- Home

- »

- Animal Health

- »

-

U.S. Poultry Medicine Market Size, Industry Report, 2033GVR Report cover

![U.S. Poultry Medicine Market Size, Share & Trends Report]()

U.S. Poultry Medicine Market (2025 - 2033) Size, Share & Trends Analysis Report By Species (Chicken, Turkey, Ducks), By Product (Biologics, Pharmaceuticals), By Disease Type, By Route Of Administration, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-648-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

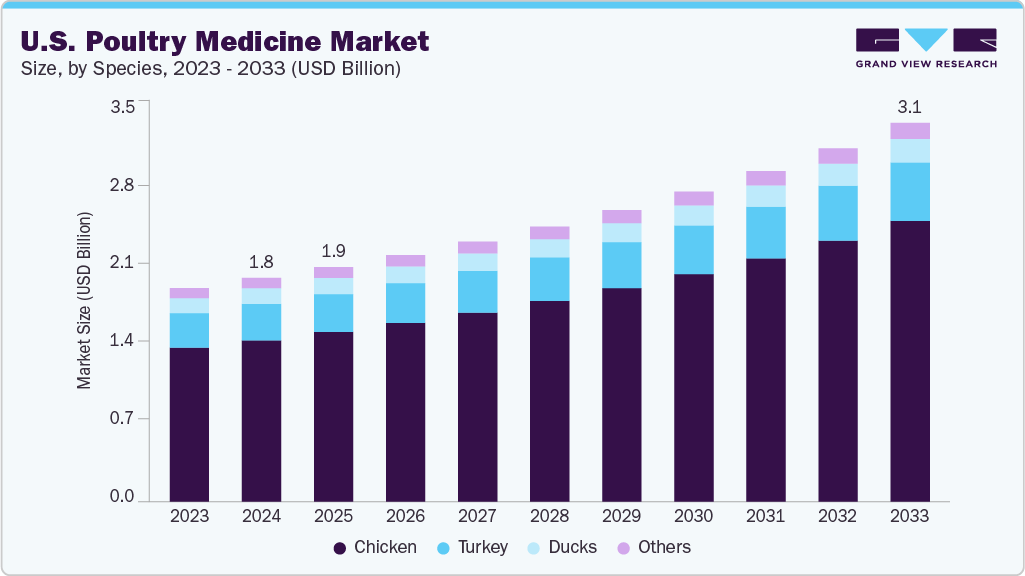

The U.S. poultry medicine market size was estimated at USD 1.83 billion in 2024 and is projected to reach USD 3.11 billion by 2033, growing at a CAGR of 6.20% from 2025 to 2033. The market is continuously growing, driven by high poultry consumption and market value, a shift towards antibiotic alternatives, andtechnological advancements in poultry healthcare. According to the USDA Economic Research Service, U.S. poultry products dominate both domestic and global meat markets, due to efficient production systems, advanced genetics, ample feed supply, and strong consumer demand. Between 2013 and 2022, broilers accounted for 67% of poultry sales, followed by eggs at 22% and turkeys at 11%, primarily for consumption.

