- Home

- »

- Consumer F&B

- »

-

U.S. Pasta And Noodles Market Size, Industry Report, 2030GVR Report cover

![U.S. Pasta And Noodles Market Size, Share & Trends Report]()

U.S. Pasta And Noodles Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Dried, Instant, Frozen/Canned), By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-797-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Pasta And Noodles Market Summary

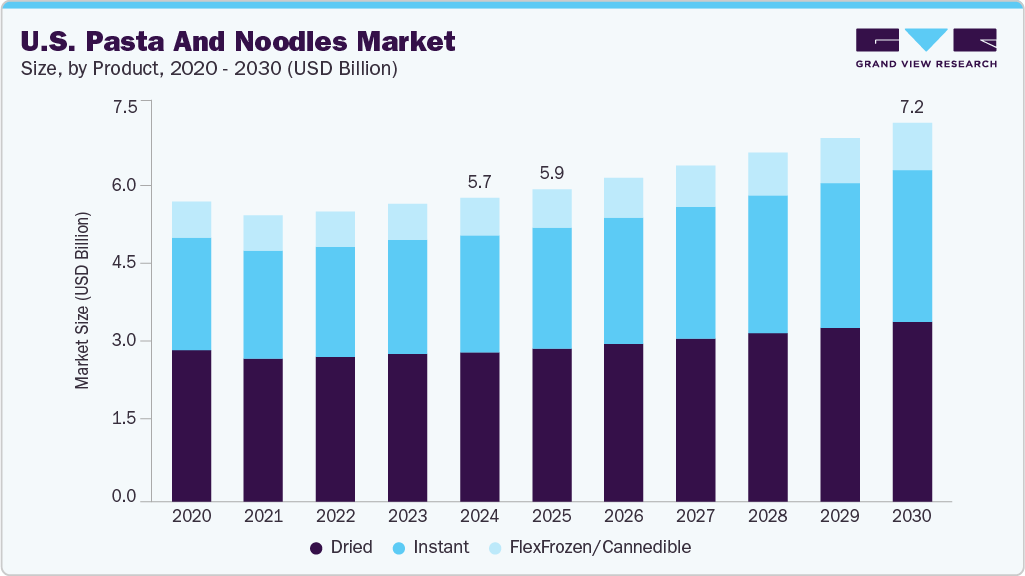

The U.S. pasta and noodles market size was estimated at USD 5,749.3 million in 2024 and is expected projected to reach USD 7,171.8 million by 2030, growing at a CAGR of 3.9% from 2025 to 2030. The market is experiencing growth due to evolving consumer preferences for convenience, flavor diversity, and quicker meal solutions.

Key Market Trends & Insights

- By product, the dried segment dominated the market with a 49.2% revenue share in 2024.

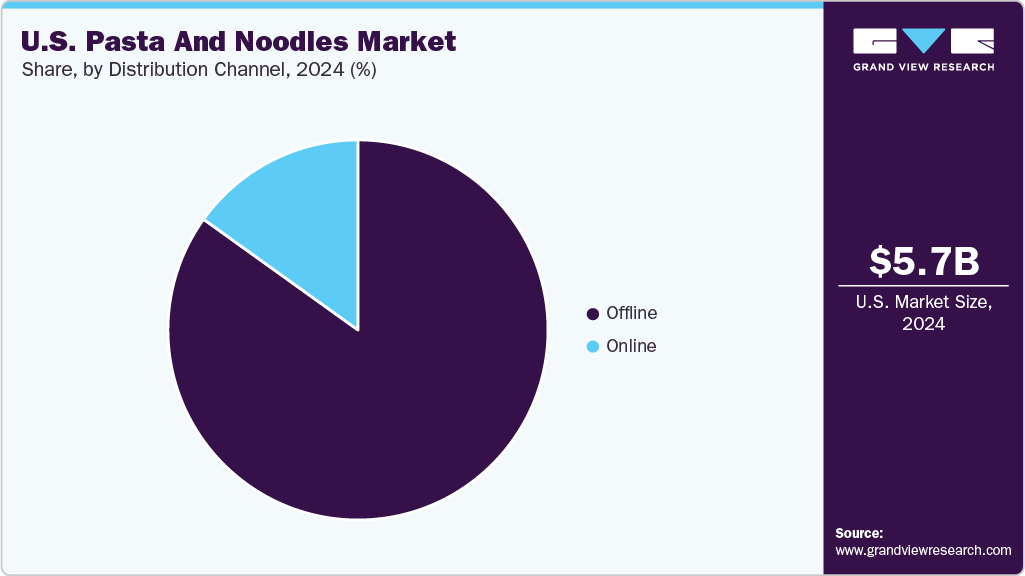

- By distribution channel, the offline segment dominated the market, with a revenue share of 84.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5,749.3 Million

