- Home

- »

- Homecare & Decor

- »

-

U.S. Pest Control Products Market, Industry Report, 2033GVR Report cover

![U.S. Pest Control Products Market Size, Share & Trends Report]()

U.S. Pest Control Products Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Sprays/Aerosols, Baits/Gels, Repellents), By Pest Type (Flying Insects, Crawling Insects, Rodents), By Control Mechanism (Chemical), By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-729-2

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Pest Control Products Market Summary

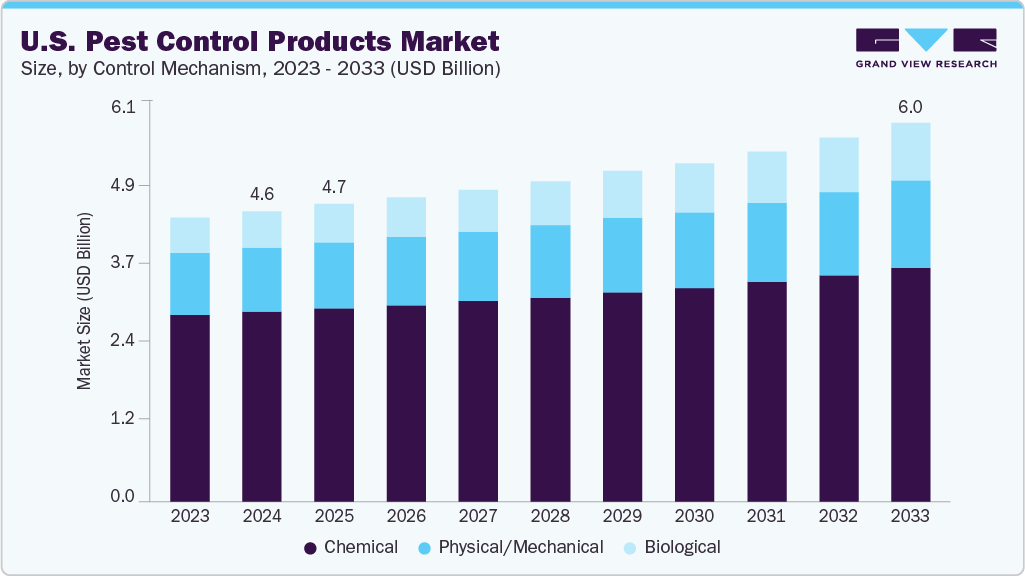

The U.S. pest control products market size was valued at USD 4.60 billion in 2024 and is expected to reach USD 6.01 billion by 2033, growing at a CAGR of 3.1% from 2025 to 2033. The industry is driven by heightened public health concerns and recurring outbreaks of vector-borne diseases. According to the CDC, more than 650,000 cases of vector-borne illnesses were reported between 2004 and 2016, with tick-borne Lyme disease accounting for a significant share. Rising incidences of mosquito-borne West Nile Virus and Zika have further accelerated household and municipal demand for repellents, insecticides, and integrated monitoring solutions.

Shifts in consumer lifestyle are another major demand driver. Growth in single-family housing starts, which rose 12% year-on-year in 2023, has expanded suburban outdoor spaces and increased exposure to rodents, ants, and mosquitoes. The popularity of backyard living, gardening, and outdoor leisure zones has boosted retail sales of sprays, aerosols, and lawn-specific pest solutions. According to the American Pet Products Association (APPA), the rise of pet ownership, with 66% of U.S. households owning a pet in 2024, has heightened concerns over flea and tick infestations, fueling purchases of specialty pest treatments.

Regulatory and sustainability trends are reshaping product portfolios. The U.S. EPA’s restrictions on high-toxicity formulations are encouraging the adoption of low-residue, natural, and biodegradable alternatives. Demand for plant-based repellents made from citronella, peppermint, and neem oils is rising, particularly among urban consumers with wellness-oriented preferences. Manufacturers are also launching eco-friendly traps and digital pest monitoring systems to align with both compliance requirements and consumer awareness of environmental impact.

On the innovation front, companies are accelerating new product development to align with these changing preferences. In May 2025, SC Johnson expanded its Off! Clean Feel range with plant-based mosquito repellents targeting sensitive-skin households. By July 2025, Central Life Sciences introduced a smart, app-enabled mosquito-control kit featuring real-time yard monitoring and eco-conscious larvicides. These product launches underscore the dual consumer priorities of safety and convenience, while highlighting the increasing role of technology in household pest control solutions.

