Market Size & Trends

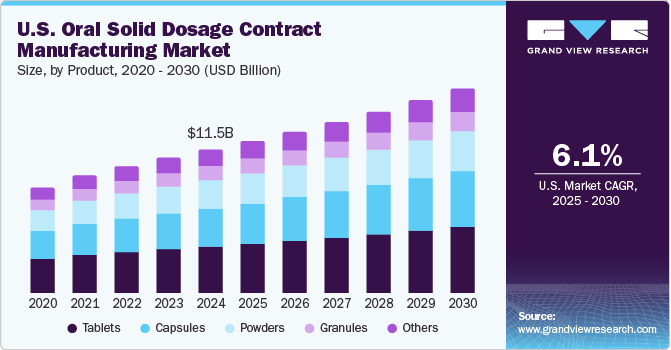

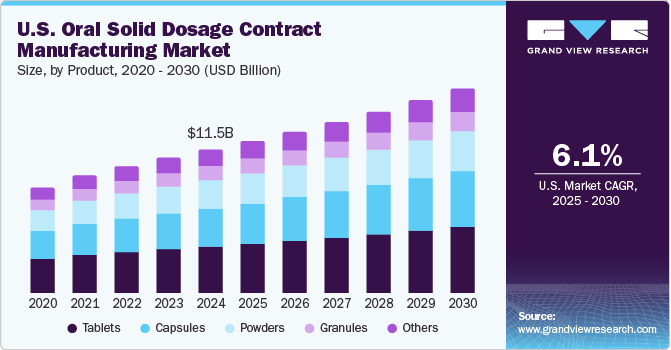

The U.S. oral solid dosage contract manufacturing market size was estimated at USD 11.53 billion in 2024 and is projected to grow at a CAGR of 6.1% from 2025 to 2030. According to the CDC, approximately 133 million citizens, or nearly 40% of the population, were estimated to suffer from chronic illnesses in 2024. This large demographic creates a pressing need for cost-effective generic medications as healthcare providers increasingly prioritize these options for managing long-term conditions. The affordability and therapeutic equivalence of generics to brand-name drugs make them a preferred choice, further fueling market growth as pharmaceutical companies seek efficient manufacturing solutions to meet this rising demand.

Regulatory compliance also plays a vital role in shaping the contract manufacturing landscape. In 2024, the FDA approved over 32,000 generic drugs, underscoring its commitment to enhancing access to affordable medications while maintaining stringent quality standards. The Generic Drug User Fee Amendments (GDUFA) have streamlined the approval process, encouraging pharmaceutical firms to leverage contract manufacturing services. By partnering with Contract Development and Manufacturing Organizations (CDMOs) that excel in navigating complex regulatory environments, companies can ensure compliance and maintain quality, thus enhancing their operational efficiency.

Moreover, technological advancements are contributing significantly to the market’s dynamism. Continuous innovations in drug delivery systems, including targeted and sustained-release formulations, are enhancing the effectiveness of oral solid dosage forms. As a result, pharmaceutical companies are increasingly attracted to contract manufacturers for specialized services. These advancements improve patient outcomes and position contract manufacturers as critical partners in the development of innovative drug formulations, fostering deeper collaborations within the industry.

The trend of pharmaceutical companies outsourcing manufacturing functions is on the rise. Firms are increasingly turning to CDMOs to reduce operational costs and focus on core competencies such as research and development. This shift allows pharmaceutical companies to optimize resource allocation, driving substantial market growth by expanding the capacity and capabilities of contract manufacturers. By aligning their strategic initiatives with these trends, businesses can effectively navigate the evolving landscape of the industry.

Product Insights

Tablets dominated the market and accounted for a share of 32.2% in 2024. Tablets are cost-effective, easy to produce, and convenient for patients, improving adherence to treatment regimens. Furthermore, advancements in manufacturing technologies, such as continuous production and 3D printing, enhance efficiency, while the growing demand for generic medications drives pharmaceutical companies to outsource manufacturing to meet market and regulatory requirements.

Capsules are expected to grow at the fastest CAGR of 6.5% over the forecast period. Capsules are favored for their swallowability, enhancing patient compliance, particularly for those who struggle with tablets. They offer rapid disintegration and absorption for medications requiring swift action, mask unpleasant tastes and odors, and support personalized medicine by customizing formulations and dosages, ensuring flexible treatment options.

Mechanism Insights

The immediate-release mechanism led the market with a revenue share of 38.1% in 2024, driven by the rapid absorption and therapeutic efficacy of immediate-release formulations, which comprised approximately 43.30% of the market in 2024. Their convenience improves patient compliance and flexible dosing, while advancements in manufacturing enhance accessibility, addressing the rising demand for prompt symptom management in chronic disease care.

The controlled release mechanism is expected to register the fastest growth of 6.3% over the forecast period. This mechanism offers sustained therapeutic effects, improving patient adherence by reducing dosing frequency. These formulations ensure stable drug levels in the bloodstream, minimizing side effects. Innovations such as polymer nanosystems and dual drug tablets enhance targeted delivery and bioavailability, driving demand for long-term treatment options amidst rising chronic diseases.

