- Home

- »

- Medical Devices

- »

-

U.S. Peripheral Nerve Stimulators Market Size Report, 2033GVR Report cover

![U.S. Peripheral Nerve Stimulators Market Size, Share & Trends Report]()

U.S. Peripheral Nerve Stimulators Market (2025 - 2033) Size, Share & Trends Analysis Report By Product Type (Systems, Wearables/Accessories), By Modality (Rechargeable, Non-rechargeable), By Connectivity, By Application, By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-771-2

- Number of Report Pages: 300

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

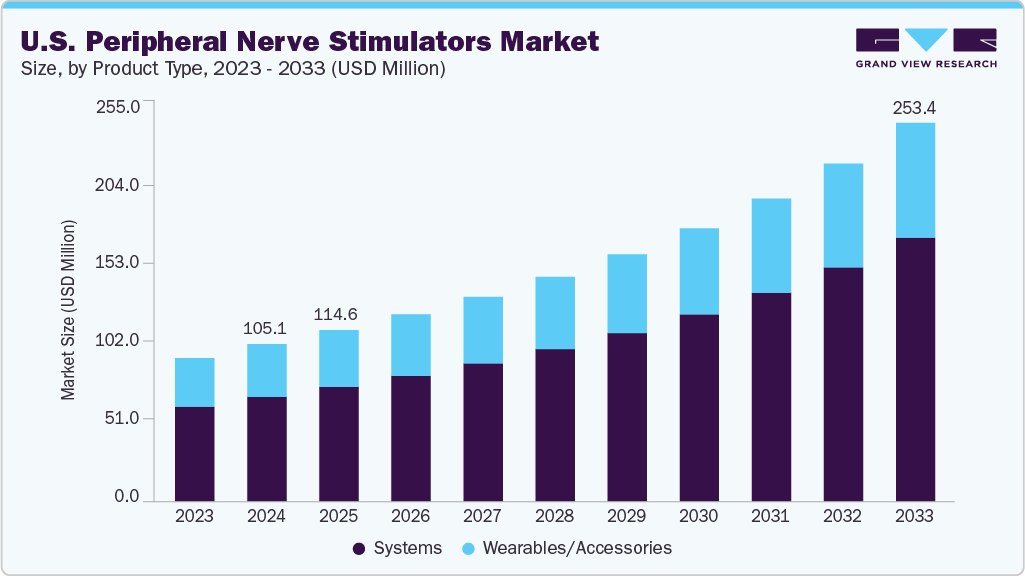

The U.S. peripheral nerve stimulators market size was estimated at USD 105.14 million in 2024 and is projected to reach USD 253.36 million by 2033, growing at a CAGR of 10.43% from 2025 to 2033. The U.S. peripheral nerve stimulators industry is primarily driven by the rising prevalence of chronic pain conditions and increasing demand for minimally invasive, targeted pain management therapies, and the growing shift toward non-opioid therapies.

Key Market Trends & Insights

- Based on product type, the systems segment led the market with the largest revenue share of 66.51% in 2024.

- Based on modality, the rechargeable segment led the market with the largest revenue share of 63.10% in 2024.

- Based on connectivity, the wireless segment led the market with the largest revenue share of 77.96% in 2024.

- Based on application, the chronic musculoskeletal pains segment led the market with the largest revenue share of 42.26% in 2024.

