- Home

- »

- Animal Health

- »

-

U.S. Pet Insurance Market Size, Share, Industry Report 2033GVR Report cover

![U.S. Pet Insurance Market Size, Share & Trends Report]()

U.S. Pet Insurance Market (2025 - 2033) Size, Share & Trends Analysis Report By Coverage (Accident & Illness, Accident Only), By Animal (Dogs, Cats), By Sales Channel (Agency, Broker), By States, And Segment Forecasts

- Report ID: GVR-4-68040-211-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Pet Insurance Market Summary

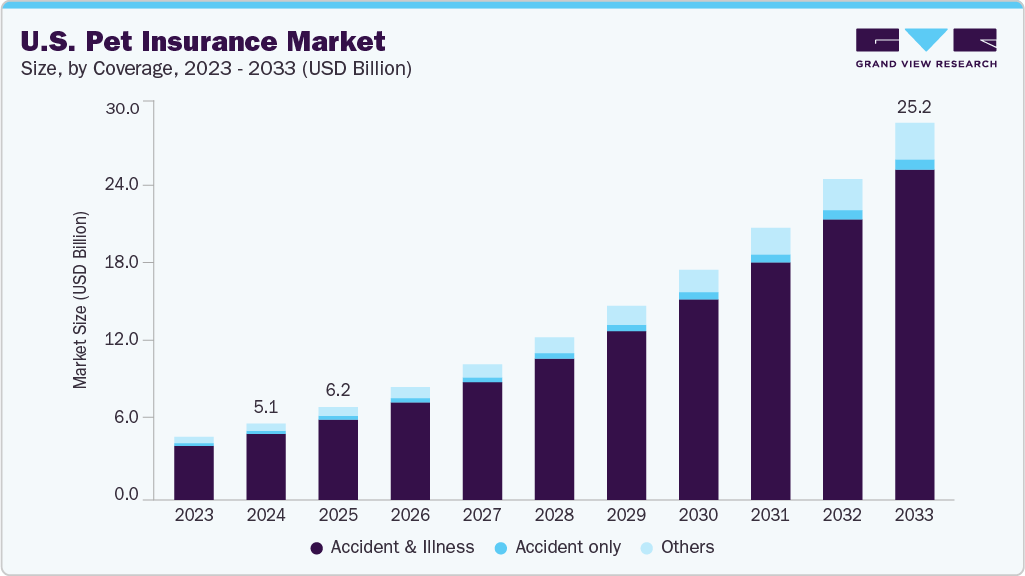

The U.S. pet insurance market size was estimated at USD 5.11 billion in 2024 and is projected to reach USD 25.21 billion by 2033, growing at a CAGR of 19.14% from 2025 to 2033. The market is experiencing significant growth driven by rising pet ownership and humanization of pets, increasing veterinary care costs, and growing awareness and marketing by providers.

Key Market Trends & Insights

- The pet insurance market in California accounted for the largest market share in 2024.

- By coverage, the accident & illness segment led the market with the largest revenue share of 86.32% in 2024.

- By animal, the dog segment accounted for the largest market revenue share in 2024.

