- Home

- »

- Consumer F&B

- »

-

U.S. Packaged Salads Market Size, Industry Report, 2030GVR Report cover

![U.S. Packaged Salads Market Size, Share & Trend Report]()

U.S. Packaged Salads Market (2025 - 2030) Size, Share & Trend Analysis Report By Product (Vegetarian, Non-Vegetarian), By Processing (Organic, Conventional), By Type (Packaged Greens, Packaged Kits), By Category, By Distribution Channel, By States, And Segment Forecasts

- Report ID: GVR-4-68040-055-2

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Packaged Salads Market Size & Trends

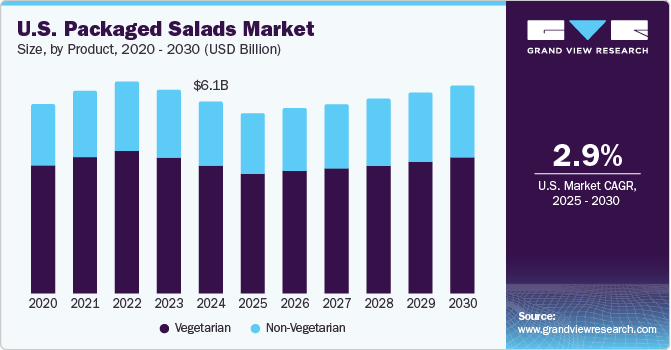

The U.S. packaged salads market size was estimated at USD 6.15 billion in 2024 and is expected to grow at a CAGR of 2.9% from 2025 to 2030. Over the last few years, the demand for healthy food has increased in the U.S., which can be attributed to the rising popularity of salads and the ease of consumption provided by packaged salad products. The availability of packaged food in combinations of different vegetables and fruits, accompanied by various condiments and dressings, as well as an assortment of meats and seafood, has driven their popularity across the region.

Over the last decade, packaged salad kits, particularly the chopped variety, have played a pivotal role in propelling the growth of the overall salad market. These kits have gained widespread popularity by offering consumers a convenient, chef-inspired, and flavorful way to enjoy a vegetable-packed dish, complete with toppings and dressings.

Curated blends of diverse greens are top sellers, as they provide consumers with the flexibility to craft both creative and traditional salads. Notably, core salad consumers in the U.S. opt for classics like Caesar, while millennials and other newcomers are drawn to the contemporary appeal of innovative chopped varieties. For instance, the best-selling salad kits by Dole include a combination of chopped varieties and Caesar. The top three salad kits by Dole are the chopped Caesar Salad Kit, the Chopped Sunflower Crunch Salad Kit, and the Ultimate Caesar Salad Kit.

Shifts in eating habits in the U.S. can be primarily attributed to time constraints for food preparation and the increasing demand from consumers for healthy and time-efficient dietary options. As a result, the consumption of ready-to-eat salads has experienced a noticeable uptick in recent years. Consumers perceive these salads as fresh, safe, nutritious, and convenient, making them an attractive choice that requires no preparation, is entirely edible, & is socially valued for its time-saving attributes & high quality.

Furthermore, packaged salads are characterized as minimally processed products. Their production involves careful selection of plant material, cutting, washing, drying, and packaging in plastic containers. This entire process must adhere to stringent hygienic conditions to prevent microbiological contamination during processing. While packaged salads maintain their sensory, nutritional, and microbiological quality for 5-7 days when stored at 4-6 °C in home refrigerators, their shelf life is relatively shorter compared to raw products.

The U.S. packaged salad industry is highly competitive, and price sensitivity plays a crucial role in determining how much of the increased costs can be transferred to the final product price. If consumers are highly price-sensitive, producers may be limited in their ability to raise prices significantly, and they may need to absorb some of the increased costs themselves. According to the data published by the United States Department of Agriculture (USDA), the weighted average price of salad (Mixed Types) for a 10-12 oz. package last week (18 December 2023 to 22 December 2023) was USD 3.10, up from 2.90 in 2021.The competitive nature of the packaged salad industry means that producers are constantly monitoring the pricing strategies of their rivals. If one producer raises prices, it may prompt others to follow suit or, conversely, to maintain or lower their prices to gain a competitive advantage. The industry's response to changing raw material prices can influence the overall pricing landscape.

