- Home

- »

- Homecare & Decor

- »

-

U.S. Oil Change Service Market Size, Industry Report, 2030GVR Report cover

![U.S. Oil Change Service Market Size, Share & Trends Report]()

U.S. Oil Change Service Market Size, Share & Trends Analysis Report, Consumer Behavior, Key Companies, Competitive Analysis, And Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-075-9

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

U.S. Oil Change Service Market Trends

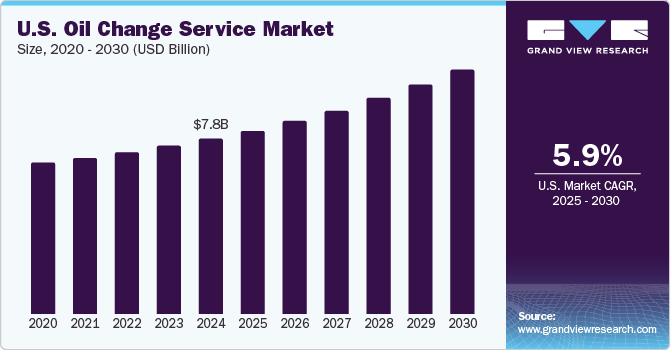

The U.S. oil change service market size was estimated at USD 8.11 billion in 2024 and is expected to grow at a CAGR of 5.9% from 2025 to 2030. The U.S. has seen steady growth in vehicle ownership due to rising disposable incomes, population expansion, and the increasing necessity of personal transportation, especially in suburban and rural areas where public transit options are limited. According to an analysis of U.S. Census Bureau American Community Survey data, in 2020, approximately 91.55 % of U.S. households had access to at least one vehicle. According to statistics published by Take-profit.org, total vehicle sales in the U.S. stood at 13.35 million units in July 2022.

The trend of Americans holding onto their vehicles longer, thanks to improved manufacturing and reliability, has further contributed to the need for oil changes. Older vehicles typically require more frequent maintenance, making oil changes a critical part of their upkeep.

Post-pandemic shifts in consumer habits have led to increased vehicle usage. Americans are driving more frequently for work, errands, and leisure travel, especially with the resurgence of road trips and domestic tourism. The return to commuting after remote work has also contributed to greater vehicle mileage. Commercial and fleet vehicles, used extensively for logistics and delivery, add to this demand as they operate continuously, requiring regular maintenance to minimize downtime.

Modern vehicles come equipped with advanced engine technologies designed to improve performance, fuel efficiency, and emissions. Engines today are more complex and operate under higher pressures and temperatures, which puts greater demands on motor oil. These advancements necessitate the use of specialized oils, such as synthetic or synthetic blends, which degrade more slowly but still require regular replacement to maintain optimal engine performance. Moreover, vehicles are equipped with oil life monitoring systems that alert drivers when an oil change is due, ensuring compliance with maintenance schedules and encouraging more frequent visits to service centers.

The boom in e-commerce has driven exponential growth in commercial vehicle fleets. Companies such as Amazon, UPS, and FedEx operate massive fleets of delivery vans and trucks that require regular oil changes to stay operational. Fleet managers prioritize preventive maintenance, including oil changes, to avoid costly breakdowns and downtime. The rise of ride-sharing services like Uber and Lyft has also contributed to this trend, as drivers for these platforms rack up high mileage, necessitating frequent oil changes.

While fully electric vehicles (EVs) do not require oil changes, hybrid vehicles, which combine internal combustion engines with electric components, still rely on traditional oil for engine lubrication. As hybrid adoption grows alongside EVs, these vehicles contribute to the ongoing demand for oil change services. Furthermore, the continued prevalence of gasoline and diesel-powered vehicles ensures that oil changes will remain a necessary service for the foreseeable future. For instance, in August 2023, the demand for gas-electric hybrid vehicles in the U.S. experienced a resurgence as major automakers such as Ford, Toyota, and Stellantis increased production to meet shifting consumer preferences. Hybrid models appeal to buyers seeking sustainable transportation options who still need to transition fully to EVs. Ford has announced plans to significantly expand its hybrid offerings, reflecting the broader industry's strategy to balance hybrid and EV production.

