- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Polymethyl Methacrylate Market Size Report, 2030GVR Report cover

![U.S. Polymethyl Methacrylate Market Size, Share & Trends Report]()

U.S. Polymethyl Methacrylate Market (2023 - 2030) Size, Share & Trends Analysis Report By Form (Extruded Sheet, Cast Acrylic Sheet, Pellets, Beads), By Grade, By Application, And Segment Forecasts

- Report ID: 978-1-68038-515-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

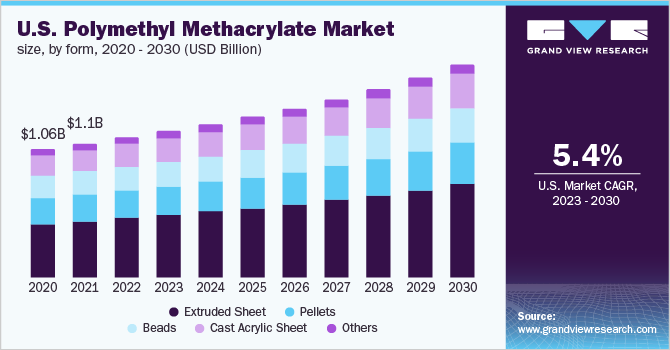

The U.S. polymethyl methacrylate market size was valued at USD 1.16 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.4% from 2023 to 2030. Increasing polymethyl methacrylate (PMMA) consumption in the automotive and construction industries is expected to drive the industry’s growth over the forecast period. Stable raw material supply and process optimization are crucial for producers to achieve economies of scale. PMMA is produced through the polymerization of methyl methacrylate (MMA), which is obtained through petrochemical sources such as acetone, hydrogen cyanide, and sulfuric acid.

Polymethyl methacrylate (PMMA) is a clear thermoplastic that has glass-like qualities. It is not as fragile material as glass. As a result, it's also known as acrylic glass and is widely used as a glass substitute. In terms of UV protection, scratch resistance, and optometry, it also outperforms glass. This is likely to drive the market forward in the forecast period. PMMA is used in a wide variety of applications such as construction, automobiles, illumination, etc. Its unique set of properties helps drive its demand and as a result, its market size continues to increase.

The process of production of PMMA is environmentally destructive and is not biodegradable in nature, and under the influence of sunshine, carbon breakdown occurs in acrylic sheets, releasing carbon dioxide fragments. Carbon particles emitted into the atmosphere reach the ozone layer, depleting it significantly. PMMA has a detrimental environmental impact which poses a significant barrier to market expansion. Acidification, respiratory problems, eutrophication, environmental toxicity, and carcinogenic effects are some of the other detrimental effects of PMMAs on the environment.

Bio-based PMMA is a sustainable alternative to non-renewable high-performance materials. Bio-based PMMA is commonly utilized in medical, optical, consumer, and automotive applications that require long-term durability. Over the next few years, technological advancements are projected to create opportunities for the market growth of bio-based PMMA products.

Crude oil price volatility has a huge impact on petrochemicals pricing, thus affecting MMA prices. To counter these challenges, companies such as Lucite and Altuglas have invested in research and development to develop PMMA through bio-based sources at prices competitive with conventional PMMA.

The industry is characterized by favorable regulatory policies by agencies such as the U.S. Food & Drug Administration (FDA) and the U.S. Environmental Protection Agency (EPA). FDA, under Code of Federal Regulations 21CFR888.3027, has reclassified PMMA bone cement from class III (premarket approval) to class II (special controls) and framed special controls guidelines.

The automotive industry has recovered and reached the pre-COVID level in the U.S. As a result, the U.S. passenger car manufacturing space has grown, along with rising exports to the markets in Canada, Mexico, Europe, and Asia. Automotive glazing, LED headlights, and body components use PMMA as a substitute for glass and polycarbonate due to its excellent transparency, clarity, and light permeability. PMMA is increasingly being used as a glass substitute in facade applications in the construction industry.

Form Insights

Based on form, the PMMA market is segmented into extruded sheets, cast acrylic sheets, pellets, beads, and others. Extruded sheets were the largest consumed product, accounting for a 55.3% share of the overall volume in 2022. Extruded sheets are used in numerous applications such as LED screens, decorative interiors, solar panels, building facades, and visual marketing communication displays.

Pellets are the most basic forms available in diverse colors and sizes, allowing ease of molding into desired shapes and sizes. PMMA pellets are generally purchased by processors who convert the product into end-use forms by different molding procedures. The construction industry is the largest consumer of cell cast sheets and blocks. Unique coloring and blending capabilities with weather/chemical resistance and superior clarity enable these sheets to substitute glass and polycarbonate (PC) in window glazing, facades, patio roofs, and worktops.

Grade Insights

Based on grade, the market is categorized into general purpose grade and optical grade. The general purpose grade segment accounted for the major share of the market in 2022 and it is anticipated that it will maintain its attractiveness during the forecast period, as it has many technical advantages over other transparent polymers, such as high resistance to UV light and weathering, excellent light transmission, and unlimited coloring options.

