- Home

- »

- Advanced Interior Materials

- »

-

U.S. PVC And CPVC Pipe Fittings Market Size Report, 2033GVR Report cover

![U.S. PVC And CPVC Pipe Fittings Market Size, Share & Trends Report]()

U.S. PVC And CPVC Pipe Fittings Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Polyvinyl Chloride (PVC), Chlorinated Polyvinyl Chloride (CPVC)), By End-use Industry (Residential, Commercial, Industrial), And Segment Forecasts

- Report ID: GVR-4-68040-685-7

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. PVC And CPVC Pipe Fittings Market Summary

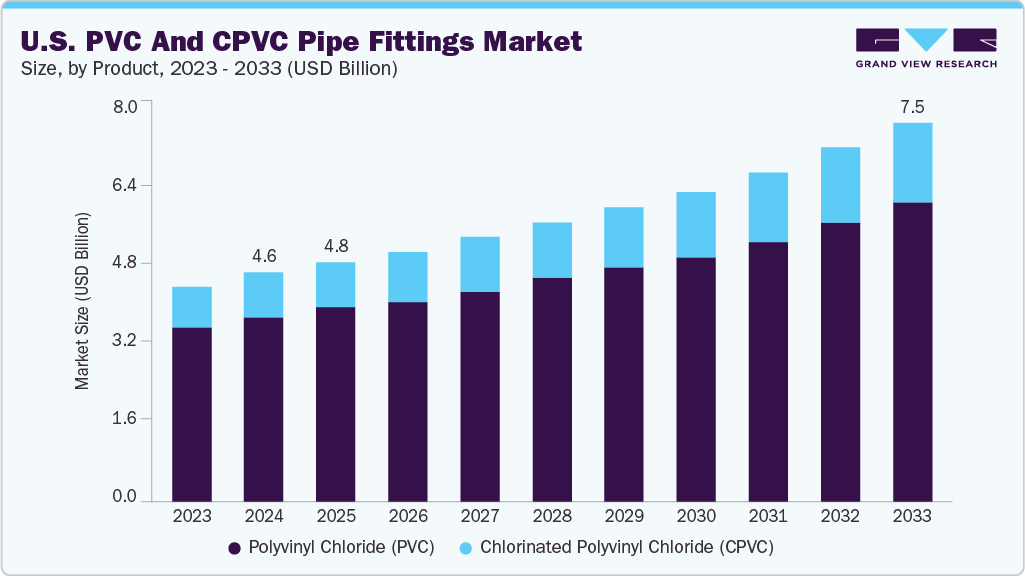

The U.S. PVC and CPVC pipe fittings market size was estimated at USD 4.59 billion in 2024 and is expected to reach USD 7.54 billion by 2030, growing at a CAGR of 5.8% from 2025 to 2033, driven by the need to upgrade and replace aging water infrastructure across the country. Many municipal systems, particularly in older cities, are operating beyond their intended service life, prompting local governments and utilities to invest in more reliable, cost-effective alternatives.

Key Market Trends & Insights

- By product, chlorinated polyvinyl chloride (CPVC) segment is expected to grow at the fastest CAGR of 6.6% over the forecast period.