The market demonstrates moderate innovation, with a focus on enhanced formulations that incorporate added nutrients like superfoods, probiotics, and high-protein ingredients to appeal to health-conscious consumers. Innovations also include new packaging methods such as resealable bags and single-serve containers to improve convenience and freshness. Overall, the market sees steady, incremental advancements.

Companies focus on strategic acquisitions to expand their presence domestically and reinforce their position in the market. Over the next few years, well-established companies are likely to acquire small and medium-sized enterprises operating in the industry to facilitate regional expansion and broaden their product offerings.

Regulations in the U.S. significantly impact the packaged salads market by ensuring product safety, quality, and labeling accuracy. These regulations, enforced by bodies like the FDA and USDA, require rigorous testing and compliance with manufacturing standards. This oversight helps maintain consumer trust and market integrity but also increases production costs and time to market for manufacturers. Compliance with these stringent regulations ensures that packaged salads are safe and meet quality standards, fostering consumer confidence and potentially driving market growth.

In the U.S. market for packaged salads, product substitutes include a variety of alternatives aimed at providing quick, healthy meal options. These substitutes encompass ready-to-eat meals, fresh-cut fruits and vegetables, and pre-prepared salad kits that offer convenience and nutrition.

The U.S. packaged salads market shows a high degree of concentration among end users. This concentration is primarily driven by a few key demographic groups: health-conscious individuals, busy professionals, and families seeking convenient, nutritious meal options. These consumers typically seek out packaged salads due to their ease of preparation and perceived health benefits.

Product Insights

Vegetarian packaged salads market accounted for a share of 66.8% of the U.S. revenues in 2024. According to an article published by Cook Unity, in 2023, 5-8% of the U.S. population identified themselves as vegetarian, signifying a substantial market for vegetarian products, including packaged salads. This demographic actively seeks convenient and readily available food options that align with their dietary choices. The vegetarian packaged salad market, therefore, has a significant consumer base looking for appealing and nutritious salad options free from animal products.

The non-vegetarian packaged salad market is projected to grow at a CAGR of 3.5% from 2025 to 2030. The consumption of non-vegetarian salads is on the rise in the U.S. This shift in dietary preferences indicates a growing demand for salads that incorporate meat or seafood, reflecting changing consumer tastes and a desire for diverse and protein-rich meal options. As non-vegetarian packaged salads gain popularity, it underscores the dynamic nature of the food industry and the importance of offering a broad range of salad choices to cater to evolving consumer preferences. This trend is also prompting restaurants, food retailers, and salad brands to expand their menu offerings and create innovative non-vegetarian salad options to meet the increasing demand in the market.

For instance, in June 2023, El Pollo Loco, a U.S.-based fire-grilled chicken restaurant chain, introduced its latest offering for the summer season-Double Chicken Chopped Salads. The newly launched salad lineup consisted of the Classic Double Chicken Salad and the Street Corn Double Chicken Chopped Salad. The Classic variant featured fire-grilled chicken, avocado, pepitas, queso fresco, spinach, lettuce, super greens, and pico de gallo. Meanwhile, the Street Corn variant included fire-grilled chicken, avocado, corn, cilantro, queso fresco, lettuce, super greens, chili lime seasoning, and pico de gallo.

Processing Insights

Conventional packaged salads market accounted for a share of 76.19% of the U.S. revenues in 2024. The conventional packaged salad market is witnessing a notable surge in growth, reflecting the continued popularity of convenience-oriented food options among consumers. As lifestyles become increasingly fast-paced, several individuals are turning to ready-to-eat solutions, and conventional packaged salads offer a quick and hassle-free way to incorporate fresh vegetables into daily meals.