Optical grade has high light transmission properties. Optical PMMA grades allow at least 92% of light to pass through it, which is more than glass or other plastics. This outstanding clarity enables the use of PMMA in many different optical and related applications. Chimei Corporation successfully manufactures optical PMMA sheets using the direct extrusion method without granulation and using polymethyl methacrylate as the main raw material. It has good weather resistance, high heat resistance, high transparency and gloss, as well as stable physical, chemical, optical, and electrical properties.

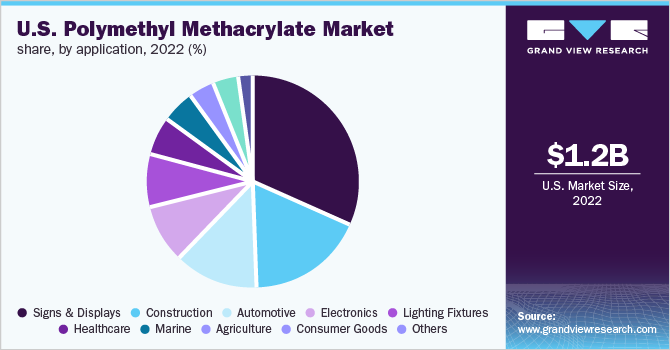

Application Insights

Based on application, the U.S. polymethyl methacrylate market has been segmented into signs & displays, construction, automotive, lighting fixtures, electronics, marine, healthcare, agriculture, consumer goods, and others.

The signs and display segment accounted for the largest revenue share of 22% in 2022. Emerging uses of MMA in digital signboards and displays in the advertising industry and optical applications such as LCD, LED screens, and flat panel displays in the electronics industry are stimulating growth in the market.

The automotive segment is the fastest-growing application of PMMA in 2022. Increasing plastic consumption in automotive components is expected to increase product usage in applications such as window glazing, LED headlights, and body components.

Polymethyl Methacrylate (PMMA) is expected to emerge as a substitute for existing medical polymers, against the backdrop of growing concerns over the health hazards caused by the use of polyvinyl chloride and polypropylene in addition to low biocompatibility issues. The presence of phthalate plasticizers in PVC is generating significant interest in PMMA in the healthcare industry.

Key Companies & Market Share Insights

The polymethyl methacrylate market is consolidated across major companies including Mitsubishi Rayon Co., Ltd., Altuglas International SAS, Sumitomo Chemical Co., Ltd., Trinseo, and Röhm GmbH.

Many key players have started investing in new production, as many PMMA plants throughout the world are a few decades old. Additionally, as environmental and sustainability standards for the industry become more stringent, more companies are showing interest in innovative technologies that do not use cyanide.

In addition to providing benefits for health and safety by eliminating an extremely dangerous chemical, these more recent technologies also benefit feedstock costs by taking advantage of the copious ethylene supplies that are available in the United States. For instance, Röhm GmBH announced the beginning of the engineering and construction of a new production facility for MMA in Bay City, Texas, United States, on June 30, 2021. Some prominent companies in the U.S. polymethyl methacrylate market include:

-

Mitsubishi Rayon Co., Ltd.

-

Altuglas International SAS

-

Kuraray Group

-

CHIMEI corporation

-

Sumitomo Chemical Co., Ltd.

-

Asahi Kasei Corporation

-

Daesan MMA

-

LG MMA

-

SABIC

-

Makevale Group Ltd.

-

Polycasa NV

-

Trinseo

-

Röhm GmbH

-

Hardie Polymers Ltd

-

GEHR Plastics Inc.

U.S. Polymethyl Methacrylate Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.21 billion

Revenue forecast in 2030

USD 1.76 billion

Growth rate

CAGR of 5.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Form, grade, application

Country Scope

U.S.

Key companies profiled

Mitsubishi Rayon Co., Ltd.; Altuglas International SAS; Kuraray Group; CHIMEI Corporation; Sumitomo Chemical Co., Ltd.; Asahi Kasei Corporation; Daesan MMA; LG MMA; SABIC; Makevale Group Ltd.; Trinseo

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Polymethyl Methacrylate Market Segmentation

This report forecasts volume and revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. polymethyl methacrylate market report based on form, grade, and application:

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Extruded Sheet

-

Cast Acrylic Sheet

-

Pellets

-

Beads

-

Others

-

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

General Purpose Grade

-

Optical Grade

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Signs & Displays

-

Automotive

-

Construction

-

Lighting Fixtures

-

Electronics

-

Marine

-

Healthcare

-

Agriculture

-

Consumer Goods

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. polymethyl methacrylate market size was estimated at USD 1.16 billion in 2022 and is expected to reach USD 1.21 billion in 2023.

b. The U.S. polymethyl methacrylate market is expected to grow at a compound annual growth rate of 5.4% from 2023 to 2030 to reach USD 1.76 billion by 2030.

b. Extruded sheets segment dominated the U.S. polymethyl methacrylate market with a share of 36.07% in 2022. Extruded sheets are utilized in numerous applications such as LED screens, decorative interiors, solar panels, building facades, and visual marketing communication displays.

b. Some key players operating in the U.S. polymethyl methacrylate market include Mitsubishi Rayon Co., Ltd., Altuglas International SAS, Kuraray Group, CHIMEI Corporation, Sumitomo Chemical Co., Ltd., and Trinseo.

b. Key factors that are driving the market growth include increasing polymethyl methacrylate (PMMA) consumption in the automotive and construction industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.