- Home

- »

- Next Generation Technologies

- »

-

U.S. Remote Sensing Technology Market Size Report, 2030GVR Report cover

![U.S. Remote Sensing Technology Market Size, Share & Trends Report]()

U.S. Remote Sensing Technology Market (2023 - 2030) Size, Share & Trends Analysis Report By Technology (Active Remote Sensing, Passive Remote Sensing), By Application, By Platform, And Segment Forecasts

- Report ID: GVR-4-68040-103-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

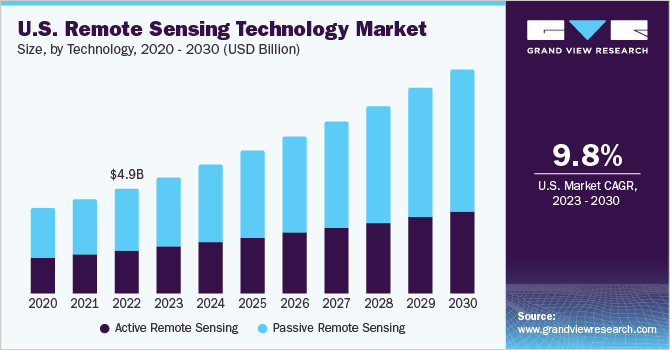

The U.S. remote sensing technology market size was estimated at USD 4.99 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 9.8% from 2023 to 2030. The wide applicability of remote sensing technology in sustainable development, disaster management, environmental degradation, and natural resource management are major factors expected to drive the growth of the U.S. market for remote sensing technology. Remote sensing technology aids in gathering information about an object, land, or area at a great distance. This information is later used to study and in the development processes like soil, forestry, geology, and agriculture.

The U.S. is a major producer of soybean and corn, with production standing at 4.44 billion bushels and 15.1 billion bushels in 2021, an increase of 7% and 5% compared to 2020. Also, agriculture, food, and related industries contributed 5.4% to U.S. gross domestic product in 2021. This high crop production in the country indicates heavy farming/agriculture activities, which is responsible for increasing the demand for smart solutions such as remote sensing technology that aid in precision farming.

Remote sensing technology helps farmers understand crop type classification, assess crop growth and estimate the yield of crops. Thus, increasing adoption of remote sensing technology in the agriculture sector for determining crop conditions, crop damage, mapping of soil characteristics, and mapping soil management practices is an important factor expected to drive the growth of the U.S. remote sensing technology market.

Wildfire is one of the prominent disturbance factors in the most vegetative zone throughout the U.S. Also, wildfires can be a threat to property and humans. According to the National Interagency Coordination Center (NICC), in 2022, 52% of the nationwide acreage burned by wildfires was on federal lands. The below table represents the annual fires and acres burned in the U.S.

Total

2018

2019

2020

2021

2022

Number of Fires (Thousand)

58.1

50.5

59.0

59.0

69.0

Acres Burned (millions)

8.8

4.7

10.1

7.1

7.6

According to the data published by National Interagency Coordination Center (NICC), there was a noticeable increase of above 80% in the number of wildfires in the U.S. This increasing wildfire calls for remote sensing technology that aids in fire danger prediction, fire detection, and fire control. With the help of remote sensing technology, several pre-fire conditions, such as fuel moisture and surface temperature, can be monitored.

Thus, increasing demand for smart remote sensing solutions from the forestry industry is expected to support the growth of the target market. Likewise, increasing demand for remote sensing technology from the geology and forestry industry for determining vegetation density, biomass estimation, and minerals exploration, among others, is another factor expected to support the growth of the market. Major challenges such as handling large volume data and complex data format & processing faced by users are lowering its adoption and further challenging the growth of the remote sensing technology market. However, the service provider's approach toward providing real-time data processing is expected to generate new opportunities in the market.