End Use Insights

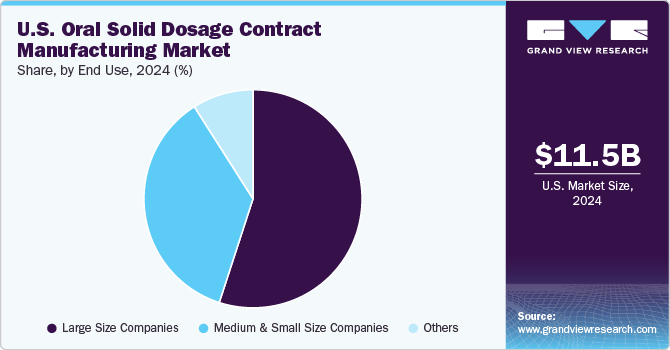

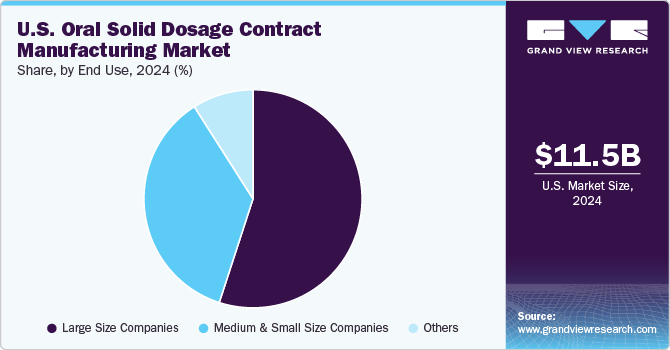

Large companies held the largest market share of 54.6% in 2024, fueled by their preference for outsourcing manufacturing processes. By collaborating with CDMOs, firms can concentrate on core activities such as research, development, and marketing while minimizing operational challenges, reducing costs, and leveraging economies of scale for efficient product introductions.

Medium and small companies are projected to grow at the fastest CAGR of 6.6% over the forecast period. These companies frequently lack the infrastructure for large-scale manufacturing, making outsourcing to CDMOs a strategic option. Leveraging CDMOs enables them to efficiently produce high-quality oral solid dosage forms while focusing on novel product development, driven by the rising prevalence of chronic diseases and the need for diverse therapeutic options.

Key U.S. Oral Solid Dosage Contract Manufacturing Company Insights

Some key companies operating in the market include Catalent, Inc. (Novo Holdings A/S), Lonza, AbbVie Inc., Aenova Group, and Adare Pharma Solutions. Companies are prioritizing strategic initiatives such as partnerships, technological advancements, and capacity expansions while investing in quality management systems to improve compliance and efficiency in drug delivery solutions.

-

Aenova Group is a prominent contract manufacturer of oral solid dosage forms, including tablets and capsules, serving the pharmaceutical and nutraceutical sectors, strongly emphasizing quality and regulatory adherence.

-

Adare Pharma Solutions offers contract manufacturing for oral solid dosage forms, specializing in advanced drug delivery technologies and customized formulations, enhancing bioavailability and patient compliance while efficiently facilitating innovative product development for pharmaceutical companies.

Key U.S. Oral Solid Dosage Contract Manufacturing Companies:

- Catalent, Inc (Novo Holdings A/S)

- Lonza

- AbbVie Inc.

- Aenova Group

- Adare Pharma Solutions

- Boehringer Ingelheim International GmbH

- Jubilant Pharmova Limited

- Patheon Pharma Services (Thermo Fisher Scientific Inc.)

- Recipharm AB

- CordenPharma

- Siegfried Holding AG

Recent Developments

-

In September 2024, Recipharm enhanced its Oral Solid Dosage capabilities, investing in development and production to meet industry demands, introducing the ReciPredict platform, and expanding high-potency manufacturing capabilities for improved efficiency.

-

In August 2024, Aenova launched a new gummy production line in Romania, producing one billion gummies annually, addressing the growing demand for convenient, effective pharmaceutical and food supplement dosage forms.

-

In July 2024, Siegfried completed the acquisition of an early-phase CDMO in Grafton, Wisconsin, enhancing its Drug Substance development services and expanding its geographical coverage in the U.S. market.

-

In May 2024, Adare Pharma Solutions announced expansions of its high potency handling capabilities, adding a second suite in Philadelphia and a new bottle packaging line.

U.S. Oral Solid Dosage Contract Manufacturing Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 12.22 billion

|

|

Revenue forecast in 2030

|

USD 16.43 billion

|

|

Growth rate

|

CAGR of 6.1% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Report updated

|

December 2024

|

|

Quantitative units

|

Revenue in USD million/billion and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, trends

|

|

Segments covered

|

Product, mechanism, end use, region

|

|

Country scope

|

U.S.

|

|

Key companies profiled

|

Catalent, Inc (Novo Holdings A/S); Lonza; AbbVie Inc.; Aenova Group; Adare Pharma Solutions; Boehringer Ingelheim International GmbH; Jubilant Pharmova Limited; Patheon Pharma Services (Thermo Fisher Scientific Inc.); Recipharm AB; CordenPharma; Siegfried Holding AG

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Oral Solid Dosage Contract Manufacturing Market Report Segmentation

This report forecasts revenue growth at the country level and analyzes the latest industry trends in each sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. oral solid dosage contract manufacturing market report based on product, mechanism, end use, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Tablets

-

Capsules

-

Powders

-

Granules

-

Others

-

Mechanism Outlook (Revenue, USD Million, 2018 - 2030)

-

Immediate Release

-

Delayed Release

-

Controlled Release

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)