- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Polyolefin Compounds Market, Industry Report, 2033GVR Report cover

![U.S. Polyolefin Compounds Market Size, Share & Trends Report]()

U.S. Polyolefin Compounds Market (2025 - 2033) Size, Share & Trends Analysis Report By Polymer (PP Compounds, PE Compounds), By Thickness (Automotive, Packaging, Building & Construction, Electrical & Electronics, Consumer Goods, Industrial), And Segment Forecasts

- Report ID: GVR-4-68040-665-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Polyolefin Compounds Market Summary

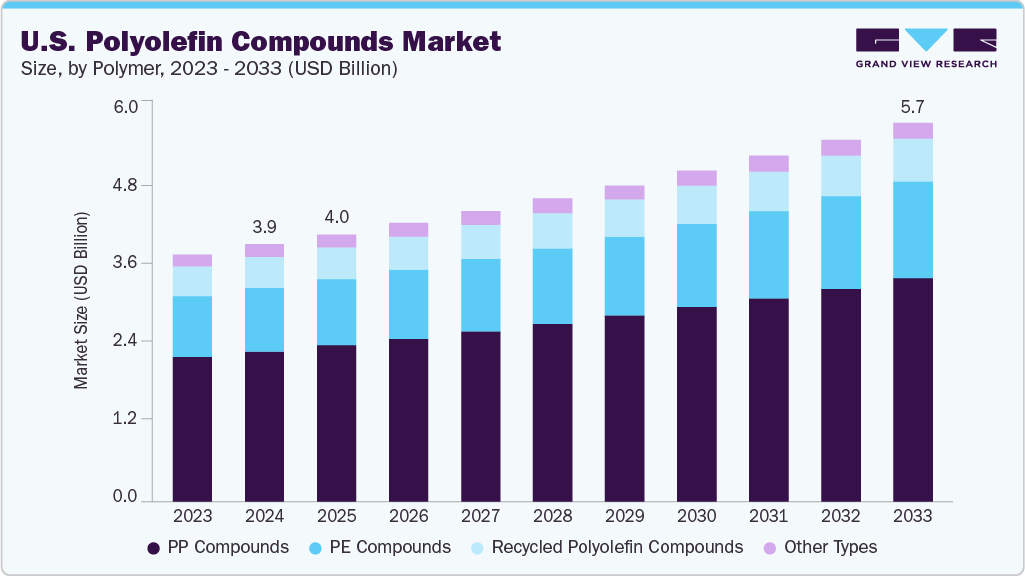

The U.S. polyolefin compounds market size was estimated at USD 3.87 billion in 2024 and is projected to reach USD 5.71 billionby 2033, growing at a CAGR of 4.5% from 2025 to 2033. Strong demand from the U.S. automotive industry is driving the use of polyolefin compounds due to their lightweight nature and cost efficiency.

Key Market Trends & Insights

- By polymer, the PE compounds segment is expected to grow at a considerable CAGR of 4.8% from 2025 to 2033 in terms of revenue.

- By applications, the packaging segment is expected to grow at a considerable CAGR of 4.9% from 2025 to 2033 in terms of revenue..

Market Size & Forecast

- 2024 Market Size: USD 3.87 billion

- 2033 Projected Market Size: USD 5.71 billion

- CAGR (2025 - 2033): 4.5%

These materials help manufacturers meet fuel economy and safety standards without compromising on performance. The polyolefin compounds market in the U.S. is witnessing a strong trend toward advanced lightweighting solutions across the automotive and consumer goods segments.

Automakers are increasingly incorporating polypropylene and polyethylene compounds with high impact strength and thermal stability to reduce vehicle weight and meet stringent fuel efficiency and emissions targets. This trend is further amplified by growing interest in electric vehicle platforms, where battery efficiency is directly influenced by component weight and thermal management. These developments are creating a lasting shift in material selection across the engineering spectrum.

Drivers, Opportunities & Restraints

The continued growth of the packaging industry in the U.S., especially in flexible packaging, is a primary driver fueling demand for polyolefin compounds. With rising e-commerce penetration and changing consumer habits post-pandemic, manufacturers are focusing on durable and lightweight packaging solutions with barrier properties. Polyethylene and polypropylene compounds offer excellent sealing strength, cost-efficiency, and recyclability, making them essential in modern packaging innovation. The driver is further reinforced by brand owners seeking sustainable yet high-performance alternatives to traditional materials.

