- Home

- »

- Advanced Interior Materials

- »

-

U.S. Plasma Cleaning Machines Market, Industry Report 2033GVR Report cover

![U.S. Plasma Cleaning Machines Market Size, Share & Trends Report]()

U.S. Plasma Cleaning Machines Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Manual, Automated), By Application (Semiconductor, Automotive, Medical Devices, Electronics), By Substrate Type (Metals, Plastics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-644-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Plasma Cleaning Machines Market Summary

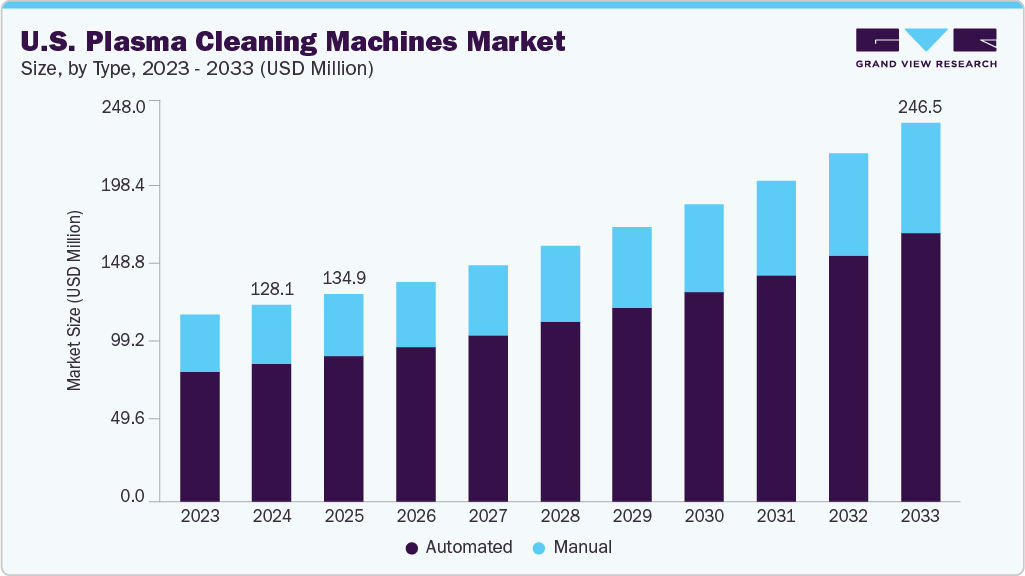

The U.S. plasma cleaning machines market size was valued at USD 128.1 million in 2024 and is projected to reach USD 246.5 million by 2033, growing at a CAGR of 7.8% from 2025 to 2033. The U.S. plasma cleaning machines market is driven by strong demand from advanced industries like semiconductors, aerospace, and medical devices.

Key Market Trends & Insights

- The plasma cleaning machine in the U.S. is expected to grow at a substantial CAGR of 7.8% from 2025 to 2033.

- By type, the automated plasma cleaning segment is expected to grow at a considerable CAGR of 8.0% from 2025 to 2033 in terms of revenue.

- By application, the medical devices segment is expected to grow at a considerable CAGR of 8.0% from 2025 to 2033 in terms of revenue.

- By substrate type, plastics segment is expected to grow at a considerable CAGR of 8.4% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 128.1 Million

- 2033 Projected Market Size: USD 246.5 Million

- CAGR (2025-2033): 7.8%

Rising focus on precision manufacturing, eco-friendly processes, and automation is encouraging wider adoption of plasma systems to enhance product quality, efficiency, and regulatory compliance across sectors. Advancements in plasma technology offer improved energy efficiency, compatibility with delicate materials, and integration with automation and smart controls. These innovations help U.S. manufacturers meet strict quality, environmental, and regulatory standards across industries like electronics, aerospace, and medical devices.