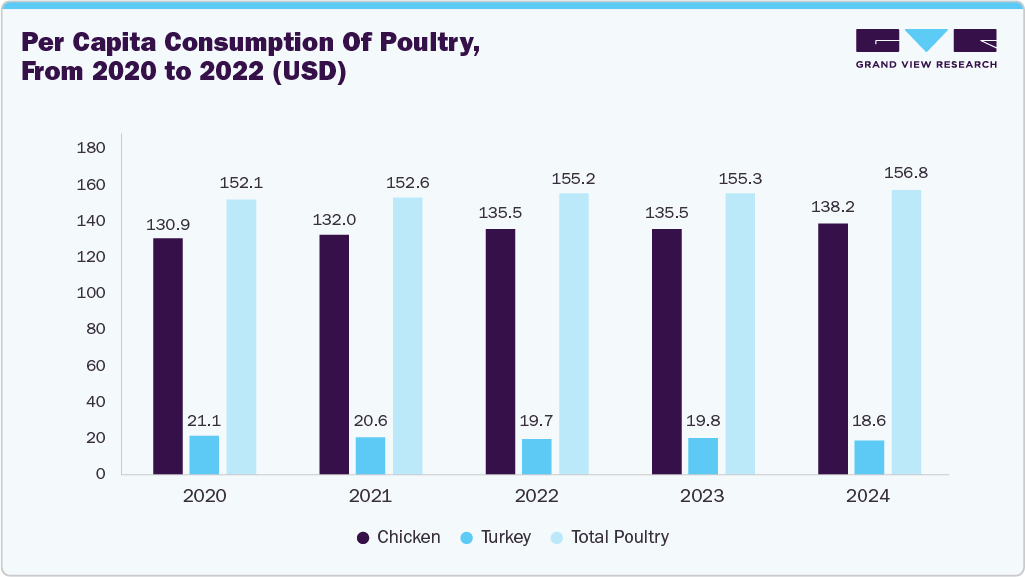

This surge in demand for poultry products directly translates into the need for efficient and sustainable poultry farming practices, necessitating comprehensive healthcare solutions to maintain the health and productivity of poultry flocks. The per capita consumption of poultry, from 2020 to 2024, is illustrated below in the chart:

Growing concerns over antimicrobial resistance have prompted the U.S. poultry industry to reduce antibiotic use. Regulations like the Preservation of Antibiotics for Medical Treatment Act (PAMTA) and the Preventing Antibiotic Resistance Act (PARA) have restricted the use of medically important antibiotics in poultry and livestock. For decades, antibiotics have been widely used in livestock and poultry, as high-dose treatments for specific infections and as low-dose growth promoters in animal feed. In 2013, around 131,000 tons of antibiotics were used in food animals, a number projected to increase to nearly 200,000 tons by 2030 due to rising global demand. This shift has led to increased demand for alternative health management strategies, such as vaccines, probiotics, and herbal supplements, to ensure poultry health and productivity.

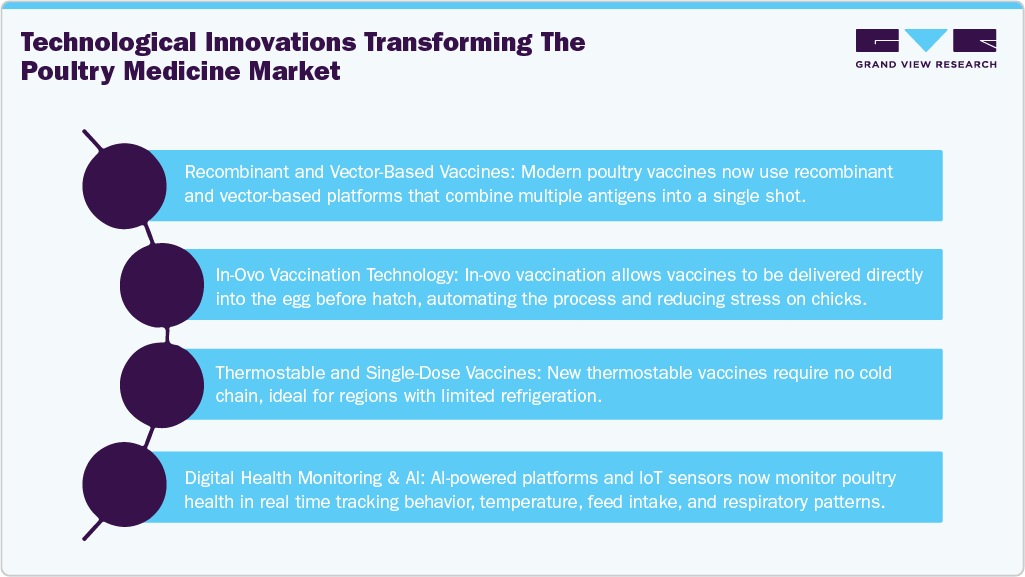

Advancements in veterinary and animal nutrition technologies have significantly impacted the U.S. poultry pharmaceuticals market. The development of new vaccines, diagnostic tools, feed supplements, and other specialized healthcare products has enabled poultry producers to address a wider range of health challenges, improve flock performance, and enhance food safety. These innovations contribute to more efficient and sustainable poultry farming practices.