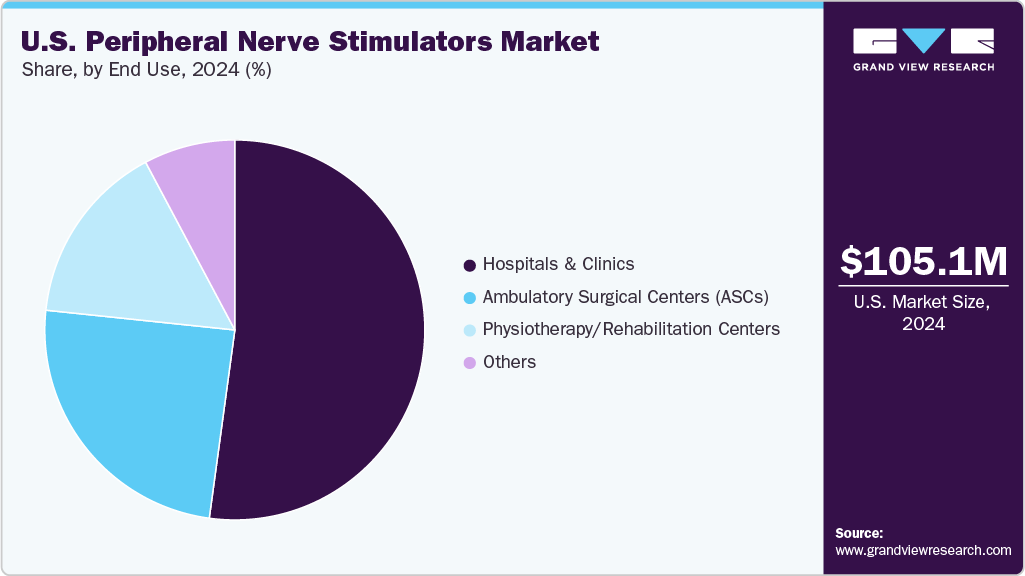

- Based on end use, the hospitals and clinics segment led the market with the largest revenue share of 52.15% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 105.14 Million

- 2033 Projected Market Size: USD 253.36 Million

- CAGR (2025-2033): 10.43%.

Growing awareness among healthcare providers and patients about the effectiveness of peripheral nerve stimulation in improving quality of life is fueling adoption. Technological advancements, including implantable systems, wearable stimulators, and enhanced programmable features, further propel market growth. The expansion of outpatient and ambulatory surgery centers, favorable reimbursement policies, and an aging population with higher surgical volumes contribute to the sustained momentum of the market.

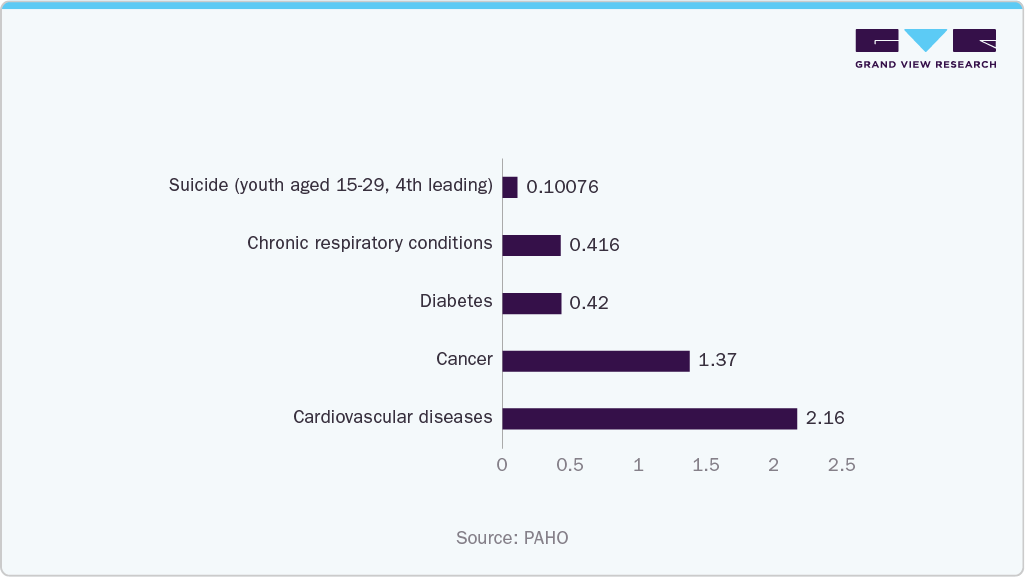

Rising prevalence of chronic diseases continues to drive growth in the U.S. peripheral nerve stimulators industry, as patients with conditions such as diabetes, obesity, hypertension, asthma, and chronic pain increasingly require targeted, long-term pain management solutions. Peripheral nerve stimulators offer minimally invasive options to alleviate pain associated with these illnesses, improving patient outcomes and quality of life.

