- Home

- »

- Healthcare IT

- »

-

U.S. Organ Donation And Transplant Software Market, 2033GVR Report cover

![U.S. Organ Donation And Transplant Software Market Size, Share & Trends Report]()

U.S. Organ Donation And Transplant Software Market (2026 - 2033) Size, Share & Trends Analysis Report By Software Type, By Deployment Mode (Cloud-based, On-premise), By Application (Organ Donation Workflow Automation), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-838-6

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Organ Donation And Transplant Software Market Summary

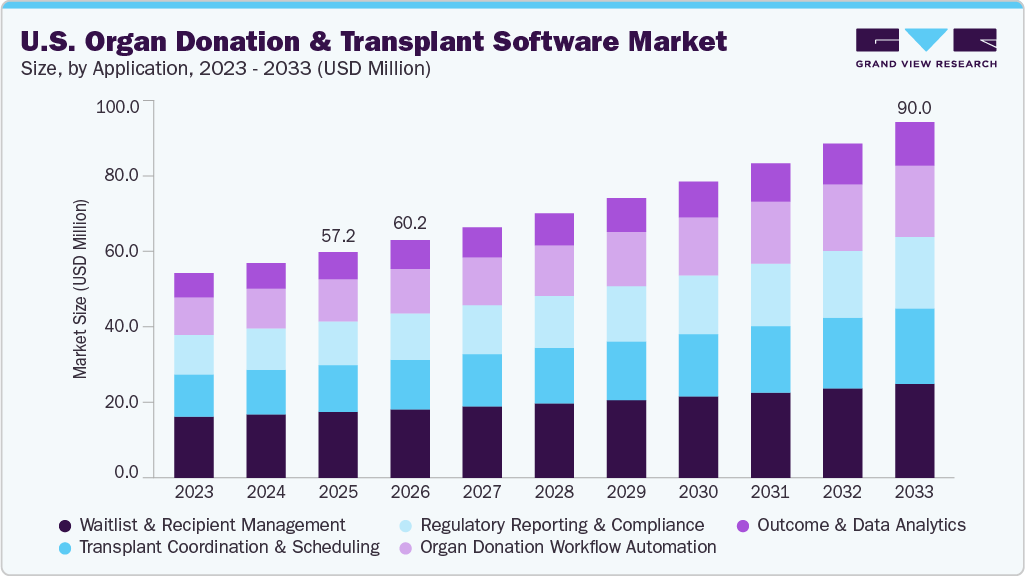

The U.S organ donation and transplant software market size was estimated at USD 57.16 million in 2025 and is projected to reach USD 90.04 million by 2033, growing at a CAGR of 5.9% from 2026 to 2033. This growth is attributed to the increasing organ transplant volumes and demand, growing prevalence of end-stage organ diseases, regulatory requirements for standardized data reporting and registry submission, and need for faster, more accurate donor-recipient matching.

Key Market Trends & Insights

- By software type, transplant management systems dominated the market with the largest revenue share of 33.50% in 2025.

- By deployment mode, the cloud-based segment led the market with a share of 65.52% in 2025.

- By application, the waitlist & recipient management segment dominated the market in 2025.