- 2030 Projected Market Size: USD 7,171.8 Million

- CAGR (2025-2030): 3.9%

The demand for pasta and noodles in the U.S. is deeply embedded in everyday eating patterns and influenced by shifting lifestyles, evolving taste preferences, and increased focus on quick meal preparation. Americans consume an estimated 20 lbs. of pasta per person annually, ranking their per-capita intake among the top ten globally. The product’s broad appeal is supported by high household penetration of pasta, with dry pasta favored by a majority of the country’s population. There is a growing demand for noodles, particularly among younger, multicultural, and single-person households, who seek convenience and a diverse range of global flavors.

Major brands continue to innovate in value-added segments to maintain consumer engagement and loyalty. Manufacturers and retailers are responding with innovations in product formats (e.g., high-protein, gluten-free, whole-grain), ethnic flavors (e.g., Asian-style noodles), and ready-to-cook convenience packs. Consumers are increasingly seeking healthier formulations and bold flavor profiles inspired by global cuisines. Strong distribution through supermarkets, club stores, and rapidly expanding online grocery channels supports product reach. Product innovation and modern grocery distribution channels, including supermarkets, mass-merchandise clubs, and online delivery platforms, are shaping how pasta and noodles remain relevant and time-efficient within U.S. diet culture.

Product Insights

The dried segment of the U.S. pasta & noodles industry accounted for the largest revenue share of 49.2% in 2024. The increasing preference of consumers for convenient meal solutions continues to drive demand for dried formats. The segment's growth is further supported by product innovations in shapes, textures, and nutritional upgrades, such as whole-grain, protein-enriched, and gluten-free formulations. Brands are increasingly emphasizing premium craftsmanship and regional authenticity. The rising adoption of quick yet high-quality meal options among busy households reinforces the segment’s growth trajectory, ensuring that dried pasta and noodles remain a staple of American dining culture.

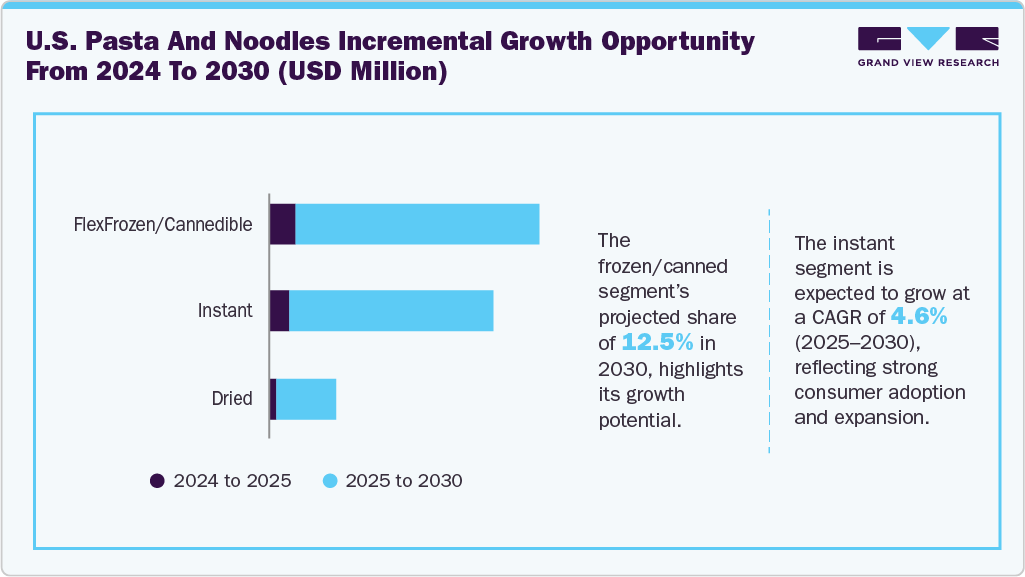

The instant segment is projected to grow at a significant CAGR of 4.6% from 2025 to 2030. The instant pasta and noodles market continues to experience strong momentum supported by shifting dietary preferences, multicultural food exploration, and the growing influence of social media on consumer purchasing behavior. Convenience remains a key driver, particularly for younger and urban populations seeking affordable, quick-to-prepare meal solutions that still deliver flavor and novelty. Rising interest in global cuisines has pushed brands to innovate with bolder taste profiles and fusion concepts in the instant segment. In May 2025, Maggi expanded its footprint in the U.S. with the launch of a new line of Maggi Noodles, including three distinctive flavors, targeting increased demand for bold, globally inspired flavors. This initiative aligns with strong category traction among younger consumers, with 79% of Gen Z trying new foods or flavors due to social media influence.