For instance, in April 2025, Health System Tracker highlighted that the U.S. has a higher rate of chronic diseases compared to peer nations, with over twice as many people affected by obesity and diabetes, 1.7 times more with asthma, and an overall higher burden of depression. This elevated prevalence of chronic conditions not only increases demand for advanced pain management therapies but also underscores the growing need for effective, clinically proven peripheral nerve stimulation solutions. According to the Pan American Health Organization’s (PAHO) report, in July 2025, cardiovascular diseases led with 2.16 million deaths, followed by cancer (1.37 million), diabetes (over 420,000), and chronic respiratory conditions (more than 416,000). Suicide, the fourth leading cause of death among youth aged 15-29, claimed 100,760 lives.

The growing demand for minimally invasive and targeted pain management therapies is a key driver of the U.S. peripheral nerve stimulators industry. Patients and healthcare providers increasingly prefer treatments that deliver precise, long-lasting pain relief while reducing recovery time, surgical risks, and hospital stays. Peripheral nerve stimulators offer a focused approach by directly targeting affected nerves, making them more effective than traditional systemic therapies such as oral medications. In addition, the adoption of outpatient procedures and advancements in implantable and wearable stimulation devices are further accelerating market growth, as these therapies provide convenience, safety, and improved quality of life for patients managing chronic pain.

Growing favorable reimbursement policies are one of the major contributors to market growth. The number of companies' peripheral nerve stimulation systems is reimbursed nationally by Medicare as a treatment for chronic pain of a peripheral origin. For instance, in January 2024, the Bioventus StimRouter Neuromodulation System Reimbursement Reference Guide was released to support healthcare providers and payers in navigating coverage and reimbursement pathways. This guide aimed to facilitate broader adoption of the StimRouter system by improving access for patients requiring peripheral nerve stimulation for chronic pain management. In addition, in January 2024, Bioventus’s StimRouter Neuromodulation System Reimbursement Reference Guide was released:

CPT Procedure Code & Description

Physician Fee

Schedule In-Office |

FacilityAmbulatory Surgery Center (ASC)Payment

RateHospital

Outpatient APCHospital

Outpatient

APC Payment

Rate64555: Percutaneous implantation of neurostimulator electrode array; peripheral nerve (excludes sacral nerve)

USD 2,084.50|

USD 316.96USD 5615.15

5462

USD 6516.28

64575: Open implantation of neurostimulator electrode array; peripheral nerve (excludes sacral nerve)

NA |USD 310.42

USD 11344.43

5463

USD 12978.95

64585: Revision or removal of peripheral neurostimulator electrode array

USD 238.38 |

USD 141.78USD 1898.16

5461

USD 3241.90

64596: Insertion or replacement of a percutaneous electrode array, peripheral nerve, with an integrated neurostimulator, including imaging guidance, when performed; initial electrode array

TBD | TBD

USD 9224.45

5463

USD 12978.95

+64597: Insertion or replacement of percutaneous electrode array; peripheral nerve, with integrated neurostimulator, including imaging guidance, when performed; each additional electrode array (list separately in addition to the code for primary procedure)

TBD | TBD

SI = N1,

Packaged

service/item;

no separate

payment

made.NA

SI=N, Items

and Services

Packaged

into APC

Rates564598: Revision or removal of neurostimulator electrode array; peripheral nerve, with integrated neurostimulator

TBD | TBD

USD 1898.16

5461

USD 3241.9

Source: StimRouter (Bioventus)

The growing shift toward non-opioid therapies is a significant driver of the U.S. peripheral nerve stimulators industry. With the global opioid crisis highlighting the dangers of addiction, dependency, and adverse side effects, healthcare providers and policymakers are prioritizing safer alternatives for chronic pain management.

