- Home

- »

- Plastics, Polymers & Resins

- »

-

Medical Polymers Market Size & Share, Industry Report 2033GVR Report cover

![Medical Polymers Market Size, Share & Trends Report]()

Medical Polymers Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Fibers & Resins, Medical Elastomers), By Application (Medical Device Packaging, Tooth Implants, Wound Care), By Region, And Segment Forecasts

- Report ID: 978-1-68038-143-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Polymers Market Summary

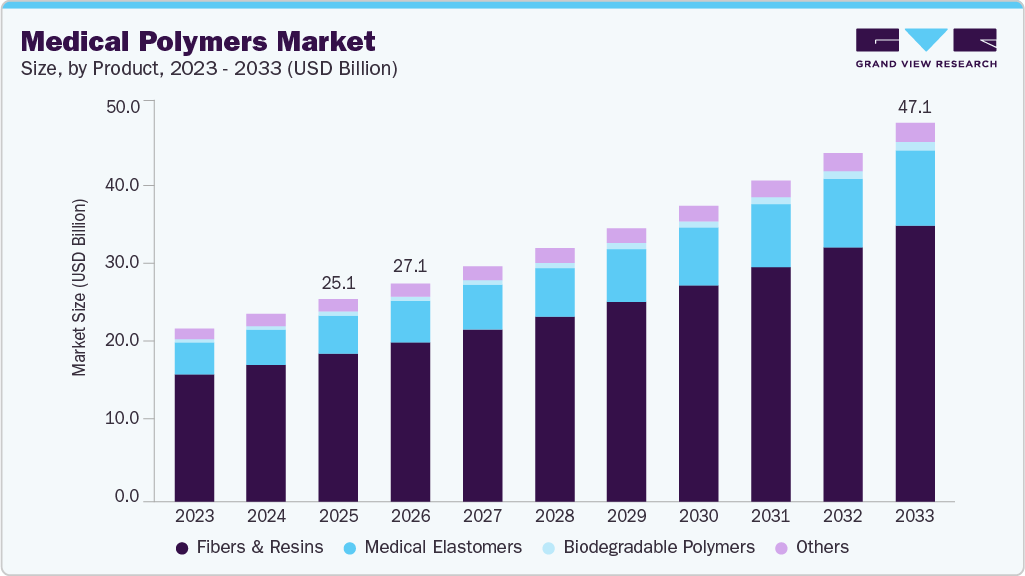

The global medical polymers market size was estimated at USD 25.08 billion in 2025 and is projected to reach USD 47.08 billionby 2033, growing at a CAGR of 8.2% from 2026 to 2033. Factors, such as increasing demand from the medical industry are anticipated to fuel the demand for medical-grade polymers.

Key Market Trends & Insights

- North America dominated the medical polymers industry with the largest revenue share of 42.33% in 2025.

- The medical polymer industry in the U.S. is expected to grow at a substantial CAGR of 8.3% from 2026 to 2033.

- By product, the biodegradable medical polymer segment is expected to grow at the fastest CAGR of 10.2% from 2026 to 2033 in terms of revenue.

- By application, the medical components led the market accounting for a market share of 43.04% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 25.08 Billion

- 2033 Projected Market Size: USD 47.08 Billion

- CAGR (2026-2033): 8.2%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Polymers are classified as synthetic and natural polymers based on raw materials. Naturally occurring polymers include bio-based polymers, wood, and natural rubber, whereas synthetic polymers include thermosets & thermoplastic resins, elastomers, and fibers.The market encompasses a range of specialized polymers engineered for use in healthcare applications, including medical devices, implants, disposables, surgical instruments, and packaging. These polymers are selected for properties such as biocompatibility, sterility, chemical resistance, flexibility, and mechanical performance, which are critical in environments where patient safety and device reliability are non-negotiable.

Furthermore, market is propelled by expanding healthcare infrastructure globally, driven by rising chronic disease incidence, increasing surgical and diagnostic procedures, and a growing emphasis on minimally invasive and personalized medical solutions. Demand is boosted by heightened infection control standards and the adoption of single-use polymeric devices in hospitals and clinics, which reduce contamination risk and improve patient outcomes. Regions such as North America and Europe lead in consumption due to advanced healthcare systems, while Asia-Pacific is emerging rapidly with expanding medical device manufacturing and rising healthcare spending.

