- Home

- »

- Advanced Interior Materials

- »

-

U.S. Residential And Commercial Roofing Materials Market Report 2030GVR Report cover

![U.S. Residential And Commercial Roofing Materials Market Size, Share & Trends Report]()

U.S. Residential And Commercial Roofing Materials Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Asphalt Shingles, Metal Roofs), By Construction Type (New Construction, Re-roofing), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-182-9

- Number of Report Pages: 121

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

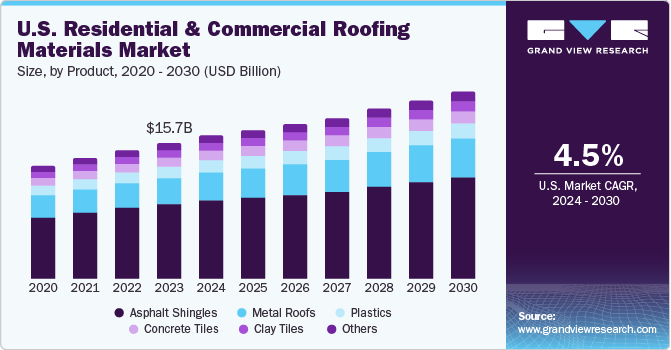

The U.S. residential and commercial roofing materials market size was estimated at USD 15.72 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 4.5% from 2024 to 2030. The growth of the market can be attributed to the flourishing global construction industry owing to increasing public and private investments in the development of residential spaces, and commercial spaces in most of the states of the U.S. With a rise in severe weather conditions, there is a rise in demand for impact resistant roofing materials, and this trend is expected to grow at a moderate pace during the forecast period.

The increase in demand for single-family homes and commercial spaces propels the need for roofing materials in the U.S. Emphasis on energy-efficient and sustainable building practices in the U.S. also aids in the increased demand for roofing materials. Moreover, factors such as the growing economy, population expansion, increasing expenditure in the renovation and re-development of both residential and commercial buildings, and robust growth in the construction sector post-COVID-19 pandemic are driving the demand for the market during the forecast period.

However, fluctuations in the raw material prices, economic uncertainties, and the cost of installation impact the potential construction projects leading to the overall slowdown in the demand for roofing materials.

Several factors influence the growth and dynamics of the market. The construction industry is thriving, with continuing residential and commercial projects generating demand for roofing materials in several construction applications.

Over the upcoming years, there's a projected increase in residential construction, propelled by government initiatives to address the current housing shortage exceeding 6 million homes. Notably, in January 2023, PulteGroup, Inc., a prominent U.S. residential construction firm, unveiled plans for Addison Square in Fort Myers. The company invested approximately USD 2.5 million in acquiring the land, intending to construct around 50 single-family homes across the expansive 17-acre site. This development is anticipated to drive demand for roofing materials within the project, consequently fueling market growth.

Furthermore, the changes in building codes and regulations with regard to energy efficiency and environmental standards are influencing the choices for roofing materials in most of the states in the U.S. Residential & commercial construction projects require compliance from building authorities of the U.S., which, is inclusive of the installation of roofing materials which adheres to the guidelines for saving energy and increase life longevity. These stringent rules and regulations aid in the increased demand for roofing materials in the U.S.

Market Concentration & Characteristics

The degree of innovation is higher as the technological developments are aimed at manufacturing products that offer better cleaning properties, longer life, and low maintenance, which, in turn, are expected to play an important role in ascending the market over the forecast period.

Regulations play a significant and multifaceted role in shaping the U.S. roofing materials market, influencing material choices, installation practices, and overall industry trends. Their Impact can be both beneficial and challenging, driving advancements in safety and performance while potentially increasing costs and complexities.

End-user concentration is a significant factor in the roofing materials demand. Moderately growing demand for asphalt shingle roofing owing to factors such as improved structural strength and lower installation costs are driving the market further during the forecast period.