For instance, according to the CDC, in May 2024, opioid overdose deaths remain high:

-

Opioid-involved overdose deaths: About 105,000 people died from drug overdoses in 2023, with nearly 80,000 deaths (≈76%) involving opioids.

-

The number of opioid overdose deaths in 2023 was almost 10 times higher than in 1999.

Market Concentration & Characteristics

The U.S. peripheral nerve stimulators industry is currently in a high-growth stage, with an accelerating pace driven by multiple factors. Key market characteristics include increasing awareness and investment in infection control, expanding adoption of peripheral nerve stimulators in ambulatory surgery centers and outpatient clinics, and growth in both patient demographics and surgical procedure volumes. The market is moderately concentrated, with a few leading players holding significant shares, leveraging technological innovation, strategic partnerships, and strong product portfolios to maintain their competitive positions. At the same time, smaller firms continue to introduce niche solutions.

The U.S. peripheral nerve stimulators industry demonstrates a high degree of innovation, driven by continuous advancements in device design, stimulation technologies, and minimally invasive delivery methods. Companies are focusing on creating patient-centric systems that enhance precision, comfort, and ease of use, while integrating features such as wireless control, rechargeable batteries, and customizable stimulation patterns. These innovations not only improve clinical outcomes but also expand the range of conditions treatable with peripheral nerve stimulation. For instance, in July 2025, SPR featured five abstracts on the SPRINT Peripheral Nerve Stimulator (PNS) at ASPN 2025, highlighting the latest clinical insights and technological progress in the field.

The U.S. peripheral nerve stimulators industry has witnessed a moderate to high level of merger and acquisition activity, driven by the strategic need of companies to expand product portfolios, enter new therapeutic areas, and strengthen technological capabilities. Key players increasingly pursue acquisitions to access innovative devices, enhance R&D pipelines, and consolidate their market positions. Such deals accelerate growth and foster competitive advantages in a rapidly evolving market. For instance, in March 2021, Bioventus Inc. announced the acquisition of Bioness Inc., a rehabilitation solutions company that specializes in peripheral nerve stimulation therapy technology.

Regulation plays a critical role in shaping the U.S. peripheral nerve stimulators industry, as approval from authorities such as the FDA ensures the safety, efficacy, and quality of devices. Regulatory milestones influence market entry, product adoption, and competitive dynamics, with companies investing heavily in compliance and clinical validation to meet stringent standards. Timely approvals can accelerate commercialization, while delays or non-compliance may restrict growth opportunities. For instance, on July 30, 2025, Bioventus Inc. announced a significant milestone with FDA 510(k) clearances for both TalisMann and StimTrial, expanding the company’s innovative portfolio of peripheral nerve stimulation solutions for chronic pain management.

In the U.S. peripheral nerve stimulators industry, several products act as substitutes, influencing market dynamics. These include traditional pain management therapies like oral medications, transcutaneous electrical nerve stimulation (TENS) units, and other non-invasive neuromodulation devices. Physical therapy, radiofrequency ablation, and corticosteroid injections serve as alternative solutions for patients seeking pain relief. While these substitutes are widely used due to lower cost or ease of access, they often provide less targeted or shorter-term relief compared to implantable peripheral nerve stimulators. The growing preference for long-lasting, minimally invasive treatments continues to drive the adoption of stimulators over these alternatives.

