- Home

- »

- Automotive & Transportation

- »

-

U.S. Pharmaceutical Logistics Market Size, Report, 2030GVR Report cover

![U.S. Pharmaceutical Logistics Market Size, Share & Trends Report]()

U.S. Pharmaceutical Logistics Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Cold Chain Logistics, Non-cold Chain Logistics), By Component (Storage, Transportation), And Segment Forecasts

- Report ID: GVR-4-68040-204-1

- Number of Report Pages: 115

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Pharmaceutical Logistics Market Trends

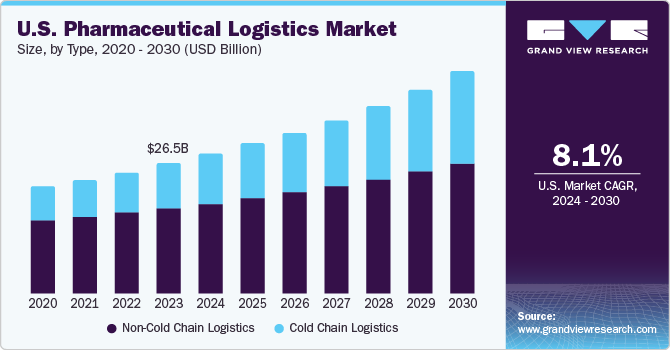

The U.S. pharmaceutical logistics market size was estimated at USD 26.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 8.1% from 2024 to 2030. The demand for pharmaceutical logistics is growing in the U.S. due to the increasing sales of generic drugs, as well as reforms in the healthcare sector favoring generics. The growth of the market is also attributed to the increasing use of Over-the-counter (OTC) medicines such as vitamins, minerals, and supplements (VMS), gastrointestinal drugs, common cold and cough drugs, and dermatology products.

The growing importance of fast-track assistance in the healthcare industry is driving the market growth for pharmaceutical logistics. Moreover, distribution costs can be further decreased by creating a single source distribution channel, this factor is fueling the demand for pharmaceutical logistics. Numerous companies are entering into mergers and acquisitions to expand their geographical presence and proprietary knowledge. They are also focusing on reducing the overall packaging costs of their products. The biotechnology and pharmaceutical supply chains are particularly prone to the risks associated with product adulteration during transport as well as non-compliance with federal regulations, standards, and guidelines.

Heavy investments are being made in technologies such as telematics and remote monitoring to provide safety and convenience during transportation operations, which is, in turn, propelling the market growth. The market for pharmaceutical logistics in U.S. is significantly fragmented owing to the presence of a large number of regional and international companies. The industry is highly competitive, owing to the presence of many local and global companies.

Major companies are striving to offer cloud-based supply chain solutions and secured supply chain functions as it helps manufacturers in verifying the authenticity of the drugs. These solutions prevent the production of counterfeit drugs and medical devices. The increasing demand for sea and air freight pharmaceutical logistics is anticipated to propel industry growth over the forecast period. The transportation of pharma products by sea reduces the transportation cost by up to 80.0% and brings down the staffing requirements. In addition, it conserves the packaging and storage needs while reducing the carbon footprint of logistics operations. The increasing use of air freight logistics for long-distance distribution of valuable vaccines and medicines is expected to fuel the market growth further.

Market Concentration & Characteristics

The market growth is medium, and the rate of growth is accelerating. The market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to gain a high market share and the need to consolidate in a rapidly growing market.

The introduction of blockchain technology has played a significant role in the pharmaceutical logistics industry. Blockchain technology helps customers and wholesalers to verify the authenticity of a drug package by connecting to the blockchain. Remote container management technology reduces the operational cost and provides real-time information about the supplier’s performance. The solar-powered refrigeration is gaining importance in the storage and transportation of vaccines and drugs.

The pharma logistics industry is regulated by stringent regulations to maintain the quality and safety of the pharma products. To reduce and prevent risks such as mixing up of different medicine batches and contamination & cross-contamination of the drugs, that are being transported, many regulations have been laid down. To avoid such incidents, the logistic companies are required to comply with guidelines associated with the Good Distribution Practices (GDP). GDP ensures product safety and ensures the same quality & quantity is delivered during supply chain operations. Managing the quality of drugs during transportation is challenging due to its specified storage conditions and shorter shelf life. The WHO and FDA are the main organizations in forming regulations and guidelines in the U.S.

