- Home

- »

- Healthcare IT

- »

-

U.S. Patient Engagement Solutions Market Size Report, 2030GVR Report cover

![U.S. Patient Engagement Solutions Market Size, Share & Trends Report]()

U.S. Patient Engagement Solutions Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (AI-Driven Engagement, Telehealth Solutions), By Delivery Type (Web/Cloud-based, On-premise), By Functionality, By End Use, By Country, And Segment Forecasts

- Report ID: GVR-2-68038-427-7

- Number of Report Pages: 149

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

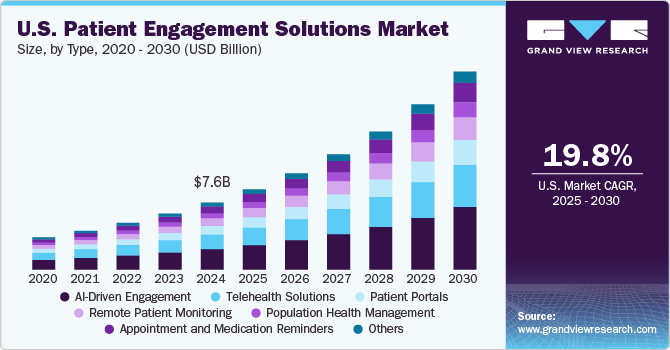

The U.S. patient engagement solutions market size was valued at USD 7.59 billion in 2024 and is expected to grow at a CAGR of 19.77% from 2025 to 2030. This growth is attributed to factors including the increasing prevalence of chronic diseases, the shift toward value-based care, advancements in healthcare technology, and the growing demand for personalized healthcare experiences. For instance, in September 2024, Health Union’s acquisition of Adfire Health emphasized the growing demand for personalized marketing solutions targeting consumers and healthcare professionals, improving patient-provider interactions and driving better engagement and outcomes in the pharmaceutical and life sciences industries.

The growing prevalence of chronic diseases in the U.S. highlights the need for continuous patient interactions and health monitoring. As of 2022, approximately 37.3 million new cases of diabetes were reported, highlighting this necessity. Patient engagement solutions empower healthcare providers to maintain regular communication with patients, send reminders, and share educational materials. This approach enhances adherence to treatment plans and improves health outcomes, making these solutions essential for effectively managing chronic conditions.

Moreover, the growing demand for personalized healthcare is another key driver. Patients increasingly seek solutions that cater to their needs and preferences rather than generic care models. Patient engagement solutions that offer tailored treatment plans, such as those powered by Artificial Investment (AI) and data analytics, are transforming the patient experience. These technologies help customize care to match the unique health profiles of individuals, leading to higher patient satisfaction and better clinical results.

Healthcare providers are shifting toward models prioritizing patient involvement in decision-making and care coordination. This transition is driven by patient demand and regulatory frameworks such as the Affordable Care Act, which emphasizes outcomes-based care. By integrating solutions that facilitate better communication, providers are making significant strides toward delivering more patient-centered care and improving overall health outcomes.

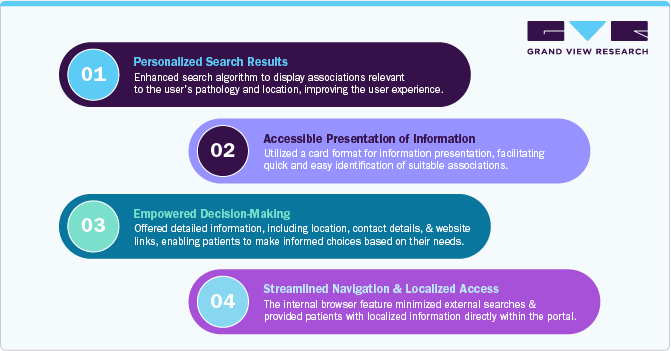

Case Study: Enhancing Patient Engagement through Localized Healthcare Association Integration in Patient Portals

Existing medical portals provided healthcare information but needed more connections to local healthcare organizations. A new patient portal was developed to address this, featuring a location-based Associations Page with an integrated internal browser for easy searching. Search results were presented in a user-friendly card format, including detailed association information such as location maps and contact details. The portal enhanced patient engagement by offering tailored search results, accessible information, and streamlined navigation, improving patient access and decision-making.

Challenge: Existing medical portals provided access to healthcare information but failed to connect patients with local healthcare organizations, especially those seeking information on specific medical conditions.

