- Home

- »

- Advanced Interior Materials

- »

-

U.S. Roofing Anchors Market Size, Industry Report, 2033GVR Report cover

![U.S. Roofing Anchors Market Size, Share & Trends Report]()

U.S. Roofing Anchors Market (2025 - 2033) Size, Share & Trends Analysis Report By Roof Type (Flat Roofs, Pitched Roofs), By End Use (Residential, Commercial, Institutional, Industrial), And Segment Forecasts

- Report ID: GVR-4-68040-687-7

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Roofing Anchors Market Summary

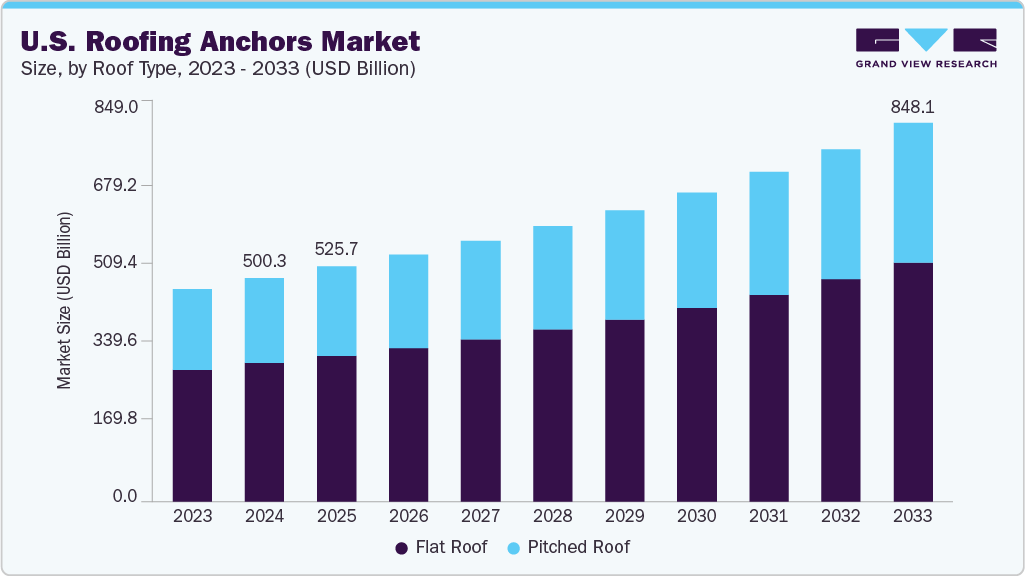

The U.S. roofing anchors market size was estimated at USD 500.27 billion in 2024 and is projected to reach USD 848.10 billion by 2033, growing at a CAGR of 6.2% from 2025 to 2033, due to rising emphasis on worker safety and OSHA compliance during construction, maintenance, and repair of buildings.

Key Market Trends & Insights

- By roof type, the flatroof segment led the market with the largest revenue share of 62.0% in 2024.

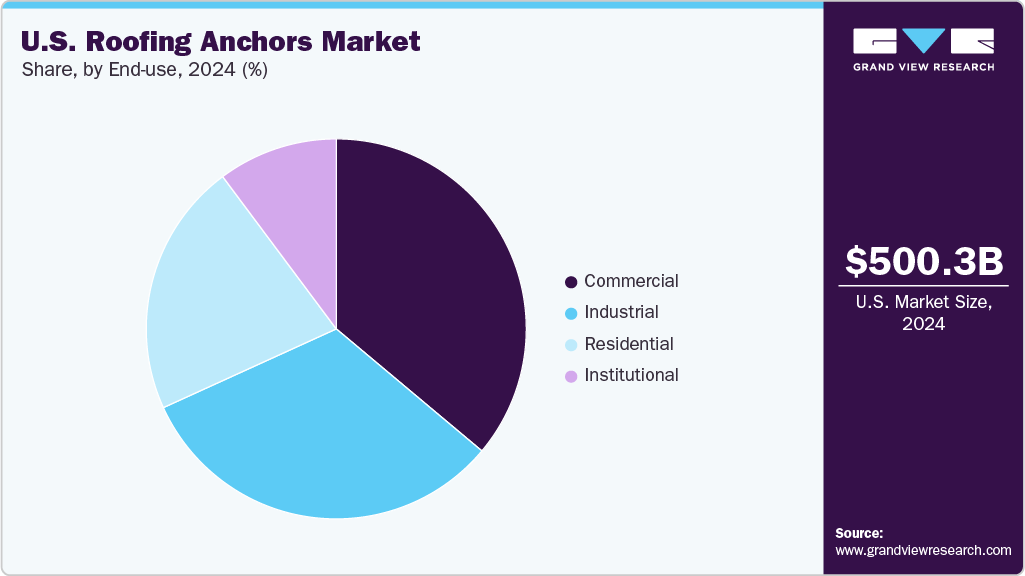

- By end use, the commercial segment led the market with the largest revenue share of 36.1% in 2024.