Pharmaceutical logistics currently lacks a direct substitute. Pharmaceutical logistics faces several obstacles concerning on-time delivery, compliance, real-time-based monitoring, and others. The temperature-sensitive drugs require real-time-based temperature monitoring during transportation. These aspects that are creating challenges for the market are expected to generate new opportunities for players.

The concentration of services within the pharmaceutical industry ensures specialized and compliant handling of sensitive and time-critical medical products. The end-use concentration allows logistics providers to tailor their services to the unique requirements and regulatory standards of the pharmaceutical sector, ensuring the safe and efficient delivery of healthcare products to end-users.

Type Insights

Based on type, the cold chain logistics segment is anticipated to witness the fastest CAGR over the forecast period. The fastest growth rate is attributable to the rising demand for temperature-controlled products such as the distribution of vaccines that require accurate temperature-control logistics services to maintain the products’ efficacy. Furthermore, the stringent regulations for maintaining accurate temperature for temperature-sensitive drugs and pharmaceutical products are projected to boost the segment growth over the forecast period. The growing adoption of telematics in cold chain pharmaceutical logistics is aiding companies in improving the connectivity, safety, and efficiency of transport cargoes.

The non-cold chain segment held the largest revenue share of 65.8% in 2023 and is anticipated to continue its dominance in the coming years owing to the increasing demand for non-cold chain pharma medicines and other products.

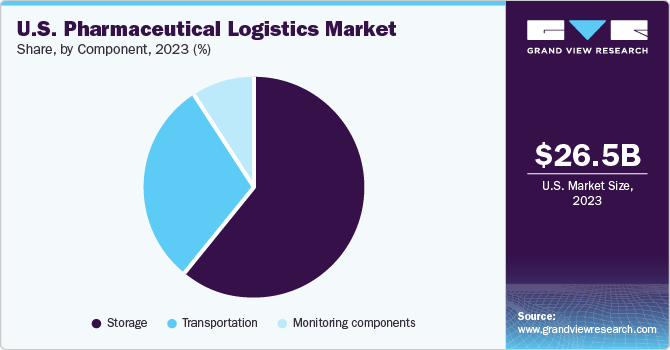

Component Insights

The storage segment dominated the market in 2023 with a revenue share of 60.8% in 2023. The rapidly rising demand for generic as well as branded pharma products has led to the growth of storage facilities to preserve and procure these products' efficacy after production and further distribution through multiple channels to distributors and retailers. This has also generated the demand for temperature-sensitive storage facilities to store temperature-sensitive drugs during logistics. This is further expected to bolster the segment growth over the coming years. Factors such as the changing lifestyles of consumers and the dietary pattern are driving the demand for temperature-sensitive protein and nutritional supplements, which is expected to boost the demand for the storage segment over the forecast period.

The monitoring components segment is anticipated to witness the fastest CAGR from 2024 to 2030. This fast growth rate is due to the increasing need to ensure the efficiency, integrity, and safety of cold chain products. The monitoring components segment is further segregated into hardware and software subsegments. The transportation segment is projected to reach a considerable momentum in growth over the forecast period. The transportation segment is further divided into sea freight logistics, air freight logistics, and overland logistics subsegments. The increasing adoption of sea-based pharmaceutical logistics is driving the pharmaceutical logistics market as the sea freight logistics services are capable of handling sensitive large molecule biologics as well as personalized medicines.

Key U.S. Pharmaceutical Logistics Company Insights

To maintain their position in the market, the pharma companies continuously undertake strategic initiatives such as mergers and acquisitions. Furthermore, the companies in the market are investing in technologies such as blockchain, telematics, remote sensing and monitoring, and GPS and GIS integration in transporting cargo, thereby providing customers with safe and convenient pharmaceutical logistics services.

Some of the key players in the U.S. market are FedEx Corp., United Parcel Service Inc., United States Cold Storage (USCS), Lineage Logistics Holdings LLC, etc.

-

In November 2023, United Parcel Service (UPS) acquired MNX Global Logistics. This MNX acquisition increases UPS's capabilities in time-critical logistics, particularly, for healthcare customers in the US, Asia, and Europe. MNX is known for providing reliable and timely delivery of critical goods.

-

In October 2023, Lineage Logistics, acquired the cold storage and e-commerce fulfillment assets of third-party logistics provider Burris Logistics for an undisclosed sum. According to the agreement, Lineage LLC acquired eight facilities in six states totalling nearly 1.3 million square feet.