A significant opportunity lies in the rising demand for recyclable and bio-based polyolefin compounds across key sectors such as healthcare, food packaging, and construction. With government regulations and corporate sustainability goals emphasizing circular economy models, there is a growing window for material manufacturers to develop and commercialize polyolefin grades that are compatible with existing recycling streams or derived from renewable feedstocks. Companies that invest in closed-loop systems and certification-backed solutions are likely to gain a competitive edge in the evolving market.

Volatility in raw material prices, particularly for crude oil derivatives such as ethylene and propylene, remains a critical restraint for the U.S. polyolefin compounds industry. Supply disruptions, geopolitical risks and refinery shutdowns often create unpredictable pricing structures, adversely impacting margins for compounders and converters.

Market Concentration & Characteristics

The market growth stage of the U.S. polyolefin compounds industry is medium, and the pace is accelerating. The market exhibits fragmentation, with key players dominating the industry landscape. Major companiessuch as LyondellBasell Industries N.V., Dow Inc., ExxonMobil Chemical, Avient Corporation, Westlake Corporation, RTP Company, Asahi Kasei Plastics North America, Teknor Apex Company, and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet evolving industry demands.

In the U.S. polyolefin compounds industry, engineering polymers such as polyamide and polybutylene terephthalate have emerged as credible alternatives where higher temperature resistance or mechanical strength is required. In addition, performance materials like polycarbonate and ABS compete in applications demanding superior toughness and dimensional stability. Growing interest in bio‑based polymers such as polylactic acid also introduces a sustainable substitution option for low‑load uses. These competitive materials challenge compounders to continuously enhance the value proposition of polyolefin grades.

Regulatory frameworks are reshaping the U.S. polyolefin compounds landscape by imposing stricter reporting and sustainability targets on resin producers and converters. The Environmental Protection Agency’s recent plastic production reporting requirements increase transparency on feedstock volumes and greenhouse gas emissions. Meanwhile, state‑level extended producer responsibility laws in California and Oregon mandate end‑of‑life management of plastic packaging, encouraging compounders to develop recyclable or chemically recyclable grades. Food contact and safety standards set by the FDA further influence formulation choices, ensuring compliance across consumer‑facing segments.

Polymer Insights

PP compounds dominated the market across the polymer segmentation in terms of revenue, accounting for a market share of 58.44% in 2024, driven by the relentless expansion of lightweight consumer goods. As appliance and furniture manufacturers seek materials that deliver strength without excess mass, PP compounds offer an ideal balance of rigidity and moldability. This dynamic is reinforced by stringent energy efficiency regulations that reward products with lower transportation and operational footprints. Consequently, compounders are ramping up capacity to serve this volume‑focused segment, cementing polypropylene’s leadership position.

The PE compounds segment is anticipated to grow at a significant CAGR of 4.8% through the forecast period. The swiftest growth reflects surging demand in flexible packaging applications. Retailers and brand owners are prioritizing thin‑gauge films that combine clarity with seal integrity, and PE compounds have evolved to meet these exacting standards. Innovations in copolymer blends are enabling lighter gauges without sacrificing durability or puncture resistance. As a result, converters are rapidly adopting these grades to capitalize on the booming direct‑to‑consumer and subscription‑box markets.

