- Home

- »

- Medical Devices

- »

-

U.S. Pharmacy Market Size, Share, Industry Report, 2033GVR Report cover

![U.S. Pharmacy Market Size, Share & Trends Report]()

U.S. Pharmacy Market (2025 - 2033) Size, Share & Trends Analysis Report By Product Type (Prescription, OTC), By Type (Hospital Pharmacy, Retail Chains, ePharmacy), By Ownership, And Segment Forecasts

- Report ID: GVR-4-68040-044-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Pharmacy Market Size & Trends

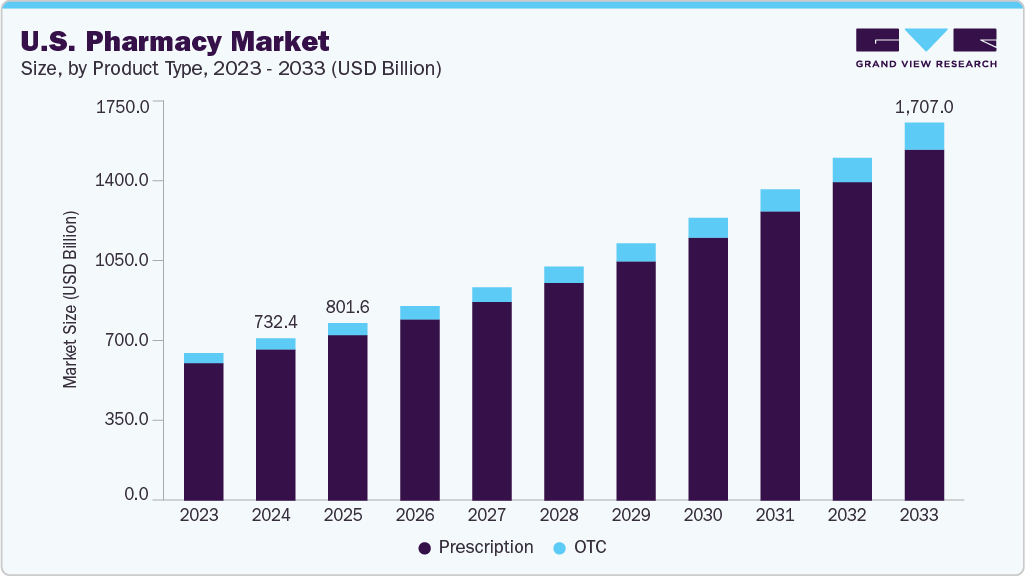

The U.S. pharmacy market size was estimated at USD 732.44 billion in 2024 and is projected to reach at USD 1,707.02 billion by 2033, growing at a CAGR of 9.91% from 2025 to 2033. The growth is attributed to the rising prevalence of chronic diseases, the high utilization of prescription drugs, and the increasing elderly population in the country.

A report from the 2023 American Heart Association (AHA) indicates that nearly half of the U.S. population (48.6%) has some form of cardiovascular disease, including coronary heart disease, heart failure, stroke, and high blood pressure.

Increasing Demand for Specialty Drugs:

The U.S. pharmacy industry is expected to witness significant growth due to the increasing demand for specialty drugs. With advancements in medical technology and an aging population, more individuals require specialized medication, leading to an increase in demand for these drugs. As a result, pharmacies are expanding their offerings to include a wider range of specialty drugs, which is driving growth in the industry.

Moreover, specialty medicines present the largest opportunity for pharmacies in the U.S., as they enable healthcare systems to improve patient outcomes. The high cost of these drugs impacts the overall economies of scale in the market. According to a National Library of Medicine report published in May 2023, specialty drugs accounted for more than 40% of overall retail drug spending and around 70% of the non-retail drug spending in 2021 in the U.S.

Case Study: Specialty Drug Launches Driving the U.S. Pharmacy Market

The U.S. specialty pharmaceutical market is increasingly influenced by new high-value therapies, including biosimilars and advanced treatments such as cell and gene therapies. Recent launches highlighted in AscellaHealth’s Q4 2024 Specialty and Rare Pipeline Digest demonstrate how innovation, pricing strategy, and targeted treatment can reshape market dynamics.

Key Developments:

-

Attruby (acoramidis) by BridgeBio offers a lower-priced alternative to Pfizer’s Vyndaqel/Vyndamax for ATTR-CM, expanding access and increasing competitive pricing pressure.

-

Itovebi (inavolisib) from Genentech addresses endocrine-resistant, PIK3CA-mutated breast cancer and shows superior efficacy, creating new clinical adoption opportunities.

