- Home

- »

- Biotechnology

- »

-

U.S. Protein Purification And Isolation Market Report, 2033GVR Report cover

![U.S. Protein Purification And Isolation Market Size, Share & Trends Report]()

U.S. Protein Purification And Isolation Market (2025 - 2033) Size, Share & Trends Analysis Report By Products (Instruments, Consumables), By Application (Drug Discovery, Toxicology Research), By Technology, By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-242-8

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

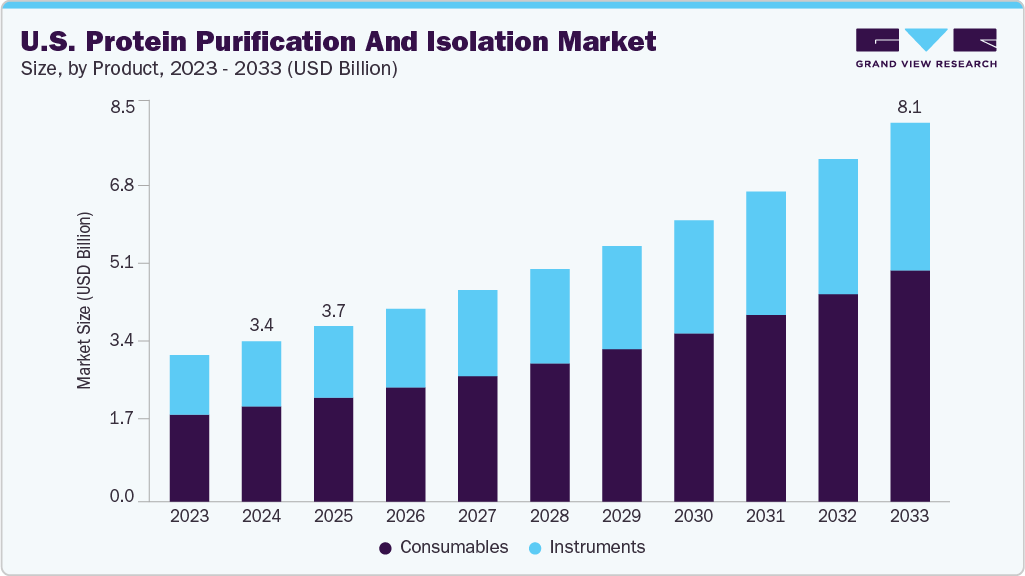

The U.S. protein purification and isolation market size was valued at USD 3.41 billion in 2024 and is projected to reach USD 8.06 billion by 2033, growing at a CAGR of 10.09% from 2025 to 2033, driven by increasing demand for biopharmaceuticals, advancements in protein-based research, and the rising need for high-purity biologics in clinical and diagnostic applications.

Increased Research in Proteomics and Genomics

The rapid progress in proteomics and genomics research is a key driver of the U.S. protein purification and isolation market. As understanding grows that proteins, not just genes, are central to disease mechanisms, drug responses, and cellular functions, there has been a notable shift toward large-scale protein studies. Proteomics, which involves the detailed analysis of protein structure, function, and interactions, depends on high-quality, purified proteins to accurately study complex biological systems. Similarly, genomics research, especially functional genomics, often requires the expression of recombinant proteins to explore gene functions. Consequently, both fields are placing increasing demands on protein purification technologies to ensure consistency, efficiency, and high yields of biologically active proteins.

The surge in funding for academic and commercial research institutions has further fueled this trend. Initiatives like the Human Proteome Project and technological advances have sped up discovery, creating a greater demand for tools that can isolate and purify a wide range of proteins quickly and accurately. Additionally, emerging fields such as synthetic, structural, and systems biology heavily depend on precise protein isolation techniques. These advancements emphasize the essential role of protein purification in life sciences research and highlight its growing importance across various scientific disciplines, making it a key factor propelling the U.S. market forward.

Rising Demand from the Diagnostic Sector

Increasing demand from the diagnostic sector is a key driver of growth in the U.S. protein purification and isolation industry. Modern diagnostic assays, especially those based on enzymes, antibodies, and other protein biomarkers, need highly purified proteins for accurate and reliable results. As the burden of chronic diseases, infectious outbreaks, and the need for early disease detection increases, there is a growing focus on developing high-performance diagnostic tools. These tools often rely on purified proteins to identify disease-specific markers with high sensitivity and specificity, which in turn boosts demand for advanced purification technologies.