Market Size & Forecast

- 2025 Market Size: USD 57.16 Million

- 2033 Projected Market Size: USD 90.04 Million

- CAGR (2026-2033): 5.9%

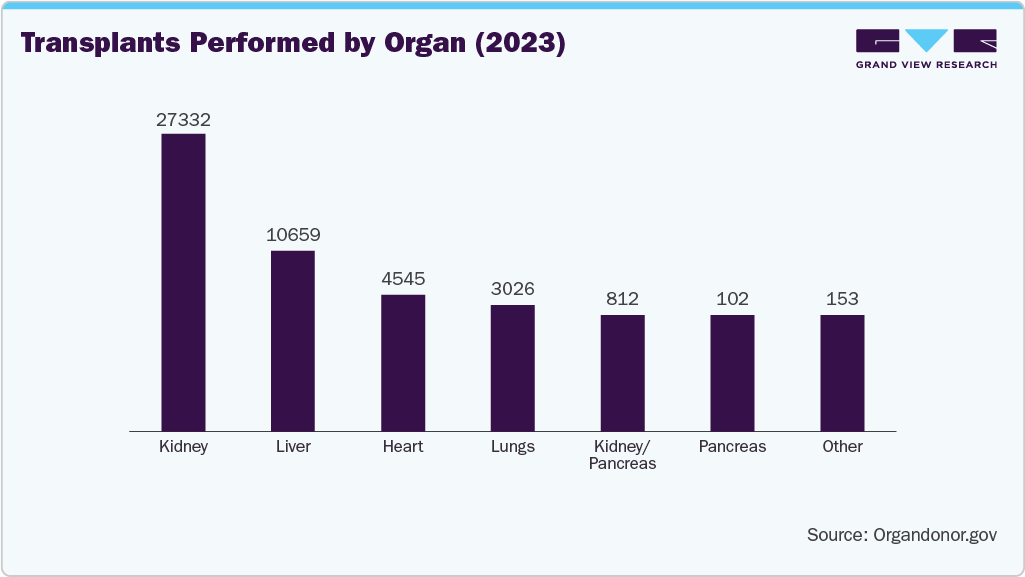

Increasing organ transplant volumes in the U.S. are significantly accelerating the adoption of organ donation and transplant software. According to United Network for Organ Sharing, more than 48,000 organ transplants were performed in the U.S. in 2024, with a 55% increase in transplant procedures since 2015, highlighting the expanding scale and complexity of national transplant operations. This rise places substantial pressure on OPOs and transplant centers to manage larger donor pools, higher match-run frequencies, faster decision cycles, and more intricate logistics workflows. As a result, advanced software solutions are increasingly required to streamline donor management, automate allocation and matching, enhance data accuracy, ensure regulatory compliance, and support real-time coordination across the entire transplant ecosystem.

Regulatory requirements for standardized data reporting and registry submission are a major driver of the U.S. organ donation and transplant software market. Transplant centers, OPOs, and histocompatibility labs must submit comprehensive and timely clinical, operational, and outcome data to national bodies such as the OPTN/UNOS and the HRSA, covering donor characteristics, match runs, organ offers, transplant events, and long-term post-transplant follow-up.

These mandatory reporting obligations, along with strict audit trails, quality metrics, and compliance standards, create a need for software platforms that can automate data capture, ensure accuracy, maintain interoperability with EHRs and laboratory systems, and streamline registry submissions. As regulatory scrutiny and data transparency expectations continue to increase, organizations are turning to advanced digital solutions to reduce administrative burden, avoid compliance gaps, and ensure consistent, standardized reporting across the transplant continuum.

Integration of AI in U.S. Healthcare Organ Donation & Transplant Software market

The integration of AI into organ donation and transplant workflows is driving strong adoption of advanced digital platforms in the U.S., as transplant centers and OPOs increasingly rely on intelligent tools to improve donor-recipient matching accuracy, accelerate decision-making, and enhance overall transplant outcomes. AI enables predictive analytics, automated risk scoring, faster data processing, and more efficient coordination across clinical and operational teams. LifeFuser is a secure, cloud-based AI-driven transplant management platform by Ataims Tech designed to optimize organ transplant workflows, including donor-recipient matching and real-time analytics.

It supports all phases of organ transplantation with predictive outcome modeling, customizable workflows, and comprehensive data integration across kidney, liver, heart, lung, and pancreas programs, while ensuring HIPAA and GDPR compliance. Such platforms demonstrate how AI is reshaping transplant operations and contributing to the growth of the U.S. organ donation and transplant software market.

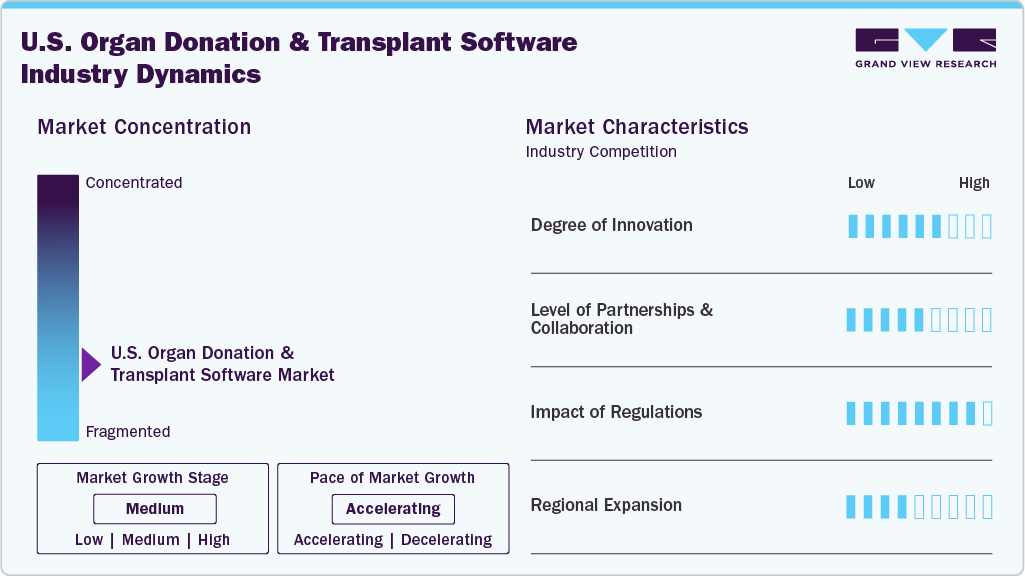

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, impact of regulations, level of partnerships & collaborations activities, degree of innovation, and regional expansion.