Market Concentration & Characteristics

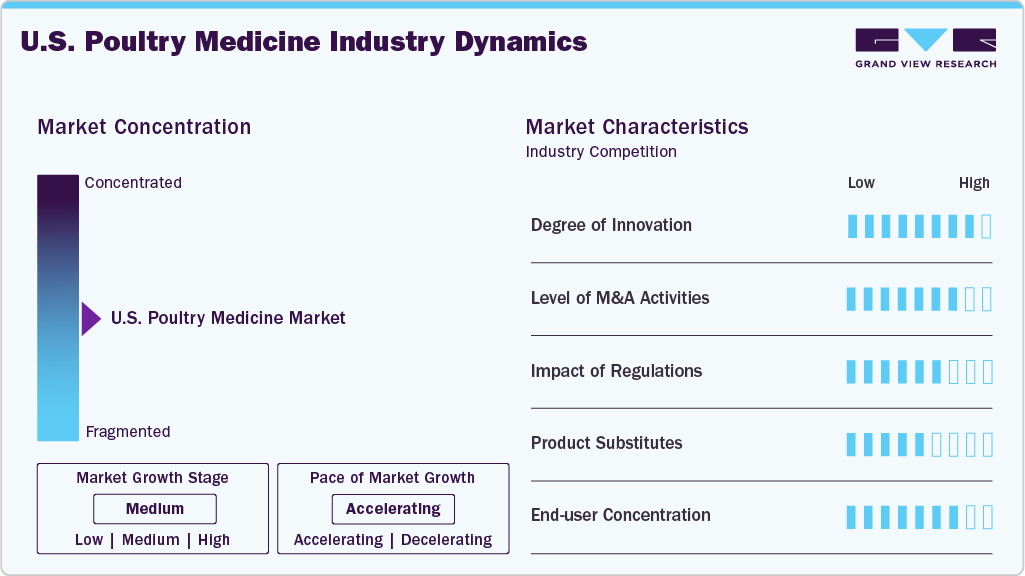

The U.S. poultry medicine market is moderately growing and experiencing accelerating growth. The key players benefit from strong brand recognition, regulatory expertise, and the ability to launch innovative vaccines and therapeutics at scale. Their dominance is reinforced by frequent mergers, acquisitions, and partnerships aimed at expanding geographical reach and technological capabilities. The emerging regional players are gaining ground in specific markets. However, barriers like high R&D costs, complex regulatory approvals, and cold-chain requirements make it challenging to disrupt the established hierarchy.

The U.S. poultry medicine industry leads in innovation, driven by strong R&D infrastructure and demand for antibiotic alternatives. Companies are developing recombinant vaccines, in-ovo delivery systems, and real-time health monitoring technologies. Emphasis on sustainable practices has accelerated innovation in probiotics, AI-based diagnostics, and precision livestock farming to enhance disease prevention and meet consumer expectations for antibiotic-free poultry. For instance, in March 2025, Base Molecular Resonance Technologies (BMRT), a startup in advanced detection, unveiled novel scanning technology that instantly detects avian influenza in poultry and identifies cancers, diseases, drugs, explosives, and more.

M&A activity in the U.S. poultry medicine sector is robust, with major players acquiring biotech firms, diagnostics companies, and complementary animal health assets. In October 2024, Phibro Animal Health Corporation completed the acquisition of Zoetis Inc.’s medicated feed additive and select water-soluble products, advancing its mission to enhance global animal health, nutrition, and sustainability. These acquisitions aim to expand therapeutic offerings, enhance technical capabilities, and gain market share. Strategic consolidations, like Zoetis’s recent portfolio streamlining, reflect an industry trend toward specialization and efficiency within a competitive, evolving regulatory environment.

U.S. regulations significantly shape the poultry medicine market. The FDA's Veterinary Feed Directive and growing restrictions on antibiotic use have pushed producers toward vaccines and alternatives. Regulatory scrutiny ensures safety and efficacy but raises costs and time to market. Increasing focus on antimicrobial resistance and food safety continues to guide product development and market adoption strategies.

In the U.S., product substitutes such as prebiotics, probiotics, phytogenic feed additives, and immune enhancers are gaining traction. These alternatives cater to the growing demand for antibiotic-free poultry products. Although they cannot fully replace vaccines or therapeutics, their adoption is increasing in integrated poultry operations focused on sustainability, consumer trust, and long-term flock health management.