Distribution Channel Insights

The offline segment led the U.S. pasta & noodles market, accounting for the largest revenue share of 84.9% in 2024. Offline distribution continues to play a crucial role in the U.S. pasta and noodles market, as major retail formats, including supermarkets, hypermarkets, and neighborhood grocery stores, remain the primary purchasing channels for households. Well-established retail chains partner closely with leading manufacturers to expand their presence, ensuring wide shelf availability of traditional dried pasta, instant noodles, regional specialties, and health-focused varieties. Trader Joe’s has announced a significant expansion plan, adding 30 new store locations across 18 U.S. states in 2025, to extend its reach and deliver its signature range of globally inspired grocery offerings to more neighborhoods nationwide.

The online segment is projected to grow at the fastest CAGR of 6.6% from 2025 to 2030. The distribution of pasta and noodles through various online channels in the U.S. continues to accelerate as consumers prioritize convenience, broader product accessibility, and value-driven purchasing. E-commerce platforms offer an extensive assortment, including traditional pasta, instant noodles, premium imported variants, and gluten-free and protein-fortified options, which may not always be available in physical retail outlets. Subscription services and direct-to-consumer channels lead to increased repeat orders. Options like quick or same-day delivery by major online retailers offer ease of access for busy households. Digital marketing and social media engagement further influence flavor exploration and trial, reinforcing online platforms as a key growth channel.

Key U.S. Pasta And Noodles Company Insights

Many brands in the U.S. pasta & noodles industry have recognized untapped opportunities within their product portfolios and are actively working to capitalize on these gaps.

Key U.S. Pasta And Noodles Companies:

- Barilla G. e R. Fratelli S.p.A

- The Kraft Heinz Company.

- TOYO SUISAN KAISHA, LTD

- NISSIN FOODS HOLDINGS CO., LTD.

- The Campbell’s Company

- Conagra Brands, Inc.

Recent Developments

-

In October 2025, Pasta Garofalo launched a new high-protein pasta line in the U.S., offering enhanced nutritional benefits while preserving authentic Italian taste.

U.S. Pasta And Noodles Market Report Scope

Report Attribute

Details

Market value size in 2025

USD 5,919.2 million

Revenue Forecast in 2030

USD 7,171.8 million

Growth rate

CAGR of 3.9% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel

Key companies profiled

Barilla G. e R. Fratelli S.p.A.; The Kraft Heinz Company.; TOYO SUISAN KAISHA, LTD.; NISSIN FOODS HOLDINGS CO., LTD.; The Campbell’s Company; Conagra Brands, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Pasta And Noodles Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. pasta and noodles market report based on product and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Dried

-

Instant

-

Frozen/Canned

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

Frequently Asked Questions About This Report

b. The U.S. pasta and noodles market size was valued at USD 5,749.3 million in 2024 and and is expected to reach USD 5,919.2 million

b. The U.S. pasta and noodles market is expected to grow at a compounded growth rate of 3.9% from 2025 to 2030 to reach USD 7,171.8 million by 2030.

b. The dried segment accounted for the largest share of 49.2% in U.S. pasta & noodles, in 2024. The increasing preference of consumers for convenient meal solutions continues to drive demand for dried formats. The segment growth is further supported by product innovation in shapes, textures, and nutritional upgrades such as whole grain, protein-enriched, and gluten-free formulations.

b. Some key players operating in the market include Barilla G. e R. Fratelli S.p.A.; The Kraft Heinz Company.; TOYO SUISAN KAISHA, LTD.; NISSIN FOODS HOLDINGS CO., LTD.; The Campbell’s Company; Conagra Brands, Inc.

b. The U.S. pasta and noodles market is experiencing growth due to evolving consumer preferences for convenience, flavor diversity, and quicker meal solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.