Furthermore, the rapid growth of point-of-care (POC) testing and personalized diagnostics has increased the demand for scalable, cost-effective protein purification solutions. POC tests, such as lateral flow assays and biosensors, need stable and high-purity proteins to work effectively outside traditional laboratory settings. These trends drive continuous expansion in the protein purification and isolation market.

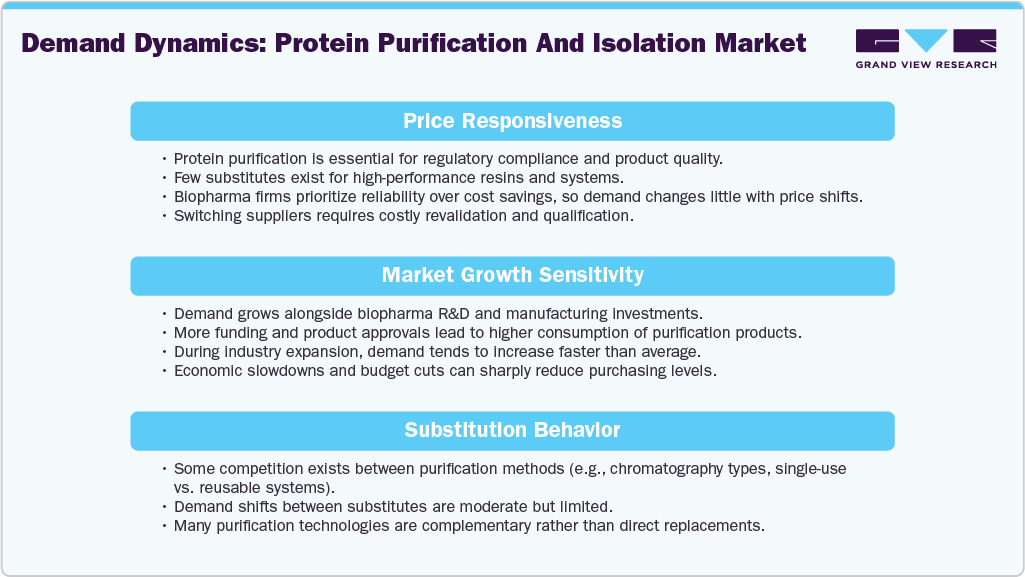

Demand Dynamics

Factors like price responsiveness, market growth sensitivity, and substitution behavior influence demand dynamics in the U.S. protein purification and isolation market. Understanding these elements is crucial for stakeholders to manage market fluctuations, refine strategies, and seize emerging opportunities effectively. These dynamics also demonstrate changing customer preferences, technological progress, and competitive pressures that shape the industry's future growth and innovation.

The section below illustrates the critical factors influencing demand behavior in the U.S. protein purification and isolation market, providing insight into how price, growth trends, and substitution impact the market demand.

Market Concentration & Characteristics

The U.S. protein purification and isolation industry is characterized by a high degree of innovation, driven by advancements in automation, chromatography, and microfluidics technologies. Cutting-edge systems now incorporate AI and robotics to enable high-throughput, precise, and scalable protein purification processes that meet the demands of complex biopharmaceutical manufacturing and proteomics research. Moreover, emerging techniques such as membrane-based purification and lab-on-a-chip platforms are improving speed and efficiency while reducing costs. Innovations also focus on sustainability, with eco-friendly methods gaining popularity. Such technological developments enhance protein purification's accuracy, scalability, and versatility, fueling growth across drug development, diagnostics, and personalized medicine.

The U.S. protein purification and isolation market is experiencing high merger and acquisition (M&A) activity, reflecting broader consolidation trends in the life sciences and biotechnology tools sector. For instance, in February 2025, Thermo Fisher Scientific acquired Solventum’s purification and filtration business, supporting its biologics manufacturing portfolio. Major players are acquiring assets that enhance their end-to-end capabilities in biologics production, diagnostics, and precision medicine, making M&A a key driver shaping the competitive landscape of the U.S. protein purification and isolation industry.

Regulatory frameworks in the U.S. play a crucial role in shaping the protein purification and isolation industry, particularly due to the industry’s close ties to biopharmaceutical manufacturing, clinical diagnostics, and therapeutic protein development. Agencies like the FDA and NIH set stringent quality, safety, and efficacy standards for biologics and protein-based drugs, requiring highly purified proteins that meet Good Manufacturing Practice (GMP) and quality control specifications. These regulations drive innovation in purification technologies to ensure compliance with evolving expectations around contamination control, batch consistency, and product traceability. Compliance pressure acts as a barrier to entry and a catalyst for innovation, pushing companies to adopt more sophisticated, validated purification methods to remain competitive in regulated markets.

