- Home

- »

- Next Generation Technologies

- »

-

U.S. Print On Demand Market Size & Share Report, 2030GVR Report cover

![U.S. Print On Demand Market Size, Share & Trends Report]()

U.S. Print On Demand Market (2023 - 2030) Size, Share & Trends Analysis Report By Platform (Software, Services), By Product(Apparel, Home Decor), And Segment Forecasts

- Report ID: GVR-4-68040-041-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

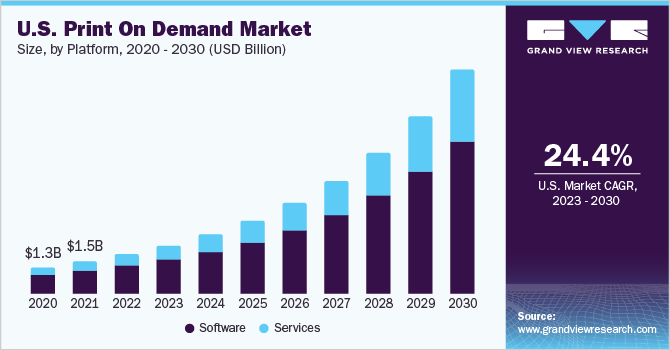

The U.S. print on demand market size was valued at USD 1,890.1 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 24.4% from 2023 to 2030. The country is home to a thriving e-commerce industry, which has made it easier for consumers to access and purchase print on demand products. In addition, the U.S. is home to a large number of creative professionals, including artists, designers, and entrepreneurs, who are taking advantage of the print on demand model to sell their work and build their businesses. The rising levels of disposable income of consumers in the U.S. are playing a significant role in driving the growth of the market. According to Trading Economics, the personal disposable income in the U.S. was about USD 19,594.7 USD billion in the year Jan 2023. In other words, the rising levels of disposable income of consumers in the U.S. are allowing consumers to spend aggressively on non-essential items, thereby driving the growth of the market. The rising levels of disposable income and the subsequent growth in spending on customized and personalized products are expected to open new opportunities for businesses and entrepreneurs considering a foray into the print on demand market.

Print on demand provides consumers with an easy and accessible way to create and purchase unique products. With print on demand, consumers can design their own t-shirts, hoodies, and other clothing items with graphics, texts, and images of their choice. Customization is typically making print on demand an attractive option for fashion-conscious consumers who look forward to express their individuality through their clothing. In other words, the growing preference for customized fashion apparel and unique products has been playing a niche role in driving the growth of the print on demand market in the U.S. Print on demand platforms provide businesses with a cost-effective and accessible way to create and sell personalized and unique products.

COVID-19 Impact on the U.S. Print on Demand Market

The outbreak of COVID-19 played a crucial role in driving the growth of the U.S. print on demand market. According to Printful Inc.’s 2021 survey of 485 Printful Inc. store owners, 75% of the respondents said that the outbreak of the pandemic prompted them to start their online businesses and 45% of the respondents witnessed an unexpected growth in sales. Printify, Inc. introduced new features, such as order routing and order import, to help businesses in adapting to COVID-19-induced challenges. Order routing refers to the process of transmitting orders for financial securities, such as stocks or bonds, from an investor or trader to the appropriate market or exchange for execution whereas order import refers to the process of importing orders for financial securities into a trading system or platform for execution.

On the other hand, as people were unable to shop in stores due to the lockdowns and restrictions on the movement of people, clothing and clothing accessories stores had to confront an over 25% decline in sales between 2019 and 2020 according to the U.S. Census Bureau’s 2020 annual retail trade survey. Lockdowns and restrictions on the movement of people particularly prompted people to opt for online shopping for print on demand products, such as clothes and accessories, thereby contributing to the growth of the market.

Platform Insights

In terms of platform, the market is classified into software, and services. The software segment dominated the overall market, gaining a market share of 71.5% in 2022. Integrated software, the sub-segment of software platform, dominated the overall market, gaining a market share of 59.6% in 2022. The software segment is further bifurcated into integrated and standalone. The integrated print on demand software platforms is the platforms that integrate with other e-commerce platforms such as Shopify; WOOCOMMERCE; BigCommerce Pty. Ltd.; Wix.com, Inc; and SQUARESPACE. These platforms also integrate with marketplaces such as Amazon.com, Inc; Etsy, Inc.; and eBay Inc. Some U.S.-based print on demand market players such as Printful Inc. and Printify, Inc. own custom Application Programming Interfaces (API) to integrate the seller website with their platform for order processing and management.

The services segment is anticipated to emerge as the fastest growing segment over the forecast period. Print on demand services includes printing services, warehousing & fulfillment, and drop shipping among others. U.S.-based players such as PRINTED MINT provides these services. For instance, whenever a customer creates a design and places a print on demand order on a print on demand platform, the company manufactures the product and ships it to the customer's doorstep. This does not necessitate merchants to be concerned about inventory and logistics.

