- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Pharmaceutical Packaging Services Market Report, 2030GVR Report cover

![U.S. Pharmaceutical Packaging Services Market Size, Share & Trends Report]()

U.S. Pharmaceutical Packaging Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Branded, Generic, Biosimilar, Vaccine, Cell Therapy, Gene Therapy), By Service Line, By Manufacturer Size, And Segment Forecasts

- Report ID: GVR-4-68040-493-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

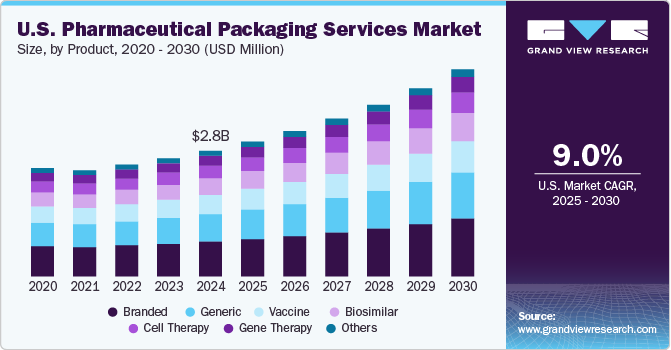

The U.S. pharmaceutical packaging services market size was estimated at USD 2.82 billion in 2024 and is expected to expand at a CAGR of 9.0% from 2025 to 2030. The market is experiencing substantial growth, primarily driven by the expansion of the country's pharmaceutical sector. In addition, an increasing shift towards serialization and anti-counterfeit measures is propelling the U.S. pharmaceutical packaging services industry growth in the country.

A key driver within the pharmaceutical industry is the biopharmaceutical segment, which focuses on biologics such as vaccines, monoclonal antibodies, and gene therapies. Biopharmaceuticals require specialized packaging solutions, including temperature-controlled and tamper-evident packaging, to maintain efficacy and safety. For instance, the COVID-19 pandemic spurred massive investments in cold-chain packaging for vaccines. Companies such as Pfizer and Moderna partnered with packaging firms to develop innovative solutions for their mRNA vaccines, demonstrating how the industry's growth stimulates the packaging sector.

In addition, as per the European Federation of Pharmaceutical Industries and Associations (EFPIA), the U.S. holds a significant position in the global production and sales of pharmaceuticals as well as carries out research activities to launch new pharmaceuticals in the market. The EFPIA data also states that the U.S. held a share of 64.4% of the global sales of new medicines launched from 2017 to 2022. As per the data provided by Pharmaceutical Research and Manufacturers of America (PhRMA), the research & development expenditure related to pharmaceuticals has witnessed an upward trend in the country from approximately USD 72,412.1 million in 2020 to approximately USD 79,610.2 million in 2021. Thus, this outlook is anticipated to exhibit a positive impact on the pharmaceutical packaging market growth in the U.S.

Moreover, an increasing emphasis on serialization and anti-counterfeit measures is a significant driver in the U.S. pharmaceutical packaging services industry. With the rising threats of counterfeit drugs entering the supply chain, regulatory mandates such as the Drug Supply Chain Security Act (DSCSA) require enhanced tracking, traceability, and authentication of pharmaceutical products. Serialization, which involves assigning unique identifiers to each package, is central to ensuring the integrity of the pharmaceutical supply chain. This trend has compelled packaging service providers to adopt advanced technologies and systems, transforming the industry landscape.

Product Insights

The branded product segment recorded the largest market revenue share of over 27.0% in 2024. The growth of branded pharmaceutical packaging services is driven by increased R&D investment in novel drugs, growing demand for premium healthcare products, and the need to combat counterfeit drugs. In addition, regulatory mandates on product traceability and safety enhance the demand for high-end packaging solutions.

Biosimilar packaging services involve packaging biologically derived products similar to already approved reference biologics. The increasing adoption of biosimilars due to their cost-effectiveness compared to biologics, coupled with the growing prevalence of chronic diseases such as cancer and autoimmune disorders, is driving the biosimilar packaging segment. Regulatory approvals and the growing pipeline of biosimilar drugs also contribute to the U.S. pharmaceutical packaging services industry growth.

Service Line Insights

The primary packaging segment accounted for the largest market share, over 43.0%, in 2024. Primary packaging refers to the packaging that comes into direct contact with the pharmaceutical product, and it is designed to protect the product from contamination, ensure dosage accuracy, and maintain stability. Primary packaging plays a crucial role in maintaining the sterility and efficacy of the drug. The growth of primary packaging is driven by the increasing demand for injectable drugs, biologics, and personalized medicines.

Secondary packaging involves packaging layers outside the primary packaging, such as cartons, boxes, and labels. It provides additional protection during storage and transportation and often contains vital product information, including batch numbers and expiry dates, to aid in product identification and compliance. Increasing focus on anti-counterfeiting measures, such as tamper-evident seals and advanced labeling technologies, is supporting the segment growth in the market.

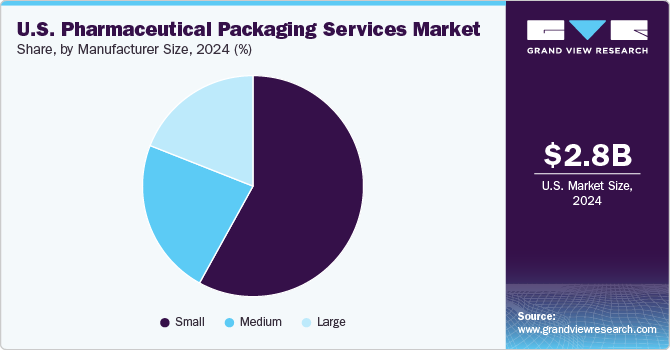

Manufacturer Size Insights

The small manufacturer size segment recorded the largest market share of over 58.0% in 2024. This positive outlook can be attributed to the rise of contract packaging organizations (CPOs) and the outsourcing of non-core activities by smaller pharmaceutical firms. Furthermore, their ability to provide cost-effective, region-specific solutions in compliance with local regulations makes them highly competitive, thus driving segment growth in the U.S. pharmaceutical packaging services industry.