Product Insights

The asphalt shingles segment held the largest revenue share of over 55% of the market in the year 2023. The segment is projected to register a CAGR of 4.1% in terms of value over the forecast period. Low capital costs and an easy installation process are anticipated to drive the demand for asphalt shingles as roofing materials over the forecast period.

Metal roofs held a significant share of the total market revenue in 2023. These roofs are known for their versatility, allowing them to be shaped into various forms like shingles or slates, adapting seamlessly to different building structures. The anticipated surge in global demand for metal roofs is attributed to their cost-effectiveness over the long term, lightweight nature, and excellent resistance to fire. These features make metal roofs a favored choice, contributing to their growing market presence in the foreseeable future.

The plastic roof segment is anticipated to grow at the fastest rate over the forecast period owing to advantages such as ease of installation, and low maintenance. However, plastic roofs offer lower aesthetic appeal than their counterparts. Furthermore, the product is particularly vulnerable to UV radiation degradation, thereby restricting its application.

Application Insights

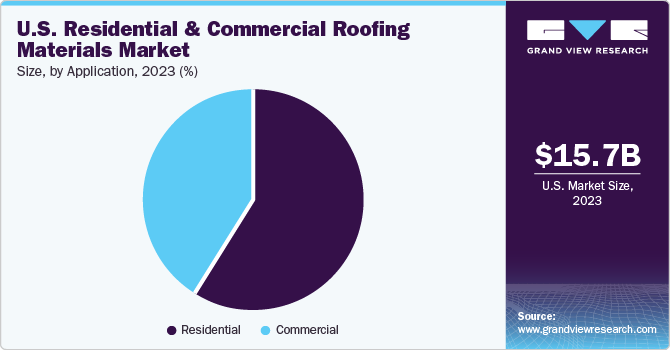

The residential application segment held the largest revenue share of over 58% in 2023. The residential segment is expected to witness growth in the forecast period, driven by factors such as the increasing global population and the growing preference among consumers for single-family housing structures.

Homeowners often choose asphalt shingles for their residential roofs due to the ease of installation and lower maintenance needs compared to metal and concrete options. These shingles come in a diverse range of colors and textures, providing homeowners with the opportunity to achieve a wood, cedar, or slate-like appearance, thereby enhancing the visual appeal of their roofing structures.

The commercial construction segment is inclusive of buildings for hypermarkets, supermarkets, departmental stores, shopping malls, hospitals & clinics, restaurants & hotels, resorts, and others.

Rapid industrial expansion as well as the increased investment from the government and private sector are anticipated to promote the growth of the commercial construction industry. Business expansion by multinational companies, combined with newly built manufacturing plants and processing units, is driving demand for commercial building. These factors are projected to fuel the need for roofing materials.

Construction Type Insights

The re-roofing segment held for USD 9.45 billion revenue share in 2023 and is anticipated to witness significant growth at a CAGR of 4.4% over the forecast period. The segment demand is majorly driven by aging infrastructure and the need to replace and repair them. The buildings in the U.S. have reached the end of their original roofing lifespan. This trend is followed in most of the states in the U.S. Thus, there is an increased demand from the re-roofing type of segment in 2023 and the trend is expected to remain the same during the forecast period.

Modern roofing materials offer better reflective properties and insulation abilities. This eventually saves the energy required by a building as compared to a building with no or fewer roofing materials installed. This result in an increased demand for roofing materials over the coming years. Additionally, with an increase in extreme weather conditions in the U.S., there is a growing demand for roofing materials from the re-roofing type of construction in most of the states in the U.S.

Regional Insights

The construction sector in Texas is projected to witness steady growth at a 5.7% CAGR, driven by factors like increasing per capita income, rapid urbanization, and a growing population. Meanwhile, the construction industry in the region is witnessing heightened investments from both local governments and foreign investors. Many companies have established their manufacturing facilities in this region, playing a pivotal role in the expansion of various construction sectors.

