- Home

- »

- Next Generation Technologies

- »

-

U.S. Online Gambling Market Size, Industry Report, 2030GVR Report cover

![U.S. Online Gambling Market Size, Share & Trends Report]()

U.S. Online Gambling Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Sports Betting, Casinos, Poker, Bingo), By Device (Desktop, Mobile), Consumer Behavior, Competitive Analysis, And Segment Forecasts

- Report ID: GVR-4-68040-222-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Online Gambling Market Size & Trends

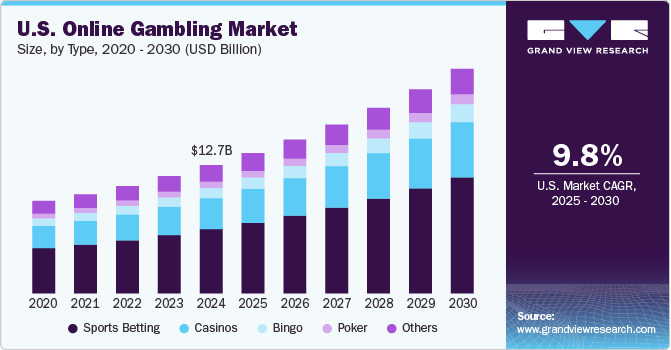

The U.S. online gambling market size was estimated at USD 12.68 billion in 2024 and is expected to grow at a CAGR of 9.8% from 2025 to 2030. The U.S. online gambling industry is increasingly shifting toward live dealer games and immersive formats, driven by rising demand for real-time interaction and authentic experiences. Live casino offerings aim to replicate traditional casino environments through high-definition video streaming, real-time chat features, and professional dealers, enhancing user engagement and trust.

These formats appeal to high-value users seeking premium and socially interactive gambling experiences. Operators collaborate with technology providers to enhance live dealer studio capacity and upgrade streaming infrastructure to support seamless, high-quality user experiences. The combination of humanized interaction and widespread broadband access continues to support the sustained growth of this segment.

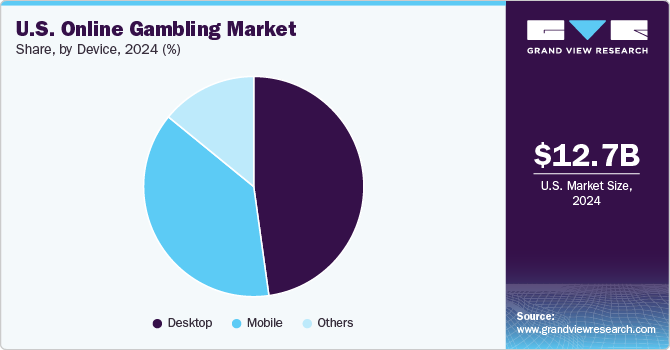

The market is shifting toward mobile platforms, fueled by widespread smartphone usage and high-speed internet availability. Operators now prioritize mobile-first strategies by integrating biometric logins, AI-powered personalization, and real-time betting features. Push notifications and in-app promotions are becoming essential for user retention, offering targeted engagement and enhancing loyalty. Streamlined compliance in progressive states like New Jersey and Pennsylvania enables faster mobile deployment and operational growth. As mobile experiences become more seamless and intuitive, the industry sees rising lifetime value per user and sustained market revenue growth.

The legalization wave in states such as Ohio, Massachusetts, and Maryland is unlocking new opportunities across the U.S. online gambling industry. Government interest in generating taxable revenue is accelerating the pace of legislative approvals. This evolving regulatory landscape encourages competitive activity, with operators expanding into new legal markets. A diverse patchwork of state-level laws prompts operators to develop scalable models that adapt to individual compliance mandates. As more states come online, interstate frameworks and cross-border partnerships are boosting market accessibility and fostering long-term growth.

Decentralized finance is driving major changes within the U.S. online gambling industry, with operators increasingly adopting blockchain technologies. Cryptocurrency is becoming a preferred payment option for younger and more tech-savvy users, offering fast, secure, and private transactions. Smart contracts are being tested for automated payouts and transparent gaming, which reduces fraud risks and boosts user trust. While regulatory uncertainty around crypto persists, adoption is growing in regions with limited banking infrastructure. The rise of Web3 technologies is set to transform the industry's approach to trust, security, and user acquisition strategies.