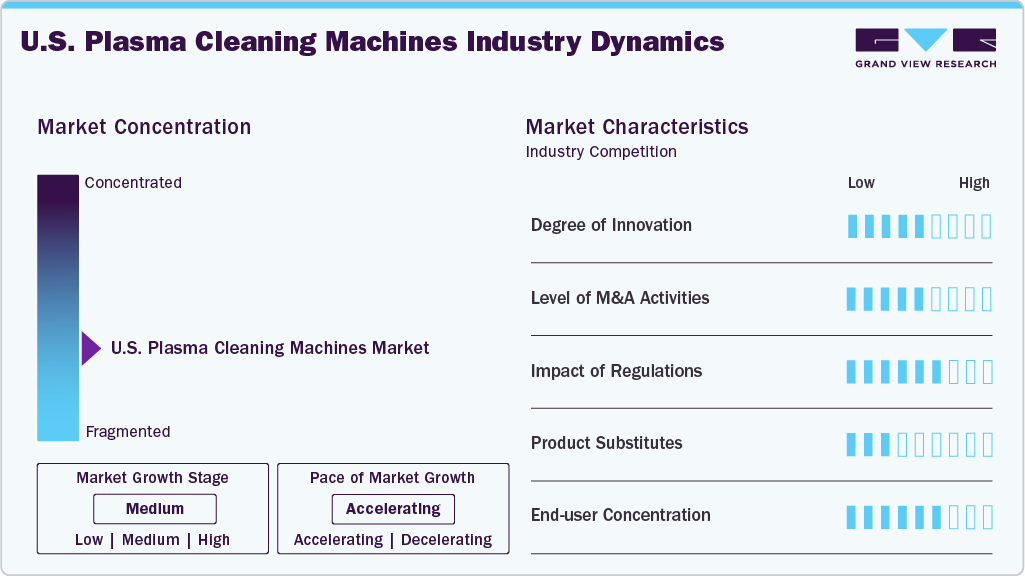

Market Concentration & Characteristics

The U.S. plasma cleaning machines market is moderately concentrated, with several key players holding significant market shares. Established companies focus on innovation, automation, and eco-friendly solutions to maintain competitive advantages. While large firms dominate advanced industrial sectors, smaller specialized manufacturers also contribute, offering customized solutions. Competitive dynamics are shaped by technology, service quality, and compliance with strict industry standards.

In the U.S., innovation in plasma cleaning machines is driven by the need for eco-friendly, chemical-free cleaning, precision surface treatment, and compliance with strict regulatory standards. Advancements focus on automation, smart controls, and Industry 4.0 integration, enabling manufacturers to enhance efficiency, reduce waste, and meet the high-quality demands of sectors like semiconductors, aerospace, and medical devices.

The U.S. plasma cleaning machine market experiences moderate merger and acquisition activity, largely involving mid-sized firms seeking growth or advanced technologies. Leading firms are acquiring specialized players to enhance expertise in advanced plasma technologies, automation, and eco-friendly solutions. These activities support innovation, strengthen customer offerings, and help meet evolving industry demands across high-tech manufacturing sectors.

Regulations are significantly shaping the U.S. plasma cleaning machine market by driving the shift toward eco-friendly, chemical-free cleaning solutions. Strict environmental, safety, and cleanliness standards across industries like semiconductors, medical devices, and aerospace compel manufacturers to adopt advanced plasma technologies. These regulations encourage innovation in energy efficiency, waste reduction, and precision cleaning, pushing companies to invest in modern systems that comply with evolving national and international guidelines while enhancing product quality and sustainability.

Drivers, Opportunities & Restraints

The U.S. plasma cleaning machines market is driven by growing demand for eco-friendly, chemical-free cleaning solutions across industries like electronics, aerospace, and medical devices. Manufacturers increasingly seek high-precision, efficient surface cleaning to improve product performance and meet stringent environmental and safety regulations. This shift toward sustainable manufacturing processes significantly boosts the adoption of advanced plasma cleaning technologies worldwide.

An emerging opportunity in the plasma cleaning machines market lies in the integration of smart technologies and Industry 4.0. Real-time monitoring, automation, and data analytics can enhance precision, efficiency, and quality control. Additionally, expanding applications in new sectors such as renewable energy, biotechnology, and electric vehicles create fresh growth avenues for plasma cleaning solutions, encouraging innovation and market expansion.

A major restraint in the plasma cleaning machines market is the high initial investment and operational costs associated with advanced plasma equipment. Small and mid-sized manufacturers, especially in developing regions, may hesitate to adopt these systems due to budget constraints. Additionally, technical complexities and the need for specialized expertise in handling plasma technologies can further limit broader market penetration.