- Crenessity (crinecerfont) by Neurocrine Biosciences improves disease management in congenital adrenal hyperplasia by reducing steroid dependency, highlighting patient-centric therapeutic value.

Market Impact:

These launches show how therapies with clear clinical benefit, targeted indications, and strategic pricing drive specialty pharmacy growth. They enhance provider uptake, improve patient access, and guide formulary and stocking decisions across the pharmacy and payer landscape.

Conclusion:

Specialty drug innovation-supported by real-time pipeline intelligence-continues to be a major driver of market expansion, shaping treatment standards and competitive positioning.

Technological Advancements:

With the increasing demand for pharmacy services in the U.S., companies are shifting from traditional practices to more technologically advanced practices to enhance patient outcomes, improve workflows, simplify communication, and increase patient safety by reducing manual errors. Companies are adopting several strategies, including Artificial Intelligence (AI), immersive technologies such as Virtual Reality (VR) & Augmented Reality (AR), and other automation technologies and devices such as automated dispensing units/cabinets, prescription drug monitoring programs, & medication therapy management.

For instance, in October 2023, iA, an integrated Pharmacy Fulfillment Platform provider for health systems, retail, and government pharmacies, launched iA 4L Canister, SmartPod Enhancements, and iA Smart SecurePack. The introduction of advanced robotics systems is expected to enhance the capabilities of its centralized fulfillment solutions and solutions that cater to pharmacies of various sizes.

Moreover, in October 2025, Amazon Pharmacy’s introduced in-office kiosks at One Medical offices representing a significant technological development in the market. These innovative kiosks enable patients to receive their prescribed medications immediately after their medical appointments, drastically reducing the traditional wait time associated with filling prescriptions at a separate pharmacy. By integrating medication dispensing directly into the clinical workflow, this approach enhances patient convenience, improves adherence to prescribed therapies, and closes a critical gap in care.

Vice president of operations, Amazon Pharmacy said:

"We know that when patients have to make an extra trip to the pharmacy after seeing their doctor, many prescriptions never get filled," "By bringing the pharmacy directly to the point of care, we're removing a critical barrier and helping patients start their treatment when it matters most-right away."

Example: CVS Pharmacy

CVS Health collaborates with leading technology providers and utilizes advanced hardware and automation systems to enhance its central fulfillment operations. These partnerships and technologies enable CVS Health to streamline processes, improve efficiency, and deliver high-quality services to patients and customers.

Automation and Robotics Providers:

-

AutoStore (by Dematic): AutoStore is a grid-based automated storage and retrieval system that maximizes storage density and optimizes order picking. CVS Health integrated AutoStore into its Lumberton Distribution Center, significantly increasing throughput and processing capacity.

-

Tompkins Robotics (tSort): tSort is a robotic sortation system that automates the sorting of items within a warehouse. CVS Health implemented tSort in conjunction with AutoStore, enhancing order fulfillment efficiency and scalability.

-

Bastian Solutions: Bastian Solutions is a systems integrator that provides material handling and automation solutions. CVS Health partnered with Bastian Solutions to deploy AutoStore and tSort systems, improving direct-to-consumer delivery capabilities and same-day service.

Increasing Prevalence of Chronic Diseases:

The U.S. pharmacy industry is currently experiencing significant growth, primarily driven by the increasing prevalence of chronic diseases. With an aging population and increasing adoption of a sedentary lifestyle, the incidence of chronic diseases, such as heart disease, cancer, & diabetes, is on the rise. This has led to a higher demand for medications to manage and treat these conditions, contributing to the growth of the market. A report from the 2023 American Heart Association (AHA) indicates that nearly half of the U.S. population (48.6%) has some form of cardiovascular disease, including coronary heart disease, heart failure, stroke, and high blood pressure.

In addition, according to a CDC report, in 2023, approximately 76.4% of U.S. adults reported having at least one chronic condition, which translates to about 194 million individuals. Among these, 51.4% (approximately 130 million adults) experienced multiple chronic conditions. The prevalence of chronic conditions has notably increased over the past decade, particularly among younger adults, where the incidence rose from 52.5% in 2013 to 59.5% in 2023.