Buyers’ Behavioral Analysis

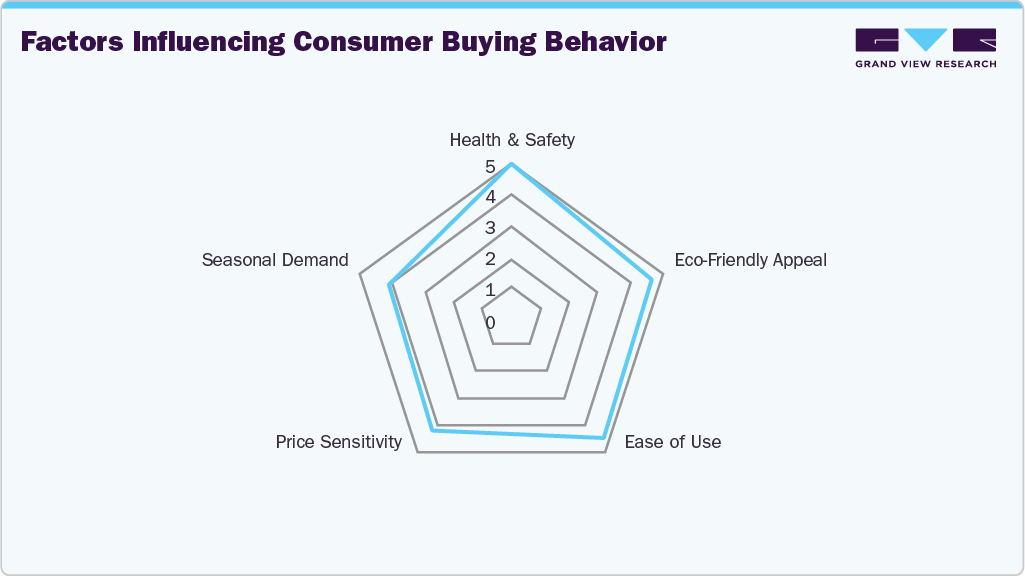

Families, particularly those with children and pets, place strong emphasis on products that combine efficacy against common pests such as ants, mosquitoes, ticks, and rodents with proven safety credentials. The demand for low-odor sprays, child-safe bait stations, and pet-friendly repellents has expanded, reflecting greater sensitivity toward indoor air quality and exposure risks. This aligns with U.S. Environmental Protection Agency (EPA) guidance and has elevated consumer trust in brands that market compliance-backed, residue-free solutions.

Convenience and adaptability to busy lifestyles also heavily influence purchasing decisions. Many U.S. households prefer ready-to-use aerosol sprays, plug-in ultrasonic devices, and subscription-based smart traps that minimize preparation and monitoring. The growing penetration of e-commerce platforms such as Amazon, Walmart.com, and Home Depot’s digital storefronts further supports this trend, as consumers increasingly rely on rapid shipping, bundled offers, and peer reviews before committing to a purchase. Seasonal fluctuations amplify these behaviors, with sales peaking in summer months when mosquitoes and ticks are most active in southern and coastal states.

Spending patterns diverge across income groups and living environments. Higher-income suburban households are adopting smart, app-enabled pest control systems, eco-certified repellents, and integrated yard management kits, reflecting their preference for sustainable and technologically advanced solutions. In contrast, cost-conscious urban renters and students often rely on traditional sticky traps, budget aerosol sprays, or bulk packs available at discount retailers.

Product Insights

Sprays/aerosols accounted for a revenue share of 35.71% in 2024. Consumers prefer sprays for their ability to deliver immediate results against common pests like ants, roaches, and mosquitoes, especially in kitchens, bathrooms, and outdoor areas. The convenience of ready-to-use packaging, no need for special equipment, and availability across supermarkets, hardware stores, and online platforms further strengthen their dominance. Additionally, manufacturers have expanded product lines with low-odor, pet-safe, and eco-conscious variants, aligning with rising health and environmental concerns while maintaining the quick action that U.S. households expect.

Microbials/biopesticides are expected to grow at a CAGR of 5.7% from 2025 to 2033 within the U.S. pest control products industry. Rising concerns about pesticide residues in homes, schools, and food-handling areas have accelerated the shift toward naturally derived products made from bacteria, fungi, and plant-based extracts. These options are viewed as safer for children, pets, and beneficial insects, aligning with the country’s broader sustainability movement and demand for green-certified products. At the same time, regulatory pressure from agencies such as the U.S. Environmental Protection Agency (EPA) is encouraging adoption of biopesticides by streamlining approval processes and promoting lower-toxicity solutions.

Control Mechanism Insights

Control mechanisms through chemicals accounted for a revenue share of 65.41% in 2024. Chemical formulations, ranging from aerosols and residual sprays to bait stations, are tailored for both residential and commercial use, offering solutions against a wide array of pests with minimal application complexity. Their scalability also appeals to industries such as hospitality and foodservice, where consistent pest management is critical to compliance with hygiene regulations.