The organic packaged salad market is projected to grow at a CAGR of 4.0% from 2025 to 2030. Consumers are increasingly seeking food options that align with their values of environmental sustainability and health consciousness. Organic packaged salads, produced without synthetic pesticides, herbicides, and genetically modified organisms (GMOs), cater to this demand. The desire for clean, wholesome eating experiences has fueled a surge in the popularity of organic salads as individuals look for convenient, ready-to-eat options that meet both their taste preferences and their commitment to environmentally responsible practices.

Type Insights

Packaged greens market accounted for a share of 63.22% of the U.S. revenues in 2024. The increased availability of diverse options of packaged greens in supermarkets, grocery stores, and online platforms contributes to the segment's expansion. Players are introducing a variety of salad blends, microgreens, and specialty greens, offering consumers a wide range of choices to suit different tastes and culinary preferences. Furthermore, packaging innovations in the industry, such as resealable bags and environmentally friendly packaging, enhance the appeal of packaged greens. These features contribute to the preservation of freshness, reduce food waste, and align with the growing awareness of sustainability among consumers.

In July 2023, UP Vertical Farms, in collaboration with its sales and marketing partner Oppy, launched an innovative packaging solution for its packaged salads. The top seal pack with a peel-and-reseal feature is designed to provide consumers with a convenient and effective way to preserve the freshness of UP Vertical Farms' products over an extended period. By allowing consumers to reseal the packaging after use, the new design minimizes exposure to external elements, ensuring that the greens remain as fresh as possible. This packaging innovation marked a strategic move by the company to enhance the shelf life of its offerings.

Packaged kits market is projected to grow at a CAGR of 3.8% from 2025 to 2030. Accessibility is a pivotal driver propelling the growth of the packaged salad kit market. These products are strategically positioned in supermarkets, grocery stores, and online platforms, making them easily accessible to a wide range of consumers. The convenience of finding packaged salad kits in these diverse retail channels contributes significantly to their popularity.

Category Insights

The branded packaged salads market accounted for a share of 76.92% of the U.S. revenues in 2024. Individuals are actively seeking convenient yet wholesome food choices in light of the growing emphasis on maintaining a healthy lifestyle. Branded salad options often boast clear labeling, promoting their nutritional benefits, organic ingredients, and other health-conscious attributes, making them an attractive choice for those looking to make mindful dietary decisions.

In-Store/ Private Label market is projected to grow at a CAGR of 4.9% from 2025 to 2030. The increasing focus on customization and differentiation brings about major improvements in the in-store/private-label packaged salad market. Retailers are investing in fostering unique and diverse salad offerings under their private labels, providing consumers with a variety of choices that mainstream brands do not offer. This emphasis on distinctiveness allows these retailers to carve out a niche within the competitive salad market.

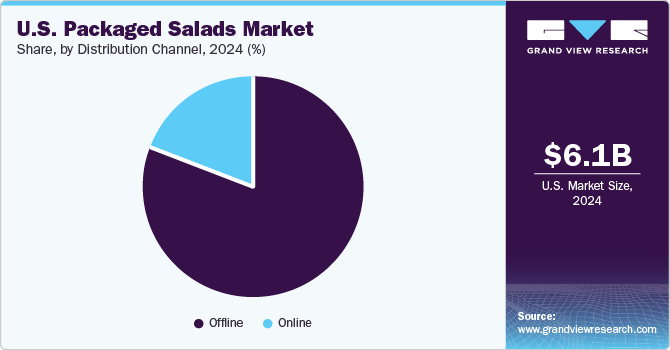

Distribution Channel Insights

Sales of U.S. packaged salads through offline accounted for a share of 79.93% of the U.S. revenues in 2024. Supermarkets and hypermarkets are prominent distribution channels for packaged salads worldwide. Target and Walmart continue to dominate this space. Unlike grocery stores, orders placed through supermarkets and hypermarkets are typically larger. While grocery stores help packaged salad brands stay customer-focused, supermarkets and hypermarkets allow brands to increase sales by providing access to a considerably larger customer base. Furthermore, supermarkets and hypermarkets often have dedicated aisles for packaged foods, making it easy for customers to find specific brands.