Product expansion is a key growth strategy in the U.S. protein purification and isolation market, driven by biologics' increasing complexity, proteomics advancements, and the rising demand for customizable purification solutions. Companies are broadening their product portfolios to include next-generation chromatography resins, membrane-based systems, magnetic bead technologies, and fully integrated automated platforms. These new offerings are designed to improve specificity and scalability, essential for supporting applications ranging from early-stage R&D to large-scale bio-manufacturing. Ongoing innovation enhances workflow efficiency and consistency and allows providers to serve a wider customer base across pharmaceuticals, academic research, and diagnostics.

Product Insights

Consumables led the U.S. protein purification and isolation industry in 2024, due to their vital role in laboratory and industrial processes. This wide category includes reagents, assay kits, resins, columns, magnetic beads, and essential components that support routine and large-scale protein isolation with consistency, reproducibility, and compatibility across various purification systems. Their continual use in research, diagnostics, and biomanufacturing drives steady demand, as they deliver reliable results and meet regulatory standards. To support this trend, companies are also innovating within the consumables sector to achieve sustainability goals.

Instruments are expected to show significant growth during the forecast period due to the advancement of precise, sensitive, and portable instruments. This growth is further fueled by the increased utilization and commercialization of cutting-edge equipment for protein analysis, ensuring accurate outcomes. The emphasis on technological innovation and the demand for more efficient purification methods are driving the expansion of this segment.

Technology Insights

Chromatography dominated the market and held the largest revenue share of 29.07% in 2024. This technique is highly accurate and sensitive for protein isolation and purification. As a result, many companies focus on launching new products based on this technology to broaden their product range. For instance, in March 2023, Waters Corporation launched its next-generation Alliance is HPLC System in the U.S., enhancing chromatography workflows by reducing up to 40% of common lab errors through smart automation. The availability of various chromatography techniques suitable for a wide range of applications further propels the segment’s growth.

Electrophoresis is growing with a significant rate during the forecast period, due to its effectiveness in separating proteins based on various properties like size, charge, and shape, allowing for precise purification. This technique is crucial for protein characterization, ensuring sample purity, and enabling detailed analysis of proteins. Electrophoresis, particularly gel electrophoresis, is widely used in laboratories for its ability to separate proteins efficiently, making it a fundamental step in proteomics analysis. The high resolution and accuracy of electrophoresis, especially in techniques like SDS-PAGE and 2D electrophoresis, contribute to its popularity and essential role in protein purification workflows.

Application Insights

Protein-protein interaction studies dominated the market and held the largest revenue share of 32.07% in 2024 due to their crucial role in understanding biological processes and developing targeted therapies. By investigating how proteins interact, researchers can uncover disease mechanisms, identify drug targets, and design more effective treatments. The emphasis on studying protein-protein interactions reflects a strategic approach to advancing biomedical research and drug development.

Drug screening is estimated to grow at the fastest CAGR during the forecast period. This process plays a crucial role in discovering new drugs with diverse applications. It involves creating more effective medicines with fewer side effects than traditional ones. Moreover, the rise in R&D investments by manufacturers in screening new drugs, particularly through structure-based studies and protein-protein interactions, is expected to fuel the growth of this segment.