The degree of innovation in the U.S. organ donation and transplant software market is moderate to high, supported by the rising need for seamless data exchange, improved donor-recipient matching accuracy, regulatory-driven reporting, and operational efficiency across transplant centers. Hospitals, OPOs, and transplant networks are increasingly adopting advanced platforms to automate workflows, enhance clinical decision-making, and ensure compliance with UNOS/OPTN requirements, enabling transplant teams to operate with greater precision and transparency.

The level of partnerships and collaborations in the U.S. organ donation and transplant software market is moderate, driven by the need for workflow optimization, data interoperability, and digital transformation across transplant centers and OPOs.

Regulatory requirements focused on patient safety, standardized reporting, and interoperability are driving the U.S. organ donation and transplant software market. UNOS/OPTN, HRSA, and CMS mandates push transplant centers and OPOs to adopt digital platforms for accurate donor-recipient matching, real-time offer management, audit-ready documentation, and outcome tracking, making these systems essential for compliance and operational efficiency.

Software Type Insights

Transplant management systems segment held the largest share of 33.50% in 2025, due to their central role in coordinating the entire transplant workflow from patient referral, evaluation, and waitlist management to perioperative coordination and post-transplant follow-up. Hospitals and transplant centers rely heavily on these systems to standardize clinical documentation, ensure regulatory compliance, and integrate seamlessly with EHRs for accurate, audit-ready reporting.

Organ procurement & logistics software segment is expected to grow at the fastest CAGR as OPOs and transplant networks intensify their focus on improving organ transportation efficiency, time-critical coordination, and chain-of-custody accuracy. Growth is driven by the rising adoption of GPS-enabled organ tracking, digital handover verification, and cold-ischemia time monitoring, which address longstanding challenges in organ loss, delays, and documentation errors.

Deployment Mode Insights

The cloud-based segment holds the largest share of 65.52% in 2025 due to the transplant centers and OPOs increasingly relying on real-time, multi-site collaboration, which cloud platforms support more efficiently than on-premise systems. Cloud deployment enables faster updates, lower IT burden, secure remote access, and easier integration with EHRs and national registries, making it the preferred choice for modernizing transplant workflows.

On-premise solutions continue to hold a significant share of the U.S. organ donation and transplant software market because many transplant centers, academic medical institutions, and OPOs still rely on in-house servers and established IT infrastructures for data security and operational control.

Application Insights

Waitlist & recipient management segment dominated the market in 2025. This segment held the largest adoption footprint since transplant centers must continuously maintain accurate waitlist status, update MELD/PELD scores, document clinical exceptions, and comply with mandatory OPTN/UNOS listing requirements. The workflow is highly complex and multidisciplinary engaging surgeons, coordinators, financial staff, and social workers which increases system dependency and broadens licensing volume. In addition, the module often integrates directly with EHRs such as Epic Phoenix and Cerner Transplant, making it deeply embedded in daily clinical operations.

Organ donation workflow automation is expected to register the fastest CAGR from 2026 to 2033, driven by OPOs and transplant centers shifting from manual, paper-based donor referral, screening, and communication processes to fully automated digital workflows. Increasing pressure to improve donor conversion rates, reduce delays, and enhance transparency in donor management is accelerating adoption of automation platforms.