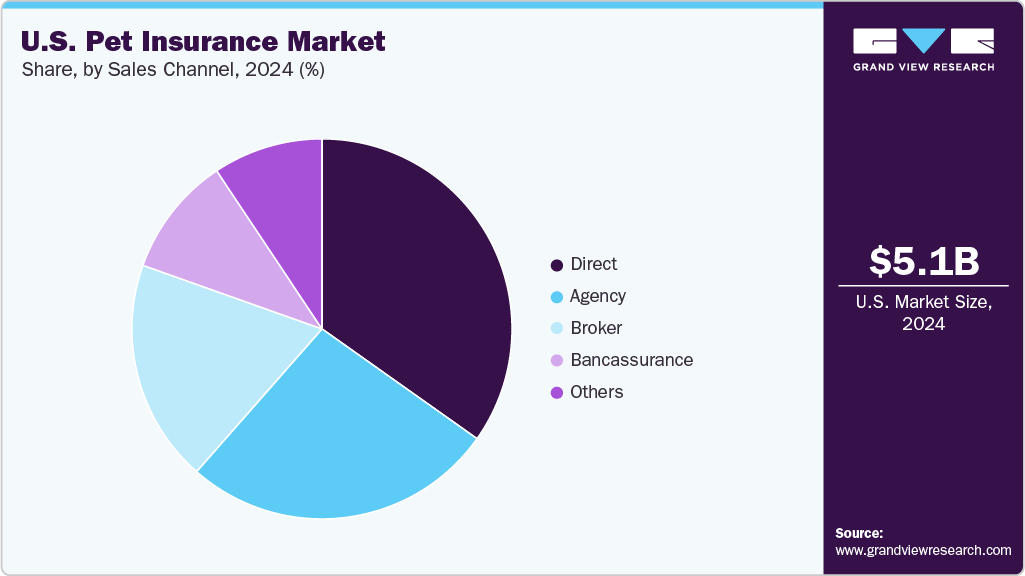

- By sales channel, the direct segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.11 Billion

- 2033 Projected Market Size: USD 25.21 Billion

- CAGR (2025-2033): 19.14%

The U.S ranks among the countries with the largest number of pets due to rising adoption rates and the increasing trend of treating pets as family members. According to a report of January 2025, 86.9 million households (approximately 66%) owned a pet. Pet humanization has propelled the demand for better healthcare, premium nutrition, and preventive care services.As pet owners seek to ensure pets’ wellbeing, insurance becomes an attractive option to offset expensive veterinary bills. According to a Forbes Advisor report of January 2025, the average annual expenditure for dogs was USD 1,400 and for cats was USD 1,150. Millennials and Gen Z, who dominate new pet adoptions, are particularly inclined towards financial planning and structured healthcare coverage for pets. In the U.S., dogs accounted for 5.36 million insured pets, making up about 80% compared to cats. The increasing humanization of pets and rising pet care expenditure are transforming the U.S. pet insurance industry.

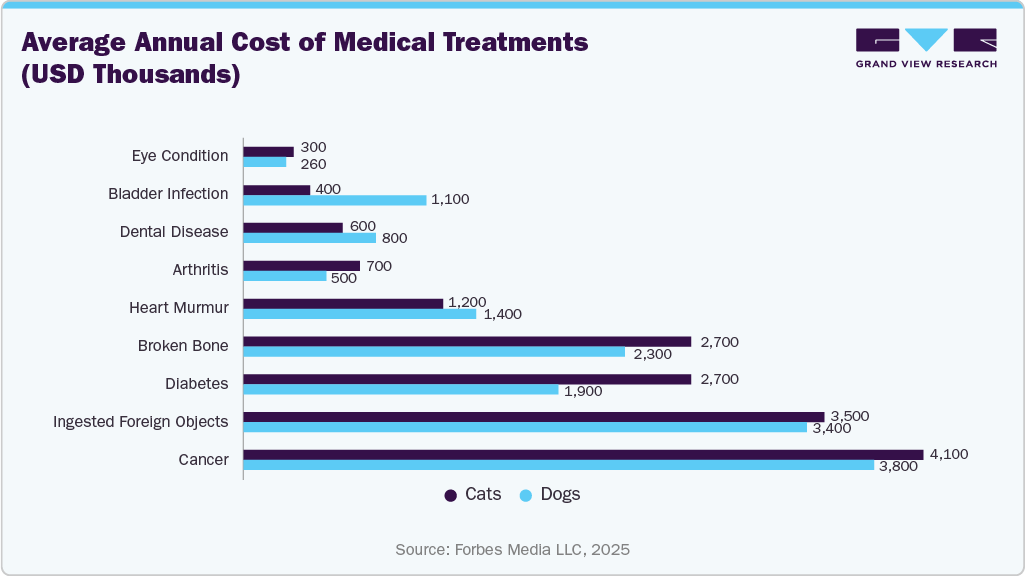

Furthermore, growing veterinary expenses serve as a primary driver of the U.S. pet insurance industry. Advanced diagnostics, surgical interventions, and specialized treatments which were limited to human medicine earlier, have now become common in veterinary care, but they come with high costs. Some of the unexpected expenses for ailments like cancer, orthopedic issues, or emergency surgery can range from hundreds to thousands of dollars for pet owners.

The American Pet Products Association, in its Industry Stats and Trend Report, estimated that the total amount spent on pets in the U.S. is projected to reach USD 157 billion in 2025. The increasing use of advanced therapies like regenerative medicine and advanced imaging highlights the need for insurance for thorough and reasonably priced pet healthcare, while pet insurance lessens this financial burden by guaranteeing prompt care.

