- Home

- »

- Medical Devices

- »

-

U.S. Ophthalmic Devices Market Size, Industry Report, 2030GVR Report cover

![U.S. Ophthalmic Devices Market Size, Share & Trends Report]()

U.S. Ophthalmic Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (OCT, Ophthalmic Ultrasound Imaging Systems), By Application (Cataract, Glaucoma), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-236-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Ophthalmic Devices Market Trends

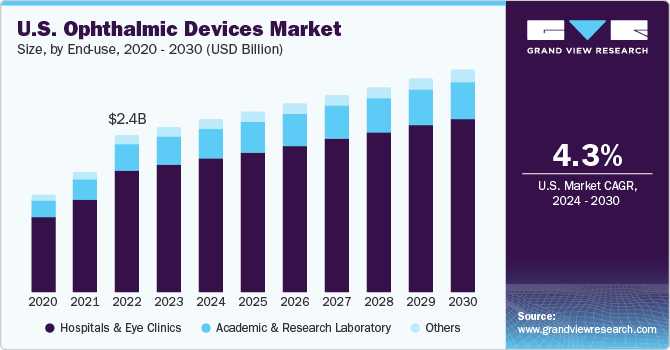

The U.S. ophthalmic devices market size was estimated at USD 2.52 billion in 2023 and is estimated to grow at a CAGR of 4.34% from 2024 to 2030. Major factors contributing to the growth of this market include the growing prevalence of ophthalmic conditions such as cataracts, diabetic retinopathy, and glaucoma, along with the development of advanced ophthalmic surgical instruments. Moreover, rising reimbursement initiatives by the government further drive the market growth.

Rising geriatric population, that are more susceptible to age-related ophthalmic disorders, is anticipated to surge the demand for ophthalmic devices. According to the CDC statistics, approximately 12 million people aged 40 and above in the U.S. have vision impairment, including 1 million who are blind, 3 million who have vision impairment after correction, and 8 million who have vision impairment due to uncorrected refractive error.

Over 7 million Americans have vision loss or blindness based on best corrected visual acuity in their better-seeing eye, and this number is expected to double over the next 30 years. The leading causes of vision impairment and blindness in the U.S. are diabetic retinopathy, age-related macular degeneration, cataract, and glaucoma.

Technological advancements have revolutionized the accurate diagnosis and treatment of ophthalmic disorders. Advent in medications, diagnostic devices, laser technology, and surgical techniques has enhanced the management of conditions such as cataracts, macular degeneration, glaucoma, and dry eye disease. Minimally invasive surgeries such as LASIK, multi-wavelength diabetic retinopathy treatment, ultrasound phacoemulsification, and femtosecond laser surgery are anticipated to drive the demand for ophthalmic devices.

Several companies are actively involved in developing innovative ophthalmic products to sustain their position in the market. Such initiatives further boost the market growth. For instance, in October 2023, Bausch + Lomb Corporation introduced new surgical planning software for the Eyetelligence platform. The new software is designed to streamline surgical planning, and information flow and enable electronic medical record (EMR) and diagnostic device integration.

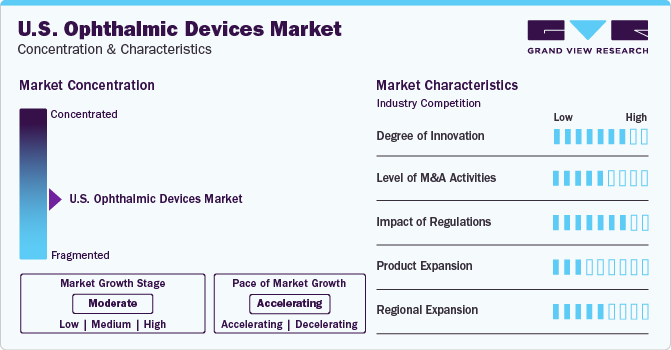

Market Concentration & Characteristics

The U.S. ophthalmic device market is fragmented with presence of numerous manufacturers, including major and minor ophthalmic device companies.

Several companies and research institutes are introducing a variety of products to enhance their product portfolios, a strategy that helps them expand their customer engagement, diversify their product offerings, and enhance the consumer’s health outcomes. For instance, in January 2023, Boomerang Ventures teamed up with Purdue Research Foundation to develop smart contact lenses to continuously monitor intraocular pressure (IOP) in a person’s eye.

