- Home

- »

- Next Generation Technologies

- »

-

U.S. Quality Management Software Market Size Report, 2030GVR Report cover

![U.S. Quality Management Software Market Size, Share & Trends Report]()

U.S. Quality Management Software Market (2024 - 2030) Size, Share & Trends Analysis Report By Solution (Complaint Handling, Employee Training, Audit Management), By Deployment (Cloud, On-premise), By Enterprise Size, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-201-3

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

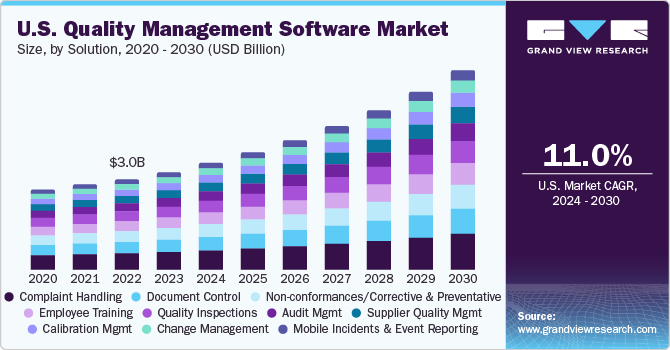

The U.S. quality management software market size was estimated at USD 3.28 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 11.0% from 2024 to 2030. Quality Management Software (QMS) aids business entities to manage their quality standards and comply with the processes to execute their day-to-day business operations relentlessly. Organizations adopt various quality management strategies and techniques, such as Six Sigma and ISO standards, to improve productivity, process effectiveness, and customer satisfaction. By following industry laws and standards, they ensure that they comply with the best practices. This has resulted in the U.S. market demand for integrating Quality Management Systems, which is driving the QMS market.

Quality management software helps businesses maintain industry standards to sustain their market presence. The need for organizations to improve their efficiency using artificial intelligence (AI) and machine learning (ML) is growing, which is helping end-use industries to enhance product quality by following industry standards. Therefore, the use of QMS surged in U.S. Businesses, which aids in quality management, checking supplied material standards, and other mandatory standard compliance management through automation. For instance, in September 2023, Rockwell Automation, a provider of industrial automation solutions, announced a 1-year partnership with BIC USA INC., a manufacturer of stationery products, to provide a Software-as-a-Service (SaaS) solution.

In addition, recently cloud-based quality management software is in high demand because it allows organizations to ensure remote access and high scalability. This, in turn, reduces the stress on the business functioning mechanism and enables businesses to execute operations in less time and with optimum resources. Additionally, cloud-based software can help in system automation, making it an attractive option for organizations looking to streamline their operations. As a result, high demand for cloud based QMS is fueling the growth of this market in U.S. Quality management software provides a better means for improving the process and operating margin by evaluating performance effectiveness and improving the quality of finished products. Additionally, it aids in the promotion of consistent and proper record-keeping by increasing employee awareness and reducing wastage and unnecessary expenses

Quality management software is a valuable tool for organizations to manage client complaints efficiently that helps to resolve complaints effectively and meet client expectations, which are essential for the growth and success of any organization. Therefore, usage of an integrated QMS enables organization to handle end-user clients efficiently, ensuring sustained business growth in the end

However, U.S. quality management software faces challenges regarding data security-related problems that may hinder market growth. On-premise and cloud-based quality management software are vulnerable to data breaches and cyber threats. When data is accessed unethically, it risks the privacy of the company, clients, and individuals. Businesses are increasing their investments in data backup centers and secondary storage devices to protect against critical data loss. Through this collaboration, clients can oversee the entire data security workflow and optimize compliance and data privacy. Integrating multiple data security components into a single workflow can help organizations gain a comprehensive overview and reduce the likelihood of vulnerabilities. This approach is expected to enhance overall productivity.

