- Home

- »

- Pharmaceuticals

- »

-

U.S. Personalized Vitamins Market, Industry Report, 2033GVR Report cover

![U.S. Personalized Vitamins Market Size, Share & Trends Report]()

U.S. Personalized Vitamins Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Wellness Supplements, Disease-Based Supplements), By Dosage Form (Tablets, Capsules), By Distribution Channel, By Age Group (Adult,Geriatric), And Segment Forecasts

- Report ID: GVR-4-68040-681-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Personalized Vitamins Market Summary

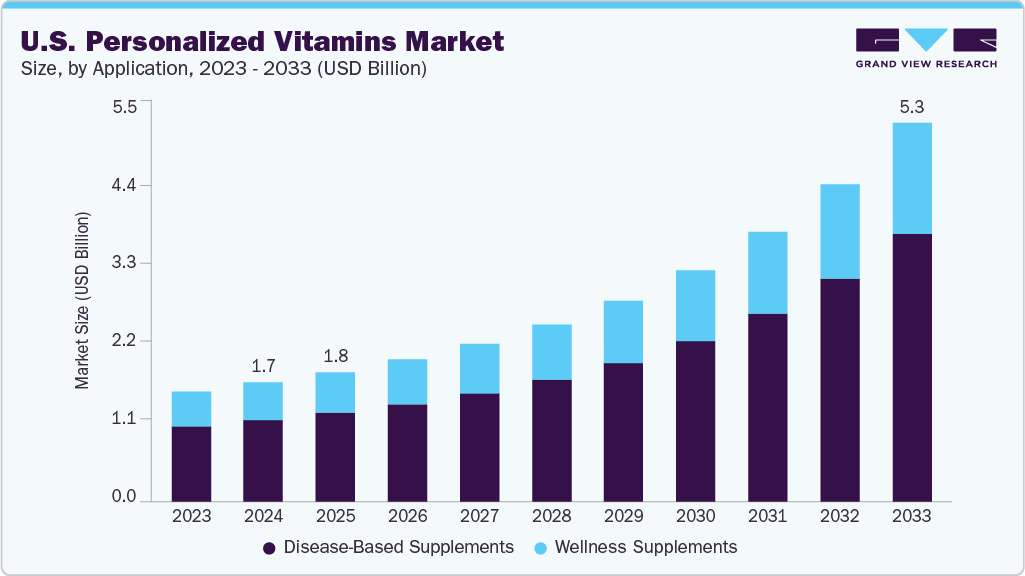

The U.S. personalized vitamins market size was estimated at USD 1.67 billion in 2024 and is projected to reach USD 5.29 billion by 2033, growing at a CAGR of 14.32% from 2025 to 2033.This growth is driven by increasing consumer awareness of health and wellness, DNA and microbiome testing advancements, and a rising demand for customized health solutions tailored to individual nutritional needs.

Rising Consumer Focus on Health and Preventive Wellness

The growing emphasis on health and preventive wellness is a key factor propelling the demand for personalized vitamins in the U.S. market. Consumers are becoming more proactive about their health, seeking ways to prevent illness rather than treat it. This shift is being driven by increasing awareness of chronic lifestyle-related conditions such as obesity, diabetes, and heart disease, which are often linked to poor nutrition and vitamin deficiencies. For instance, as per the data published by the Centers for Disease Control and Prevention (CDC), approximately 38.4 million Americans, accounting for 11.6% of the U.S. population, were living with diabetes in 2021. As a result, individuals are investing in supplements tailored to their specific health needs, life stages, and wellness goals, rather than opting for generic, one-size-fits-all products.