The sales of U.S. packaged salads through online distribution channels are projected to grow at a CAGR of 5.9% from 2025 to 2030. The rise of e-commerce platforms and the increasing adoption of online grocery shopping have contributed to the notable growth of online sales within the packaged salad market. Consumers with busy schedules prefer online platforms to streamline their grocery shopping. The ability to browse, select, and purchase packaged salads from the comfort of one's home or via a mobile device aligns with the desire for hassle-free and efficient shopping experiences.

State Insights

The packaged salads market in Florida is projected to grow at a CAGR of 2.3% from 2025 to 2030. The packaged salad market in Florida will grow at a significant pace during the forecast period. Fruits and vegetables are an important part of the state's agricultural economy, and these crops are grown on both small and large farms throughout the state. They are sold through various channels, including farmers' markets, grocery stores, and wholesalers.

New York Packaged Salads Market Trends

The packaged salads market in New York is projected to grow at a CAGR of 4.9% from 2025 to 2030. Agriculture stands out as one of the primary industries in New York, covering a significant quarter of the state's land area, and plays a vital role in enhancing the quality of life for New York residents by generating substantial economic activity. The agricultural sector's contributions extend beyond the rural areas, impacting the overall economic landscape and contributing to the diverse and thriving environment of the state.

As stated by the New York State Department of Health, a notable portion of adults in New York State, specifically 27.7%, do not consume vegetables or fruits daily. Within the state, there is considerable variation among counties, with the percentage of adults who consume no vegetables or fruits daily ranging from 16.0% to 36.1%. This presents a great potential for the packaged salads market in New York.

Pennsylvania Packaged Salads Market Trends

The packaged salads market in Pennsylvania is accounted for a share of around 1.9% of the U.S. revenues in 2024. Pennsylvania is experiencing robust growth in both the production and processing of organic products. This positive trend is expected to fuel the demand for organic packaged salads in the coming years. As consumers increasingly prioritize healthy choices, the state's focus on organic agriculture will likely result in an increased availability of organic produce for packaged salads. As per the 2021 Pennsylvania Economic Impact of Agriculture Update, the cultivation of organic fruits and vegetables in Pennsylvania provides vital support to over 7,200 family farms, sustains 31,000 jobs, and contributes over USD 6.1 billion to the state economy on an annual basis.

Illinois Packaged Salads Market Trends

The packaged salads market in Illinois is projected to grow at a CAGR of 3.1% from 2025 to 2030. Regional players are taking on a crucial role in distributing fresh packaged products through supermarkets in Illinois. By leveraging local and regional distribution channels, these players contribute to making new packaged products more accessible to consumers within the state.

Key U.S. Packaged Salads Company Insights

The market for U.S. packaged salads is highly competitive, with a range of companies offering various products. Many big players are increasing their focus on new product launches, partnerships, and expansion into new markets to compete effectively.

Key U.S. Packaged Salads Companies:

- BrightFarms, Inc.

- Dole Food Company, Inc.

- Earthbound Farm

- Eat Smart (Curation Foods)

- Missionero

- Gotham Greens Holdings, PBC

- Mann Packaging Co., Inc.

- Bonduelle

- Fresh Express, Inc.

- VegPro Intenational, Inc.

- ORGANICGIRL, LLC

Recent Developments

-

In May 2024, Earthbound Farm introduced a line of organic salad kits featuring dressings made with 100% organic avocado oil and its limited harvest wild red arugula blend. These new products will augment Earthbound Farm’s portfolio with additional fresh, flavorful, and healthy options for consumers to grow the salad category.

-

In March 2024, Fresh Express launched two new products to its lineup of best-selling fresh and convenient salad kits. The Asian Apple Salad Kit and Twisted Caesar Creamy Truffle Caesar Chopped Salad Kit are recent additions to the shelf.

