment (Volvo CE) partnered with CRH to decarbonize construction. This partnership majorly focuses on electrification that can potentially reduce carbon emissions. Both companies are determined to decarbonize construction and produce cutting-edge technologies that are sustainable and eco-friendly.

-

In April 2022, Sany Heavy Industry Co. Ltd. signed a strategic partnership with Contemporary Amperex Technology Co. Ltd. to promote electrification development in various sectors such as construction, agriculture, and mining.

-

In March 2022, J C Bamford Excavators Ltd. introduced a new HTD-5E electric dumpster, carrying around 1,100 lbs of load. This tracked dumper is designed to move materials across various terrains. This electric model represents the company’s commitment to developing environmentally friendly, zero-emissions equipment suitable for multiple applications.

U.S. Off-highway Electric Vehicle Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 622.9 million

Revenue forecast in 2030

USD 1.25 billion

Growth rate

CAGR of 12.4% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Propulsion, storage type, application

Country scope

U.S.

Key companies profiled

AB Volvo; Caterpillar Inc.; CNH Industrial America LLC; Deere & Company; Doosan Bobcat; J C Bamford Excavators Ltd.; Kobelco Construction Machinery U.S.A Inc.; Komatsu Ltd.; Mitsubishi Heavy Industries Ltd.; Sany America Inc.; Terex Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options U.S. Off-Highway Electric Vehicle Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the U.S. Off-highway electric vehiclemarket research report based on the propulsion, storage type, and application:

-

Propulsion (Revenue, USD Million, 2018 - 2030)

-

BEV

-

HEV

-

-

Storage Type (Revenue, USD Million, 2018 - 2030)

-

Li-ion

-

Lead-acid

-

-

Application (Revenue, USD Million, 2018 - 2030)

-

Agriculture

-

Construction

-

Mining

-

Frequently Asked Questions About This Report

b. The U.S. off-highway electric vehicle market size was estimated at USD 543.35 million in 2023 and is expected to reach USD 622.9 million in 2024

b. The U.S. off-highway electric vehicle market is expected to grow at a compound annual growth rate of 12.4% from 2024 to 2030 to reach USD 1.25 billion by 2030

b. The Hybrid Electric Vehicle (HEV) segment dominated the market with a share of 57.4% in 2023. The demand for HEVs has been increasing due to their fuel efficiency, lower emissions, and reduced dependency on fossil fuels.

b. Some key players operating in the U.S. off-highway EV market include AB Volvo, Caterpillar Inc., CNH Industrial America LLC, Deere & Company, Doosan Bobcat, J C Bamford Excavators Ltd., Kobelco Construction Machinery U.S.A Inc., Komatsu Ltd., Mitsubishi Heavy Industries Ltd., Sany America Inc., Terex Corporation

b. Factors such as increasing advancements in battery technology, increasing environmental awareness, and supportive government policies are driving the U.S. off-highway electric vehicle market growth

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.