Biological control mechanisms are expected to grow at a CAGR of 5.1% from 2025 to 2033, driven by the rising demand for eco-friendly and residue-free alternatives to synthetic chemicals. Growing consumer concerns about pesticide exposure, particularly in households with children and pets, are pushing the adoption of products based on natural agents such as beneficial microbes, predators, and botanical extracts. Regulatory momentum toward sustainable pest management in agriculture, landscaping, and urban environments is also encouraging companies to expand biological offerings.

End Use Insights

The B2B segment accounted for a revenue share of 79.68% in 2024. Businesses in sectors such as foodservice, hospitality, healthcare, and retail must adhere to federal and state hygiene standards, where even minor infestations can result in penalties, reputational damage, or operational shutdowns. This regulatory pressure, coupled with the scale of commercial facilities, drives consistent and bulk demand for professional-grade pest control products. Additionally, integrated pest management (IPM) programs adopted by facility managers emphasize systematic and ongoing use of chemical, biological, and mechanical solutions, reinforcing the sector’s reliance on structured procurement.

The B2C segment is expected to grow at a CAGR of 5.3% from 2025 to 2033. Households are increasingly investing in preventive pest control solutions to address common issues like mosquitoes, ants, and cockroaches, which are linked to health risks. Growing awareness of eco-friendly and low-toxicity options, alongside the convenience of ready-to-use sprays, traps, and plug-in devices, has further boosted adoption. The expansion of e-commerce platforms and subscription-based delivery models has also made pest control products more accessible to consumers, enabling quick replenishment and trial of new product formats.

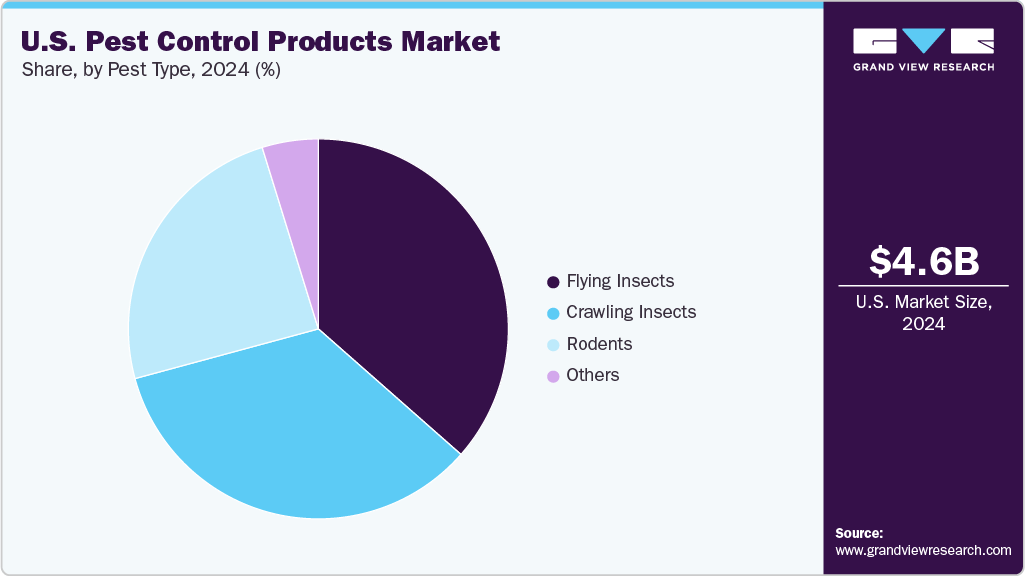

Pest Type Insights

The flying insects segment accounted for a revenue share of 36.49% in 2024. The segment is driven largely by rising mosquito- and fly-borne health risks and lifestyle factors that increase human exposure. Warmer summers and longer breeding cycles, linked to climate change, have expanded mosquito activity across more states, while urban density and backyard landscaping provide favorable habitats for flies and gnats. At the same time, the popularity of outdoor dining, recreation, and residential patios has amplified demand for repellents, traps, and yard treatments that ensure comfort and safety. Public awareness campaigns around diseases such as West Nile virus and Lyme disease have further boosted preventive use of sprays, coils, and eco-friendly repellents.