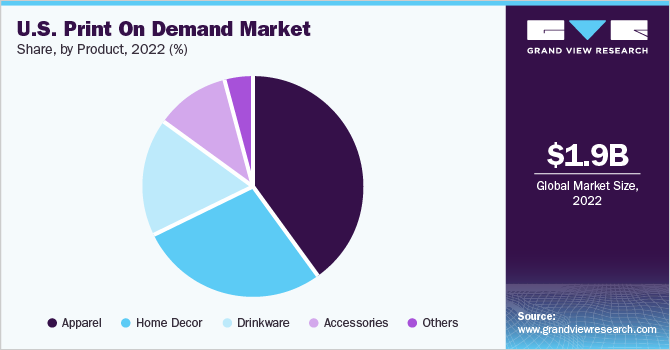

Product Insights

In terms of products, the market is classified into apparel, home decor, aerospace & defense, drinkware, accessories, and others. Among these, the apparel print on demand market is expected to dominate in 2022, gaining a market share of 39.7%. The expansion is primarily due to a shift toward fashion apparel and rapid penetration of fashion in the e-commerce space. According to Printify, Inc., a U.S.-based company, apparel was the highest-selling product group on its platform in September 2021 and accounted for 62.38% of the total items sold. With the increase in online retailing and e-commerce, the apparel segment has experienced increased sales. The products in the apparel segment include t-shirts, dresses, leggings, kids & babywear, swimwear, and sweaters. The users can design and customize their apparel using custom design software such as Canva or the design maker tools provided by print on demand service providers such as Printful Inc.

The home decor segment is anticipated to exhibit the fastest CAGR of 26.0% through the forecast period. The home and living category became popular due to the lockdown restrictions during the pandemic. According to Printify, Inc.’s 2021 e-commerce statistics, the company’s home and living product category experienced a growth of approximately 244% in the first six months of 2020. Furthermore, the home décor segment is anticipated to experience significant growth in the upcoming years as working from home became a norm. Moreover, factors such as the increasing popularity of custom interior home designs and the trend of gifting custom wall décor products are driving the segment growth. The products offered under this category include wall art posters, canvases, pillows, and floor mats.

Key Companies & Market Share Insights

The market is fairly fragmented and is anticipated to witness intense competition due to several players' presence. Market players are focused on increasing investments and product developments to improve the performance of their print on demand platforms. Companies are engaged in the adoption of strategic initiatives such as partnerships & collaborations and new product developments to gain a competitive edge in the market. For instance, in November 2021, Printful Inc. announced a partnership with Uruguay-based design platform Vexels, which offers merchandise and commercial use graphics and design services. The partnership would help integrate designs into Printful Inc.’s designing tool, further enabling customers to use and make high-quality designs. Some of the prominent players in the U.S. print on demand market include

-

Printify, Inc.,

-

AMPLIFIER,

-

VistaPrint (Cimpress),

-

PRINTED MINT

-

Spreadgroup

-

Teelaunch

-

Zazzle, Inc.

-

apliiq

-

JetPrint Fulfillment

-

Gooten

-

CustomCat

-

Gelato

Recent Development

- In June 2022, Gooten announced a strategic partnership with Fujifilm to provide print-on-demand solutions for retailers, small businesses, and online merchants

U.S. Print On Demand Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2,316.7 million

Revenue forecast in 2030

USD 10.66 billion

Growth rate

CAGR of 24.4% from 2023 to 2030

Historic year

2017 - 2021

Base year for estimation

2022

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Platform, product

Key companies profiled

Printify; Inc.; AMPLIFIER; CustomCat; Gelato; VistaPrint (Cimpress); Gooten; spreadgroup; PRINTED MINT; teelaunch; Printful Inc.; Zazzle Inc.; apliiq; JetPrint Fulfillment; Redbubble Group

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Print On Demand Market Segmentation

This report forecasts market revenue growth at a country level and offers an analysis of the qualitative and quantitative market trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. print on demand market report based on platform, and product

-

Platform Outlook (Revenue, USD Million; 2017 - 2030)

-

Software

-

Stand-alone

-

Integrated

-

-

Services

-

-

Product Outlook (Revenue, USD Million; 2017 - 2030)

-

Apparel

-

Home Decor

-

Drinkware

-

Accessories

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. print on demand market size was estimated at USD 1,890.1 million in 2022 and is expected to reach USD 2,316.7 million in 2023.

b. The U.S. print on demand market is expected to grow at a compound annual growth rate of 24.4% from 2023 to 2030 to reach USD 10.66 billion by 2030.

b. The software platform segment led the U.S. print on demand market and accounted for more than 71% of the revenue in 2022.

b. The key players in the U.S. print on demand market include CustomCat, Gelato, VistaPrint (Cimpress), Gooten, AMPLIFIER, Spreadgroup, PrintedMint, Teelaunch, Zazzle, Inc., and RedBubble Group.

b. The increasing demand for personalized and customized apparel, along with increasing disposable income in the country, are some of the significant factors driving the demand for on demand printing solutions and services.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.