The industry is witnessing a surge in technological innovation, particularly in states like California, even in the absence of full legalization. Consumer demand for personalization, gamification, and rapid interactions pushes startups and established firms to invest in AI-powered tools and advanced user interfaces. California is emerging as a key R&D hub, influencing national innovation strategies despite lacking legal online gambling operations. Venture capital is flowing into Silicon Valley gambling tech startups, showcasing investor belief in the region's disruptive potential. This West Coast innovation engine is playing a pivotal role in shaping the future of the industry nationwide.

The market is experiencing a rise in social gambling, where users seek community-driven experiences alongside traditional betting. Platforms are incorporating features like multiplayer tournaments, social leaderboards, and live chat to replicate the social atmosphere of physical casinos. These tools increase session durations and enhance user retention through peer interaction and shared milestones. Operators are exploring influencer partnerships and live-streamed betting to build authentic engagement among younger demographics. As the line between gaming and gambling blurs, social features are becoming essential for differentiating offerings in a highly competitive market.

Type Insights

The sports betting segment accounted for a significant market share of over 24% in 2024. Live dealer games transform the online casino experience by offering a more immersive and authentic atmosphere. These games, where real dealers manage the action via live video streaming, bridge the gap between land-based casinos and digital platforms. Players appreciate the real-time interaction and the sense of being in a physical casino, which enhances their engagement and satisfaction. The growth of live casino offerings is propelled by advancements in video streaming technology, making high-quality, seamless broadcasts possible even for mobile users. As live dealer games become more popular, operators focus on diversifying their offerings to include various casino table games, catering to a wider range of preferences.

The casino segment is expected to grow at the highest CAGR of 10.5% from 2025 to 2030. Integrating artificial intelligence (AI) and machine learning transforms the sports betting landscape, particularly in odds-setting and user experience. These technologies are used to analyze vast amounts of historical data and real-time statistics to offer predictive insights, improving the accuracy of odds and bet recommendations. Personalized betting options, such as tailored bets based on individual preferences or past behaviors, are becoming more common, enhancing the user experience. AI’s ability to quickly process and react to data allows sportsbooks to offer better risk management and betting options, which also helps improve customer retention. As AI continues to evolve, its ability to enhance betting strategies will only deepen, leading to more sophisticated and engaging betting experiences.

Device Insights

The desktop segment accounted for the largest market share in 2024. With the rise of desktop gambling platforms, ensuring robust security and fraud prevention measures has become a top priority for operators. Desktop users are increasingly concerned about the safety of their personal data and financial transactions, making security features such as SSL encryption, multi-factor authentication, and biometric verification critical for gaining user trust. Operators invest heavily in advanced security technologies to safeguard user accounts and detect fraudulent activities in real-time. Additionally, the growing sophistication of cyberattacks has pushed gambling platforms to continuously update their security protocols to stay one step ahead of potential threats. As the online gambling space becomes more competitive, secure and trustworthy platforms will be key to retaining and attracting desktop players.

The mobile segment is expected to witness the highest CAGR from 2025 to 2030. Mobile-only promotions and bonuses are becoming a key strategy for attracting and retaining players in the mobile gambling space. Operators increasingly offer exclusive bonuses for mobile app users, such as free spins, no-wagering bonuses, or special promotions tied to mobile-only events. These incentives create a sense of exclusivity and encourage players to download and use mobile apps rather than relying on desktop platforms. With the mobile-first approach continuing to dominate the market, mobile-exclusive bonuses are proving effective in driving new sign-ups and increasing customer engagement. As mobile gambling continues to rise, these targeted offers are expected to become an integral part of operators' mobile acquisition strategy.

Key U.S. Online Gambling Company Insights

Some key players operating in the market include 888 Holdings Plc and 888 Holdings PLC.

-

Flutter Entertainment, the parent company of FanDuel, has become a dominant force in the U.S. sports betting market. Specializing in sports betting, iGaming, and daily fantasy sports, their FanDuel brand is one of the most recognized in the U.S. The company leverages its extensive global expertise in gaming to deliver innovative, customer-centric experiences. With ongoing investments in mobile-first platforms and technology, Flutter Entertainment is solidifying its position as a market leader.

-

888 Holdings has a longstanding presence in the online gambling sector and continues to expand its reach across various online gaming platforms such as poker, casino games, and sports betting. Specializing in regulated markets, 888’s success is rooted in its commitment to compliance, responsible gaming, and high-quality mobile-first gaming experiences. They have built a strong brand emphasizing innovation and player engagement. Their partnerships with other major gambling entities bolster their market presence and user base in the U.S.