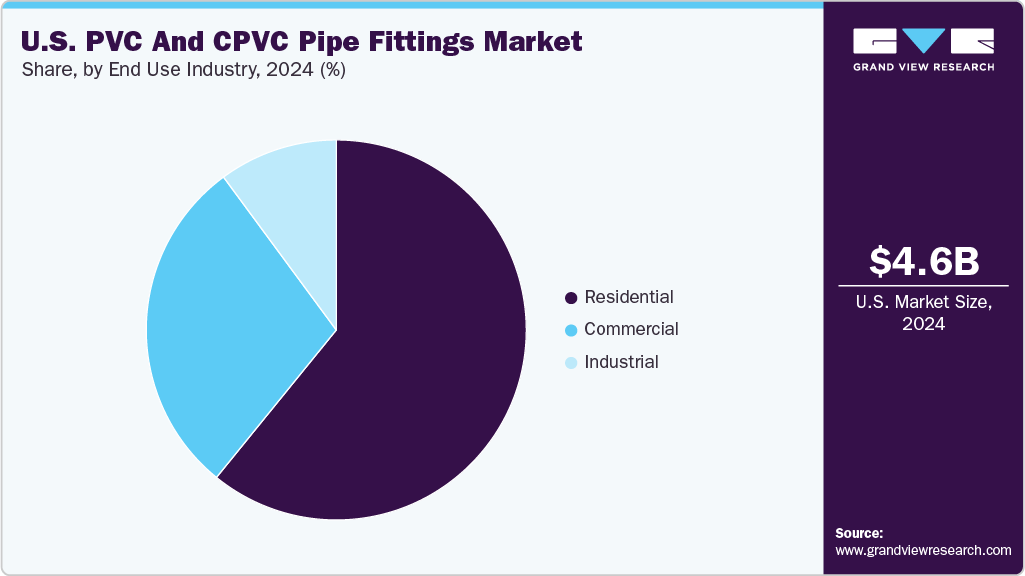

- By end use industry, residential segment held the highest revenue of 60.84% in 2024 in the U.S. market

Market Size & Forecast

- 2024 Market Size: USD 4.59 Billion

- 2033 Projected Market Size: USD 7.54 Billion

- CAGR (2025-2033): 5.8%

Polyvinyl chloride (PVC) and chlorinated polyvinyl chloride (CPVC) materials offer excellent resistance to corrosion and scaling, making them ideal for water distribution and wastewater management systems. Their long lifespan and low maintenance requirements contribute to lower lifecycle costs, supporting increased adoption in public infrastructure projects.Another significant driver is the growing demand for sustainable and energy-efficient construction in the residential and commercial sectors. PVC and CPVC pipe fittings are lightweight, easy to install, and offer superior insulation properties, aligning with the industry’s goals of reducing material waste and energy consumption. In residential plumbing, CPVC fittings are particularly favored for hot and cold water systems due to their thermal resistance and long-term performance. With the expansion of urban housing developments and smart city initiatives, the demand for these advanced piping systems is expected to remain strong.

In the commercial and industrial domains, stricter building codes and safety regulations have boosted the use of CPVC fittings, especially in applications involving fire sprinkler systems and chemical transport. CPVC’s ability to withstand high temperatures and aggressive substances without compromising structural integrity makes it a preferred material in hospitals, hotels, laboratories, and manufacturing plants. Furthermore, industries are increasingly prioritizing non-metallic solutions to prevent corrosion-related failures and ensure uninterrupted operations, further accelerating market demand.