Technology Insights

The passive remote sensing segment accounted for the largest market share of over 58% in 2022 and is anticipated to register the highest CAGR over the forecast period. Most passive systems for remote sensing applications operate in the electromagnetic spectrum's thermal, visible, infrared, and microwave ranges. Also, to monitor and assess the Earth's surface features, passive remote sensing technology examines the sunlight reflected from the Earth's surface. Since the technology delivers high-quality satellite photos, numerous applications for Earth observation rely on it.

The active remote sensing segment is expected to grow at a considerable CAGR over the forecast period. Active remote sensing technology is frequently used to assess the topography of oceans, ice, and forests, among others. Active sensors allow measurements to be taken at any time, irrespective of the time of day or season. They can be used to better regulate how a target is lighted or to examine wavelengths that are insufficiently offered by the Sun, such as microwaves.

Application Insights

The military and intelligence segment accounted for the largest market share of nearly 32% in 2022. Military decision-makers rely on remote sensing technologies to provide precise information about the target location, the vicinity of civilian areas, weather information, and terrain analysis. Moreover, the increasing need for battlefield management, which involves integrating, tracking, and processing data to improve the effectiveness of command and control in military operations, is expected to drive the segment’s growth. The way wartime fights are organized has transformed due to the use of remote sensing technology. For digital mapping, planning of combat operations, and command control, the military commander in a conflict uses spatial data and Geographic Information System (GIS) technologies.

The disaster management segment is expected to register the fastest CAGR over the forecast period. Natural disasters occur frequently due to events such as earthquakes, volcanoes, and floods. Remote sensing can support risk reduction operations by locating risk areas related to floodplains, coastal erosion and inundation, and active faults. Determining the location and scale of actual incidents can also be used to validate hazard models. Distant sensors can detect the onset of an earthquake by providing essential information to estimate the locations that will be impacted.

Remote sensing technology is crucial in emergency mapping to facilitate a simple and rapid catastrophe response. The emergency crew uses the massive, widespread, and fast data provided by the sensors to organize their rescue operation. The use of remote sensing in damage assessment and recovery following a disaster can transform how disasters are managed completely. It can offer precise, timely details regarding the degree of damage, the type of debris present, and the quantity of resources required for an effective recovery.

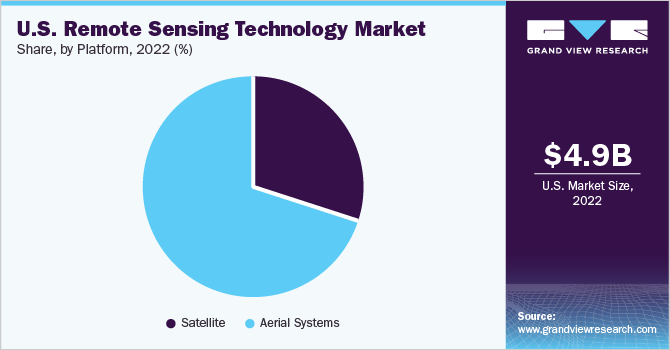

Platform Insights

The aerial systems segment accounted for the largest market share of over 69% in 2022. The aerial systems segment is expected to witness considerable growth owing to the factors such as the increasing adoption of drones and UAVs for aerial mapping, which lowers costs and facilitates the collection of data more quickly. Additionally, drones can deliver extremely precise data for surface mapping in locations that are not reachable by satellites.

For instance, in March 2023, Cloudeo, a geospatial solutions provider, announced a partnership with Globhe, a drone-as-a-service company, to expand its range of geospatial products on the Cloudeo marketplace. In addition to satellite and aerial solutions, the partnership included drone data for Cloudeo geospatial offerings. along with user workflows and applications, the partnership also included integrating Globhe drone data and services into answer. Cloudeo's API-based solution for risk evaluation and damage assessment.

