- Home

- »

- Medical Devices

- »

-

U.S. Patient Positioning And Support Aids Market Report, 2030GVR Report cover

![U.S. Patient Positioning And Support Aids Market Size, Share & Trends Report]()

U.S. Patient Positioning And Support Aids Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Gel & Foam Positioners, Fluidized Positioners, Sling-based Positioning Aids, Repositioning & Turning Systems), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-506-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

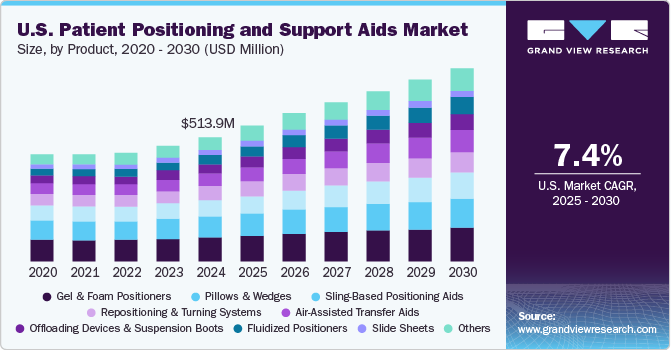

The U.S. patient positioning and support aids market size was estimated at USD 513.98 million in 2024 and is projected to grow at a CAGR of 7.35% from 2025 to 2030. The increasing volume of surgical procedures, the elderly population, and advancements in healthcare infrastructure are some of the key factors driving the market growth. As the aging population rises, the prevalence of chronic diseases and conditions requiring surgical interventions, such as joint replacements and cardiovascular procedures, also increases. This drives demand for effective patient positioning and support aids to ensure safety, comfort, and optimal access during procedures.

Cardiovascular diseases (CVD) significantly drive the U.S. patient positioning and support aids market growth due to their high prevalence and the critical need for precise patient handling during diagnostic and therapeutic interventions. CVD remains a leading cause of morbidity and mortality in the U.S., leading to a substantial number of surgical procedures, including angioplasties, bypass surgeries, and heart valve replacements. These procedures often require specialized positioning aids to ensure patient safety, enhance surgical accuracy, and improve outcomes.

Diagnostic tests such as echocardiograms, cardiac catheterizations, and imaging studies such as CT and MRI scans rely on effective patient positioning to provide precise, accurate results. The increasing adoption of minimally invasive techniques and robotic-assisted surgeries in cardiology further boosted the need for advanced positioning aids designed for precision and stability. Moreover, the aging population, which is more susceptible to CVD, contributes to a rising demand for these aids in hospital and ambulatory care settings. The focus on reducing pressure injuries, optimizing comfort, and adhering to stringent safety standards further supports the growth of this market segment. According to the American Health Association, in 2024, there were 931,578 cardiovascular disease deaths in the U.S. This was an increase of less than 3,000 from the previous year. The age-adjusted death rate for CVD in 2024 was 233.3 per 100,000, which was a 4.0% increase from 2023.

The increasing number of surgical procedures is expected to boost the demand for patient positioning and support aids in the U.S. The surgeries require positioning and support aids such as fluidized positioners, gel positioners, pillows, wedges, transfer aids, repositioning products, turning systems, slide sheets, and offloading devices to prevent the patient from pressure ulcers and to move the patient from one area to another area post-surgical procedures. Various surgical procedures, such as orthopedic, neurosurgeries, and cosmetic surgeries, are being carried out. For instance, as per a study published by the National Library of Medicine in July 2020, around 310 million major surgical procedures are performed annually, of which around 40 to 50 million are conducted in the U.S.

Hospital admissions are a key growth driver for the U.S. patient positioning and support aids industry, as these aids are integral to providing safe, effective, and comfortable care for patients during their hospital stays. High admission rates, mainly for conditions requiring extended care, critical interventions, and rehabilitation, directly increase the demand for such products. As per the American Hospital Association, 2022, the total number of hospital admissions in the U.S. exceeds 33 million annually. Large-scale procurement of positioning aids, such as hospital beds, mattresses, and cushions, becomes essential for hospitals to meet patient care demands.

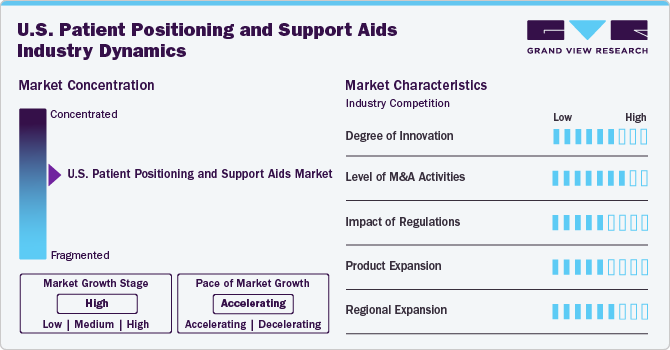

Market Concentration & Characteristics

The market growth stage is high, and the pace of its growth is accelerating. The U.S. market for patient positioning and support aids is characterized by acquisitions, partnerships, technological advancements, and increasing regulatory approval for novel product launches.