Strong marketing efforts and educational campaigns by insurers and veterinary networks are significantly fueling the growth of the U.S. pet insurance industry. Companies are strengthening digital platforms, social media, and partnerships with veterinary hospitals highlighting the benefits of coverage and build consumer trust.

For instance, in June 2025, Spot Pet Insurance partnered with pop star Kesha to launch a U.S.-wide campaign promoting pet healthcare and shelter support, offering customizable insurance, 24/7 telehealth, and adoption events. This initiative raises awareness while empowering pet owners to safeguard their pets’ health effectively. The market has been further bolstered by greater clarity regarding coverage alternatives, wellness add-ons, and reimbursement rates. Employers who incorporate pet insurance into optional benefit plans have also made it more widely available and normalized its use. Pet insurance is being witnessed as a proactive way to guarantee that pets receive high-quality, reasonably priced healthcare as awareness grows, especially in cities where veterinarian expenses are higher.

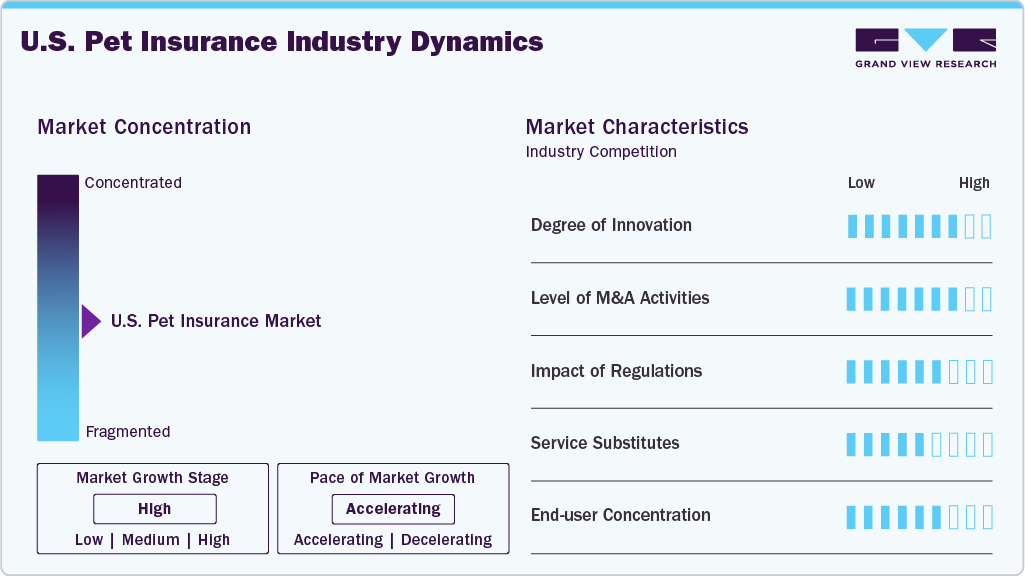

Market Concentration & Characteristics

The U.S. pet insurance industry is moderately concentrated, dominated by key players such as Nationwide, Trupanion, and Healthy Paws. These companies command significant market share through strong distribution networks, partnerships, and product innovation, while new entrants focus on niche offerings and digital platforms to compete.

The U.S. pet insurance industry shows strong innovation with digital platforms, AI-driven claims processing, and personalized policy options. The young generation uses digital platforms to provide a smoother and interesting client experience. Traditional insurers are improving their products by incorporating wellness programs and tailoring plans to specific needs. Customer satisfaction is rising due to creative compensation schemes and adaptable coverage options.

As insurers and financial institutions buy out or collaborate with specialized providers, M&A activity is increasing in the U.S. pet insurance sector. These agreements improve market penetration, fortify product ranges, and broaden distribution networks. For instance, in March 2024, Independence Pet Holdings (IPH) acquired Pets Best from Synchrony, integrating pet insurance offerings and leveraging synergies with Synchrony’s CareCredit, strengthening market presence and expanding strategic collaborations in the pet industry.

The U.S. pet insurance industry is evolving with strong regulatory frameworks, with the National Association of Insurance Commissioners (NAIC) introducing model laws to standardize practices. Regulations address transparency in coverage terms, reimbursement processes, and consumer rights. For instance, according to AVMA, in September 2024, bipartisan legislation was introduced in the U.S. Congress aimed at addressing rising veterinary care and pet insurance costs. The proposal suggested allowing pet and service animal expenses to qualify under tax-advantaged health savings accounts (HSAs) and flexible spending accounts (FSAs).