Expanding Health Insurance Coverage:

Health insurance coverage and proximity to home are the major parameters patients prefer when selecting retail pharmacies. Under federal Medicaid law, pharmacy coverage is considered an optional benefit. However, all states have decided to provide coverage for outpatient prescription medications to all eligible individuals and most other enrollees in the Medicaid programs of the state. The Centers for Medicare & Medicaid Services (CMS) is taking initiatives to lower the total out-of-pocket expenses of beneficiaries and enable access to care. For instance, in May 2022, CMS finalized a pharmacy price concessions provision as part of the Contract Year 2023 Medicare Advantage and Part D final rule. This provision is expected to have several benefits, including a reduction in total beneficiary out-of-pocket costs, improved price transparency, better alignment with pharmacy payment arrangements, and the ability of CMS to assess the payment practices of Part D plan sponsors & Pharmacy Benefit Managers (PBMs) with respect to pharmacies under the Medicare Part D program.

Furthermore, HCSC’s launch of a national healthcare brand in July 2025 represents a significant development that is likely to drive growth in the market. By expanding its brand presence nationwide, HCSC aims to improve access to quality care, including integrated pharmacy services, for a broader population. This development can increase prescription volumes as more members gain coverage and convenient access to medications, preventive care, and chronic disease management programs.

Moreover, the increasing direct-to-consumer access and price transparency initiatives is driving the market demand. The Pharmaceutical Research and Manufacturers of America (PhRMA) announced the launch of a new website, AmericasMedicines.com, in January 2026. This platform aims to connect patients directly with pharmaceutical companies offering discounted medications, by passing traditional intermediaries such as pharmacies and insurers. This initiative is a response to mounting pressure from the Trump administration to reduce U.S. drug prices and eliminate intermediaries that contribute to high costs It aligns with broader industry efforts to simplify access to medications and reduce out-of-pocket expenses for consumers.

Market Concentration & Characteristics

The U.S. pharmacy industry is moderately fragmented, with many small players entering the market and launching new innovative products. The degree of innovation is medium, and the level of mergers & acquisitionsactivity is medium. The impact of regulations on the market is high; level of product substitute is medium and regional expansion of players is medium.

The degree of innovation in the U.S. pharmacy industry is steadily increasing, driven by advances in specialty pharmaceuticals, personalized medicine, digital health integration, and value-based care models. Pharmacies are no longer limited to dispensing medications; they are evolving into clinical support hubs that manage complex therapies such as biologics, specialty injectables, and cell and gene therapies. In September 2025, Novartis announced to launch a Direct-to-Patient (DTP) platform for its top-selling biologic, Cosentyx (secukinumab), in the U.S. in November 2025. This initiative aims to offer cash-paying patients access to Cosentyx at a 55% discount off the list price, aligning the cost with the average savings typically retained by insurers and pharmacy benefit managers.

The market players are leveraging strategies such as collaborations, partnerships, and acquisitions, to promote the reach of their offerings and increase their services capabilities. In October 2025, CVS Pharmacy expanded its footprint by acquiring 63 former Rite Aid and Bartell Drugs locations across Idaho, Oregon, and Washington. The company also assumed responsibility for the prescription records of 626 pharmacies in 15 states, increasing its patient reach by over nine million individuals.

Regulations play a crucial role in the U.S. pharmacy industry, dictating operational standards and care delivery. The Poison Prevention Packaging Act mandates child-resistant packaging for household substances and medication. Non-child-resistant packaging may be requested for patients with difficulty opening them. Emergency medications may be exempt from these requirements. Moreover, the Drug Enforcement Administration (DEA) enforces the Controlled Substances Act and regulates controlled substances. Pharmacists who handle controlled substances must register with the DEA

The growth of product substitutes in the industry is being driven largely by the increasing availability of generics, biosimilars, and therapeutic alternatives that offer comparable clinical effectiveness at lower cost. As healthcare payers and PBMs push to reduce prescription spending, formulary strategies increasingly prioritize lower-cost substitutes, steering patients toward generics or preferred brands through tiered copays, prior authorizations, and substitution programs at the pharmacy counter. At the same time, growing consumer price sensitivity and rising out-of-pocket costs have encouraged patients to request lower-cost alternatives directly.

California alone has about nine million residents living in “pharmacy deserts,” where access to a pharmacy is more limited than access to a supermarket. Programs such as UCSF’s initiative present an opportunity to expand the pharmacist workforce, particularly in underserved and rural areas such as the Central Valley. By creating structured pathways for pharmacy technicians to advance into PharmD roles, the program directly targets regions with low pharmacy coverage, enhancing healthcare accessibility and supporting public health goals.

Type Insights

The retail chains segment led the market with the largest revenue share of 47.71% in 2024. The rapid rise in the number of independent pharmacies & chains and the availability of medications in mass retailers & supermarkets in the U.S. is expected to drive the retail pharmacy segment growth. Moreover, the presence of large chains of retail pharmacy providers, such as Walmart Inc., Walgreens Boots Alliance, Inc., Rite Aid Corp, CVS Health, and others, is anticipated to support segment growth. For instance, in August 2023, Tallahassee Memorial HealthCare (TMH) partnered with ProxsysRx, a hospital systems solutions provider, to operate & own a retail and a specialty pharmacy on the hospital’s main campus in Tallahassee. This partnership enhances patient access to medications and ensures efficient & effective medication management.