Key companies are engaging in partnerships and collaborations to foster growth, and innovation, and enhance competitiveness by leveraging the expertise and resources of diverse organizations. For instance, in July 2022, Carl Zeiss Meditec announced a collaboration with Precise Bio for the commercialization of tissue-based implants in patients who require endothelial keratoplasty.

Key companies are constantly making efforts to establish a robust industry position involving efficiently operating by introducing diverse facilities across multiple locations to expand their presence and secure a larger market share. For instance, in December 2023, Corza Medical announced the launch of the new ophthalmic facility at Fenton, Missouri to develop rapid prototyping of new product designs, enhanced manufacturing capabilities, and expansion of research and development capabilities.

Regulatory bodies such as the U.S. FDA offer transparency in device approval procedures, holding manufacturers accountable for product safety and efficacy. These measures establish trust and encourage ethical practices within the industry. For instance, in October 2023, Glaukos announced FDA approval for the use of iDose TR, a travoprost intracameral implant, for reducing intraocular pressure (IOP) in patients with ocular hypertension (OHT) or open-angle glaucoma (OAG).

Product Insights

Based on product, optical coherence tomography (OCT) held the largest market share in 2023. OCT produces high-resolution cross-sectional and three-dimensional images of biological microstructure and has major applications in the diagnosis of diseases such as glaucoma, age related Macular Degeneration (AMD), and diabetic retinopathy. Furthermore, the incorporation of artificial intelligence (AI) with optical coherence tomography (OCT) is anticipated to enhance the adoption of this device by healthcare professionals, leveraging market growth over the forecast period.

The ophthalmoscope segment is expected to grow at the fastest CAGR from 2024 to 2030. Ophthalmoscopes play a crucial role in diagnosing conditions such as CMV retinitis, papilledema, glaucoma, age-related macular degeneration (AMD), and diabetic retinopathy. Moreover, few key companies implement some strategic initiatives to fulfill the demand ophthalmoscopes. For instance, in October 2023, Baxter International Inc. announced the integration of digital image capture capability for eye examinations with its existing Welch Allyn PanOptic Plus Ophthalmoscope, enhancing its functionality and capabilities. Such initiatives is expected to accelerate the market growth.

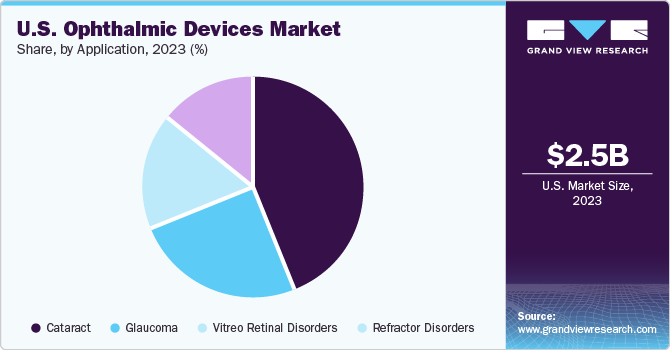

Applications Insights

Based on application, cataract dominated the market with a share of 44% in 2023. This growth can be attributed to the widespread acceptance of ophthalmic devices for cataract surgical procedures. High prevalence of cataracts significantly impact need of cataract surgeries and thereby increasing segment’s growth.

The refractive disorders segment is expected to grow at a significant CAGR from 2024 to 2030. The refractive disorders include myopia, hyperopia, and astigmatism. High prevalence of refractive disorders in the country is fueling the growth of this segment. For instance, as per the report published in Journal of Clinical Medicine, approximately 41.6% of individuals are diagnosed with myopia in the U.S.

End-use Insights

Based on end-use, hospitals & eye clinic held the largest market share in 2023. The increasing adoption of ophthalmic devices in hospitals and low-cost, effective treatment provided in clinics is driving the growth of this segment. Moreover, mergers and acquisitions undertaken by key companies are expected to boost the demand in market.

The academic and research laboratories segment is projected to witness substantial growth from 2024 to 2030 owing the growing funding for ophthalmic care and research. For instance, in January 2024, The University of California, Irvine School of Medicine received Unrestricted Grant by the nonprofit organization Research to Prevent Blindness. The five-year grant, amounting to $575,000, will be allocated to support eye research undertaken by the Department of Ophthalmology.