Drivers, Opportunities & Restraints

One of the primary drivers for the medical polymers industry is the increasing demand for biocompatible and advanced polymer materials that safely interact with the human body without adverse effects. These materials are essential in the manufacture of high-performance medical devices and components such as catheters, surgical tools, implants, and drug delivery systems. As technologies evolve toward minimally invasive surgery and personalized healthcare, the need for polymers with specific properties, such as transparency, flexibility, bioresorbability, and sterilizability has surged, making polymers indispensable to modern medical device design.

In addition to procedural trends, demographic shifts such as the global aging population and rising prevalence of chronic conditions are increasing the volume of medical interventions requiring polymer-based products. Older populations typically require more frequent diagnostic and therapeutic procedures, further boosting demand for medical polymers in both reusable and single-use formats. This demographic pressure underpins long-term growth expectations for both conventional medical plastics and next-generation specialty polymers.

A significant opportunity lies in the growth of bio-based and biodegradable medical polymers. Materials such as polylactic acid (PLA), polyhydroxyalkanoates (PHA), and other renewable polymers offer an opportunity for medical devices to degrade safely in the body or environment, leading to more sustainable and single-use products. This trend aligns with broader circular-economy goals in healthcare, presenting meaningful growth corridors for manufacturers who innovate in sustainable material science.

A primary restraint facing the medical polymers industry is the rigorous regulatory landscape governing the approval and use of polymeric materials in healthcare. Agencies such as the U.S. FDA and European Medicines Agency (EMA) require exhaustive biocompatibility, safety, and performance testing before new polymers or devices reach the market. These stringent protocols slow time-to-market, increase development costs, and demand extensive documentation, particularly for novel materials or applications, a high barrier for smaller innovators and startups.

Market Concentration & Characteristics

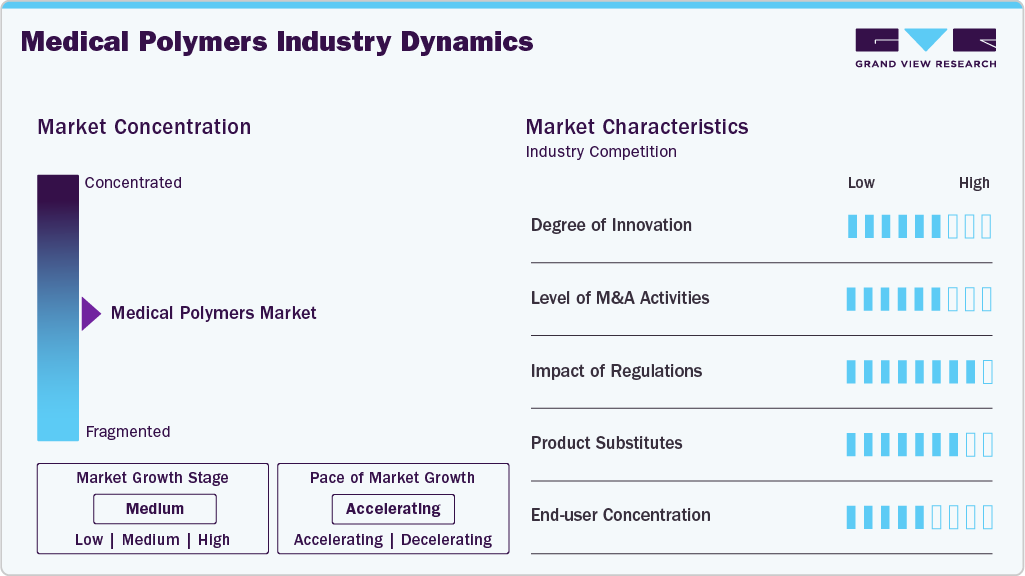

The medical polymer industry is currently in a medium growth stage, exhibiting an accelerating pace of growth. The market exhibits a high degree of innovation, particularly in the development of high-performance materials such as bioresorbable polymers, advanced thermoplastics like PEEK, and multifunctional compound systems that support minimally invasive devices, drug delivery carriers, and regenerative medicine. Ongoing research is expected to push polymer formulations that meet increasing demanding clinical specifications for strength, biocompatibility, and sterilization resilience.

M&A activity in the medical polymer industry is moderate but strategically focused, with large chemical and materials companies acquiring specialty polymer technology developers or forging partnerships to expand high-value portfolios, particularly in biocompatible and bioresorbable materials. Such strategic initiatives often integrate novel polymer platforms into broader medical device supply chains or accelerating entry into emerging applications like 3D-printable polymers and sustainable bio-derived materials.

