- Home

- »

- Advanced Interior Materials

- »

-

U.S. Prefabricated Steel Market Size And Share Report, 2030GVR Report cover

![U.S. Prefabricated Steel Market Size, Share & Trends Report]()

U.S. Prefabricated Steel Market Size, Share & Trends Analysis Report By Application (Residential, Non-residential, Prisons & Detention Centers, Healthcare Facilities, Industrial Buildings), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-148-0

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

Market Size & Trends

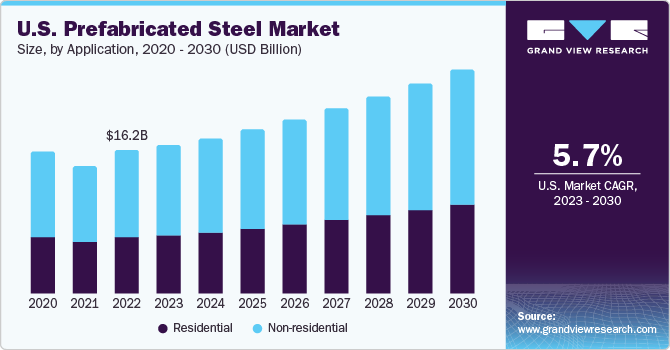

The U.S. prefabricated steel market size was estimated at USD 16.24 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.7% from 2023 to 2030. Increasing inclination toward steel as a key raw material in modular construction is propelling the demand for steel fabrication in the U.S. Modular construction is witnessing rapid growth due to various factors, such as increasing property prices, low costs, shortened project timelines, and off-site production. The usage of steel is growing in modular construction owing to its high strength, recyclability, availability, and low price, which is driving the growth of the prefabricated steel market in the U.S.

The rising need to upgrade infrastructure in the U.S. is expected to increase the demand for prefabricated steel over the forecast period. Moreover, the growing focus on sustainable materials has further propelled the market growth, as steel is considered a green construction material due to its recyclability. It helps reduce greenhouse gas emissions and contributes to a sustainable environment. The construction companies are focused mainly on reducing wastage during the erection of structures.

Despite the negative impact on the U.S. economy due to the pandemic, construction was deemed an essential service in certain states. As a result, the overall spending by the U.S. in 2020 increased, impacting the industry positively. After a slight decline in March-April 2020, the total construction spending in the U.S. has been climbing. The spending rose by over 30% in April 2023 compared to April 2020. This proves to be beneficial for the market growth in the country.

However, certain obstructions restrict the market growth despite the growing demand for prefabricated buildings in the U.S. Transportation is one of the restraints, as the process is quite risky. The transporters must be very careful, as any mishap, damage, or deformation to the module or prefab component can impact the entire structure and lead to significant repair or replacement costs.

Application Insights

Based on application, the residential segment accounted for a revenue share of more than 39.0% in 2022. The demand for prefabricated steel structures is propelled by the residential segment as a safe, secure, and efficient option for homeowners.Prefabricated buildings allow the owners to participate in exterior and interior designing processes. Furthermore, it offers higher energy efficiency when compared to traditional wooden structures.

Emphasis toward greener infrastructure, growing need for multi-family projects, and affordable houses propel market growth. Some creative modular construction projects in the U.S. are Homeless housing at the Hilda L. Solis First Village in Los Angeles, California; Modular Micro Homes in South Austin, Texas; and a 32-story modular building in Brooklyn, New York. Growing population, increase in household formation, and rising property rates are expected to be the key factors aiding the growth in the residential sector.

The non-residential segment is anticipated to witness rapid growth over the forecast period owing to the accelerated adoption of modular systems in commercial and non-residential buildings. The key significance of using prefabricated buildings or modular construction is saving time and labor-related costs, as a significant part of the manufacturing and fabrication occurs in factories.

Healthcare is one of the key sub-segments within non-residential applications. The elderly population is increasing in the U.S., indicating the need for larger medical office space. It is estimated that by 2030 one out of every five U.S. citizens will attain retirement age, driving the demand for healthcare facilities in the future. Building owners can construct prefabricated exam rooms, patient bathrooms, single-toilet rooms, and overhead utilities off-site.