End Use Insights

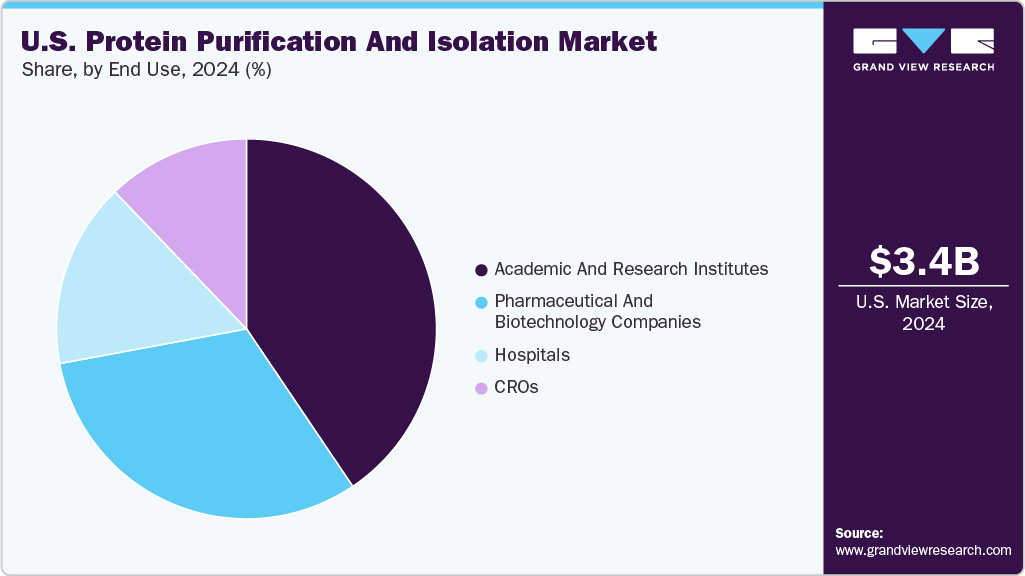

Academic and research institutes dominated the market and held the largest revenue share of 40.56% in 2024. This leadership is driven by the extensive use of protein purification technologies in fundamental research, drug discovery, and proteomics studies conducted within universities and research centers. The continuous advancement in molecular biology, genomics, and biotechnology fuels demand for reliable and high-quality purification tools in these settings. Moreover, strong funding support from government agencies and private organizations enables academic institutions to invest in cutting-edge equipment and consumables, further solidifying their significant contribution to the market’s revenue.

Hospitals are expected to witness the fastest growth over the forecast period due to their significant role in various medical applications. These products are essential for studying protein structure, function, and interactions and are vital for diagnostics, therapeutics, and research. They are used in drug development, studying protein interactions, and researching protein-based therapeutics, all crucial for medical advancements. The demand for high-quality proteins in pharmaceuticals and biotechnology, often used in hospitals, further drives the need for these products. Thus, the high demand for these products in hospitals stems from proteins' critical role in various medical applications.

Key U.S. Protein Purification and Isolation Company Insights

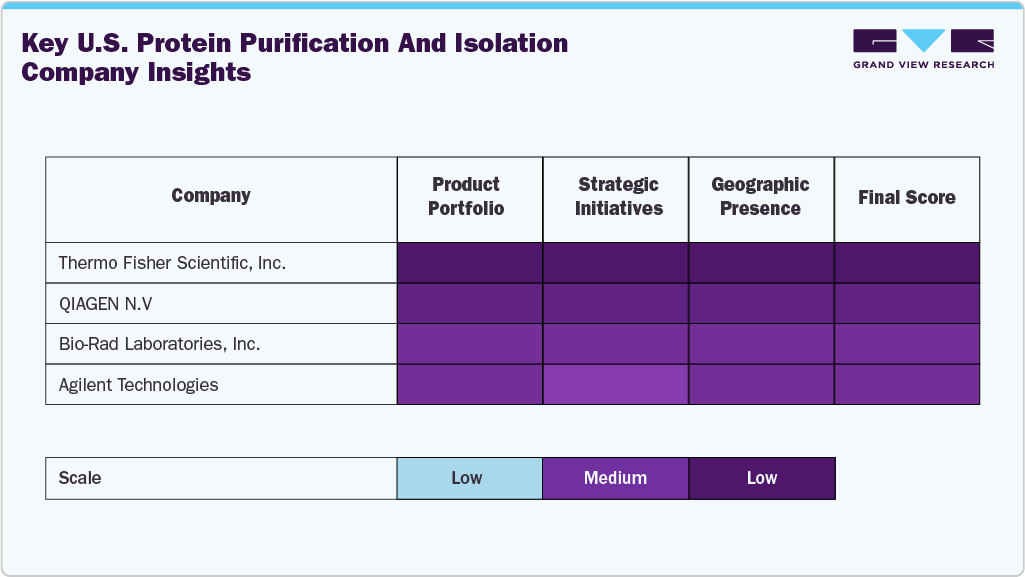

The U.S. protein purification and isolation industry is led by well-established companies that maintain dominance through strong product portfolios, strategic partnerships, and ongoing investment in research and development. Major players such as Thermo Fisher Scientific, Merck KGaA, QIAGEN N.V., Bio-Rad Laboratories, and Agilent Technologies have gained significant market share by offering advanced purification systems, chromatography resins, consumables, and integrated workflow solutions. Their wide range of applications and extensive global distribution networks enable them to serve various sectors, including biopharmaceutical manufacturing, academic research, and diagnostics.