Regulations exert a significant impact on the medical polymer industry dynamics, as compliance with stringent standards for biocompatibility, toxicity, and sterilization directly affects product approval timelines and development costs. Regulatory scrutiny ensures patient safety and device efficacy, but also raises barriers to rapid innovation, especially for novel materials with limited historical safety data. In addition, emerging regulations targeting medical waste management and environmental safety are shaping material selection and pushing suppliers toward sustainable alternatives.

Medical polymers experience high competition from alternative materials such as metals, ceramics, and glass, particularly in applications where extreme strength, rigidity, and temperature resistance are required. While polymers often offer weight, cost, and process advantages, substitutes retain advantages in durability and long-term performance in some specialized clinical cases.

End use demand in the medical polymer industry is concentrated among healthcare providers, medical device manufacturers, and surgical centers, with the largest volume stemming from single-use disposables, diagnostic equipment, and therapeutic devices. This buyer base is highly influenced by healthcare infrastructure, reimbursement policies, and clinical adoption trends, and concentrated purchasing can exert significant pricing and specification pressures on polymer suppliers, particularly for high-volume consumables.

Product Insights

Fibers & resins across the product segmentation dominated the market in 2025 with a share of 73.09% in terms of revenue owing to the high chemical & electrical resistance offered by resins such as polypropylene (PP) and polyethylene (PE). Furthermore, polycarbonate polymer resins offer heat resistance, strength, and toughness, which enables them to replace metal and glass in many medical products. Optical clarity is a vital characteristic in clinical and diagnostic contexts where blood, tissues, and other fluids must be visible.

Extrusion of medical polymers can result in monofilaments, which are single threadlike synthetic fibers. These medical-grade monofilaments can be used in magnetic resonance imaging (MRI) as an alternative to metal filaments. Also, medical polymer fibers exhibit a high strength-to-weight ratio, making them an ideal choice for many minimally invasive devices and medical clothing.

Biodegradable polymers are expected to grow at the fastest CAGR of 10.2% over the forecast period. The segment includes polylactic acid (PLA), polyglycolic acid (PGA), polycaprolactone (PCL), and polyhydroxyalkanoates (PHA) which are increasingly used in the market due to their ability to safely degrade into non‑toxic byproducts within the body. These materials are applied in sutures, drug‑delivery systems, orthopedic implants, and tissue engineering scaffolds, where controlled degradation eliminates the need for surgical removal and supports natural healing.

Application Insights

The medical components led the market across the application segmentation in terms of revenue, accounting for a market share of 43.04% in 2025. Polymers such as polypropylene, polyethylene, and polycarbonate are integral to medical components including syringes, catheters, IV bags, and diagnostic devices. Their biocompatibility, chemical resistance, and lightweight properties make them ideal for disposable and reusable products. Advances in polymer engineering also enable precision molding and miniaturization, supporting the growth of minimally invasive medical technologies.

Wound care is projected to grow at a significant CAGR of 8.7% throughout the forecast period. Medical polymers play a critical role in dressings, bandages, hydrogels, and films designed for wound management. They offer moisture control, antimicrobial protection, and controlled drug release, accelerating healing while reducing infection risks. Innovations in biodegradable and bioactive polymer systems are enabling advanced wound care solutions that integrate sustainability with therapeutic effectiveness.

In orthopedics, polymers are used in braces, supports, prosthetic liners, and cushioning materials. Their flexibility, durability, and ability to mimic soft tissue provide comfort and functional support for patients recovering from injuries or surgeries. Emerging biodegradable and high‑performance elastomers are enhancing patient compliance and long‑term wearability in orthopaedic applications.

Medical polymers are widely used in sterile packaging solutions such as blister packs, trays, and pouches. Their durability, transparency, and barrier properties ensure protection against contamination, moisture, and oxygen, while maintaining compliance with stringent healthcare regulations. Increasing demand for single‑use and recyclable packaging is driving innovation in polymer formulations tailored for medical safety and sustainability.

Regional Insights

North America medical polymers industry held the largest share of 42.33% in terms of revenue in 2025. The rising demand for medical polymers in pharmaceutical packaging applications and the rapid growth of pharmaceutical industries in Mexico and Canada is expected to further fuel the growth. For instance, the repealing of stringent regulations by the Mexican government that restricted the establishment of new manufacturing units has resulted in the establishment of new pharmaceutical manufacturing facilities by major companies such as Takeda and Astellas in Mexico.