The long-term-care pharmacies segment is expected to grow at the fastest CAGR during the forecast period. This is driven by demographic and clinical forces (rapid growth of the 65+ population and rising chronic, multi-morbid disease burden), plus operational and regulatory pressures that favor specialized dispensing and clinical services facilities and families demand unit-dose/blister packaging, medication reconciliation, adherence programs and clinical reviews to reduce polypharmacy and avoid costly hospital readmissions; meanwhile technology (automation, single-dose blister machines, ADMs and pharmacy-EHR integrations), vertical consolidation and investor interest (IPOs and roll-ups) are making LTC pharmacy services more efficient and scalable.

Product Type Insights

The prescription segment accounted for the largest market revenue share in 2024. This can be attributed to the increasing burden of chronic diseases and the growing aging population, which is expected to drive the demand for prescription drugs. According to the CDC’s National Diabetes Statistics Report for 2021, around 38.4 million people had diabetes, indicating a significant need for prescription medications to manage and treat chronic diseases, thereby contributing to growing demand. With the increasing demand for prescription drugs, pharmacies are expected to witness new opportunities to expand their offerings and cater to patients with chronic illnesses. According to a report published by IQVIA Inc., in March 2023, the total number of prescriptions reached 6.7 billion in 2022, a significant increase from 6.1 billion in 2018. This growth is expected to have long-term benefits for the industry, as it will increase revenue streams and improve healthcare outcomes for patients.

The OTC segment is anticipated to grow at the fastest CAGR during the forecast period. The OTC segment is expected to witness growth due to new service launches & innovations, including the approval of certain prescription medications for OTC use. For instance, in March 2022, Albertsons Companies introduced a new program that allows customers to buy fresh produce and OTC medications using supplemental benefits in their stores. The program enables customers to use prepaid cards that Medicare Advantage funds plan for healthcare providers, employer incentives, or local governments.

Ownership Insights

The pharmacy chains segment accounted for the largest market revenue share in 2024 and is expected to grow at the fastest CAGR from 2025 to 2033. Significant competitive rivalry among key players is one of the key factors expected to drive market growth. The need to compete with other players in the market often leads to consolidation and expansion strategies by chain pharmacies to maintain their share. Some major service providers in the U.S. chain pharmacy are CVS Health, Rite Aid Corp., Walgreens Boots Alliance Inc., Walmart Inc., Kroger, and others. For instance, in January 2024, Kroger announced the extension of its partnership with Centene Corporation’s pharmacy network. This extension aims to provide patients with increased opportunities to save on essential prescriptions. The agreement ensures continued access to the Kroger Family of Pharmacies for approximately 700,000 Centene members throughout 2024.

The independent pharmacies segment is expected to grow at a substantial CAGR over the forecast period. Major factors driving segment growth include flexibility & personalized customer relationships, entrepreneurial opportunities, profitability, differentiated services, and community engagement. Independent pharmacies have the advantage of building strong relationships with customers, offering tailored services, and meeting specific needs. In addition, owning an independent pharmacy provides pharmacists with the opportunity for entrepreneurship and the ability to shape the direction of their business.

Key U.S. Pharmacy Company Insight

The U.S. pharmacy industry is led by major retail chains, independent pharmacies, and specialty pharmacies, which collectively influence drug access and pricing. CVS Health, Walgreens, and Walmart dominate retail dispensing and are expanding digital and clinical services. PBM leaders such as OptumRx, Express Scripts, and CVS Caremark shape reimbursement and formulary controls. Specialty pharmacies, such as Accredo and AllianceRx Walgreens Prime, focus on high-cost and complex therapies, offering patient support programs to enhance adherence. Health system pharmacies, such as Kaiser Permanente, also play a growing role by integrating care and pharmacy services to improve patient outcomes.

Key U.S. Pharmacy Companies:

- Walgreens

- CVS

- Walmart

- The Kroger Co.

- Publix Pharmacy

- Albertsons

- Costco Wholesale Corporation

- Kaiser Permanente

- Amazon Pharmacy (PillPack)

- Hims & Hers Pharmacy

- ExactCare Pharmacy.

- Alto Pharmacy

- Capsule Corporation

- BlinkRx (Blink Health)

- Avita Pharmacy

- Tarrytown Pharmacy Inc.