Solution: To address this issue, a patient portal was designed to offer location-based assistance, enhancing patient engagement by introducing the following features:

-

Associations Page with Integrated Internal Browser: Enabled direct search functionality for healthcare associations by location, pathology, or name within the portal.

-

Search Results in User-Friendly Card Format: Displayed search outcomes in an accessible card format, tagged with relevant pathologies for easy identification, and included essential decision-making information.

-

Comprehensive Card Information: Provided detailed information on each association, including a location map, contact details, and a website link.

Outcome: The deployment of the patient portal led to improved patient access to localized healthcare organizations:

Market Concentration & Characteristics

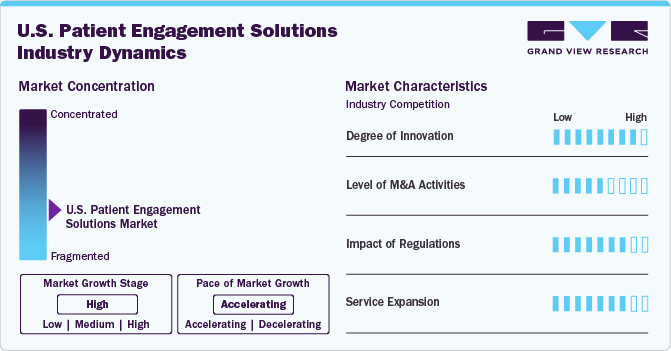

The U.S. market experienced high levels of innovation, driven by advancements in AI, machine learning, and telemedicine. For instance, in August 2024, Press Ganey, a healthcare provider of experience measurement and data analytics, announced an expansion of its PX Connect Suite, allowing healthcare organizations to capture and respond to patient feedback directly within Epic.

Mergers and acquisitions are moderate in the U.S. market. For instance, in December 2024, Commure acquired Memora Health, a platform focused on digital care navigation. This acquisition strengthens Commure’s portfolio, which utilizes artificial intelligence and encompasses patient engagement, clinical documentation, revenue cycle management, and real-time location services (RTLS).

The impact of regulations on the U.S. market is high. Regulatory bodies play a critical role in shaping the market by setting guidelines and encouraging initiatives prioritizing patient involvement in healthcare processes. For instance, the FDA and CTTI collaborated on the Patient Engagement Collaborative (PEC) in November 2024. The PEC comprises patient organizations and individual representatives who discuss enhancing patient engagement in medical product development and regulatory discussions at the FDA.

Type Insights

The AI-driven engagement segment held the largest revenue share of 30.54% in 2024 and is anticipated to expand at the fastest CAGR due to its ability to personalize care and enhance patient-provider interactions. AI tools such as chatbots, predictive analytics, and virtual assistants improve patient communication, automate scheduling, and provide tailored health advice. For instance, in April 2023, TeleVox introduced Iris, an AI-powered virtual assistant, at HIMSS 2023 to enhance patient access and experience. It offers voice, web chat, and SMS features, reducing staff workload while improving patient acquisition and engagement. In addition to the above factors, increasing demand for efficient care, rising healthcare costs, and advancements in AI technology significantly drive the market.

The remote patient monitoring (RPM) segment is projected to grow at the fastest rate of 20.47% in the market owing to the increasing demand for at-home care, advancements in wearable devices, and the need for cost-effective healthcare. RPM allows patients to monitor vital signs like blood pressure, glucose levels, and heart rate from home, reducing hospital visits and improving care management. The aging population, rising chronic conditions, and healthcare system pressures are key drivers.

Delivery Type Insights

The web/cloud-based segment dominated the market in 2024 with a revenue share of 67.38% and is anticipated to expand at the fastest CAGR. Factors include the growing adoption of telehealth, increased demand for remote patient monitoring, and the shift to value-based care models. Cloud platforms enable healthcare providers to offer real-time, secure access to patient data and communication tools across various devices, enhancing engagement and convenience.

The on-premise segment experienced a significant growth in the market. These solutions involve hosted and managed on-site software, providing greater control over data security and customization for specific healthcare environments. This segment is driven by concerns over data privacy, regulatory compliance (e.g., HIPAA), and the need for customized solutions tailored to specific healthcare systems.