U.S. Medical Polymers Market Trends

The medical polymer industry in the U.S. is anticipated to grow at a significant CAGR over the forecast period. The presence of key government initiatives such as the Affordable Care Act (ACA) and Medicaid has enabled a large percentage of the population to gain access to healthcare facilities and services in the U.S. This has further boosted the demand for branded drugs, medical devices, and healthcare services, thereby driving the need for medical polymers in the country, primarily in applications such as medical components, packaging, and wound care.

Europe Medical Polymers Market Trends

Europe medical polymer industry represents the second largest market globally, backed by advanced healthcare systems, stringent quality and regulatory standards, and a strong pharmaceutical and medical device manufacturing base. The region’s demand is bolstered by high usage of polymer components in diagnostic equipment, sterile packaging, and surgical devices, while sustainability and biodegradable polymer adoption trends are gaining traction under evolving environmental policies.

Germany medical polymer industry is a leading national market within Europe, anchored by its robust medical device manufacturing ecosystem, deep chemical engineering expertise, and strong demand for high-grade polymer materials in implantables, diagnostic, and hospital-use products. German manufacturers emphasize compliance with EU standards and advanced polymer innovation, positioning the country at the forefront of European medical polymer consumption and technology adoption.

Asia Pacific Medical Polymers Market Trends

Asia Pacific medical polymer industry is anticipated to be the fastest-growing region with a CAGR of 8.8% over the forecast period, driven by rapidly expanding healthcare infrastructure and rising surgical procedures across China, India, Japan, and South Korea. High population density, growth in disposable medical device production, and expanding demand for diagnostic and implantable polymer products further contribute to strong regional momentum.

China medical polymers industry stands out as a major growth engine within the Asia Pacific market, supported by extensive healthcare modernization initiatives and strategic expansion of local polymer processing capabilities. Government policy focus on domestic healthcare capacity and partnership with global polymer producers is fueling rapid adoption of biocompatible and high-performance medical polymers across a range of device applications.

Latin America Medical Polymers Market Trends

The Latin America medical polymer industry is projected to grow over the forecast period owing to increased medical device production and rising government healthcare expenditure across countries such as Brazil, Mexico, Argentina, and Chile. While overall regional share remains smaller compared to APAC and Europe, increased foreign investment and public-health initiatives are strengthening demand for polymer-based medical products and sterile packaging solutions.

Middle East & Africa Medical Polymers Market Trends

The medical polymer industry in the Middle East and Africa is expected to steadily expand, supported by growing healthcare spending, hospital construction, and adoption of polymer-based devices and sterile consumables in countries such as the UAE, South Africa, Egypt, and Morocco. GDP growth and demographic shifts are driving increased demand for modern healthcare materials, even as overall regional consumption remains a smaller portion of the global market.

Saudi Arabia medical polymer industry is one of the key markets within the Middle East, propelled by significant healthcare infrastructure investment, population growth, and national programs aimed at expanding access to advanced medical services. The country’s increasing adoption of disposable medical devices, hospital consumables, and polymer-based diagnostic components supports ongoing demand for medical polymers, making it an important expanding market in the region.

Key Medical Polymers Company Insights

The competitive landscape of the medical polymer industry is characterized by a mix of large multinational chemical and materials companies alongside specialized polymer suppliers and regional players, all vying to serve the rapidly growing healthcare and medical device sectors. Industry leaders maintain strong positions through extensive product portfolios of high-performance, biocompatible polymers tailored for medical devices, diagnostic equipment, packaging, and advanced applications.

These major players differentiate based on innovation in polymer chemistry, regulatory compliance capabilities, global manufacturing footprints, and deep ties with medical device OEMs, making material performance and safety as crucial competitive factors as price.

Key Medical Polymers Companies:

The following are the leading companies in the medical polymers market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- NatureWorks LLC

- Covestro AG

- Celanese Corporation

- Eastman Chemical Corporation

- Evonik Industries AG

- Dow Inc.

- Exxon Mobil Corporation

- Arkema

- Koninklijke DSM NV

- Formosa Plastics Corporation

- Foryou Medical

- KRATON CORPORATION

- SABIC

- Trinseo S.A.

Recent Developments

-

On October 2025, AlchemPro announced that LyondellBasell expanded its Purell medical‑grade polyolefin portfolio to North America, enhancing local access to trusted materials for healthcare and pharmaceutical applications. Previously established in Europe, the Purell line is known for its regulatory compliance, traceability, and supply reliability, and the expansion underscores LyondellBasell’s commitment to advancing healthcare innovation and customer collaboration while strengthening its footprint in the North American medical polymers market.