The end user concentration is primarily centered on large commercial integrators and vertically integrated producers, who control a significant share of vaccine, feed additive, and diagnostic purchases. Mid-sized independent producers and poultry veterinarians comprise the secondary market. Backyard poultry owners and small-scale farms represent a smaller, niche segment. This concentration ensures predictable demand but also increases reliance on industry standards set by major integrators and vet networks.

Species Insights

Chickens represent the largest segment in the U.S. poultry medicine market, with a revenue share of 72.14% in 2024, driven by their dominance in meat production. The high consumer demand for chicken meat and eggs drives continuous investment in health management solutions tailored specifically for chickens. This includes vaccines, medications, and nutritional supplements designed to enhance flock health, prevent diseases, and improve productivity.

In October 2022, Huvepharma, Inc. reintroduced PoultrySulfa, the only FDA-approved triple-sulfa veterinary antibiotic powder, used in water to help control coccidiosis and acute fowl cholera in chickens. The segment benefits from advancements in veterinary technology and increasing awareness among producers about disease control. Overall, chickens remain central to the poultry medicine market’s expansion, reflecting their economic importance and critical need for effective health interventions.

Product Insights

The pharmaceuticals segment represented a dominant position in the U.S. poultry medicine market with a revenue share of 67.21% in 2024, driven by the necessity for effective disease prevention and treatment in poultry farming. Pharmaceuticals, including vaccines, antibiotics, and antiparasitics, are essential for maintaining flock health, enhancing productivity, and ensuring food safety. This segment benefits from ongoing advancements in veterinary medicine, such as the development of novel drug delivery systems and improved formulations. The regulatory pressures to reduce antibiotic use have led to increased demand for alternative pharmaceutical solutions, further solidifying the pharmaceuticals segment's leading role in the market.

Biologics have emerged as the fastest-growing segment in the U.S. poultry medicine industry, driven by the increasing demand for effective disease prevention and control strategies in poultry farming. This growth is attributed to several factors, including the rising prevalence of infectious diseases, the need for sustainable farming practices, and advancements in biotechnology. Biologics, such as vaccines and monoclonal antibodies, offer targeted and efficient solutions, reducing the reliance on antibiotics and minimizing the risk of antimicrobial resistance. The development of innovative biologic products has led to enhanced flock health, improved productivity, and better food safety standards, positioning biologics as a critical component in modern poultry health management.

Disease Type Insights

Newcastle Disease (ND) held the largest revenue share of 22.38% in 2024, due to its significant impact on poultry health and productivity. This highly contagious viral infection can cause severe economic losses, making effective prevention and control measures essential. Vaccination remains the most effective strategy to mitigate the risks associated with ND. The widespread use of ND vaccines across various poultry operations underscores their critical role in maintaining flock health and ensuring the sustainability of poultry farming. As such, ND continues to be a central focus in the development and application of poultry medicines.

Infectious Bronchitis (IB) is the fastest-growing segment in the U.S. poultry medicine market due to its widespread impact on poultry health and productivity. This highly contagious respiratory disease affects chickens of all ages, leading to symptoms such as coughing, sneezing, and nasal discharge. The disease can cause significant economic losses through reduced egg production, poor growth in broilers, and increased susceptibility to secondary infections. The continuous emergence of new IB virus strains necessitates ongoing research and development of updated vaccines and diagnostic tools. The increasing prevalence and economic impact of IB drive the demand for effective prevention and control measures, positioning it as a critical focus in poultry health management.

Route Of Administration Insights

Injectables represented the largest segment of the U.S. poultry medicine industry, with a revenue share of 49.07% in 2024, offering precise and effective disease prevention and treatment. This method ensures rapid absorption and targeted action, which is crucial for managing acute infections and chronic conditions in poultry. Injectable vaccines, such as those for Newcastle Disease and Marek’s Disease, are widely used due to their reliability and long-lasting immunity. The preference for injectables is driven by their proven efficacy, especially in large-scale commercial operations where controlling disease outbreaks swiftly is essential. As poultry health challenges evolve, injectable solutions remain integral to maintaining flock health and productivity.