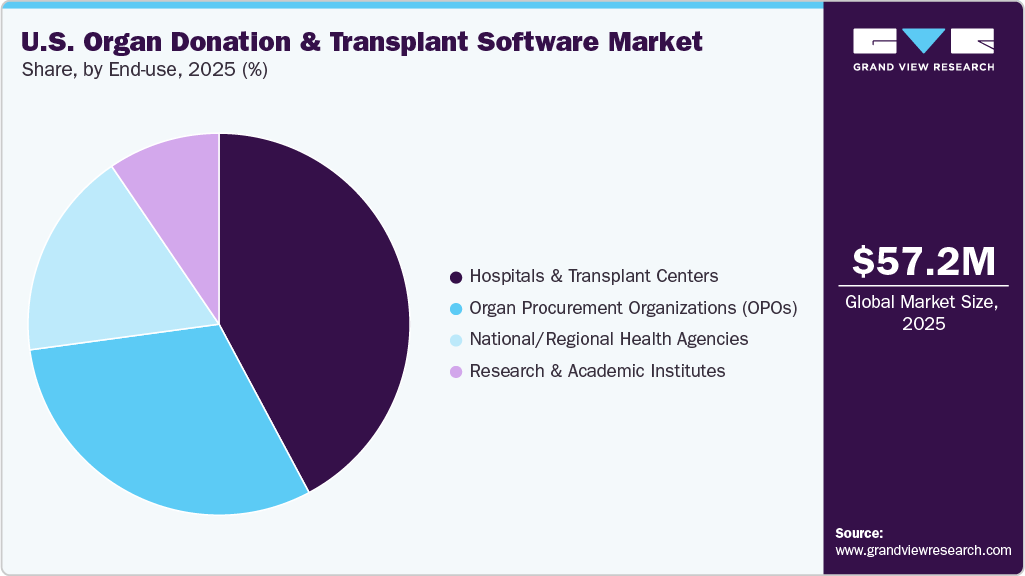

End-use Insights

Hospitals & transplant centers segment held the largest share in 2025, as they perform the actual transplant procedures and rely most heavily on software for patient evaluation, waitlist management, organ acceptance, surgical coordination, compliance reporting, and post-transplant follow-up.

Organ procurement organizations (OPOs) segment is expected to register the fastest CAGR during the forecast period, driven by increasing adoption of digital solutions for donor identification, referral management, organ recovery coordination, real-time communication with transplant centers, and regulatory compliance. The shift from manual workflows to automated, software-driven processes in OPOs is accelerating growth in this segment.

Key U.S. Healthcare Organ Donation And Transplant Software Company Insights

The market is moderately consolidated, with a few players dominating the U.S. organ donation and transplant software space. These key vendors leverage strategies such as product innovation, strategic partnerships, and acquisitions to strengthen their market position, driving overall growth and shaping industry standards.

Key U.S. Healthcare Organ Donation And Transplant Software Companies:

- InVita Healthcare Technologies

- XVIVO

- CareDx

- Afflo

- Ataims Tech

- MedSleuth, Inc.

- EDITLife

- Buckeye Transplant Solutions

- United Network for Organ Sharing

Recent Developments

-

In March 2023, LiveOnNY, the organ procurement organization for the New York City area, partnered with MediGO to launch real-time GPS organ tracking technology, enhancing transparency and accountability in the donation and transplant ecosystem. The collaboration addresses logistical challenges, as nearly half of LiveOnNY's 1,300 organs in 2022 were transported out-of-area, aiming to proactively identify issues and save more lives through better monitoring of location, routes, and delays. MediGO's HIPAA-compliant platform provides shared data to stakeholders, supporting equity and efficiency in organ transport.

-

In May 2021, UNOS launched a national Organ Tracking Service that allows organ procurement organizations (OPOs) and transplant centers to track organs in transit in real time using GEGO global tracking devices. This service provides automated notifications and a live tracking map to monitor the organ's journey, ensuring safe and reliable delivery to patients. It integrates with existing systems used by OPOs and transplant centers, enhancing confidence for donor families and transplant programs.

U.S. Healthcare Organ Donation And Transplant Software Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 60.16 million

Revenue forecast in 2033

USD 90.04 million

Growth rate

CAGR of 5.9% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Software type, deployment model, application, end-use

Key companies profiled

InVita Healthcare Technologies; XVIVO; CareDx; Afflo; Ataims Tech; MedSleuth, Inc.; EDITLife; Buckeye Transplant Solutions; United Network for Organ Sharing

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Healthcare Organ Donation And Transplant Software Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. healthcare organ donation and transplant software market report based software type, deployment mode, application, and end-use:

-

Software Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Organ Donor Management Systems

-

Transplant Management Systems

-

Organ Allocation & Matching Platforms

-

Organ Procurement & Logistics Software

-

Others

-

-

Deployment Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

Cloud-based

-

On-premise

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Organ Donation Workflow Automation

-

Waitlist & Recipient Management

-

Transplant Coordination & Scheduling

-

Regulatory Reporting & Compliance

-

Outcome & Data Analytics

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals & Transplant Centers

-

Organ Procurement Organizations (OPOs)

-

National/Regional Health Agencies

-

Research & Academic Institutes

-

Frequently Asked Questions About This Report

b. The U.S organ donation & transplant software market size was estimated at USD 57.16 million in 2025 and is expected to reach USD 60.16 million in 2026.

b. The U.S organ donation & transplant software market is expected to grow at a compound annual growth rate of 5.93% from 2026 to 2033 to reach USD 90.04 million by 2033.

b. Transplant management systems segment held the largest share of 33.50% in 2025, due to their central role in coordinating the entire transplant workflow from patient referral, evaluation, and waitlist management to perioperative coordination and post-transplant follow-up.

b. Some key players operating in the U.S organ donation & transplant software market include InVita Healthcare Technologies, XVIVO, CareDx, Afflo, Ataims Tech, MedSleuth, Inc., EDITLife, Buckeye Transplant Solutions, and United Network for Organ Sharing

b. Key factors that are driving the market growth include increasing organ transplant volumes and demand, growing prevalence of end-stage organ diseases, regulatory requirements for standardized data reporting and registry submission, and need for faster, more accurate donor-recipient matching.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.