The U.S. peripheral nerve stimulators industry is moderately concentrated, with a few key players holding a significant share of the overall market. Leading companies focus on technological innovation, strategic partnerships, and product launches to maintain their competitive edge. The presence of specialized devices, such as implantable systems and wearable stimulators, creates barriers for new entrants, while regulatory approvals and reimbursement policies influence market dynamics. Despite the dominance of established players, increasing demand for minimally invasive and patient-centric therapies encourages smaller firms to introduce niche solutions, contributing to gradual diversification within the market.

Product Type Insights

The systems segment led the market with the largest revenue share of 66.51% in 2024 and is also anticipated to grow at the fastest CAGR during the forecast period. This growth is driven by rising adoption of advanced stimulation systems, increasing prevalence of chronic pain conditions, and growing preference for minimally invasive therapies that provide targeted, long-lasting pain relief. The systems are classified into two segments: systems and wearables/accessories. The availability of technologically sophisticated systems, strong physician awareness, and patient acceptance propel market expansion. For instance, in July 2025, Bioventus received FDA 510(k) clearances for two next-generation peripheral nerve stimulation systems, further strengthening the portfolio of advanced solutions and expanding treatment options across diverse patient needs.

The wearables and accessories segment is anticipated to grow at a significant CAGR during the forecast period, driven by rising demand for patient-friendly, non-invasive pain management solutions. These devices offer convenience, mobility, and ease of use, allowing patients to manage pain outside clinical settings. Technological advancements, such as wireless connectivity and app-based control, are further enhancing their adoption. As healthcare providers and patients increasingly prefer customizable and portable options, the wearables and accessories segment is poised for substantial expansion.

Modality Insights

The rechargeable segment led the market with the largest revenue share of 63.10% in 2024 and is also expected to grow at the fastest CAGR during the forecast period. Growth in the U.S. peripheral nerve stimulators industry is driven by increasing demand for long-lasting, patient-friendly devices that reduce the need for frequent replacements and ensure continuous neurostimulation therapy. For instance, in January 2022, Medtronic, one of the global leaders in healthcare technology, announced it received U.S. Food and Drug Administration approval for its Intellis rechargeable neurostimulator and Vanta recharge-free neurostimulator, designed to treat chronic pain associated with diabetic peripheral neuropathy (DPN).

The non-rechargeable segment is expected to grow at a notable CAGR during the forecast period, driven by its simplicity, lower upfront cost, and ease of use for short- to medium-term pain management. This segment is preferred for patients requiring temporary therapy or those unable to manage regular device recharging. Continued innovations in battery efficiency and device miniaturization are further supporting its expansion.

Connectivity Insights

The wireless segment led the market with the largest revenue share of 77.96% in 2024 and is also projected to grow at the fastest CAGR during the forecast period. The U.S. peripheral nerve stimulators industry is driven by the rising demand for patient-friendly, minimally invasive, and remotely programmable devices that enhance treatment efficiency and comfort. For instance, in April 2023, Neuspera Medical, a medical device company developing implantable devices for patients battling chronic illnesses, announced it received U.S. Food and Drug Administration (FDA) clearance for its next-generation Neuspera ultra-miniaturized system. The system features a micro-implant that delivers neurostimulation therapy through a wireless platform, including a wearable transmitter and iPad-based clinician programmer.

“We look forward to bringing this innovative technology to physicians and patients in the U.S. The Neuspera ultra-miniaturized system has the potential to revolutionize the way physicians treat patients battling chronic pain while restoring patients’ health and quality of life,” said Steffen Hovard, CEO of Neuspera Medical.

The wired segment is expected to witness at a significant CAGR during the forecast period, driven by its reliability, consistent signal delivery, and established clinical adoption. Many healthcare providers prefer wired systems for complex or long-term pain management cases due to their precision and durability. Ongoing innovations in lead design and implantation techniques are further supporting the segment’s expansion.