The other route of administration is anticipated to grow at the fastest-growing segments over the forecast period. These non-invasive delivery methods offer several advantages, including ease of administration, reduced stress on birds, and the ability to stimulate local mucosal immunity, which is crucial for preventing respiratory diseases. Intranasal vaccines are gaining traction due to their suitability for mass vaccination programs and their potential to minimize viral shedding, thereby enhancing overall flock health. The growing prevalence of respiratory disorders in poultry and advancements in vaccine formulations are expected to further drive the adoption of these administration routes, positioning them as key contributors to the future of poultry health management.

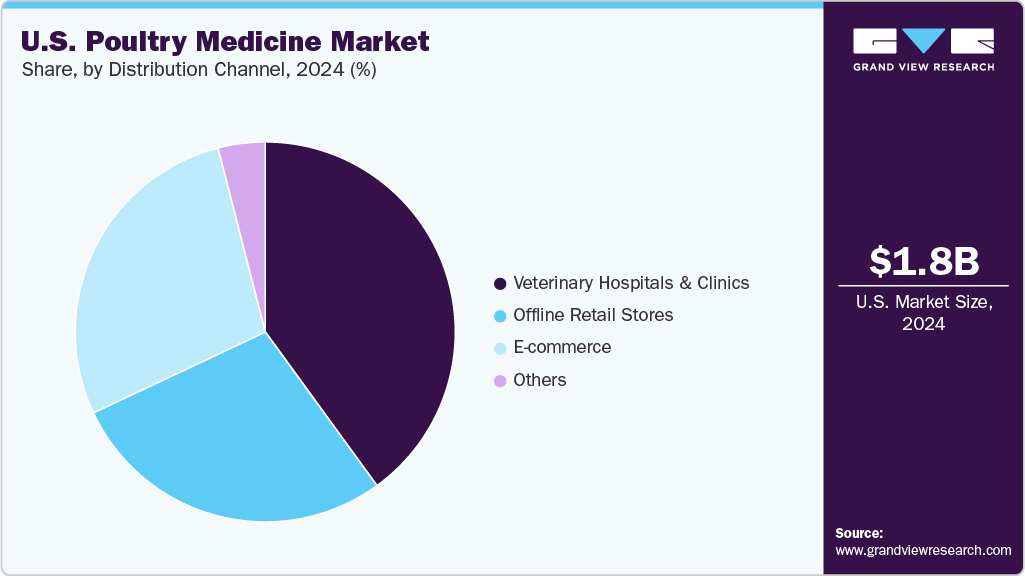

Distribution Channel Insights

Veterinary hospitals and clinics accounted for the largest revenue share of 40.17% in 2024, due to their essential role in delivering comprehensive healthcare services to poultry farms. These facilities offer a wide range of services, including disease diagnosis, vaccination, treatment, and health management programs, ensuring optimal flock health and productivity. Equipped with advanced diagnostic tools and staffed by specialized veterinarians, they provide timely interventions for infectious diseases such as Newcastle disease and avian influenza. The growing emphasis on biosecurity and preventive care further drives demand for veterinary services, making hospitals and clinics critical hubs for poultry health management and pharmaceutical distribution.

E-commerce has emerged as the fastest-growing segment in the U.S. poultry medicine industry, driven by the increasing adoption of digital platforms among poultry farmers. Online stores offer the convenience of purchasing a wide range of poultry healthcare products from the comfort of one's home, providing access to competitive pricing and detailed product information. This shift towards online purchasing is particularly beneficial for farmers in remote areas, where access to physical stores may be limited. The growth of e-commerce is further supported by advancements in logistics and supply chain management, ensuring the timely and safe delivery of products. As digital literacy continues to rise and internet infrastructure improves, the e-commerce segment is expected to continue its rapid expansion in the poultry medicine market.

Global players like Zoetis, Merck Animal Health, Elanco, and Boehringer Ingelheim dominate the U.S. poultry medicine market. These companies lead in vaccines, diagnostics, and feed additives. Rising demand for antibiotic alternatives, stricter regulations, and growing consumer preference for sustainable poultry products are driving innovation, while smaller biotech firms and startups are entering with specialized solutions. In February 2025, U.S. Agriculture Secretary Brooke Rollins unveiled a USD 1 billion strategy aimed at combating HPAI, safeguarding the poultry sector, and reducing rising egg prices nationwide. Technological advancements include recombinant vaccines, in-ovo delivery, AI-driven disease monitoring, rapid diagnostics, and thermostable, needle-free vaccines, enhancing efficiency, early detection, and reducing antibiotic reliance.