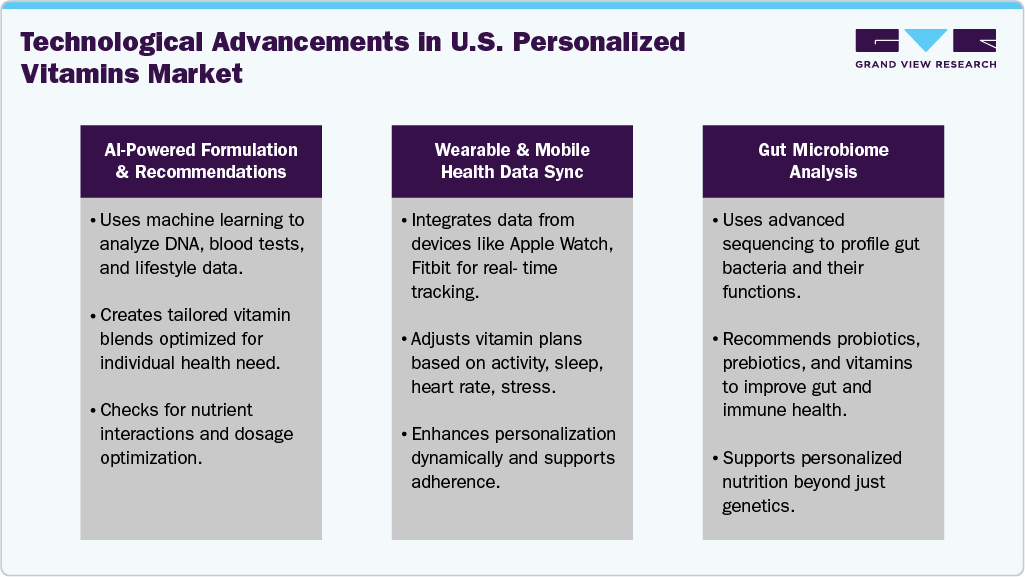

The following illustration highlights key technological trends shaping the future of personalized health and nutrition. It highlights how AI, wearable devices, and gut microbiome analysis tailor nutrition and supplement plans based on individual data, enabling more precise, dynamic, and effective health interventions.

Moreover, the pandemic heightened awareness around immune health and encouraged a more holistic approach to wellness. This has led to a surge in demand for targeted vitamins that support immunity, energy, sleep, digestion, and mental well-being. Personalized vitamins appeal to consumers because they promise optimized outcomes based on individual biology and lifestyle factors. These solutions offer a more intelligent and results-oriented alternative to traditional supplements by addressing specific deficiencies or health objectives, further reinforcing their value in the preventive healthcare landscape.

Convenience and Direct-to-Consumer (DTC) Models

The growing consumer demand for convenience has been effectively addressed through direct-to-consumer (DTC) business models. Personalized vitamin brands now offer subscription-based services that deliver customized supplements directly to consumers’ homes, removing the need for physical store visits or clinical consultations. These services typically include online quizzes or health assessments that generate individualized formulations based on lifestyle, diet, age, and health goals. These models enhance consumer adherence, reduce purchase friction, and foster long-term brand loyalty by streamlining access and automating monthly deliveries. For instance, in January 2025, Optum Now partnered with Vous Vitamin in the United States to offer customers a 20% recurring discount on personalized vitamin subscriptions via the Optum Now platform.

The digital-first nature of these offerings particularly appeals to tech-savvy adults and young consumers who value personalization, speed, and seamless digital experiences. Many platforms incorporate features such as mobile tracking apps, integration with wearable devices, and data-informed recommendations from genetic or diagnostic testing. As a result, DTC personalized vitamin brands are not just selling supplements, but also offering a full-service health experience that aligns with modern expectations for convenience, customization, and accessibility.