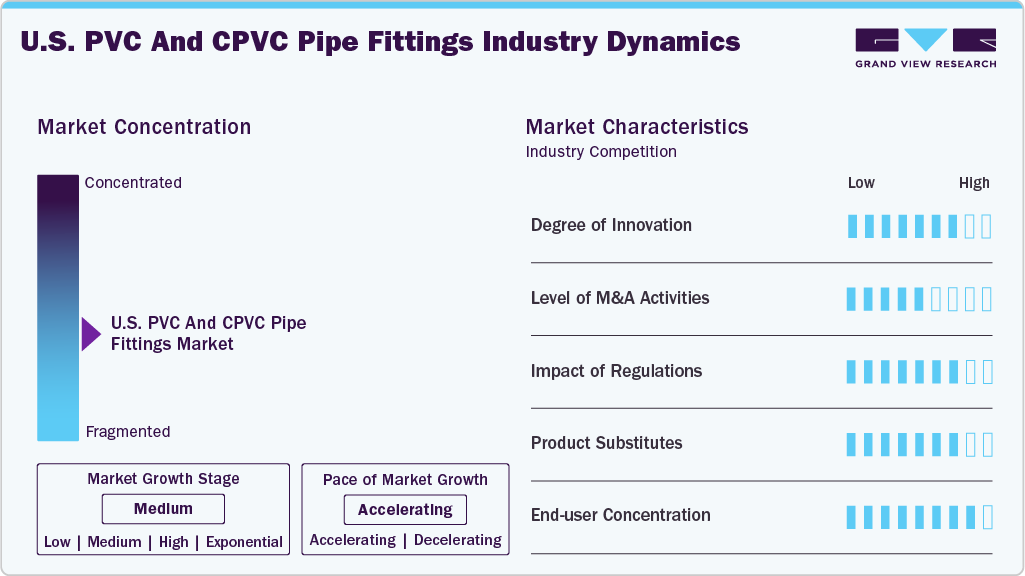

Market Concentration & Characteristics

The PVC and CPVC pipe fittings market exhibits a moderately concentrated structure, with several key players holding substantial revenue shares across regions. The degree of innovation is steady, marked by continuous improvements in material formulations, pressure ratings, and jointing technologies to enhance durability, ease of installation, and performance in harsh conditions. Players are increasingly investing in R&D to develop eco-friendly and lead-free alternatives that align with sustainability goals. The market has also witnessed strategic collaborations and partnerships aimed at technology transfer and expanding production capacity, thereby supporting innovation-led growth.

Mergers and acquisitions play a significant role in shaping the competitive landscape, with companies seeking to consolidate operations, expand their geographic footprint, and gain technological advantages. Regulatory policies governing potable water safety, chemical handling, and construction standards significantly influence the market, necessitating compliance with standards like ASTM, NSF, and UPC. Despite the presence of metal piping and PEX (cross-linked polyethylene) as product substitutes, PVC and CPVC maintain a strong foothold due to cost-effectiveness and chemical resistance. End use concentration is diverse, spanning residential, commercial, and industrial sectors, with growing infrastructure investments further enhancing demand consistency.

Product Insights

The polyvinyl chloride (PVC) segment held the highest revenue share of 80.56% in 2024, driven by its widespread adoption in water distribution, drainage, and irrigation systems due to its cost-effectiveness, chemical resistance, and ease of installation. The durability and corrosion resistance of PVC make it a favorable choice in municipal and residential plumbing applications, while the material’s compatibility with various jointing techniques supports efficient system assembly. Furthermore, rising emphasis on water conservation and sustainable infrastructure has bolstered the demand for PVC piping in both new and retrofit projects.

The chlorinated polyvinyl chloride (CPVC)segment is expected to grow at the fastest CAGR of 6.6% over the forecast period, driven by its superior thermal resistance and strength under high-pressure and high-temperature conditions, making it ideal for hot water distribution and industrial fluid handling. CPVC is widely used in fire sprinkler systems, chemical processing, and commercial HVAC piping, benefiting from strict compliance with national safety codes such as NFPA and IAPMO standards. Increasing awareness of the benefits of non-metallic alternatives in corrosive environments and the material’s long lifecycle are key drivers accelerating the adoption of CPVC fittings in both residential and industrial settings.

End use Industry Insights

Residential segment held the highest revenue of 60.84% in 2024 in the U.S. market, driven by robust housing development, ongoing renovations, and government incentives for plumbing modernization. The growing trend of replacing aging metal pipes with thermoplastic alternatives has led to increased adoption of PVC and CPVC fittings due to their affordability, longevity, and resistance to corrosion. Moreover, heightened consumer awareness regarding lead-free and safe potable water systems is driving demand for certified plastic piping systems in newly constructed homes and retrofits.

Commercial segment is expected to grow significantly at CAGR of 5.7% over the forecast period, driven by large-scale construction projects, including office buildings, hotels, healthcare facilities, and educational institutions. The material’s versatility, lightweight nature, and ease of transport make it a preferred choice for contractors seeking efficient and cost-effective piping systems. CPVC, in particular, is favored for hot and cold water systems and fire protection applications in commercial buildings due to its compliance with building safety codes. Increasing investments in commercial infrastructure upgrades and green building certifications further reinforce the segment’s growth trajectory.

Key U.S. PVC And CPVC Pipe Fittings Company Insights

Some key players operating in the U.S. market include Charlotte Pipe, Foundry Company, and Nibco Inc.