Application Insights

The chronic musculoskeletal pains segment led the market with the largest revenue share of 42.26% in 2024, driven by the high prevalence of back, shoulder, and joint pain. Rising patient demand for non-opioid, minimally invasive therapies and increasing adoption of neuromodulation devices by pain specialists are key factors fueling market growth. For instance, in June 2025, Rheumatology Advisor highlighted that percutaneous 60-day peripheral nerve stimulation provided long-lasting relief for shoulder pain, underscoring PNS's clinical effectiveness and growing acceptance in managing chronic musculoskeletal conditions.

The complex regional pain syndrome (CRPS) segment is expected to witness at the fastest CAGR during the forecast period. Driven by increasing awareness of CRPS, rising adoption of minimally invasive neuromodulation therapies, and the growing demand for effective pain management solutions. Advanced peripheral nerve stimulation technologies offer targeted relief, improving patient outcomes and quality of life. As clinicians increasingly recognize the benefits of these therapies, the CRPS segment is positioned for rapid expansion.

End Use Insights

The hospitals and clinics segment led the market with the largest revenue share of 52.15% in 2024. This leadership was attributed to the high patient volume requiring advanced pain management and post-surgical care, where peripheral nerve stimulators play a critical role. Hospitals and clinics served as primary centers for procedures addressing neuropathic pain, complex surgical recoveries, and chronic pain conditions, driving strong adoption of these devices.

The ambulatory surgery centers segment is anticipated to witness at the fastest CAGR during the forecast period. ASCs offer minimally invasive procedures with shorter recovery times and lower costs, making them preferred for peripheral nerve stimulators implantation. Growing patient preference for outpatient care and efficiency-driven healthcare models is driving ASCs' adoption in this market.

Key U.S. Peripheral Nerve Stimulators Company Insights

Nalu Medical, Inc., Curonix LLC., SPR, Vygon, among others, are key players in the U.S. peripheral nerve stimulators industry. These companies are enhancing their product portfolios by launching advanced PNS solutions. To meet rising demand, they are expanding manufacturing capacities and optimizing distribution networks to ensure consistent supply across hospitals, outpatient centers, pain clinics, and rehabilitation facilities.

Key U.S. Peripheral Nerve Stimulators Companies:

- B. Braun Medical Inc.

- Nalu Medical, Inc

- Curonix LLC.

- SPR

- Vygon

- AirLife

- Neuspera Medical

- Anesthesia Associates, Inc.

- AVNS

- Mercury Medical

- Medtronic

- Boston Scientific Corporation

- Abbott

- Bioventus

- Checkpoint Surgical Inc.

- Nervonik, Inc

Recent Developments

-

In August 2025, Nalu Medical advanced wearable neurostimulation with the launch of its new Therapy Disc, which is 39% smaller than the previous version. This next-generation device enhanced patient comfort, expanded accessibility, and broadened eligibility for chronic pain patients to benefit from clinically proven peripheral nerve stimulation therapy.

-

In August 2025, Checkpoint Surgical marked a milestone with the first use of its investigational nerve regeneration system, Regen10, in the FASTR-TEN clinical trial. This advancement represented a significant step forward in exploring innovative approaches to promote peripheral nerve regeneration and improve outcomes for patients with nerve injuries.

-

In July 2025, SPR announced that it will feature five abstracts highlighting the SPRINT Peripheral Nerve Stimulation (PNS) System at the upcoming ASPN 2025 meeting. The presentations will showcase new clinical evidence on the role of SPRINT PNS in managing chronic pain, including data on patient outcomes, functional improvement, and real-world applications across multiple pain indications. This marks another step in expanding awareness and adoption of PNS as a minimally invasive, non-opioid treatment option for patients with unmet pain management needs.

-

In July 2025, Bioventus Inc., a global leader in innovations for active healing, announced it had received FDA 510(k) clearances for both TalisMann and StimTrial. These approvals mark a significant expansion of the company’s Peripheral Nerve Stimulation (PNS) portfolio, strengthening its position in delivering innovative, non-opioid solutions for chronic pain management.