Type Insights

Manual segment is expected to grow at a significant CAGR of 7.5% from 2025 to 2033 in terms of revenue. the automated segment accounted for a revenue share of 70.0% in 2024, driven by rising demand for precise, consistent, and efficient cleaning in industries like electronics, aerospace, and medical devices. U.S. manufacturers prefer automation to reduce labor costs, minimize errors, and enhance productivity. Integration with smart controls and Industry 4.0 further strengthens this segment’s position across advanced manufacturing sectors.

The manual segment in the plasma cleaning machines market is growing steadily, driven by its cost-effectiveness, flexibility, and suitability for low-volume or specialized applications. Small manufacturers, research labs, and prototyping units favor manual systems for their simplicity and ease of use, making them ideal where customized, precise cleaning is required without significant capital investment.

Substrate Type Insights

The plastic segment is expected to grow at a significant CAGR of 8.4% from 2025 to 2033 in terms of revenue. Metal segment dominated the market with a revenue share of 34.4% in 2024. This segment is growing as industries like aerospace, automotive, and medical devices increasingly require precise, non-damaging cleaning for metal components. Plasma technology ensures effective removal of oxides, residues, and contaminants, improving adhesion, coating quality, and reliability in critical applications where surface integrity is essential.

The plastic segment is expected to grow fastest during the forecast period, due to the rising use of polymers in electronics, automotive, and medical manufacturing. Plasma cleaning enables safe decontamination and surface activation of sensitive plastic components, enhancing coating adhesion and bonding without material damage, supporting the production of high-precision parts in advanced industries.

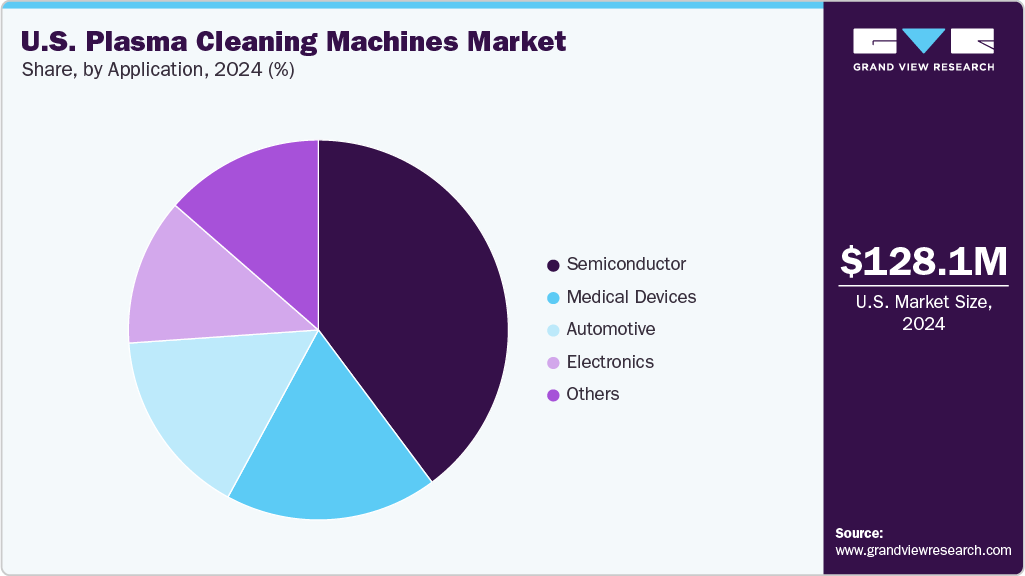

Application Insights

The medical devices segment is expected to grow at a considerable CAGR of 8.0% from 2025 to 2033 in terms of revenue.The semiconductor segment accounted for a revenue share of 39.8% in 2024. This segment is growing due to the country’s advanced chip manufacturing industry. As devices become smaller and more complex, manufacturers increasingly rely on plasma cleaning for precise, chemical-free surface preparation and contamination control, ensuring higher yields, improved adhesion, and superior performance of semiconductor components.

The medical devices segment is expanding rapidly in the U.S. plasma cleaning machines market, driven by strict sterility and cleanliness requirements. Plasma cleaning provides residue-free, precise cleaning essential for surgical tools, implants, and diagnostic equipment. Regulatory compliance and the demand for ultra-clean surfaces make plasma technology the preferred choice for medical device manufacturers.

Key U.S. Plasma Cleaning Machines Company Insights

Some key players operating in the market include Plasma Technology Inc., GmbH, Nordson Corporation, and PVA TePla AG.