The substitutes for pet insurance in the U.S. include savings plans, credit cards, and veterinary wellness packages. Some owners prefer self-funding for routine or emergency expenses instead of paying premiums. However, rising veterinary costs make these substitutes less reliable compared to insurance.

End-user concentration in the U.S. pet insurance industry is diversified across dog and cat owners, with dogs accounting for the majority of insured pets. Urban households and millennials form key adopters due to higher spending capacity and lifestyle trends. Employers offering insurance as a voluntary benefit are also expanding uptake.

Coverage Insights

The accident & illness segment led the market with the largest revenue share of 86.32% in 2024 and is projected to grow at the fastest CAGR over the forecast period, driven by the growing demand for comprehensive coverage to protect pets against unforeseen medical expenses. This segment covers a wide range of conditions, including accidents, infections, chronic illnesses, cancer, and hereditary disorders, ensuring peace of mind for pet owners. Rising veterinary costs, coupled with increasing awareness of advanced diagnostic and treatment options, have further fueled adoption. The wellness or accident-only plans, accident and illness policies offer broader protection, making them the preferred choice for most pet owners seeking value and security.

The other segment, comprising liability insurance policies, is expected to grow at the second-fastest CAGR during the forecast period, due to rising concerns about pet-related accidents, third-party injuries, and property damage. As pet owners seek financial protection against unforeseen liabilities, insurers are expanding coverage options.

Animal Insights

The dogs accounted for the largest market revenue share in 2024, driven by the higher adoption of dogs compared to other pets and their greater healthcare needs. According to a January 2024 Forbes Advisor report, more than 65.1 million American households own dogs, far more than the 46.5 million that own cats. Increased risk of accidents, chronic diseases, and lifestyle-related disorders, dogs require more regular veterinary care, which raises medical expenses. To handle these costs, owners are looking for extensive insurance coverage. A high number of annual veterinarian visits and increasing adoption of dogs have boosted the market growth.

The cat segment is anticipated to grow at the fastest CAGR during the forecast period, driven by increasing cat ownership and rising awareness of feline health needs. According to the North American Pet Health Insurance Association (NAPHIA) SOI 2024 report, between 2022 and 2023, the U.S. pet insurance industry saw an increase in Gross Written Premium (GWP) for cats by around 26%, outpacing dogs, which grew by around 20%. In addition, the growing trend of humanizing cats and treating them as family members has increased demand, making the cat insurance segment a key growth driver in the U.S. market.

Sales Channel Insights

The direct segment led the market with the largest revenue share of 34.81% in 2024, driven by the growing preference of pet owners to purchase policies directly from insurers. Convenience, quicker policy issuance, and customized plan alternatives are provided by this strategy. Businesses employ phone assistance, mobile apps, and web portals to interact with clients, improve user experience, and offer immediate bids. Insurers can also cut expenses, cut off intermediaries, and keep policyholders closer by using direct sales.

The others segment includes animal care centers, veterinary clinics, and others is anticipated to grow at the fastest CAGR during the forecast period, driven by an increase in partnerships between veterinary networks and insurers. Pet owners can enroll during visits when insurance is offered directly at clinics, guaranteeing prompt coverage for services. In order to increase adoption rates, veterinarians are essential in educating owners about the advantages of policies. This channel integrates digital tools for smooth claims and renewals, promoting ease, trust, and structured advice.

State-level Insights

California Pet Insurance Market Trends

The pet insurance market in California accounted for the largest market share in 2024 and is expected to maintain its dominance over the forecast period. The reason behind state dominance lies in two main factors: the pet population and the dynamic regulatory scenario. The state is home to more than 18% of the country's pet population, and state legislators are actively improving pet insurance laws to safeguard pet owners against unfair business practices. For instance, in September 2024, the governor of California approved a bill named SB 1217, under which pet insurance providers must disclose policy terms, including coverage limits, exclusions, and pre-existing condition clauses. Such laws will boost the uptake of pet insurance as they will increase transparency in state pet insurance policies.