The degree of innovation in the U.S. patient positioning and support aids market is high, driven by technological advancements, a growing focus on patient safety, and the increasing demand for ergonomically designed systems. Manufacturers utilize lightweight, durable, and hypoallergenic materials to enhance patient comfort and ease of use. Pressure-reducing materials, such as memory foam and gel-infused surfaces, are increasingly incorporated to minimize the risk of pressure ulcers and improve long-term usability.

The level of mergers and acquisitions (M&A) in the U.S. patient positioning and support aids industry has been moderately active. Larger players are acquiring smaller, specialized companies to expand their product portfolios and strengthen their market position. Consolidation enables companies to offer comprehensive solutions, catering to a wider range of procedures and patient needs.

Regulations significantly influence the patient positioning and support aids market in the U.S. These regulations ensure the safety, efficacy, and quality of products used in healthcare settings. Stringent FDA requirements and compliance with standards such as ISO certifications are pivotal in shaping product design, manufacturing processes, and market entry strategies.

Product expansion is a key growth strategy in this market, driven by technological advancements and the growing demand for specialized solutions. Companies are introducing innovative products, such as motorized positioning aids, imaging-compatible devices, and bariatric systems, to cater to diverse patient needs and surgical requirements. The focus on enhancing ergonomics, reducing hospital-acquired injuries, and integrating smart technologies is accelerating product diversification.

Companies seek to strengthen their presence in high-demand areas. Urban regions with advanced healthcare infrastructure offer significant opportunities, while rural and underserved areas are being targeted for growth through partnerships with local distributors and healthcare providers. Expanding regional footprints increases market share and helps address disparities in access to advanced patient positioning and support aids across the U.S.

Product Insights

The gel and foam positioners segment dominated the market in 2024 and is expected to register a significant CAGR from 2025 to 2030. The growth is driven by the rising prevalence of pressure injuries, particularly among immobile patients and those recovering from surgical procedures. Gel and foam positioners are designed to distribute weight evenly, reducing pressure points and enhancing patient comfort during extended periods of immobility. Advancements in technology also contribute to the growth of this segment.

Manufacturers are constantly innovating their products, incorporating advanced materials that enhance the performance of gel and foam positioners. These materials provide better pressure redistribution, temperature regulation, and moisture management, crucial for maintaining skin integrity and patient comfort. For instance, in August 2023, U.S. Surgitech, Inc., one of the prominent medical device manufacturers, announced that it had been granted a patent for its innovative SurgyPad patient positioning system. The SurgyPad is an advanced patient positioning system that improves safety and comfort during surgical procedures. Its innovative design features integrated arm protectors, an anti-skid strip along the back, and additional safety straps to ensure exceptional patient security. Made with moisture-absorbing, high-rebound foam, the SurgyPad offers optimal support and pressure distribution while helping to minimize the risk of post-operative complications.

The fluidized positioners segment is anticipated to grow the fastest over the forecast period. The adaptability of fluidized positioners enhances their usability across various clinical environments, including surgical theaters, intensive care units, and long-term care facilities. They aid in multiple procedures, such as surgeries and diagnostic imaging, where precise positioning is crucial for patient safety and procedural efficacy. One of the primary driving factors is the growing prevalence and incidence of pressure ulcers. For instance, according to the Agency for Healthcare Research and Quality, more than 2.5 million individuals in the U.S. develop pressure ulcers annually. These conditions continue to be prevalent across all age groups and settings following surgery.

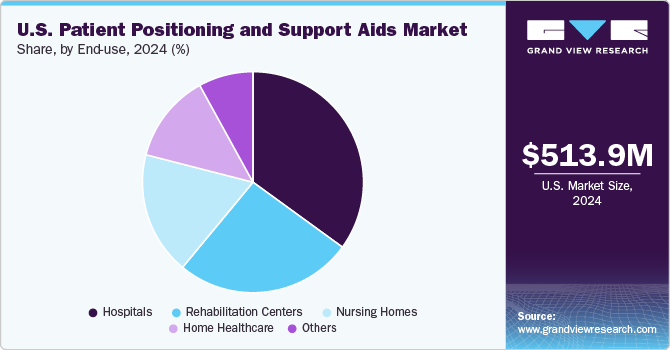

End-use Insights

The hospital end use segment dominated the market in 2024. The growth of the hospital segment in the patient positioning and support aids market can be attributed to the increasing prevalence of chronic diseases, which has led to a surge in surgical interventions. Procedures such as orthopedic surgeries, cardiothoracic surgeries, and laparoscopic surgeries contribute significantly to the demand for effective patient positioning solutions. Hospitals are investing in ergonomic and innovative positioning systems to optimize surgical outcomes and enhance patient safety.