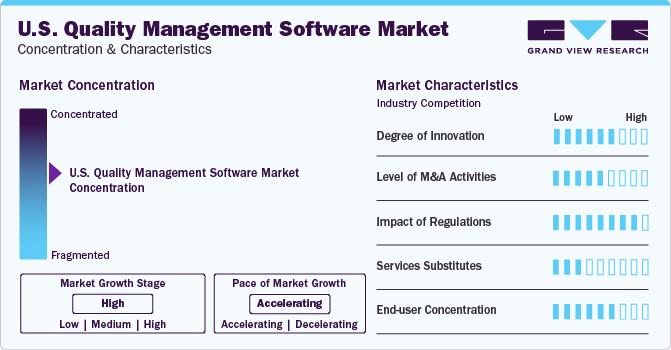

Market Concentration & Characteristics

The U.S. quality management software market is experiencing a high rate of growth, which is accelerating with each passing day. This is mainly due to the rise in the adoption of new technologies, such as cloud computing, analytics, and big data, which have become more prevalent in recent years. As a result, companies are increasingly turning towards quality management software based on these technologies to streamline their quality control processes. Thus, market looks fairly concentrated due to availability of products and services requires highest standards of quality.

Moreover, AI & ML are improving the scalability and cost-effectiveness of business entities. Increased automation integration in operations such as document categorization, data extraction, and intelligent search functionalities are helping the QMS market grow. The market is also witnessing high merger and acquisition (M&A) activities. For instance, in Jan 2024, a U.S.-based company, Zendesk, announced a completion of an agreement to acquire Klaus, an AI-powered QMS. It will help both entities to enhance their presence in United States.

The U.S. market is also subject to rules and regulations set by the regulatory bodies of the United States. An example, The FDA has issued the Quality Management System Regulation (QMSR) to modify the Current Good Manufacturing Practice (CGMP) requirements for medical devices under the Quality System (QS) regulation. This incorporates the international standard set by ISO 13485:2016, which outlines quality management systems for medical devices and is required for regulatory purposes. All market players operating in the market should abide by the regulations in the countries wherever they are applicable.

The reduced availability of quality management solutions has resulted in a lower threat of substitutes, but very few substitutes provide differentiated and customized solutions. The market has become highly competitive due to the emergence of industry-specific solutions for QMS, resulting in intense competition within each type of solution. There is a relatively high demand for solutions such as change management and non-conformance.

Furthermore, the market has diverse end-users, which include SMEs, and big organizations that cover a broad spectrum of industry verticals, such as the public sector, healthcare, media and entertainment, manufacturing and retail, finance and insurance, information technology (IT), and telecommunications. Organizations seek solutions that promote continuous improvement culture and compliance, optimizing workflows and boosting productivity.

Solution Insights

The complaint-handling segment held the largest revenue share of over 15.0% in 2023 and is expected to register a considerable CAGR of 12.8% over forecast period. Effective complaint management is crucial for businesses to meet customer expectations. Traditional tools and processes for complaint handling can help companies handle customer complaints efficiently, enabling them to remain successful. However, changing consumer behavior and purchasing patterns, along with the rising demand for personalized solutions, are compelling organizations to focus more on enhancing customer satisfaction to keep them engaged for more extended periods. Therefore, a robust complaint management system can help handle unique and complex customer queries, resolve their issues, and provide them with a delightful consumer experience.

Moreover, document control segment is showing significant growth from 2024 to 2030. Document control solutions in any company are critical while adhering to compliance. Organizations operating across various domains and industry verticals use this solution for structured management of documents used in the design, development, and manufacturing of products or the delivery of services. The solution helps create a central hub for all quality management documentation, thereby annulling the possibilities of misplacing critical documents, alerting stakeholders to various issues, streamlining corrective action processes, and minimizing risks by providing closed-loop quality management processes within a single system. It also improves information security, increases transparency across various business domains, and ensures the growth of QMS market.

Deployment Insights

The cloud segment accounted for the largest revenue share of over 50.0% in 2023. The cloud segment is poised for the fastest growth over the forecast period. Also, Cloud-based quality management software is hosted on the cloud, and it can be accessed using a web browser. In a cloud-based deployment, the vendor is responsible for managing all system upgrades. This makes it easy for end-users to access data from any location. The flexibility and mobility offered by cloud-based QMS have driven their widespread adoption. Moreover, cloud-based deployment eliminates the need for end-users to invest in dedicated hardware, which significantly reduces costs.

However, the demand for on-premise software is decreasing, and more companies are opting for cloud-based Quality Management System (QMS) solutions. However, some companies need help accessing or affording cloud services. The market is observing changes as businesses transition from manual to automated systems. On-premise deployment of QMS allows for greater customization to the client's business requirements. Businesses that prioritize high levels of data protection tend to prefer on-premise QMS deployment to mitigate the risks associated with the loss of sensitive information and critical company data. Therefore, it is evident that both on-premise and cloud deployments will contribute to the growth of the QMS Market.