Key U.S. Poultry Medicine Company Insights

The U.S. poultry medicine market is dominated by key players like Zoetis, Merck, Elanco, and Boehringer Ingelheim, holding major shares through extensive product portfolios, global reach, and innovation-driven strategies.

Key U.S. Poultry Medicine Companies:

- Boehringer Ingelheim International GmbH

- Zoetis Services LLC

- Vaxxinova International BV

- Merck & Co., Inc.

- Elanco

- Ceva Santé Animale

- Phibro Animal Health Corporation

- Virbac

- Hipra

- Vetanco

- Kemin Industries, Inc.

Recent Developments

-

In May 2025, BIOXYTRAN, INC. announced that the University of Georgia selected its antiviral PHM23 for inclusion in a USDA grant proposal, recognizing its broad-spectrum potential to combat H5N1 and avian influenza.

-

In May 2025, Mangoceuticals, Inc. revealed promising field trial results of MGX-0024, a patented antiviral delivered via drinking water, achieving 100% survival against respiratory diseases like Newcastle and Chronic Respiratory Disease in poultry.

-

In August 2023, Merck Animal Health introduced INNOVAX-ILT-IBD, a dual-construct HVT vaccine offering long-lasting protection against infectious laryngotracheitis, bursal disease, and Marek’s disease, recently receiving approval from the European Commission.

U.S. Poultry Medicine Market Report Scope

Report Attribute

Details

Market size in 2025

USD 1.92 billion

Revenue forecast in 2033

USD 3.11 billion

Growth rate

CAGR of 6.20% from 2025 to 2033

Historical Period

2021 - 2023

Actual data

2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Species, product, disease type, route of administration, distribution channel

Key companies profiled

Boehringer Ingelheim International GmbH; Zoetis Services LLC; Vaxxinova International BV; Merck & Co., Inc.; Elanco; Ceva Santé Animale; Phibro Animal Health Corporation; Virbac; Hipra; Vetanco; Kemin Industries, Inc.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to the segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Poultry Medicine Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. poultry medicine market report based on species, product, disease type, route of administration, and distribution channel:

-

Species Outlook (Revenue, USD Million, 2021 - 2033)

-

Chicken

-

Broiler

-

Layer

-

-

Turkey

-

Ducks

-

Others

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Biologics

-

Vaccines

-

Modified/ Attenuated Live

-

Inactivated (Killed)

-

Other Vaccines

-

-

Other Biologics

-

-

Pharmaceuticals

-

Parasiticides

-

Anti-infectives

-

Anti-inflammatory

-

Analgesics

-

Others

-

-

Medicated Feed Additives

-

-

Disease Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Newcastle Disease

-

Infectious Bronchitis

-

Infectious Bursal Disease

-

Coccidiosis

-

Salmonella

-

Marek's Disease

-

Others

-

-

Route of Administration Outlook (Revenue, USD Million, 2021 - 2033)

-

Oral

-

Injectable

-

Topical

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Veterinary Hospitals & Clinics

-

E-commerce

-

Offline Retail Stores

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. poultry medicine market size was estimated at USD 1.83 billion in 2024 and is expected to reach USD 1.92 billion in 2025.

b. The U.S. poultry medicine market is expected to grow at a compound annual growth rate of 6.20% from 2025 to 2033 to reach USD 3.11 billion by 2033.

b. Pharmaceuticals dominated the U.S. poultry medicine market with a share of 67.21% in 2024, driven by the necessity for effective disease prevention and treatment in poultry farming. Pharmaceuticals, including vaccines, antibiotics, and antiparasitic, are essential for maintaining flock health, enhancing productivity, and ensuring food safety.

b. Some key players operating in the U.S. poultry medicine market include Boehringer Ingelheim International GmbH, Zoetis Services LLC, Vaxxinova International BV, Merck & Co., Inc., Elanco, Ceva Santé Animale, Phibro Animal Health Corporation, Virbac, Hipra, Vetanco, Kemin Industries, Inc

b. Key factors that are driving the market growth include high poultry consumption and market value, shift towards antibiotic alternatives and technological advancements in poultry healthcare

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.