Some of the emerging players in the U.S. market are Stirling Ultracold, Cryoport, Airspace Technologies, etc.

-

In November 2023, Cryoport, Inc., a leading global provider of innovative products and services to the fast-growing cell and gene therapy industry, announced the expansion of its global supply chain network with the acquisition of Bluebird Express, LLC, a provider of time-sensitive domestic and international transportation services.

-

In November 2023, to expand its global footprint, QuickSTAT is investing in its network and logistics capabilities to be on par with the modern cold chain and the complex requirements of the industry. The expansion will support QuickSTAT’s ongoing focus on transportation and customized logistics and includes opening new QuickSTAT Control Towers and enhancement of existing facilities.

Key U.S. Pharmaceutical Logistics Companies:

- FedEx Corp.

- Americold Logistics

- Lineage Logistics

- United States Cold Storage (USCS)

- CTW Logistics

- United Parcel Service Inc.

- C H Robinson Worldwide Inc.

- SEKO Logistics

- Owens and Minor Inc.

- Nichirei Logistics Group, Inc.

Recent Developments

-

In November 2023, Nippon Express Holdings and Cryoport entered into a global strategic partnership for Temperature-Controlled Supply Chain Services. This relationship brings together Nippon Express' industry-leading global logistics, with Cryoport Systems' fully integrated system, processes, and equipment including its shipping packages, data solutions, biostorage and bioservices, and the ability to provide complete cell and gene therapy support services from upstream biomaterial collection to final delivery for dosing.

- In January 2023, Nichirei Logistics announced that its subsidiary in the United Kingdom, Themotraffic UK Limited, has acquired the remaining 50% share of Kevin Hancock Limited. Kevin Hancock Limited has been a subsidiary of Nichirei Logistics since it first acquired a 50% holding in September 2020.

U.S. Pharmaceutical Logistics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 28.39 billion

Revenue forecast in 2030

USD 45.22 billion

Growth rate

CAGR of 8.1% from 2024 to 2030

Historical data

2017 - 2022

Base year for estimation

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share analysis, competitive analysis, competitive landscape, growth factors, and trends

Segments covered

Type, component

Country scope

U.S.

Key companies profiled

FedEx Corp.; Americold Logistics; Lineage Logistics; United States Cold Storage (USCS); CTW Logistics; United Parcel Service Inc.; C H Robinson Worldwide Inc.; SEKO Logistics; Owens and Minor Inc.; Nichirei Logistics Group, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Pharmaceutical Logistics Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2024 to 2030. For this study, Grand View Research has segmented the U.S. pharmaceutical logistics market report based on type and component:

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cold Chain Logistics

-

Non-Cold Chain Logistics

-

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Storage

-

Warehouse

-

Refrigerated container

-

-

Transportation

-

Sea freight Logistics

-

Airfreight Logistics

-

Overland Logistics

-

-

Monitoring components

-

Hardware

-

Sensors

-

RFID Devices

-

Telematics

-

Networking Devices

-

-

Software

-

-

Frequently Asked Questions About This Report

b. The U.S. pharmaceutical logistics size was estimated at USD 26.5 billion in 2023 and is expected to reach USD 28.39 billion in 2024.

b. The U.S. pharmaceutical logistics market is expected to grow at a compound annual growth rate of 8.1% from 2024 to 2030 to reach USD 45.22 billion by 2030.

b. The storage segment dominated the U.S. pharmaceutical logistics market with a share of over 60% in 2023. The growth of the storage segment can be attributed to the rapidly rising demand for generic as well as branded pharma products.

b. Some key players operating in the U.S. pharmaceutical logistics market include FedEx Corp.; Americold Logistics; Lineage Logistics; United States Cold Storage (USCS); CTW Logistics; United Parcel Service Inc.; C H Robinson Worldwide Inc.; SEKO Logistics; Owens and Minor Inc.; Nichirei Logistics Group, Inc.

b. Key factors driving the market growth include the increasing sales of generic drugs, as well as reforms in the healthcare sector favoring generics. The growth of the market is also attributed to the increasing use of Over-the-counter (OTC) medicines such as vitamins, minerals, and supplements (VMS), gastrointestinal drugs, common cold and cough drugs, and dermatology products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.