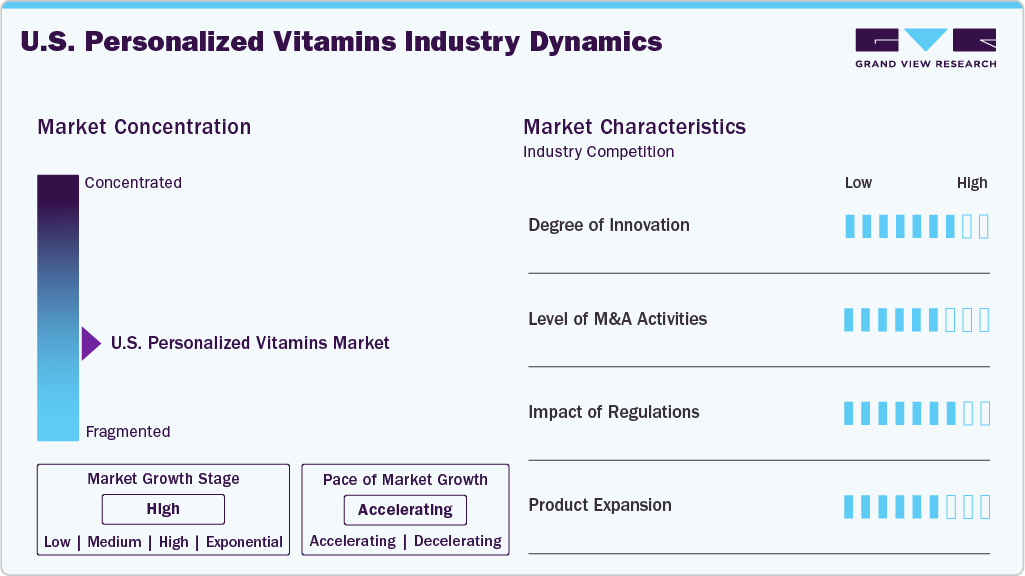

Market Concentration & Characteristics

The U.S. personalized vitamin industry demonstrates a high degree of innovation by combining advanced technologies such as genetic and biomarker testing, AI-driven data analysis, and digital platforms to create tailored supplement formulations unique to each individual’s health profile. This approach moves beyond traditional “one-size-fits-all” vitamins, offering personalized recommendations based on lifestyle, diet, and biological data. Innovative delivery models, including subscription services with pre-packaged daily doses, enhance user convenience and adherence, making personalized vitamins a cutting-edge solution that integrates science, technology, and consumer-centric design for optimized health outcomes.

The U.S. personalized vitamin industry has seen increasing merger and acquisition (M&A) activity as larger wellness, pharmaceutical, and consumer health companies seek to enter or expand their presence in this rapidly growing segment. Established supplement brands and startups with proprietary technology or personalized formulations are attractive acquisition targets due to their innovative offerings and loyal customer bases. For instance, in November 2023, Pharmavite, a U.S.-based subsidiary of Otsuka Pharmaceutical, acquired Bonafide Health for USD 425 million, enhancing its leadership in women's health with science-backed, hormone-free products. This M&A momentum reflects the sector's promising growth potential and the strategic value of integrating personalization capabilities into broader health and wellness ecosystems.

The personalized vitamin industry in the U.S. operates within a complex regulatory environment that significantly impacts product development, marketing, and consumer trust. Dietary supplements, including personalized vitamins, are primarily regulated by the FDA under the Dietary Supplement Health and Education Act (DSHEA), which requires manufacturers to ensure safety and truthful labeling but does not mandate pre-market approval. This regulatory framework allows innovation and market entry to proceed rapidly, but also places responsibility on companies to substantiate health claims and maintain quality control. Compliance with these evolving regulations is critical to avoid legal challenges, maintain consumer confidence, and ensure long-term growth in this personalized nutrition segment.

Product expansion in the U.S. personalized vitamin industry is driven by growing consumer demand for comprehensive, targeted health solutions beyond basic vitamins and minerals. Companies are broadening their offerings to include supplements tailored for specific health concerns such as gut health, mental wellness, immune support, skin health, and fitness performance. Expansion also includes new delivery formats such as gummies, powders, liquids, and functional beverages to cater to diverse consumer preferences. For instance, in June 2022, Vitafusion, the top U.S. adult gummy vitamin brand, partnered with Tiffany Haddish to launch two new 2-in-1 multivitamin gummies, available at major U.S. retailers. This broadening of product lines helps companies capture larger market share, increase customer lifetime value, and address a wider range of wellness goals.

Application Insights

Disease-based supplements accounted for the largest revenue share in 2024 and are projected to witness the fastest CAGR over the forecast period, driven by increasing consumer focus on managing chronic conditions such as diabetes, cardiovascular diseases, and immune disorders through targeted nutritional support. For instance, in March 2025, AJMC highlighted the rising prevalence of celiac disease in the U.S. and emphasized tailored nutrition to manage common vitamin deficiencies such as iron, folate, vitamin D, zinc, and B12 in affected patients.

The wellness supplements segment is growing significantly during the forecast period, fueled by a global shift toward preventive health, holistic well-being, and individualized care. Consumers increasingly seek tailored solutions that address their unique health goals, ranging from immunity and energy to sleep and mental clarity, rather than relying on one-size-fits-all products. This trend is amplified by greater health awareness, digital health tools, and the popularity of subscription-based convenience, aligning with the wellness movement’s emphasis on customization and proactive self-care, further supporting the U.S. personalized vitamins industry expansion.