The satellite segment is anticipated to register a considerable CAGR over the forecast period. The satellite segment growth in the U.S. can be attributed to the growing number of Earth observation projects undertaken by major space agencies such as the National Aeronautics and Space Administration (NASA). The increasing usage of satellite-based photographs for weather forecasting is another factor anticipated to fuel the segment’s growth. Satellites are the most prominent space platforms for remote sensing to collect data from across the globe and track changes in the Earth's atmosphere, oceans, and land. They are also used in national security and catastrophe management.

Key Companies & Market Share Insights

The key players in the U.S. remote sensing technology market include Maxar Technologies; Esri; General Dynamics Mission Systems, Inc.; Hexagon; Lockheed Martin Corporation; Orbital Insight; Planet Labs PBC; Raytheon Technologies Corporation; Teledyne Technologies Incorporated; and Leidos. Companies are engaging in several growth strategies, including partnerships, mergers & acquisitions, and geographical expansion, to stay afloat in the competitive market scenario.

For instance, in January 2023, Teledyne Technologies Incorporated acquired ChartWorld International Limited, which specializes in digital marine navigation software and hardware. The main objective of this acquisition was to expand Teledyne's customer base by offering digital Electronic Navigational Charts (ENCs), as well as other geospatial software and services, to include commercial vessels operating under the Safety of Life at Sea (SOLAS) classification and their respective fleet operators.

In June 2023, Hexagon introduced HxGN Smart Sites, a real-time data visualization and location intelligence solution, for complex operations at sites such as airports, industrial facilities, hospitals, and entertainment venues. The objective of this platform is to offer a comprehensive perspective of any intricate site by establishing connections with various data sources and systems, including Computer-Aided Design (CAD), Enterprise Resource Planning (ERP), Building Information Modeling (BIM), and workforce systems. Moreover, it facilitates optimizing safety and resilience in operations, streamlines workflows and enables faster and improved decision-making. Some prominent players in the U.S. remote sensing technology market include:

-

Maxar Technologies

-

Esri

-

General Dynamics Mission Systems, Inc.

-

Hexagon

-

Lockheed Martin Corporation

-

Orbital Insight

-

Planet Labs PBC

-

Raytheon Technologies Corporation

-

Teledyne Technologies Incorporated

-

Leidos

U.S. Remote Sensing Technology Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 10.70 billion

Growth rate

CAGR of 9.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, platform

Country Scope

U.S.

Key companies profiled

Maxar Technologies; Esri; General Dynamics Mission Systems, Inc.; Hexagon; Lockheed Martin Corporation; Orbital Insight; Planet Labs PBC; Raytheon Technologies Corporation; Teledyne Technologies Incorporated; Leidos

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Remote Sensing Technology Market Report Segmentation

The report forecasts revenue growth at a country level and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. remote sensing technology market report based on technology, application, and platform:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Active Remote Sensing

-

Passive Remote Sensing

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Agriculture & Living Resources

-

Military & Intelligence

-

Disaster Management

-

Infrastructure

-

Weather

-

Others

-

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Satellite

-

Aerial Systems

-

Frequently Asked Questions About This Report

b. The U.S. remote sensing technology market size was estimated at USD 4.99 billion in 2022.

b. The U.S. remote sensing technology market is expected to witness a compound annual growth rate of 9.8% from 2023 to 2030 to reach USD 10.70 billion by 2030.

b. The passive remote sensing segment accounted for the largest market share of over 58% in 2022. Most passive systems for remote sensing applications operate in the electromagnetic spectrum's thermal, visible, infrared, and microwave ranges. Also, to monitor and assess the Earth's surface features, passive remote sensing technology examines the sunlight reflected from the Earth's surface.

b. The key market players in the U.S. remote sensing technology market include Maxar Technologies; Esri; General Dynamics Mission Systems, Inc.; Hexagon; Lockheed Martin Corporation; Orbital Insight; Planet Labs PBC; Raytheon Technologies Corporation; Teledyne Technologies Incorporated; and Leidos.

b. The wide applicability of remote sensing technology in sustainable development, disaster management, environmental degradation, and natural resource management are major factors expected to drive the growth of the U.S. remote sensing technology market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.