Modern consumers value convenience, which has led to a rise in demand for professional oil change services offered by quick-lube centers, dealerships, and independent garages. These services provide fast, reliable maintenance and often include additional perks like inspections and tire rotations. For busy Americans, these one-stop-shop services save time and eliminate the hassle of performing oil changes at home. Many service providers also use loyalty programs, digital reminders, and discounts to retain customers, ensuring they return for regular maintenance.

Key U.S. Oil Change Service Company Insights

New product developments in many parts, technological upgrades, and the spurring rise in the OEMs and aftermarkets are some of the significant tailwinds contributing to the growth of the global automotive industry. The industry is growing quickly due to rapid urbanization and the expansion of international manufacturers into new emerging markets.

With the proliferation of new technology, increased customer demands, and sustainability policies, the automotive sector is undergoing game-changing shifts. Leading companies operating in the market are expanding their service portfolio to launch the advanced oil formulations and combinations required by modern-age vehicles. Players in the market are diversifying their service offerings to maintain market share.

Key U.S. Oil Change Service Companies:

- Valvoline Inc.

- Take 5 Oil Change

- Jiffy Lube International, Inc.

- Strickland Brothers

- Meineke Car Care Centers, LLC

- Chevron Corporation

- Express Oil Change & Tire Engineers

- FullSpeed Automotive

- Victory Lane Quick Oil Change

- Dipstx Mobile Oil Change

Recent Developments

-

In December 2023, Take 5 Oil Change announced the opening of its 1,000th service location. Known for its convenient and customer-focused approach to automotive maintenance, Take 5 has grown rapidly across North America. The brand specializes in providing quick oil change services, allowing customers to stay in their vehicles during the process. This expansion underscores the company's commitment to meeting the growing demand for efficient and accessible vehicle care services.

-

In June 2022, Valvoline announced the expansion of its service strategy to include heavy-duty vehicles, reflecting its commitment to catering to a broader range of customer needs. This strategic move aligns with the increasing demand for professional maintenance services for larger vehicles, such as trucks and commercial fleets. The company plans to leverage its extensive network of service centers and its expertise in motor oil and lubrication technology to deliver high-quality solutions tailored for heavy-duty applications. This initiative reinforces Valvoline's position as an industry leader and demonstrates its adaptability in meeting diverse market demands.

U.S. Oil Change Service Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.49 billion

Revenue forecast in 2030

USD 11.31 billion

Growth rate

CAGR of 5.9% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Country scope

U.S.

Key companies profiled

Valvoline Inc.; Take 5 Oil Change; Jiffy Lube International, Inc.; Strickland Brothers; Meineke Car Care Centers, LLC; Chevron Corporation; Express Oil Change & Tire Engineers; FullSpeed Automotive; Victory Lane Quick Oil Change; Dipstx Mobile Oil Change

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Frequently Asked Questions About This Report

b. The U.S. oil change service market was estimated at USD 8.11 billion in 2024 and is expected to reach USD 8.49 billion in 2025.

b. The U.S. oil change service market is expected to grow at a compound annual growth rate of 5.9% from 2025 to 2030 to reach USD 11.31 billion by 2030.

b. The U.S. Car Wash Service Market through the U.S. oil change services was estimated at USD 2.06 billion in 2024 and is expected to reach USD 2.16 billion in 2025.

b. Some of the key players operating in the U.S. oil change service market include Valvoline Inc.; Take 5 Oil Change; Jiffy Lube International, Inc.; Strickland Brothers; Meineke Car Care Centers, LLC; Chevron Corporation; Express Oil Change & Tire Engineers; FullSpeed Automotive; Victory Lane Quick Oil Change; and Dipstx Mobile Oil Change.

b. Key factors that are driving the U.S. oil change service market growth include the growth in vehicle ownership, rising disposable incomes and gthe increasing necessity of personal transportation.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."