Dosage Form Insights

The tablets segment accounted for the largest revenue share of 33.51% in 2024. This dominance is attributed to tablets’ ease of manufacturing, longer shelf life, precise dosage, and cost-effectiveness, making them a preferred choice for manufacturers and consumers. Tablets are also familiar to consumers and widely accepted as a traditional supplement form, which supports their continued popularity. As a result, they are expected to maintain a significant share in the market, even as innovation in delivery methods continues to evolve.

The liquid segment is expected to grow fastest in the U.S. over the forecast period. This growth is driven by rising consumer preference for easily absorbable and quick-acting supplement formats, particularly among older adults and individuals with difficulty swallowing pills. Liquid vitamins also allow for greater dosing flexibility and the inclusion of complex nutrient blends, making them ideal for personalized formulations. Moreover, innovations in flavoring and packaging, such as ready-to-drink shots, droppers, and single-serve sachets, enhance user convenience and appeal. As personalization becomes more integrated with lifestyle and taste preferences, the liquid segment is poised for strong expansion across various health and wellness categories.

Distribution Channel Insights

Based on distribution channel, the supermarkets/hypermarkets segment held the largest revenue share of 43.55% in 2024. This is primarily due to wide accessibility, strong foot traffic, and consumer preference for purchasing health and wellness products alongside everyday groceries. These retail formats offer high visibility, on-the-spot buying decisions, and the opportunity for customers to physically examine products, which enhances trust, especially among first-time buyers of personalized vitamins. Leading brands have increasingly established retail partnerships to gain shelf presence in large chains, leveraging in-store promotions to educate consumers, further driving the demand in the U.S. personalized vitamins industry.

The online pharmacies and e-commerce site segment is expected to witness the fastest CAGR over the forecast period. This surge is fueled by increasing consumer preference for convenience, customized shopping experiences, and the ability to access a wider variety of products and subscription services online. E-commerce platforms allow customers to complete health assessments, receive tailored recommendations, and subscribe to monthly deliveries from the comfort of home. Moreover, digital channels offer targeted marketing, customer reviews, and easy product comparison, which enhance buyer confidence and engagement. The rising adoption of smartphones, increased internet penetration, and greater comfort with digital health solutions, especially among Millennials and Gen Z, are expected to continue driving rapid growth in this segment.