The medium manufacturer size segment in the market refers to companies that typically have a moderate scale of operations, serving a diverse range of pharmaceutical companies. Medium-sized pharmaceutical packaging service providers are distinguished by their ability to offer tailored packaging solutions. These manufacturers, typically more agile than their larger counterparts, can quickly adapt to shifting market demands or specific client needs. They provide a comprehensive range of packaging services, including primary, secondary, and tertiary packaging, all crucial for ensuring the protection, presentation, and secure transportation of pharmaceutical products.

Moreover, large manufacturers represent the most sophisticated and comprehensive players in the market. These companies typically have extensive infrastructure, advanced technological capabilities, and the financial resources to handle large-scale pharmaceutical packaging projects for major pharmaceutical companies, biotechnology firms, and global healthcare organizations. Their operations are characterized by state-of-the-art manufacturing facilities that meet the most stringent regulatory requirements, including FDA standards and international quality certifications such as ISO 15378.

Key U.S. Pharmaceutical Packaging Services Company Insights

The U.S. pharmaceutical packaging services market is highly competitive, driven by stringent regulatory requirements, rising demand for advanced drug delivery systems, and increasing emphasis on patient safety and product integrity. Key players such as SGS North America Inc., Intertek Group plc, and West Pharmaceutical Services, Inc. dominate the landscape, leveraging cutting-edge technology, extensive manufacturing capabilities, and comprehensive service offerings, including design, primary, secondary, and tertiary packaging. In addition, companies differentiate through value-added services such as regulatory compliance support, digital serialization, and end-to-end supply chain solutions, fostering strong partnerships with pharmaceutical manufacturers and driving market growth.

-

In November 2024, Crown Packaging Corp. announced plans to open a new branch in Chicago in 2025, expanding its footprint in the Midwest region of U.S. This move is part of the company's ongoing strategy to enhance its service offerings and meet the growing demand for packaging solutions in the region.

-

In July 2024, SGS North America Inc. SGS, a major global testing, inspection, and certification company, announced its strategy to enhance its mergers and acquisitions (M&A) activities by entering into definitive agreements to acquire three companies: Gossamer Security Solutions in the U.S., and Analisis Quimico y Microbiologico SAS and Cromanal SAS in Colombia. Gossamer specializes in cybersecurity evaluation and consulting, while AQM and Cromanal are significant players in the Colombian pharmaceutical testing sector. These acquisitions aim to bolster SGS's capabilities in cybersecurity and pharmaceutical testing.

Key U.S. Pharmaceutical Packaging Services Companies:

- SGS North America Inc.

- All Packaging Services, LLC.

- Intertek Group plc

- PakFactory

- Crown Packaging Corp.

- U.S. Continental Packaging

- Sharp Services, LLC

- PCI Pharma Services

- Aphena Pharma Solutions

- Legacy Pharma Solutions

- Wasdell Packaging Group

- West Pharmaceutical Services, Inc.

U.S. Pharmaceutical Packaging Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.02 billion

Revenue forecast in 2030

USD 4.65 billion

Growth rate

CAGR of 9.0% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, service line, manufacturer size, region

Country scope

U.S.

Key companies profiled

SGS North America Inc.; All Packaging Services, LLC.; Intertek Group plc; PakFactory; Crown Packaging Corp.; U.S. Continental Packaging; Sharp Services, LLC; PCI Pharma Services; Aphena Pharma Solutions; Legacy Pharma Solutions; Wasdell Packaging Group; West Pharmaceutical Services, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Pharmaceutical Packaging Services Market Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. pharmaceutical packaging services market report based on Product, service line, and manufacturer size:

-

Product Outlook (Revenue, USD Million 2018 - 2030)

-

Branded

-

Generic

-

Biosimilar

-

Vaccine

-

Cell Therapy

-

Gene Therapy

-

Others

-

-

Service Line Outlook (Revenue, USD Million 2018 - 2030)

-

Primary Packaging

-

Secondary Packaging

-

Repackaging

-

Bulk-up

-

-

Manufacturer Size Outlook (Revenue, USD Million 2018 - 2030)

-

Large

-

Medium

-

Small

-

Frequently Asked Questions About This Report

b. The U.S. pharmaceutical packaging services market was estimated at around USD 2.65 billion in the year 2024 and is expected to reach around USD 3.02 billion in 2025.

b. The U.S. pharmaceutical packaging services market is expected to grow at a compound annual growth rate of 9.0% from 2025 to 2030 to reach around USD 4.65 billion by 2030.

b. Branded emerged as a dominating product type segment with a value share of around 27.0% in the year 2024 due to strong demand for premium and innovative packaging solutions that ensure product safety and differentiation. High investment in R&D and the launch of patented drugs by pharmaceutical companies further fueled the segment's growth.

b. The key players in the U.S. pharmaceutical packaging services market include SGS North America Inc.; All Packaging Services, LLC.; Intertek Group plc; PakFactory; Crown Packaging Corp.; U.S. Continental Packaging; Sharp Services, LLC; PCI Pharma Services; Aphena Pharma Solutions; Legacy Pharma Solutions; Wasdell Packaging Group; West Pharmaceutical Services, Inc.

b. The expansion of the country's pharmaceutical sector is driving the growth of the market. Additionally, an increasing shift towards serialization and anti-counterfeit measures is expected to drive the growth of the market during the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.