Enterprise Size Insights

The large enterprises segment accounted for the largest revenue share of over 60.0% in 2023. Big companies need a unified system to oversee their business operations on a single platform. Quality Management System (QMS) solutions enable them to maintain authority over processes and aid in implementing a deployment across the entire organization. The cost-effectiveness of QMS solutions is one of the key drivers behind their adoption by large enterprises.

However, U.S. quality management software faces challenges regarding data security-related problems that may hinder market growth. On-premise and cloud-based quality management software are vulnerable to data breaches and cyber threats. When data is accessed unethically, it risks the privacy of the company, clients, and individuals. Businesses are increasing their investments in data backup centers and secondary storage devices to protect against critical data loss. Through this collaboration, clients can oversee the entire data security workflow and optimize compliance and data privacy. Integrating multiple data security components into a single workflow can help organizations gain a comprehensive overview and reduce the likelihood of vulnerabilities. This approach is expected to enhance overall productivity.

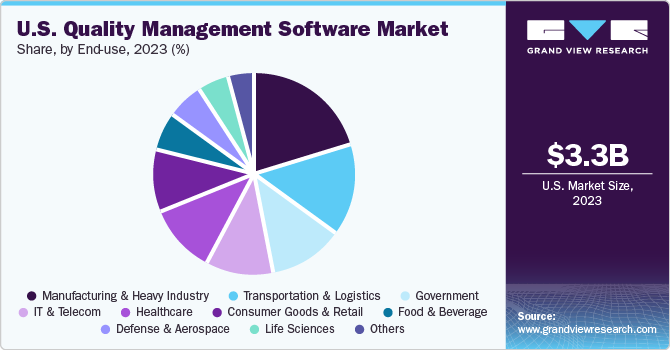

End-use Insights

The manufacturers and heavy industry segment accounted for the largest revenue share of 19.4% in 2023.Manufacturing and heavy industry companies are investing in advanced technologies to speed up their digital transformation process and recover from the losses caused by the pandemic. They are opting for quality management software to gain complete visibility into their supply chain and improve revenue forecasting accuracy. This has resulted in an expansion of the market as end-users are increasingly seeking unified software that integrates applications such as supply chain management, customer relationship management, and business intelligence. Such software can be tailored to specific business needs and deployed across corporate networks on different platforms.

The need for improving organizational effectiveness and documentation processes for reviewing operations and IT services is driving the demand for quality management system from IT & telecom organizations. QMS solutions help telecom service providers enhance their strategy by complying with the highest quality standards applicable in the telecommunications industry, including TL9000 requirements. Incumbents of the telecommunications industry are increasingly adopting cloud-based quality management software to standardize their processes and ensure consistent product and service quality. It highlights that QMS is in demand for diverse end-users and eventually it will grow.

Key U.S. Quality Management Software Market Company Insights

Some of the key players operating in the U.S. quality management software market are Microsoft Corporation, Oracle Corporation, MasterControl Inc.,

-

Microsoft Corporation provides QMS solutions for its Microsoft 365 suite. It offers customized solutions per the organization's requirements, allowing scalability, versatility, smooth integration, and similar benefits.

-

Oracle Cloud Quality Management software offers modern enterprise QMS solutions that complement the Oracle Cloud Supply Chain Management suite of applications with embedded, best practice processes such as identity, analysis, correctness, and prediction, which help companies build their analytic capabilities.

-

MasterControl Inc. offers an integrated Quality Management System (QMS) solution for tailored requirements that aims to optimize and simplify quality processes. The QMS platform delivers features such as document control, training, and audit management for effective quality management in regulated sectors.

-

Veeva Systems, Plex Systems Inc., Sparta Systems, EtQ Management Consultants, Inc., Arena Solutions, Inc., etc. are the emerging participants in the U.S. QMS market.

-

Arena Solutions, Inc. provides a product-focused quality management system, which helps connect product designs and quality into a secure single system. In this way, new products can be introduced into the market while complying with regulatory requirements.

-

Plex Quality Management System (QMS) can help you eliminate the guesswork of quality management and error-proof your production operation. Plex QMS offers manufacturers increased quality visibility and real-time data capture to ensure repeatability, predictability, and compliance management.