-

Charlotte Pipe and Foundry Company is a prominent U.S.-based manufacturer of plastic and cast iron pipe and fittings. The company offers a wide portfolio of PVC and CPVC fittings designed for applications in plumbing, drainage, and fire protection systems. Their products are known for compliance with ASTM and NSF standards and are widely used in residential and commercial settings for both hot and cold water supply systems.

-

Nibco Inc. is a leading manufacturer of flow control solutions including valves, fittings, and piping systems. In the PVC and CPVC segment, Nibco offers an extensive line of pressure-rated pipe fittings suitable for potable water distribution, chemical processing, and industrial fluid systems. The company emphasizes engineered thermoplastics that provide heat resistance, chemical durability, and long service life.

Lubrizol Corporation, IPEX Inc. are some emerging market participants in the PVC and CPVC pipe fittings market.

-

Lubrizol Corporation, through its FlowGuard® and Corzan® product lines, specializes in CPVC compound technologies. Its CPVC pipes and fittings are widely adopted for residential plumbing and commercial fire sprinkler systems, recognized for high temperature tolerance, corrosion resistance, and pressure handling. Lubrizol licenses its technology to partner manufacturers, ensuring a wide market presence across North America.

-

IPEX Inc. provides integrated piping solutions with a strong focus on thermoplastic systems. Its PVC and CPVC product offerings include fittings for potable water, DWV (drain, waste, and vent), and industrial applications. The company’s fittings are known for high performance, safety certifications, and compatibility with modern construction standards, serving both new construction and retrofit markets.

Key U.S. PVC And CPVC Pipe Fittings Companies:

- Charlotte Pipe and Foundry Company

- Nibco Inc.

- Lubrizol Corporation

- IPEX Inc.

- Georg Fischer LLC

- Finolex Industries

- Supreme Industries

- Prince Pipes and Fittings Ltd

- Astral Limited

Recent Developments

-

In August 2024, Aliaxis strengthened its footprint in the Southern United States by entering into a definitive agreement to acquire the CPVC pipe and fittings business of Johnson Controls, which serves residential and light commercial fire sprinkler systems.

U.S. PVC And CPVC Pipe Fittings Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.80 billion

Revenue forecast in 2033

USD 7.54 billion

Growth rate

CAGR of 5.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2021 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use industry

Country scope

U.S

Key companies profiled

Charlotte Pipe and Foundry Company; Nibco Inc.; Lubrizol Corporation; IPEX Inc.; Georg Fischer LLC; Finolex Industries; Supreme Industries; Prince Pipes and Fittings Ltd; Astral Limited.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. PVC And CPVC Pipe Fittings Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. PVC and CPVC pipe fittings market report based on material, and end use industry:

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Polyvinyl Chloride (PVC)

-

Chlorinated Polyvinyl Chloride (CPVC)

-

-

End use Industry Outlook (Revenue, USD Billion, 2021 - 2033)

-

Residential

-

Commercial

-

Industrial

-

Frequently Asked Questions About This Report

b. The U.S. PVC and CPVC pipe fittings market size was estimated at USD 4.59 billion in 2024 and is expected to reach USD 4.80 billion in 2025.

b. The U.S. PVC and CPVC pipe fittings market is expected to grow at a compound annual growth rate of 5.8% from 2025 to 2033 to reach USD 7.54 billion by 2033.

b. Residential segment held the highest revenue of 60.84% in 2024 in the U.S. market, driven by robust housing development, ongoing renovations, and government incentives for plumbing modernization

b. Some of the prominent companies in the PVC and CPVC pipe fittings market include Charlotte Pipe and Foundry Company, Nibco Inc., Lubrizol Corporation, IPEX Inc., Georg Fischer LLC, Finolex Industries, Supreme Industries, Prince Pipes and Fittings Ltd, and Astral Limited.

b. Key factors driving the U.S. PVC and CPVC pipe fittings market include rising demand for cost-effective and corrosion-resistant piping solutions in residential, commercial, and industrial infrastructure projects.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.