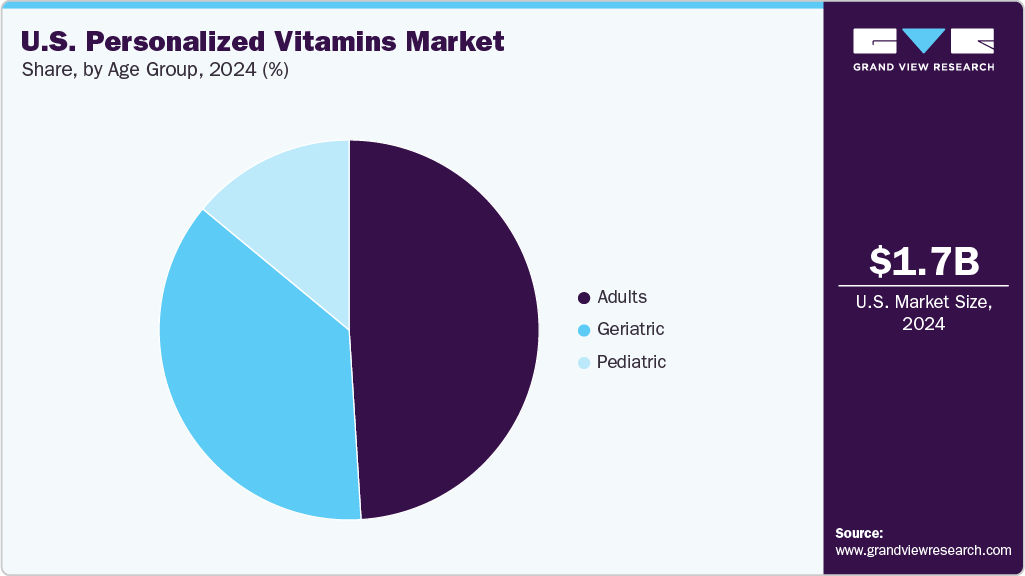

Age Group Insights

Based on age group, the adult segment accounted for the largest revenue share of 48.86% in 2024. This dominance is largely attributed to increasing health consciousness among adults, particularly those aged 25 to 50, who are more proactive in managing wellness, immunity, and chronic health conditions. Adults also represent the primary target demographic for personalized nutrition services, as they typically have greater purchasing power and are more engaged with digital health platforms that offer customized supplement plans. Rising stress levels, lifestyle-related health concerns, and the demand for preventative care are expected to drive continued growth in this segment over the forecast period.

The geriatric segment is expected to grow significantly over the forecast period, driven by the aging population and increasing focus on age-related health management. For instance, according to data published by the Population Reference Bureau in 2024, the population of Americans aged 65 and older is expected to grow from 58 million in 2022 to 82 million by 2050, marking a 47% increase. Older adults often face specific nutritional deficiencies, such as vitamin D, B12, and calcium. They are more likely to seek personalized solutions for bone health, cognitive decline, and heart health conditions. Personalized vitamins tailored to this age group's unique biological and lifestyle needs are gaining popularity, especially as the geriatric demographic becomes more comfortable with digital health tools and at-home testing, further boosting U.S. personalized vitamins industry demand.

Key U.S. Personalized Vitamins Company Insights

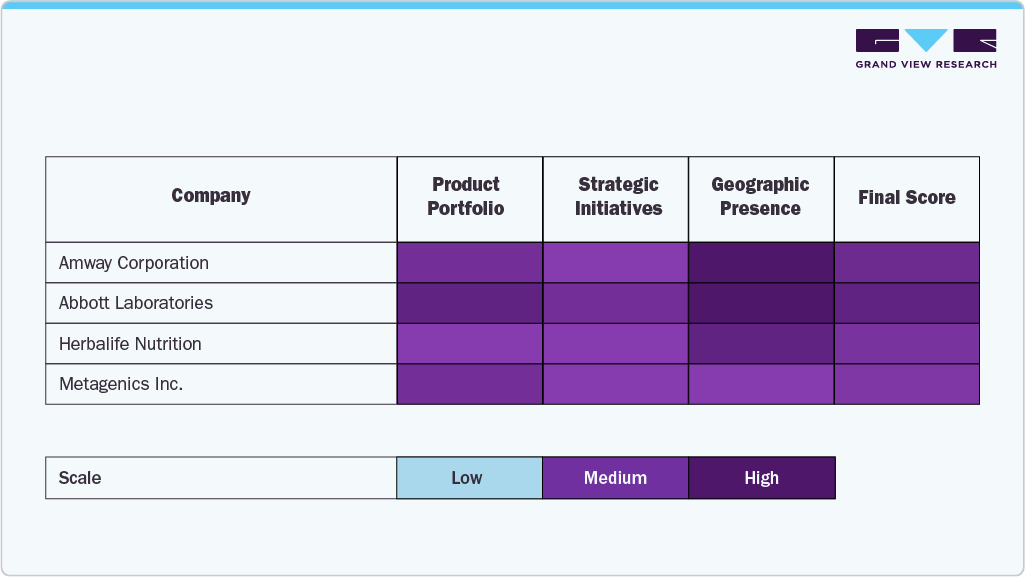

The U.S. personalized vitamins industry is characterized by a blend of established health and wellness companies and digitally native brands, all leveraging customization, data-driven insights, and direct-to-consumer models to meet growing demand for tailored nutrition. Leading players such as Amway Corporation, Abbott Laboratories, and Herbalife Nutrition maintain a significant market presence through extensive product portfolios, well-established consumer trust, and global distribution capabilities. These companies continue to invest in expanding their personalized health offerings, integrating supplement science with consumer health data and lifestyle assessments.

Companies such as Metagenics, Inc., Viome Life Sciences, Inc., and DNAfit are strengthening their market positions by offering precision health solutions powered by microbiome analysis, DNA testing, and metabolic profiling. These innovations enable highly targeted supplement formulations, addressing specific health needs ranging from immune function and gut health to stress management and fitness performance. Their integration of diagnostics with supplementation sets a new standard for personalization in space.