-

Veeva System’s Vault QMS is software that manages life sciences-specific quality processes. It offers quality processes like deviations, audits, and continuous improvement. Moreover, It also provides external partners access to the system to collaborate on audit findings and supplier corrective actions.

Key U.S. Quality Management Software Companies:

The following are the leading companies in the U.S. Quality Management Software market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these U.S. Quality Management Software companies are analyzed to map the supply network.

- Microsoft Corporation

- Oracle Corporation

- Arena Solutions, Inc.

- Cority Software Inc.

- EtQ Management Consultants, Inc.

- Ideagen Plc.

- SAP

- MasterControl, Inc.

- MetricStream, Inc.

- Pilgrim Quality Solution

- Plex Systems, Inc.

- Sparta Systems Inc.

- Veeva Systems

- Greenlight Guru

- QT9 QMS

Recent Developments

-

In May 2023, Greenlight Guru announced new Risk Solutions, a complete risk management software that pairs AI-generated insights with risk management workflows. Furthermore, the software allows Medtech companies to enhance their risk management process by including in-line editing, documentation, and auto-calculated risk probabilities.

-

In July 2023, Rephine and Greenlight Guru Partnership to Enable QMS for the Medical Device Sector. Rephine is a quality assurance and compliance solutions provider for biotech & medical devices and pharmaceuticals.

-

In September 2023, PTC announced the availability of arena PLM and QMS in China to meet the growing demand for SaaS solutions. With Arena QMS, medical device and biotechnology manufacturers can develop and introduce safe and compliant products by connecting quality records and processes to product design.

U.S. Quality Management Software Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.59 billion

Revenue forecast in 2030

USD 6.70 billion

Growth Rate

CAGR of 11.0% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Solution, deployment, enterprise size, end-use

Country scope

U.S.

Key companies profiled

•Microsoft Corporation; Oracle Corporation; Arena Solutions, Inc.; Cority Software Inc.; EtQ Management Consultants, Inc.; Ideagen Plc.; SAP; MasterControl, Inc.; MetricStream, Inc.; Pilgrim Quality Solution; Plex Systems, Inc.; Sparta Systems Inc.; Veeva Systems; Greenlight Guru; QT9 QMS

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Quality Management Software Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. quality management software market report based on, solution, deployment, enterprise size, and end-use.

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Document Control

-

Non-conformances/Corrective & Preventative

-

Complaint Handling

-

Employee Training

-

Quality Inspections (PPAP & FAI)

-

Audit Management

-

Supplier Quality Management

-

Calibration Management

-

Change Management

-

Mobile Incidents and Event Reporting

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small & Medium Enterprise (SME)

-

Large Enterprise

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

IT & Telecom

-

Life Sciences

-

Transportation & Logistics

-

Aviation

-

Maritime

-

Railways

-

-

Consumer Goods & Retail

-

Food & Beverage

-

Defense & Aerospace

-

Manufacturing & Heavy Industry

-

Utilities

-

Government

-

Federal

-

State

-

Local

-

-

Healthcare

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. quality management software market size was estimated at USD 3.28 billion in 2023 and is expected to reach USD 3.59 billion in 2024.

b. The U.S. quality management software market is expected to witness a compound annual growth rate of 11.0% from 2024 to 2030 to reach USD 6.70 billion by 2030.

b. The complaint-handling segment held the largest revenue share of over 15.0% in 2023. Effective complaint management is crucial for businesses to meet customer expectations. Traditional tools and processes for complaint handling can help companies handle customer complaints efficiently, enabling them to remain successful.

b. Microsoft Corporation; Oracle Corporation; Arena Solutions, Inc.; Cority Software Inc.; EtQ Management Consultants, Inc.; Ideagen Plc.; SAP; MasterControl, Inc.; MetricStream, Inc.; Pilgrim Quality Solution; Plex Systems, Inc.; Sparta Systems Inc.; Veeva Systems; Greenlight Guru; and QT9 QMS are some of the other players driving the market growth.

b. Quality management software helps businesses maintain industry standards to sustain their market presence. The need for organizations to improve their efficiency using artificial intelligence (AI) and machine learning (ML) is growing, which is helping end-use industries to enhance product quality by following industry standards among the key factors driving market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.