DraftKings and Churchill Downs are some of the emerging market participants in the Military Wearables Market.

-

DraftKings has emerged as a leading player in the U.S. online gambling market. Initially focusing on daily fantasy sports, it expanded into online sports betting and casino games. It specializes in user engagement through innovative features like in-app betting, live streaming, and AI-driven personalization. Its aggressive expansion into new states, as they legalize online sports betting, has rapidly expanded its customer base. As a tech-driven operator, DraftKings continues to dominate by leveraging data-driven insights to enhance user experiences.

-

Churchill Downs, a well-known name in horse racing, has increasingly made inroads into the online gambling space with its BetAmerica platform, which focuses on online sports betting and casino games. Specializing in horse racing, they bring a niche offering to the U.S. online gambling market. Their growing focus on mobile-first platforms and sportsbook expansion positions them as an emerging competitor. The company's strong brand association with racing provides a unique advantage as it expands into other betting segments.

Key U.S. Online Gambling Companies:

- 888 Holdings PLC

- Cherry Gold Casino

- Churchill Downs

- DraftKings

- Eldorado Resorts Inc.

- FanDuel

- Flutter Entertainment

- Golden Nugget

- MGM Resorts International

- PokerStars

- Rivers Casino

Recent Developments

-

In April 2025, Caesars Entertainment partnered with AGS, making its online casino platforms the exclusive first home for the popular Triple Coin Treasures slot series. The expansion debuted with the launch of Shamrock Fortunes across Caesars Sportsbook & Casino, Caesars Palace Online Casino, and Horseshoe Online Casino, with more titles set to follow. This collaboration focuses on bringing fan-favorite slot games and brand-new releases to online players, enriching the digital casino experience.

-

In February 2025, GR8 partnered with Betting Software (BSW) to incorporate its Sportsbook iFrame Solution into BSW’s platform. This partnership seeks to expand GR8 Tech’s footprint in Asia and Latin America while allowing more operators to utilize its cutting-edge, user-friendly sportsbook technology.

-

In November 2024, Evolution extended its U.S. partnership with FanDuel Casino for three more years, continuing as the exclusive provider of live dealer games. The agreement ensures FanDuel players access to Evolution and Ezugi's live casino offerings, along with slots from Red Tiger, Big Time Gaming, NetEnt, and Nolimit City. This marks the second renewal since their collaboration began in 2020, reinforcing their commitment to delivering premium online casino experiences across North America.

U.S. Online Gambling Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13.88 billion

Revenue forecast in 2030

USD 22.19 billion

Growth rate

CAGR of 9.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, device

Key companies profiled

Rivers Casino; Cherry Gold Casino; MGM Resorts International; 888 Holdings PLC; Flutter Entertainment; Eldorado Resorts Inc.; DraftKings; Churchill Downs; Golden Nugget; FanDuel; PokerStars

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Online Gambling Market Report Segmentation

The report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. online gambling market report based on type, and device:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Sports Betting

-

Casinos

-

iSlots

-

iTable

-

iDealer

-

Other iCasino Games

-

-

Poker

-

Bingo

-

Others

-

-

Device Outlook (Revenue, USD Billion, 2018 - 2030)

-

Desktop

-

Mobile

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. online gambling market size was estimated at USD 12.68 billion in 2024 and is expected to reach USD 13.88 billion in 2025.

b. The U.S. online gambling market size is expected to grow at a compound annual growth rate of 9.8% from 2025 to 2030 to reach USD 22.19 billion by 2030.

b. The desktop segment accounted for the largest revenue share of over 47.0% in 2024. The rise of desktop gambling platforms, ensuring robust security and fraud prevention measures, has become a top priority for operators.

b. Some key players operating in the U.S. online gambling market include Rivers Casino, Cherry Gold Casino, MGM Resorts International, 888 Holdings PLC, Flutter Entertainment, Eldorado Resorts Inc., DraftKings, Churchill Downs, Golden Nugget, FanDuel, and PokerStars.

b. The legalization of online gambling, celebrity endorsements, and corporate sponsorships are helping market grow in the country. Moreover, the growing use of mobile phones and other digital devices, coupled with access to the internet is creating growth opportunities for online gambling market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.