Functionality Insights

The enhanced communication segment held the largest revenue share in 2024. With the increasing adoption of AI-driven solutions in healthcare, the demand for advanced communication capabilities is growing. These functionalities empower healthcare organizations to interact with patients efficiently, delivering timely information and support. By leveraging AI technologies, such as Natural language processing (NLP) & sentiment analysis, healthcare systems personalize patient interactions, improving engagement and satisfaction. In addition, enhanced communication functionalities enable healthcare organizations to streamline administrative tasks, such as appointment scheduling and medication reminders, enhancing patient experience. Hence, the integration of advanced communication features into AI-powered patient engagement solutions is expected to significantly drive market growth in the coming years.

The patient education segment is projected to grow at the fastest rate over the forecast period, driven by the need for informed patients and better health outcomes. As healthcare becomes more complex, patients seek accessible, clear information about their conditions, treatments, and wellness strategies. Digital tools, such as educational apps, websites, and interactive videos, empower patients to make informed decisions. For instance, in June 2023, Vital Advances enhanced precision patient education by launching the industry's first AI-powered video education feature. By providing personalized, evidence-based video education tailored to individual patient needs, this innovation enhances the overall patient experience and engagement.

“With the introduction of our AI-Powered Video Education feature, we are tackling some of healthcare’s most pressing patient engagement challenges head-on. It’s well known that patient education increases adherence to care plans, resulting in fewer readmissions. However, education delivery methods historically have been variable and inconsistent at best. With this new offering, patients and caregivers receive a personalized prescription of highly relevant video-based education content automatically, akin to how YouTube or Spotify delivers user-tailored content. This gives nurses and other clinicians critical time back in their day to practice at the top of their license.”

- Aaron Patzer, co-founder and CEO at Vital.

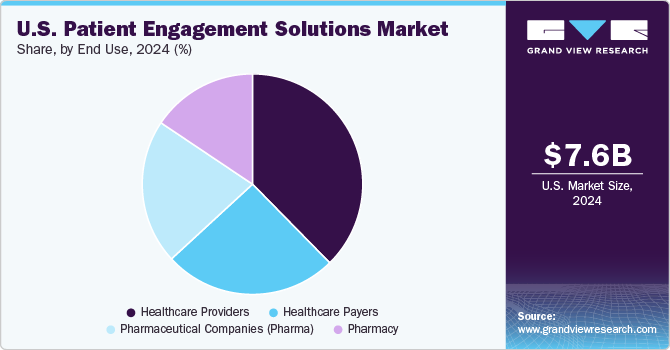

End Use Insights

The healthcare providers segment held the largest revenue share in 2024. Providers handle the highest number of patients and serve as the main point of contact for a wide range of health issues, from general to specialized care, and are the primary adopters of patient engagement solutions. For instance, in December 2021, Northwell Health in the U.S. implemented a patient engagement platform from Playback Health at several clinical locations to enhance mobility and facilitate the sharing of point-of-care medical data, all while maintaining compliance with health information security standards.

The pharmaceutical companies (pharma) segment is estimated to expand at the fastest rate of 20.91% over the forecast period. This segment's growth is driven by the need to improve patient adherence, reduce treatment costs, and enhance drug efficacy. Pharma companies use patient engagement tools to provide education, personalized support, and monitoring to ensure patients follow prescribed therapies. Key drivers include the rising demand for specialty drugs and biologics and increasing regulatory pressure for improved patient outcomes. For instance, in September 2024, AllazoHealth introduced an advanced AI-driven content optimization solution designed to assist pharmaceutical companies in personalizing patient communications and enhancing medication initiation and adherence.

“Healthcare consumers want to be understood as individuals. Pharmaceutical companies that excel at personalization are exceeding their goals because their customers are more engaged. Our AI-Enabled Dynamic Modular Content helps pharmaceutical companies effectively predict the most relevant information for each specific patient - at the right time and in the ways they prefer to receive it - helping boost medication initiation, adherence, compliance, and patient health outcomes.”

- AllazoHealth CEO William Grambley

Key U.S. patient engagement solutions Company Insights

The market is competitive, with large and small companies participating. Major players focus on strategies including product innovation, expanding into new regions, and pursuing mergers, acquisitions, and partnerships to grow their market presence. For instance, in May 2021, IQVIA partnered with Corium, Inc. to deploy its Orchestrated Customer Engagement (OCE) solution to support the commercialization strategy for AZSTARYS, an oral ADHD prodrug.

Key U.S. patient engagement solutions Companies:

- Cerner Corporation (Oracle)

- NextGen Healthcare, Inc.

- Epic Systems Corporation

- Allscripts Healthcare, LLC

- McKesson Corporation

- ResMed

- Koninklijke Philips N.V.