Regional Insights

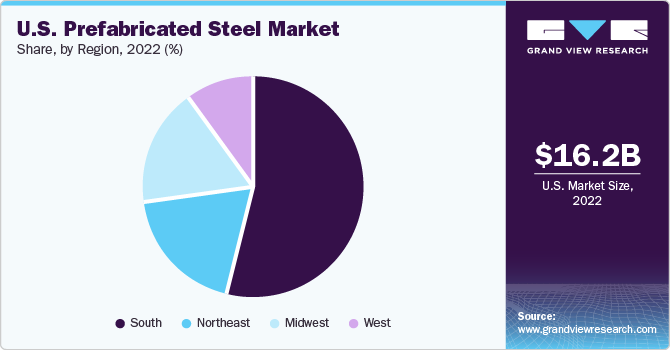

Based on region, South U.S. accounted for the largest revenue share of more than 54.0% in 2022. The southern U.S. is the second-largest area in the country. The hospitality industry is anticipated to boost the adoption of prefabricated steel structures in the region as the industry uses off-site construction methods, where prominent hoteliers have recognized the need for reducing the time required for hotel completion and opting for steel framing as a reliable solution.

The Northeast region of the U.S. is anticipated to witness the highest CAGR over the forecast period. The growing use of modular construction techniques in smart cities, increasing measures for managing waste, shifting focus toward minimizing emissions, and rising adoption of green practices have driven the adoption of prefabricated construction activities in the region. Growth opportunities are attracting big firms to expand in this region. In April 2022, LeChase Construction Services, LLC, one of the largest contractors in the Northeast U.S., acquired Sano-Rubin Construction Services to expand its presence in New York. The strategic initiative aligns with its long-term growth plan and continues a wide range of infrastructure projects such as industrial, housing, education, healthcare, hospitality, and entertainment.

Key Companies & Market Share Insights

The market is highly competitive owing to significant developments in prefabricated structures. Therefore, companies are opting for strategies to gain a higher market share owing to the presence of numerous players. In December 2022, Modulex Modular Buildings Plc, a construction tech manufacturer, signed an agreement with PHP Ventures Acquisition Corporation. PHP is set to become a subsidiary of Modulex, expand its business portfolio, and gain an advantage over the competitors with more significant market share across the region.

Key U.S. Prefabricated Steel Companies:

- BMarko Structures Inc.

- Carl A. Nix Welding Service, Inc.

- Cornerstone Inc.

- Eagle Companies

- MODLOGIQ, Inc

- Modular Genius

- Nashua Builders

- Panel Built, Inc.

- SteelCell of North America, Inc.

- Sunbelt Modular, Inc.

- Sweeper Metal Fabricators Corp.

- U.S. Engineering Company Holding

- Vanguard Modular Building Systems

- Wilmot Modular

- Z Modular

U.S. Prefabricated Steel Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 25.37 billion

Growth rate

CAGR of 5.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, trends

Segments covered

Application, region

Country scope

U.S.

Key companies profiled

BMarko Structures Inc.; Carl A. Nix Welding Service, Inc.; Cornerstone Inc.; Eagle Companies; MODLOGIQ, Inc; Modular Genius; Nashua Builders; Panel Built, Inc.; SteelCell of North America, Inc.; Sunbelt Modular, Inc.; Sweeper Metal Fabricators Corp.; U.S. Engineering Company Holding; Vanguard Modular Building Systems; Wilmot Modular; Z Modular

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Prefabricated Steel Market Report Segmentation

This report forecasts volume and revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. prefabricated steel market report based on application, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Residential

-

Non-residential

-

Prisons & Detention Centers

-

Healthcare Facilities

-

Industrial Buildings

-

Others

-

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Northeast

-

Midwest

-

West

-

South

-

-

Frequently Asked Questions About This Report

b. The U.S. prefabricated steel market size was estimated at USD 16.24 billion in 2022 and is expected to reach USD 16.80 billion in 2023.

b. The U.S. prefabricated steel market is expected to grow at a compound annual growth rate of 5.7% from 2023 to 2030 to reach USD 25.37 billion by 2030.

b. Non-residential dominated the U.S. prefabricated steel market with a revenue share of over 60.0% in 2022, owing to the growing significance of modular construction in the hospitality and healthcare industries.

b. Some of the key players operating in the U.S. prefabricated steel market include BMarko Structures Inc., Panel Built, Inc., SteelCell of North America, Inc., Vanguard Modular Building Systems, and Z Modular.

b. Increasing real-estate prices in the Northeast and West U.S. is compelling contractors and builders to switch to prefabrication and modular option. Rising costs of constructing structures using conventional processes is driving market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."