Florida Pet Insurance Market Trends

TheFlorida pet insurance market is set to exhibit at the fastest CAGR during the forecast period, due to a rapid rise in GWP and insured pets among all the other states in the country. According to NAPHIA, the state recorded an increase of more than USD 100 million in total GWPs in just 2 years. Also, the number of pets insured rose by more than 100,000 between 2021 and 2023.

Key U.S. Pet Insurance Company Insights

Key players in the U.S. pet insurance industry include Trupanion, Jab Holding Company, and Nationwide Mutual Insurance Company. The market is expanding through digital platforms, veterinary partnerships, collaborations, and innovative coverage options, driving competitive growth across the sector. For instance, in August 2025, the Standard partnered with OnePack Plan by PetPartners to offer employer-based pet insurance, enhancing employee satisfaction, financial security, and pet care access through convenient enrollment and comprehensive coverage options.

Key U.S. Pet Insurance Companies:

- Trupanion, Inc.

- Jab Holding Company

- Nationwide Mutual Insurance Company

- Allianz

- Fetch Pet Insurance

- Spot Pet Insurance

- MetLife, Inc.

- Odie Pet Insurance

- Crum & Foster

- ManyPets (EQT Group)

- Lemonade Inc.

Recent Developments

-

In August 2025, Adoro Pet Insurance entered the U.S. pet insurance industry by partnering with Crum & Forster to offer full-stack policies, enhancing pet owners’ access to affordable, comprehensive healthcare solutions.

-

In April 2024, Chubb acquired Healthy Paws from Aon, expanding its presence in the U.S. pet insurance industry and enabling more owners to manage rising veterinary costs through an established, trusted brand.

-

In January 2024,Nationwide and Petco launched co-branded pet insurance on petco.com, offering customizable coverage for dogs, cats, and exotic pets, including accidents, illnesses, and optional wellness plans to meet individual needs.

U.S. Pet Insurance Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.21 billion

Revenue forecast in 2033

USD 25.21 billion

Growth rate

CAGR of 19.14% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Coverage, animal, sales channel, states

Country scope

U.S.

States scope

California; New York; Florida; Texas; New Jersey; Pennsylvania; Massachusetts; Washington; Illinois; Other States

Key companies profiled

Trupanion, Inc.; Jab Holding Company; Nationwide Mutual Insurance Company; Allianz; Fetch Pet Insurance; Spot Pet Insurance; MetLife, Inc.; Odie Pet Insurance; Crum & Foster; ManyPets (EQT Group); Lemonade Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Pet Insurance Market Report Segmentation

This report forecasts revenue growth at the country, state levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. pet insurance market report based on coverage, animal, sales channel, and states.

-

Coverage Outlook (Revenue, USD Million, 2021 - 2033)

-

Accident & Illness

-

Accident only

-

Others

-

-

Animal Outlook (Revenue, USD Million, 2021 - 2033)

-

Dogs

-

Cats

-

Others

-

-

Sales Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Agency

-

Broker

-

Direct

-

Bancassurance

-

Others

-

-

State Outlook (Revenue, USD Million, 2021 - 2033)

-

California

-

New York

-

Florida

-

Texas

-

New Jersey

-

Pennsylvania

-

Massachusetts

-

Washington

-

Illinois

-

Other States

-

Frequently Asked Questions About This Report

b. The U.S. pet insurance market size was estimated at USD 5.11 billion in 2024 and is expected to reach USD 6.21 billion in 2025.

b. The U.S. pet insurance market is expected to grow at a compound annual growth rate of 19.14% from 2025 to 2033 to reach USD 25.21 billion by 2030.

b. By state, California accounted for the largest share of the market in 2024 and is expected to maintain its dominance over the forecast period. The reason behind state dominance lies in two main factors: the pet population and the dynamic regulatory scenario. The state is home to more than 18% of the country's pet population, and state legislators are actively improving pet insurance laws to safeguard pet owners against unfair business practices.

b. Some key players operating in the U.S. pet insurance market include Trupanion, Inc., Jab Holding Company, Nationwide Mutual Insurance Company, Allianz, Fetch Pet Insurance, Spot Pet Insurance, MetLife, Inc., Odie Pet Insurance, Crum & Foster, ManyPets (EQT Group), and Lemonade Inc.

b. The expansion of this market is primarily driven by factors such as the increasing disbursement of insurance claims, the rise in underwritten policies, the increase in veterinary care costs, initiatives by key companies, and the evolution of regulatory structures

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.