Key U.S. Ophthalmic Devices Company Insights

Key companies in the U.S. ophthalmic device market include Nidek Co. Ltd Ltd, Johnson & Johnson Vision Care, AbbVie CMO, Sevenoe, and Duckworth& Kent among others.

The intense competition among key players is driving them to expand market share and enhance product offerings through strategic initiatives like innovative product launches, mergers, acquisitions, and partnerships to diversify their portfolios.

Key U.S. Ophthalmic Devices Companies:

- Nidek Co. Ltd Ltd

- Johnson & Johnson Vision Care

- AbbVie CMO

- Sevenoe

- Duckworth& Kent

- Alcon

- The Cooper Companies, Inc

- BVI Medical

- Advancing Eyecare

- MicroSurgical Technology

- Visionix USA

- OASIS Medical

- Marco Ophthalmic

- Precision Lens

Recent Developments

-

In March 2024, Clario partnered with Cleveland Clinic’s Cole Eye Institute. This collaboration will support clinical trials evaluating the efficacy of therapeutics designed to treat the eye as well as other trials monitoring ophthalmic safety events.

-

In October 2023, Bausch + Lomb announced the launch of SeeNa, an ophthalmic diagnostic system for refractive cataract patients in the U.S. This provides a new way for busy refractive cataract practices to enhance surgical planning efficiency.

U.S. Ophthalmic Devices Market Report Scope

Report Attribute

Details

The market size value in 2024

USD 2.64 billion

The revenue forecast for 2030

USD 3.40 billion

Growth rate

CAGR of 4.34% from 2024 to 2030

Actual estimates

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use

Country Scope

U.S.

Key companies profiled

Nidek Co. Ltd; Johnson & Johnson Vision Care; AbbVie CMO; Sevenoe; Duckworth& Kent; Alcon; The Cooper Companies, Inc; BVI Medical; Advancing Eyecare; MicroSurgical Technology; Visionix USA; OASIS Medical; Marco Ophthalmic; Precision Lens

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Ophthalmic Devices Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the U.S. ophthalmic devices marketbased on product, application, and end-use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Optical Coherence Tomography Scanners

-

Fundus Cameras

-

Perimeters/Visual Field Analysers

-

Autorefractors and Keratometers

-

Ophthalmic Ultrasound Imaging Systems

-

Ophthalmic A-Scan Ultrasound

-

Ophthalmic B-Scan Ultrasound

-

Ophthalmic Ultrasound Biomicroscopes

-

Ophthalmic Pachymeters

-

-

Tonometers

-

Slit Lamps

-

Phoropters

-

Wavefront Aberrometers

-

Optical Biometry Systems

-

Ophthalmoscopes

-

Lensmeters

-

Corneal Topography Systems

-

Specular Microscopes

-

Retinoscopes

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cataract

-

Vitreo retinal disorders

-

Glaucoma

-

Refractor Disorders

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals and Eye Clinics

-

Academic and Research Laboratory

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. ophthalmic devices market size was estimated at USD 2.52 billion in 2023 and is expected to reach USD 2.65 billion in 2024.

b. The U.S. ophthalmic devices market is expected to grow at a compound annual growth rate of 4.3% from 2024 to 2030 to reach USD 3.40 billion by 2030.

b. Based on product, optical coherence tomography scanners dominated the ophthalmic devices market with a share of 23.2% in 2023. This is attributable to advancements in OCT, which help in the efficient diagnosis and treatment of retinal disorders, glaucoma, and other ophthalmic disorders.

b. Some key players operating in the U.S. ophthalmic devices market include Abbott Medical Optics, Inc., Carl Zeiss Meditec AG, Alcon, Inc., Bausch & Lomb, Inc., Haag-Streit, Topcon Corporation, Johnson & Johnson, Essilor International S.A., Ziemer Ophthalmic Systems AG, and Nidek Co. Ltd.

b. Key factors that are driving the U.S. ophthalmic devices market growth include the rising prevalence of eye diseases, technological advancements in ophthalmic devices, and government initiatives for increasing awareness regarding visual impairment.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.