-

In November 2023, Gotham Greens introduced a new range of salad kits in three popular varieties-Southwest Ranch, Green Goddess, and Caesar. These salad kits feature fresh ingredients, including lettuce grown in Gotham Greens' greenhouses, and flavorful dressings and toppings. They offer a convenient option for preparing delicious home-cooked meals. These kits are available at select Kroger and Jewel-Osco stores.

-

In October 2023, Gotham Greens announced the expansion of its inaugural state-of-the-art hydroponic greenhouse in the Southeast, marking its 12th greenhouse across the country. This facility will offer a continuous, year-round source of locally grown produce to retail, restaurant, and food service clients in the North American region. Prominent retail partners across the U.S. include Whole Foods Market, Publix, Harris Teeter, and The Fresh Market.

-

In September 2023, Mann Packing Co., Inc. partnered with the Asian culinary brand P.F. Chang's to introduce two new salad kits inspired by Asia. These kits are available at Giant Eagle and select retailers across the U.S.

U.S. Packaged Salads Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.79 billion

Revenue forecast in 2030

USD 6.68 billion

Growth rate (Revenue)

CAGR of 2.9% from 2025 to 2030

Actual Data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Processing, Type, Category, Distribution Channel, States

State scope

Florida; New York; Pennsylvania; Illinois; Ohio; Georgia

Key companies profiled

BrightFarms, Inc.; Dole Food Company, Inc.; Earthbound Farm; Eat Smart (Curation Foods); Missionero; Gotham Greens Holdings; PBC; Mann Packaging Co., Inc.; Bonduelle; Fresh Express, Inc.; VegPro Intenational, Inc.; ORGANICGIRL, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to states & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global U.S. Packaged Salads Market Report Segmentation

This report forecasts revenue growth at the state levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. packaged salads market report on the basis of product, processing, type, category, distribution channel, and states:

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Vegetarian

-

Non-Vegetarian

-

-

Processing Outlook (Revenue, USD Million; 2018 - 2030)

-

Organic

-

Conventional

-

-

Type Outlook (Revenue, USD Million; 2018 - 2030)

-

Packaged Greens

-

Packaged Kits

-

-

Category Outlook (Revenue, USD Million; 2018 - 2030)

-

Branded

-

In-Store/ Private Label

-

-

Distribution Channel Outlook (Revenue, USD Million; 2018 - 2030)

-

Online

-

Offline

-

-

States Outlook (Revenue, USD Million; 2018 - 2030)

-

U.S.

-

Florida

-

New York

-

Pennsylvania

-

Illinois

-

Ohio

-

Georgia

-

-

Frequently Asked Questions About This Report

b. The U.S. packaged salads market size was estimated at USD 6.15 billion in 2024 and is expected to reach USD 5.79 billion in 2025.

b. The U.S. packaged salads market is expected to grow at a compounded growth rate of 2.9% from 2024 to 2030 to reach USD 6.68 billion by 2030.

b. Vegetarian packaged salads market accounted for a share of over 66% of the U.S. revenues in 2024. According to an article published by Cook Unity, in 2023, 5-8% of the U.S. population identified themselves as vegetarian, signifying a substantial market for vegetarian products, including packaged salads. This demographic actively seeks convenient and readily available food options that align with their dietary choices. The vegetarian packaged salad market, therefore, has a significant consumer base looking for appealing and nutritious salad options free from animal products.

b. Some key players operating in the U.S. packaged salads market are BrightFarms, Inc., Dole Food Company, Inc., Earthbound Farm, Eat Smart (Curation Foods), Missionero, Gotham Greens Holdings, PBC, Mann Packaging Co., Inc., Bonduelle, Fresh Express, Inc., VegPro Intenational, Inc., ORGANICGIRL, LLC

b. The availability of packaged food in combinations of different vegetables and fruits, accompanied by various condiments and dressings, as well as an assortment of meats and seafood, has driven their popularity across the region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.