-

In March 2025, Nervonik, Inc., a medical device company developing an opioid-free peripheral nerve stimulation (PNS) system, announced the successful closing of a USD 13 million Series A funding round. The round was led by U.S. Venture Partners (USVP) with participation from Foothill Ventures, Correlation Ventures, and other investors. This financing builds on Nervonik’s earlier USD 4.4 million in SAFE and convertible note investments from Shangbay Capital, Camford Capital, Joyance Partners, Life Science Angel, Seraph Group, and others, further strengthening the company’s resources to advance development and clinical validation of its novel PNS platform.

-

In January 2024, Nalu Medical, Inc. presented long-term and holistic outcomes from the COMFORT randomized controlled trial (RCT) for peripheral nerve stimulation (PNS) at the North American Neuromodulation Society (NANS) meeting. The results highlighted sustained pain relief, functional improvement, and quality-of-life benefits, reinforcing the clinical value of Nalu’s PNS therapy.

-

In April 2023, Neuspera Medical announced FDA clearance of its system for Peripheral Nerve Stimulation (PNS). The minimally invasive technology is designed to provide adequate pain relief by targeting specific peripheral nerves with greater precision and flexibility. This milestone clearance supports broader clinical adoption of PNS as a non-opioid therapy option and strengthens Neuspera’s position in advancing next-generation neuromodulation solutions.

U.S. Peripheral Nerve Stimulators Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 114.59 million

Revenue forecast in 2033

USD 253.36 million

Growth rate

CAGR of 10.43% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis

Segments covered

Product type, modality, connectivity, application, end use

Regional scope

U.S.

Key companies profiled

B. Braun Medical Inc.; Nalu Medical, Inc.; Curonix LLC.; SPR; Vygon; AirLife;, Neuspera Medical; Anesthesia Associates, Inc.; AVNS, Mercury Medical; Medtronic; Boston Scientific Corporation; Abbott; Bioventus; Checkpoint Surgical Inc.; Nervonik, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Peripheral Nerve Stimulators Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. peripheral nerve stimulators market report based on product type, modality, connectivity, application, and end use:

-

Product Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Systems

-

Implantable

-

Non-implantable

-

Handheld

-

Others

-

-

-

Wearables/Accessories

-

-

Modality Outlook (Revenue, USD Million, 2021 - 2033)

-

Rechargeable

-

Non-rechargeable

-

-

Connectivity Outlook (Revenue, USD Million, 2021 - 2033)

-

Wired

-

Wireless

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Diabetic Peripheral Neuropathy Pain

-

Chronic Musculoskeletal Pain

-

Complex Regional Pain Syndrome (CRPS)

-

Headache and Migraine Disorders

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals and Clinics

-

Ambulatory Surgical Centers (ASCs)

-

Physiotherapy/Rehabilitation Centers

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. peripheral nerve stimulators market size was valued at USD 105.14 million in 2024 and is expected to reach the value at USD 253.36 million by 2033.

b. The U.S. peripheral nerve stimulators market s projected to grow at a CAGR of 10.43% from 2025 to 2033.

b. The systems segment dominated the U.S. peripheral nerve stimulators market in 2024 with the revenue share of 66.51% and is also anticipated to be the fastest-growing segment during the forecast period. This growth is driven by rising adoption of advanced stimulation systems, increasing prevalence of chronic pain conditions, and growing preference for minimally invasive therapies that provide targeted, long-lasting pain relief.

b. The key players include B. Braun Medical Inc., Nalu Medical, Inc, Curonix LLC., SPR, Vygon, AirLife, Neuspera Medical, Anesthesia Associates, Inc., AVNS, Mercury Medical, Medtronic, Boston Scientific Corporation, Abbott, Bioventus, Checkpoint Surgical Inc., and Nervonik, Inc.

b. The growing demand for minimally invasive and targeted pain management therapies is a key driver of the U.S. peripheral nerve stimulators market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.