- The Medicine Shoppe Pharmacy

- Sullivan's Pharmacy and Medical Supply

- Honeybee Health

- Good Neighbor Pharmacy

- Andrews Pharmacy

- Dinno Health

- Island Family Pharmacy

- Gloyer's Pharmacy

- Huntington Pharmacy

- Daniel's Pharmacy

- Apteek Pharmacy & Compounding

- V-Care Pharmacy

- Randol Mill Pharmacy

- Boca Pharmacy & Home Health Center

- Grand Avenue Pharmacy

- Skenderian Apothecary

- Doyle’s Pharmacy

- Gary Drug Co

- Care Rx Pharmacy

- Palm Harbor Pharmacy

- DiRx Inc.

- Allen Family Drug

- ScriptCo Pharmacy

Recent Developments

- In October 2024, Alto announced the launch of Alto Technologies - a suite of enterprise-pharmacy technology solutions that combine automation, digital tools, and pharmacist expertise across the hub and dispensing parts of the pharmacy value chain.

Alto’s Chief Executive Officer said:

“We are thrilled to introduce our revolutionary Alto Technologies solutions to help partners improve patient experience,” “Our technology fundamentally improves the connection between provider, payor, patient, and medicine in novel ways that move beyond traditional pharmacy. We’re excited to offer solutions to our partners that not only solve challenges long-held in healthcare, but also allow us to scale our impact and help even more patients, faster than we could alone.”

- In April 2025, Hims & Hers entered a partnership with Novo Nordisk to expand access to Wegovy-based obesity care, which concluded in June 2025 following regulatory and contractual disputes.

CEO and founder of Hims & Hers said:

“We’re excited to work with Novo Nordisk, a company known for breakthrough innovation in clinical medicine and a strong portfolio of medications,”. “Bringing our teams together and continuing to explore our shared commitment and focus on delivering the future of healthcare has been inspiring. We share a vision of what consumer-centered healthcare looks like, and this is just the first step towards delivering that future.”

- In February 2025, BlinkRx appointed Donald Trump Jr., Partner at 1789 Capital, to its Board of Directors following 1789 Capital’s lead investment in the company’s USD 140 million Series D funding round. The move strengthens BlinkRx’s strategic leadership as it continues expanding access and affordability in digital pharmacy fulfillment.

Co-Founder and CEO of BlinkRx said:

"We're thrilled to welcome Donald Trump Jr. to our Board as we build a better healthcare experience nationwide, "Don shares our passion and determination for improving the lives of everyday Americans. We look forward to working closely with him to drive innovation and advance the health and well-being of all patients."

U.S. Pharmacy Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 801.6 billion

Revenue forecast in 2033

USD 1,707.02 billion

Growth rate

CAGR of 9.91% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast data

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product type, ownership

Country scope

U.S.

Walgreens; CVS; Walmart; The Kroger Co.; Publix Pharmacy; Albertsons; Costco Wholesale Corporation; Kaiser Permanente; Amazon Pharmacy (PillPack); Hims & Hers Pharmacy; ExactCare Pharmacy; Alto Pharmacy; Capsule Corporation; BlinkRx (Blink Health). Avita Pharmacy; Tarrytown Pharmacy Inc.; The Medicine Shoppe Pharmacy; Sullivan's Pharmacy and Medical Supply; Honeybee Health; Good Neighbor Pharmacy; Andrews Pharmacy; Dinno Health; Island Family Pharmacy; Gloyer's Pharmacy; Huntington Pharmacy; Daniel's Pharmacy; Apteek Pharmacy & Compounding; V-Care Pharmacy; Randol Mill Pharmacy; Boca Pharmacy & Home Health Center; Grand Avenue Pharmacy; Skenderian Apothecary; Doyle’s Pharmacy; Gary Drug Co; Care Rx Pharmacy; Palm Harbor Pharmacy; DiRx Inc.; Allen Family Drug; ScriptCo Pharmacy

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Pharmacy Market Report Segmentation

This report forecasts revenue growth, country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. pharmacy market report based on type, product type, and ownership.

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Retail chains (e.g., Walgreens, CVS)

-

Supermarket pharmacies

-

Health system/hospital pharmacies

-

Independent pharmacies

-

Mail-order pharmacies

-

Specialty / central fill pharmacies

-

Long-term care and defense-related pharmacies

-

ePharmacy

-

Others

-

-

Product Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Prescription

-

OTC

-

-

Ownership Outlook (Revenue, USD Billion, 2021 - 2033)

-

Chain

-

Independent

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.