The rehabilitation center segment is anticipated to grow the fastest over the forecast period. The rising incidence of disabilities results from various factors, including aging populations, obesity, and chronic conditions such as stroke and arthritis. As the number of patients requiring rehabilitative services continues to increase, the demand for effective patient positioning aids has also grown. These aids enhance patients’ comfort during rehabilitation sessions and facilitate better therapist access, promoting efficient therapeutic practices. Technological advancements have further transformed the landscape of patient positioning aids used in rehabilitation centers. Innovations in materials and ergonomic design have led to the development of more versatile and adjustable devices, capable of accommodating a wide range of patient needs.

Key U.S. Patient Positioning And Support Aids Company Insights

The key players operating in the U.S. patient positioning and support aids industry are adopting product approval to increase the reach of their products in the market and improve the availability of their products in diverse geographical areas, along with expansion as a strategy to enhance production/research activities. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key U.S. Patient Positioning And Support Aids Companies:

- Spry

- Medline Industries, LP

- Arjo

- EHOB

- DeRoyal Industries, Inc.

- Etac AB

- Hillrom (Baxter)

- Guldmann

- ANSELL LTD

- Mölnlycke Health Care AB

- Stryker

- Soule Medical

- STERIS

- Cardinal Health

Recent Developments

-

In October 2024, ifm efector, inc. (IFM), a leading innovator in sensors, controls, and software for industrial automation, announced the launch of its latest product, the MVQ301 process valve positioner. This new addition is the third in IFM’s MVQ series of pneumatic quarter-turn valve sensors. Designed for precision and efficiency, the MVQ301 serves dual valve positioner and sensor functions, enabling enhanced process control and automation.

-

In August 2024, Collette Health launched its new Position Monitoring feature, further enhancing its innovative fall prevention system. This advanced tool is designed to tackle the critical issue of hospital-acquired pressure injuries, a significant concern in healthcare settings. By continuously monitoring patient positioning, the feature helps healthcare providers identify, and address risks associated with prolonged immobility, improving patient outcomes and reducing injury-related costs.

-

In February 2024, Xodus Medical introduced the Pink Pad Air-Assist, two innovative lift-free patient positioning instrument variations. It includes the launch of the Pink Pad Air-Assist Trendelenburg + and the Pink Pad Air-Assist EXT + Trendelenburg.

U.S. Patient Positioning and Support Aids Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 559.94 million

Revenue forecast in 2030

USD 798.22 million

Growth rate

CAGR of 7.35% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis

Segments covered

Product, end-use

Key companies profiled

Spry; Medline Industries, LP; Arjo; EHOB; DeRoyal Industries, Inc.; Etac AB; Hillrom (Baxter); Guldmann; ANSELL LTD; Mölnlycke Health Care AB; Stryker; Soule Medical; STERIS; Cardinal Health

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Patient Positioning and Support Aids Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. patient positioning and support aids market report based on product and end use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Gel and Foam Positioners

-

Reusable Gel Positioners

-

Disposable Foam Positioners

-

-

Pillows and Wedges

-

Bed Wedge

-

Positioning Pillows

-

-

Sling-Based Positioning Aids

-

Repositioning and Turning Systems

-

Air-Assisted Transfer Aids

-

Offloading Devices and Suspension Boots

-

Slide Sheets

-

Fluidized Positioners

-

Flo Fluidized Positioners

-

Flo-Lock Filtered Positioners

-

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Rehabilitation Centers

-

Nursing Homes

-

Home Healthcare

-

Others

-

Frequently Asked Questions About This Report

b. The global U.S. patient positioning and support aids market size was estimated at USD 513.98 million in 2024 and is expected to reach USD 559.94 million in 2025

b. The global U.S. patient positioning and support aids market is expected to grow at a compound annual growth rate of 7.35% from 2025 to 2030 to reach USD 798.22 million by 2030.

b. The gel and foam positioners segment dominated the market in 2024 and is expected to register a significant CAGR from 2025 to 2030.

b. Some key players operating in the U.S. patient positioning and support aids market include Spry; Medline Industries, LP; Arjo; EHOB; DeRoyal, Industries, Inc.; Etac AB; Hillrom (Baxter); Guldmann; ANSELL LTD; Mölnlycke Health Care AB; Stryker; Soule Medical; STERIS; Cardinal Health.

b. Key factors driving the market growth include increasing Medicare reimbursement for telehealth services, reducing emergency room visits and hospitalization rates, and technological innovation in communication technology.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.