The crawling insects segment is expected to grow at a CAGR of 3.4% from 2025 to 2033. These pests thrive in urban housing complexes, restaurants, warehouses, and healthcare facilities, where food residue, moisture, and clutter create favorable conditions. Their association with health risks, such as food contamination, asthma triggers, and disease transmission, has heightened consumer demand for targeted solutions. Households rely on sprays, gels, and baits for quick relief, while businesses increasingly adopt integrated pest management (IPM) programs to comply with hygiene regulations. Seasonal outbreaks, particularly during warmer months, further intensify purchases, reinforcing crawling insects as the leading driver of product demand in the market.

Key U.S. Pest Control Products Company Insights

Key players operating in the U.S. pest control products market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key U.S. Pest Control Products Companies:

- BASF SE

- Bayer AG

- FMC Corporation

- Control Solutions, Inc.

- Rentokil Initial plc

- Ecolab Inc.

- Syngenta Group

- Woodstream Corporation

- Bell Laboratories, Inc.

- Corteva Agriscience

Recent Developments

-

In April 2025, Envu, a prominent U.S. pest control company, introduced Barricor Essential Mosquito Control and Suspend Contact & Residual Aerosol to its professional pest management lineup. Barricor is a plant-based insecticide that provides quick mosquito control while being safe for pollinators, and Suspend combines pyrethrin and deltamethrin for rapid action with long-lasting residual protection against common pests like cockroaches, ants, ticks, and spiders. Both products prioritize user safety, ease of application, and sustained effectiveness, and are now accessible through Envu’s distribution network across the U.S.

-

In March 2023, Zevo, a U.S.-based pest control brand owned by Procter & Gamble, launched its new On-Body Mosquito + Tick Repellents, designed to provide up to eight hours of protection. The products utilize IR3535, a naturally derived ingredient, and are formulated to be odorless and non-greasy. Available in aerosol spray, pump spray, and lotion forms, the line addresses consumer concerns over the stickiness and strong odors of traditional repellents. This launch reflects Zevo’s focus on comfort and convenience while maintaining effective pest protection, and the products are now widely available across major U.S. retailers, including Walmart, Target, Home Depot, Lowe’s, Kroger, and Meijer.

U.S. Pest Control Products Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.72 billion

Revenue forecast in 2033

USD 6.01 billion

Growth rate

CAGR of 3.1% from 2025 to 2033

Actuals

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, pest type, control mechanism, end use

Country scope

U.S.

Key companies profiled

BASF SE; Bayer AG; FMC Corporation; Control Solutions, Inc.; Rentokil Initial plc; Ecolab Inc.; Syngenta Group; Woodstream Corporation; Bell Laboratories, Inc.; Corteva Agriscience

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Pest Control Products Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. pest control products market report based on product, pest type, control mechanism, and end use.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Sprays/Aerosols

-

Baits/Gels

-

Repellents

-

Predators/Parasites

-

Microbials/Biopesticides

-

Barriers/Exclusion

-

Mechanical Traps

-

Electronic Devices

-

-

Pest Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Flying Insects

-

Crawling Insects

-

Rodents

-

Others

-

-

Control Mechanism Outlook (Revenue, USD Million, 2021 - 2033)

-

Chemical

-

Physical/Mechanical

-

Biological

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

B2C

-

Supermarkets and Hypermarkets

-

Pharmacies & Drugstores

-

Home Improvement & Hardware Stores

-

E-commerce/Online

-

Others (Grocery Stores, Department Stores, etc.)

-

-

B2B

-

Direct Sales

-

Distributors & Wholesalers

-

Agricultural Supply Stores & Co-operatives

-

Commercial & Institutional E-procurement Platforms

-

Others (Government Procurement Programs, etc.)

-

-

Frequently Asked Questions About This Report

b. The U.S. pest control products market was estimated at USD 4.60 billion in 2024 and is expected to reach USD 4.72 billion in 2025.

b. The U.S. pest control products market is expected to grow at a compound annual growth rate of 3.1% from 2025 to 2033 to reach USD 6.01 billion by 2033.

b. Sprays/aerosols accounted for a revenue share of 35.71% of the U.S. pest control products market in 2024. Their dominance is supported by the wide assortments offered by established brands and strong visibility across supermarkets, home improvement stores, and online channels. Seasonal surges in pest infestations, particularly in warmer months, also contribute to the sustained demand for these products.

b. Some of the key players in the U.S. pest control products market include BASF SE; Bayer AG; FMC Corporation; Control Solutions, Inc.; Rentokil Initial plc; Ecolab Inc.; Syngenta Group; Woodstream Corporation; Bell Laboratories, Inc.; Corteva Agriscience

b. The U.S. pest control products market is being driven by rising consumer focus on home hygiene and preventive pest management. Expanding sales through large retail chains and e-commerce platforms is making products more accessible nationwide. In addition, recurring seasonal infestations and climate-related pest pressures continue to sustain strong demand across categories.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.