In developing states, the U.S. government is actively working to enhance infrastructure, including the construction of hospitals, educational centers, commercial spaces, and residential complexes. These initiatives, combined with a growing population, are anticipated to stimulate the need for roofing materials in the region. Additionally, this area stands as one of the major consumers of roofing materials in the U.S. With a surge in investments in affordable housing, the construction of smart cities, infrastructure upgrades, and tourism sector investments, there's a projected increase in demand for roofing materials in the coming years.

Key Companies & Market Share Insights

-

GAF Materials Corporation provides all types of roofing materials in the U.S. The company is involved in providing installation and related services in the entire U.S. It provides roofing materials from timber to the Solar grade TPO membranes.

Key U.S. Residential And Commercial Roofing Materials Companies:

- GAF Materials Corporation

- Atlas Roofing Corporation

- Owens Corning

- TAMKO Building Products, Inc.

- CSR Ltd.

- Carlisle Companies Inc.

- Crown Building Products LLC

- Metal Sales Manufacturing Corporation

- Wienerberger AG

- Etex

- CertainTeed Corporation

- Johns Manville

- Fletcher Building Limited

- Eagle Roofing Products

- Boral Roofing. (Ltd.).

U.S. Residential & Commercial Roofing Materials Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 21.69 billion

Growth rate

CAGR of 4.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, construction type, region

Country scope

U.S.

Key companies profiled

GAF Materials Corporation, Atlas Roofing Corporation, Owens Corning, TAMKO Building Products, Inc., CSR Ltd., Carlisle Companies Inc., Crown Building Products LLC., Metal Sales Manufacturing Corporation, Wienerberger AG, Etex, CertainTeed Corporation, Johns Manville, Fletcher Building Limited, Eagle Roofing Products, Boral Roofing. (Ltd.).

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Residential And Commercial Roofing Materials Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. residential & commercial roofing materials market report based on product, application, construction type, and region:

-

Product Outlook (Volume, Million Square Feet; Revenue, USD Million, 2018 - 2030)

-

Asphalt Shingles

-

Metal Roofs

-

Plastics

-

Concrete Tiles

-

Clay Tiles

-

Others

-

-

Application Outlook (Volume, Million Square Feet; Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Construction Type Outlook (Volume, Million Square Feet; Revenue, USD Million, 2018 - 2030)

-

New Construction

-

Re-roofing

-

-

Regional Outlook (Volume, Million Square Feet; Revenue, USD Million, 2018 - 2030)

-

U.S.

-

California

-

Texas

-

Florida

-

Arizona

-

North Carolina

-

South Carolina

-

New Jersey

-

New York

-

Colorado

-

Georgia

-

Utah

-

-

Frequently Asked Questions About This Report

b. The U.S. residential and commercial roofing materials market size was estimated at USD 15.72 billion in 2023 and is expected to reach USD 16.64 billion in 2024.

b. The U.S. residential and commercial roofing materials market is expected to grow at a compound annual growth rate, a CAGR of 4.5% from 2024 to 2030, to reach USD 21.69 billion by 2030

b. The asphalt shingles segment of the U.S. residential and commercial roofing materials market accounted for the largest revenue share of 55% in 2023 owing to the lower cost and durability as compared to the other roofing materials.

b. Some key players operating in the U.S. residential and commercial roofing materials market include GAF Materials Corporation, Atlas Roofing Corporation, Owens Corning, TAMKO Building Products, Inc., CSR Ltd., Carlisle Companies Inc., Crown Building Products LLC., Metal Sales Manufacturing Corporation, Wienerberger AG, Etex, CertainTeed Corporation, Johns Manville, Fletcher Building Limited, Eagle Roofing Products, Boral Roofing. (Ltd.)

b. Key factors that are driving the market growth include the growing expenditure in the residential and commercial spaces for renovation and repairing of the buildings.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.