-

Plasma Technology Inc. (PLASMAtech) specializes in low-pressure microwave plasma and parylene coating technologies. They offer both surface treatment equipment and contract services, including process R&D in a GMP-compliant facility. Their microwave plasma systems enable ultra-pure cleaning, surface activation, and thin‑film deposition on diverse substratespolymers, metals, ceramics, glass, and fabrics. Their vacuum-based methods use bottled gases, eliminating chemical waste and operator hazards, and are ideal for delicate materials like balloon catheters and electronics. Customized solutions and controlled environments ensure precise results with minimal thermal or physical stress.

-

Nordson Corporation is a leading U.S.-based manufacturer specializing in precision technology solutions, including plasma cleaning machines, fluid dispensing systems, and industrial coating equipment. Headquartered in Westlake, Ohio, Nordson serves diverse industries such as electronics, aerospace, medical devices, automotive, and packaging. The company focuses on innovation, offering advanced, eco-friendly plasma systems designed for high-precision surface preparation, contamination control, and adhesion improvement. With a global presence and strong U.S. operations, Nordson emphasizes automation, smart technologies, and sustainability in its product offerings.

Key U.S. Plasma Cleaning Machines Companies:

- Plasma Technology Inc.

- Nordson Corporation

- MKS Instruments Inc.

- Harrick Plasma

- Surface Technology Systems PLC

- Advanced Plasma Solutions

- Trion Technology

- Plasma Etch

- Plasmatreat

- PVA TePla AG

Recent Developments

-

In February 2025, Plasmatreat GmbH, introduced HydroPlasma, a breakthrough method for cleaning stubborn contaminants from plastics, glass, and metal surfaces. Combining Openair-Plasma with water-based chemistry, HydroPlasma delivers efficient, gentle, and eco-friendly surface preparation, significantly enhancing cleanliness and readiness for subsequent production steps. This innovation advances plasma cleaning applications in industrial settings.

-

In July 2024, Nordson Corporation, headquartered in Westlake, announced relocation of its expanding manufacturing operations to a new facility in South Carolina. This strategic move aims to support the company’s growth, enhance production capabilities, and improve operational efficiency.

U.S. Plasma Cleaning Machines Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 134.9 million

Revenue forecast in 2033

USD 246.5 million

Growth rate

CAGR of 7.8% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, substrate type, region.

Country scope

U.S.

Key companies profiled

Plasma Technology Inc.; Nordson Corporation; MKS Instruments Inc.; Harrick Plasma; Surface Technology Systems PLC; Advanced Plasma Solutions; Trion Technology; Plasma Etch; Plasmatreat; PVA TePla AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Plasma Cleaning Machines Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. plasma cleaning machines market report based on type, application, substrate type, and region.

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Manual

-

Automated

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Metals

-

Plastics

-

Ceramics

-

Composites

-

Glass

-

-

Substrate Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Semiconductor

-

Automotive

-

Medical Devices

-

Electronics

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. plasma cleaning machines market size was estimated at USD 128.1 million in 2024 and is expected to be USD 134.9 million in 2025.

b. The U.S. plasma cleaning machines market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.8% from 2025 to 2033 to reach USD 246.5 million by 2033.

b. Automated segment accounted for a share of 39.8% in 2024. Driven by rising demand for precise, consistent, and efficient cleaning in industries like electronics, aerospace, and medical devices. U.S. manufacturers prefer automation to reduce labor costs, minimize errors, and enhance productivity. Automated segment accounted for a share of 39.8% in 2024. Driven by rising demand for precise, consistent, and efficient cleaning in industries like electronics, aerospace, and medical devices. U.S. manufacturers prefer automation to reduce labor costs, minimize errors, and enhance productivity.

b. Some of the key players operating in the U.S. plasma cleaning machines market include Plasma Technology Inc., Nordson Corporation, MKS Instruments Inc., Harrick Plasma, Surface Technology Systems PLC, Advanced Plasma Solutions, Trion Technology, Plasma Etch, Plasmatreat, PVA TePla AG.

b. Key factors driving the U.S. plasma cleaning machines market include the growing demand for eco-friendly, chemical-free cleaning, rising precision requirements in industries like semiconductors, aerospace, and medical devices, and strict regulatory standards for cleanliness and safety. Advances in automation, smart controls, and Industry 4.0 integration further support market growth by enhancing efficiency and quality.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.