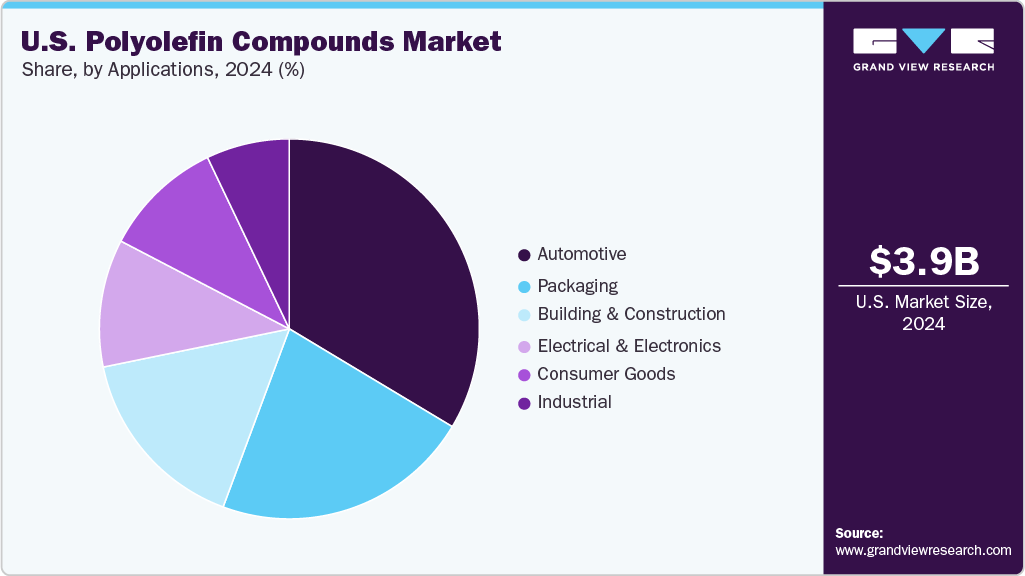

Applications Insights

Automotive led the market across the thickness segmentation in terms of revenue, accounting for a market share of 32.71% in 2024, driven by the industry’s pivot toward fleet electrification paired with ever‑tighter crash safety mandates. Polyolefin compounds are being engineered to provide high impact performance in structural components and thermal stability around battery enclosures. This dual requirement for passenger protection and battery efficiency propels material selection decisions. Leading OEMs are collaborating with compounders to tailor grades that meet both lightweighting goals and regulatory compliance.

The packaging segment is expected to expand at a substantial CAGR of 4.9% throughout the forecast period. The packaging segment’s rapid ascent is underpinned by the exponential rise of e‑commerce and consumer preference for sustainable formats. Growth in online grocery and meal‑kit services demands robust films that can endure complex supply chains while supporting recyclability claims. Polyolefin compound developers are responding with formulations that enhance barrier properties yet remain compatible with existing recycling streams. This alignment with circular economy imperatives is catalyzing swift market uptake.

U.S. Polyolefin Compounds Company Insights

The U.S. polyolefin compounds industry is highly competitive, with several key players dominating the landscape. Major companies include LyondellBasell Industries N.V., Dow Inc., ExxonMobil Chemical, Avient Corporation, among others. The market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key U.S. Polyolefin Compounds Companies:

- LyondellBasell Industries N.V.

- Dow Inc.

- ExxonMobil Chemical

- Avient Corporation

- Westlake Corporation

- RTP Company

- Asahi Kasei Plastics North America

- Teknor Apex Company

Recent Developments

-

In March 2024, Dow Inc. introduced a new polyolefin elastomer (POE)-based artificial leather designed for the automotive market, marking the first commercialization of this animal-free leather alternative for global automotive seating. Developed in partnership with China-based HIUV Materials Technology and approved by an electric vehicle manufacturer, this innovative material offers ultra-soft texture, improved color stability, resistance to aging and low temperatures, and eliminates hazardous chemicals

-

In January 2024, LyondellBasell Industries N.V. launched Petrothene T3XL7420, a cross-linkable, all-in-one flame-retardant polymer compound, on January 23, 2024. This innovative product was designed to optimize manufacturing by improving production line speeds and efficiency, while delivering significant cost savings.

U.S. Polyolefin Compounds Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.03 billion

Revenue forecast in 2033

USD 5.71 billion

Growth rate

CAGR of 4.5% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Polymer, applications

Country Scope

U.S.

Key companies profiled

LyondellBasell Industries N.V.; Dow Inc.; ExxonMobil Chemical; Avient Corporation; Westlake Corporation; RTP Company; Asahi Kasei Plastics North America; Teknor Apex Company

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Polyolefin Compounds Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. polyolefin compounds market report based on polymer and applications:

-

Polymer Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

PP Compounds

-

PE Compounds

-

Recycled Polyolefin Compounds

-

Other Types

-

-

Applications Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Automotive

-

Packaging

-

Building & Construction

-

Electrical & Electronics

-

Consumer Goods

-

Industrial

-

Other Applications

-

Frequently Asked Questions About This Report

b. .The U.S. polyolefin compounds market size was estimated at USD 3.87 billion in 2024 and is expected to reach USD 4.03 billion in 2025.

b. .The U.S. polyolefin compounds market is expected to grow at a compound annual growth rate of 4.5% from 2025 to 2033 to reach USD 5.71 billion by 2033.

b. .PP compounds dominated the U.S. polyolefin compounds market across the polymer type segmentation in terms of revenue, accounting for a market share of 58.44% in 2024, driven by the relentless expansion of lightweight consumer goods.

b. .Some key players operating in the U.S. polyolefin compounds market include LyondellBasell Industries N.V., Dow Inc., ExxonMobil Chemical, Avient Corporation, Westlake Corporation, RTP Company, Asahi Kasei Plastics North America, and Teknor Apex Company.

b. Strong demand from the U.S. automotive industry is driving the use of polyolefin compounds due to their lightweight nature and cost efficiency. These materials help manufacturers meet fuel economy and safety standards without compromising on performance.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.