Digital-first brands Persona Nutrition (Nestlé Health Science), HUM Nutrition, and Vous Vitamin have generated substantial market share by combining data-driven personalization engines with engaging user experiences and seamless e-commerce platforms. These companies focus on transparency, convenience, and lifestyle integration, often appealing to younger demographics through online quizzes, sleek packaging, and subscription-based delivery models. Backed by strong parent organizations, these brands have been scaled rapidly by prioritizing accessibility, personalization, and brand trust.

As the market matures, the convergence of advanced health tech, nutritional science, and digital convenience reshapes consumer expectations: strategic partnerships, acquisitions, and continued innovation in personalization algorithms and testing technologies fuel competition. The market's future will be increasingly defined by integrating personalized nutrition into broader wellness ecosystems, emphasizing ethical sourcing, inclusivity, and preventative care. Companies that balance scientific innovation with consumer-centric design and affordability are best positioned to lead this evolving and high-potential sector.

Key U.S. Personalized Vitamins Companies:

- Amway Corporation

- Abbott Laboratories

- Herbalife Nutrition

- Metagenics, Inc.

- DNAfit

- Viome Life Sciences, Inc.

- Life Extension

- Persona Nutrition (Nestlé Health Science)

- HUM Nutrition

- Vous Vitamin

Recent Developments

-

In July 2025, Metagenics (USA) introduced its proprietary UltraFlora Probiotic + Multivitamin, a 2-in-1 capsule that delivers 24‑hour gut support with a targeted probiotic and 17 essential nutrients in one convenient daily dose.

-

In March 2025, Herbalife (U.S.) announced it acquired all Pro2col Health and Pruvit Ventures assets, and secured a 51% controlling stake in Link BioSciences, advancing its personalized nutrition platform.

-

In November 2024, Persona Nutrition in the U.S. launched a white-label service enabling brands to offer personalized nutrition subscription solutions with tailored vitamin assessments, algorithm-driven regimens, Drug‑Nutrient Interaction checks, nutritionist support, and end-to-end subscription management.

U.S. Personalized Vitamins Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.81 billion

Revenue forecast in 2033

USD 5.29 billion

Growth rate

CAGR of 14.32% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, dosage form, distribution channel, age group

Key companies profiled

Amway Corporation; Abbott Laboratories; Herbalife Nutrition; Metagenics, Inc.; DNAfit; Viome Life Sciences, Inc.; Life Extension; Persona Nutrition (Nestlé Health Science); HUM Nutrition; Vous Vitamin

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Personalized Vitamins Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the U.S. personalized vitamins market report based on application, dosage form, distribution channel, and age group:

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Wellness Supplements

-

Disease-Based Supplements

-

-

Dosage Form Outlook (Revenue, USD Million, 2021 - 2033)

-

Tablets

-

Capsules

-

Powders

-

Gummies/Chewable

-

Liquids

-

Softgels

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Supermarkets/Hypermarkets

-

Specialty Stores

-

Retail Pharmacies

-

Online pharmacies & E-commerce site

-

-

Age Group Outlook (Revenue, USD Million, 2021 - 2033)

-

Pediatric

-

Adults

-

Geriatric

-

Frequently Asked Questions About This Report

b. The U.S. personalized vitamins market size was valued at USD 1.67 billion in 2024 and is expected to reach USD 1.81 billion by 2025

b. The U.S. personalized vitamins market is expected to grow at a compound annual growth rate of 14.32% from 2025 to 2033 to reach USD 5.29 billion by 2033.

b. Disease-based supplements accounted for the largest revenue share in 2024 and are projected to witness the fastest growth rate over the forecast period, driven by increasing consumer focus on managing chronic conditions such as diabetes, cardiovascular diseases, and immune disorders through targeted nutritional support.

b. Some key players operating in the U.S. personalized vitamins market include Amway Corporation; Abbott Laboratories; Herbalife Nutrition; Metagenics, Inc.; DNAfit; Viome Life Sciences, Inc.; Life Extension; Persona Nutrition (Nestlé Health Science); HUM Nutrition; Vous Vitamin.

b. This growth is driven by increasing consumer awareness of health and wellness, DNA and microbiome testing advancements, and a rising demand for customized health solutions tailored to individual nutritional needs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.