-

On July 2025, Evonik announced that IMCD has become the new distributor for its RESOMER portfolio of bioresorbable polymers used in medical devices and pharmaceutical applications. The partnership will strengthen Evonik’s global distribution network, ensuring broader access to RESOMER materials that are widely applied in drug delivery, orthopedic implants, and tissue engineering. By leveraging IMCD’s expertise in specialty chemicals distribution, Evonik aims to enhance customer support, streamline supply chains, and accelerate innovation in the medical polymer industry.

Medical Polymers Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 27.07 billion

Revenue forecast in 2033

USD 47.08 billion

Growth rate

CAGR of 8.2% from 2026 to 2033

Historical data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue & volume forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S., Canada; Mexico; Germany; UK; France; Italy; Spain, China; India; Japan; Malaysia, Singapore, Oceania, Brazil; Argentina, Saudi Arabia, South Africa, UAE

Key companies profiled

BASF SE; Celanese Corporation; SABIC; Dow Inc.; NatureWorks LLC.; Exxon Mobil Corporation; Covestro AG; Eastman Chemical Corporation; Evonik Industries AG; Arkema; koninklijke DSM NV; Formosa Plastic Corporation; Foryou medical; KRATON CORPORATION; Trinseo S.A.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Polymers Market Report Segmentation

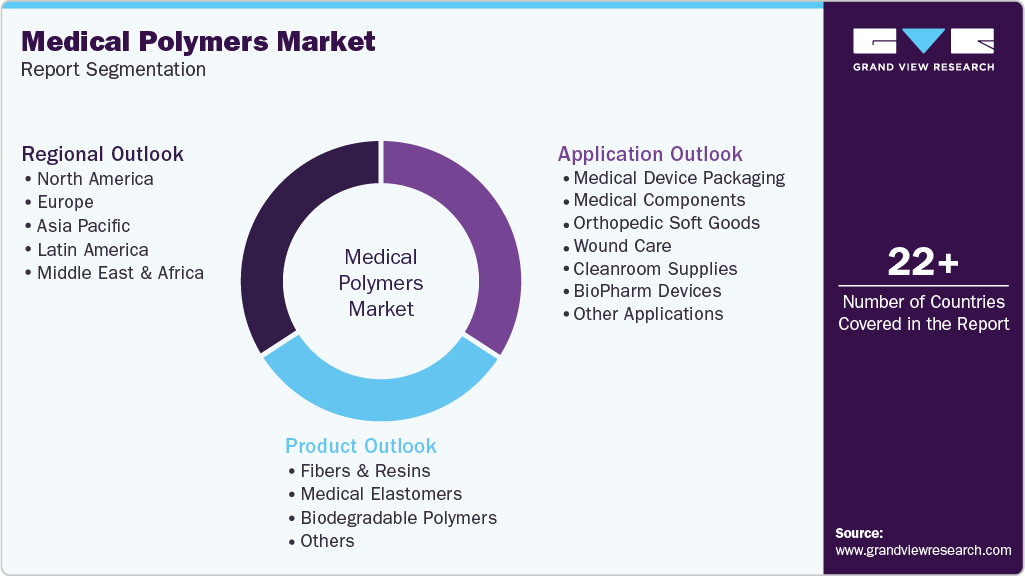

This report forecasts revenue & volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global medical polymers market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Fibers & Resins

-

Medical Elastomers

-

Biodegradable Polymers

-

Polylactic Acid (PLA)

-

Polyhydroxyalkanoate (PHA)

-

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Medical Device Packaging

-

Medical Components

-

Orthopedic Soft Goods

-

Wound Care

-

Cleanroom Supplies

-

BioPharm Devices

-

Mobility Aids

-

Sterilization & Infection Prevention

-

Tooth Implants

-

Denture-based Materials

-

Other Implants

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Malaysia

-

Singapore

-

Oceania

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global medical polymers market size was estimated at USD 25.08 billion in 2025 and is expected to reach USD 27.07 billion in 2026.

b. The global medical polymer market is expected to grow at a compound annual growth rate of 8.2% from 2026 to 2033 to reach USD 47.08 billion by 2033.

b. The fibers & resins segment dominated the medical polymer market with a share of 73.09% in 2025. The growing use of fibers and resins in various applications including spinal implants, cranial injuries, and hip and joint replacements is anticipated to drive the demand in the segment.

b. Some key players operating in the medical polymers market include BASF SE, Bayer Material Science AG, Celanese Corporation, DSM N.V., and Exxon Mobil Corporation.

b. Key factors that are driving the medical polymer market growth include the high adoption of polymers for implants due to chemical inertness and superior fatigue resistance.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.