Emerging and specialized companies like Promega Corporation, Norgen Biotek Corp., Abcam plc, Cube Biotech GmbH, and Danaher are expanding their presence by offering innovative and customizable protein purification products and services. These companies focus on meeting the changing needs of research institutions, biotech startups, and pharmaceutical firms through new technologies such as affinity chromatography, membrane filtration, and automated purification platforms, improving efficiency and scalability.

Leading organizations continue to dominate the market by combining cutting-edge purification technologies with comprehensive service offerings and strategic growth initiatives, including mergers and acquisitions and partnerships. They have solidified their positions by meeting the rising demand for high-purity proteins in drug development, proteomics, diagnostics, and personalized medicine applications. As the market responds to increasing investments in biologics, cell and gene therapies, and precision diagnostics, future growth will be shaped by commitments to process optimization, sustainability, and regulatory compliance.

The U.S. protein purification and isolation market is witnessing a dynamic interplay between established industry leaders and innovative challengers. Ongoing technological advancements, strategic alliances, and consolidation activities are intensifying competition. Companies that successfully integrate scientific innovation with tailored, customer-focused solutions are best positioned to create sustained value in this rapidly evolving sector.

Key U.S. Protein Purification And Isolation Companies:

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- QIAGEN

- Bio-Rad Laboratories, Inc.

- Agilent Technologies, Inc.

- Cube Biotech GmbH

- Promega Corporation

- Norgen Biotek Corp.

- Takara Bio. Inc.

- Danaher

Recent Developments

-

In April 2025, QIAGEN announced plans to launch three new sample preparation instruments by 2026, enhancing lab automation with improved efficiency, sustainability, and scalability across various needs.

-

In January 2025, Bio-Rad expanded its Foresight Pro chromatography columns with a 45 cm ID option, enhancing scalable, GMP-ready purification for biotherapeutics like vaccines and antibodies.

U.S. Protein Purification And Isolation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.74 billion

Revenue forecast in 2033

USD 8.06 billion

Growth rate

CAGR of 10.09% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, end use

Key companies profiled

Thermo Fisher Scientific, Inc.; Merck KGaA; QIAGEN; Bio-Rad Laboratories, Inc.; Agilent Technologies; Cube Biotech GmbH; Promega Corporation; Norgen Biotek Corp.; Abcam plc; Danaher

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

U.S. Protein Purification And Isolation Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For the purpose of this report, Grand View Research has segmented the U.S. protein purification and isolation market on the basis of product, technology, application, and end use.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Instruments

-

Consumables

-

Kits

-

Reagents

-

Columns

-

Magnetic Beads

-

Resins

-

Others

-

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Ultrafiltration

-

Precipitation

-

Chromatography

-

Ion Exchange Chromatography

-

Affinity Chromatography

-

Reversed Phase Chromatography

-

Size Exclusion Chromatography

-

Hydrophobic Interaction Chromatography

-

-

Electrophoresis

-

Gel Electrophoresis

-

Isoelectric Focusing

-

Capillary Electrophoresis

-

-

Western Blotting

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Drug Screening

-

Biomarker Discovery

-

Protein-Protein Interaction Studies

-

Diagnostics

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Academic And Research Institutes

-

Hospitals

-

Pharmaceutical And Biotechnology Companies

-

CROs

-

Frequently Asked Questions About This Report

b. The U.S. protein purification and isolation market size was estimated at USD 3.41 billion in 2024.

b. The U.S. protein purification and isolation market is projected to reach USD 8.06 billion by 2033. This growth reflects a compound annual growth rate (CAGR) of 10.09% from 2025 to 2033

b. Chromatography dominated the market and held the largest revenue share of 29.07% in 2024. This technique is highly accurate and sensitive for protein isolation and purification. As a result, many companies focus on launching new products based on this technology to broaden their product range.

b. Some prominent players in the U.S. protein purification and isolation market include Thermo Fisher Scientific, Inc.; Merck KGaA; QIAGEN; Bio-Rad Laboratories, Inc.; Agilent Technologies; Cube Biotech GmbH; Promega Corporation; Norgen Biotek Corp.; Abcam plc; Danaher

b. The demand for protein purification and isolation is fueled by increasing demand for biopharmaceuticals, advancements in protein-based research, and the rising need for high-purity biologics in clinical and diagnostic applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.