- Klara Technologies, Inc.

- CPSI, Ltd.

- Experian Information Solutions, Inc.

- athenahealth

- Solutionreach, Inc.

- IBM

- MEDHOST

- Nuance Communications, Inc. (Acquired by Microsoft in March, 2022)

Recent Developments

-

In September 2024 SEQSTER and PatientsLikeMe collaborated to create a connected patient health hub to integrate real-time EHR data.

"Partnering with SEQSTER empowers us to realize the full potential of our patient communities and elevate the value we deliver to our partners. By integrating seamless EHR access and real-world data collection into our platform, we are not only accelerating the pace of medical research but also transforming real-world data into real-world evidence that drives better patient outcomes for all."

- John Hervey, CEO of PatientsLikeMe

-

In October 2023, ZS unveiled the ZAIDYN Connected Health solution powered by artificial intelligence. This tool, part of the broader ZAIDYN platform, assists pharmaceutical companies, healthcare providers, and payers in driving innovation, engaging with patients, and enhancing health outcomes through dependable insights.

“Our ZAIDYN Connected Health team is excited to help bridge gaps in healthcare and drive a patient-centric future. We’re poised to optimize patient experiences, enhance patient engagement and design interventions that lead to better outcomes.”

- Asheesh Shukla, managing principal at ZS

U.S. Patient Engagement Solutions Market Report Scope

Report Attribute

Details

Revenue Forecast in 2025

USD 9.10 billion

Revenue Forecast in 2030

USD 22.41 billion

Growth rate

CAGR of 19.77% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Type, delivery type, functionality, end use

Key companies profiled

Cerner Corporation (Oracle), NextGen Healthcare, Inc., Epic Systems Corporation, Allscripts Healthcare, LLC, McKesson Corporation, ResMed, Koninklijke Philips N.V., Klara Technologies, Inc., CPSI, Ltd., Experian Information Solutions, Inc., athenahealth, Solutionreach, Inc., IBM, MEDHOST, Nuance Communications, Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Patient Engagement Solutions Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. patient engagement solutions market report based on type, delivery type, functionality, and end use.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

AI-Driven Engagement

-

Telehealth Solutions

-

Patient Portals

-

Remote Patient Monitoring

-

Population Health Management

-

Appointment and Medication Reminders

-

Others

-

-

Delivery Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Web/Cloud-based

-

On-premise

-

-

Functionality Outlook (Revenue, USD Million, 2018 - 2030)

-

Enhanced Communication

-

Patient Education

-

Predictive Analytics

-

Streamlined Operations

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare Providers

-

Outpatient Facility

-

Inpatient Facility

-

-

Healthcare Payers

-

Private

-

Public

-

-

Pharmaceutical Companies (Pharma)

-

Pharmacy

-

Independent Pharmacies (Nuclear Pharmacies)

-

Community Pharmacies

-

Mail-Order Pharmacies

-

Retail Pharmacies

-

Digital Pharmacies

-

Specialty Pharmacies

-

Central Fill Pharmacies

-

Compounding Pharmacies

-

Others (Alternate dispensing site, Closed door)

-

-

Frequently Asked Questions About This Report

b. The U.S. patient engagement solutions market size was estimated at USD 7.59 billion in 2024 and is expected to reach USD 9.10 billion in 2025.

b. The U.S. patient engagement solutions market is expected to grow at a compound annual growth rate of 19.77% from 2025 to 2030 to reach USD 22.41 billion by 2030.

b. Web/cloud-based solutions segment dominated the U.S. Patient Engagement Solutions market in 2024. This is attributed to the growing adoption of telehealth, increased demand for remote patient monitoring, and the shift to value-based care models.

b. Some key players operating in the U.S. patient engagement solutions market include Cerner Corporation (Oracle), NextGen Healthcare, Inc., Epic Systems Corporation, Allscripts Healthcare, LLC, McKesson Corporation, ResMed, Koninklijke Philips N.V., Klara Technologies, Inc., CPSI, Ltd., Experian Information Solutions, Inc., athenahealth, Solutionreach, Inc., IBM, MEDHOST, Nuance Communications, Inc.

b. Key factors that are driving the U.S. patient engagement solutions market growth include the increasing healthcare digitalization, rising chronic disease prevalence, regulatory mandates for patient-centric care, growing telehealth adoption, AI-driven analytics, and enhanced interoperability between healthcare providers, payers, and patients for improved outcomes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.