- The residential segment is expected to grow at the fastest CAGR of 6.4% during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 500.27 Billion

- 2033 Projected Market Size: USD 848.10 Billion

- CAGR (2025-2033): 6.2%

As infrastructure in major cities ages, reroofing projects are becoming more common, directly boosting demand for safety equipment like anchors. Moreover, the resurgence of residential construction after pandemic-related delays has revived roofing activity, further fueling market growth. Climate events like hurricanes and heavy snowfall also necessitate safer and stronger anchoring systems. Urbanization and vertical construction trends are accelerating the need for fall protection on high-rise buildings. Demand also rises from the growing adoption of solar panel installations, which require rooftop access and anchoring systems. In both new builds and retrofits, fall protection is non-negotiable, ensuring sustained demand.

Stricter regulations by OSHA, ANSI, and state-level authorities are key demand drivers. Contractors are increasingly investing in certified, permanent anchor systems to avoid penalties and protect workers. The roofing industry’s shift toward safety-first practices, driven by union advocacy and rising insurance costs, pushes builders to install roof anchors during initial construction. Increased demand for low-slope and flat commercial roofs (which require more frequent maintenance access) drives anchor installations. In the residential sector, safety-conscious homebuilders are incorporating anchors in custom and luxury homes. Growth in solar rooftop installations and smart HVAC systems requiring regular rooftop maintenance also strengthens demand for accessible and durable anchoring solutions. Material advancements like corrosion-resistant alloys are improving performance, expanding their appeal across geographies.

Modern roofing anchors now include swiveling, reusable, and hidden anchor types for aesthetic and functional flexibility. Companies are integrating smart tags and inspection tracking into anchors for compliance audits. Lightweight yet strong stainless steel and powder-coated carbon steel anchors are gaining traction due to enhanced durability in harsh environments. Modular and multi-point anchoring systems are becoming popular for larger commercial or industrial rooftops. There is a rising trend in offering anchor systems as part of full-service fall protection kits, including harnesses, lifelines, and anchor points, simplifying procurement for contractors. Some manufacturers now offer pre-engineered, prefabricated anchor layouts that speed up installation. Software-enabled planning tools for anchor placement based on roof slope and layout are also emerging.

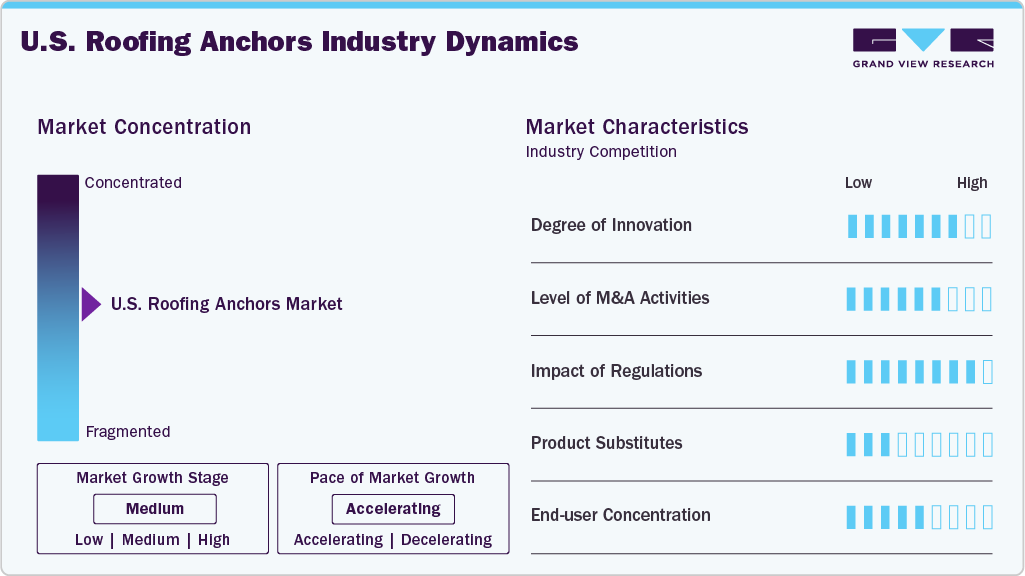

Market Concentration & Characteristics

The U.S. roofing anchors industry is moderately consolidated, with several dominant players such as 3M, Honeywell, Guardian Fall Protection, and FallTech holding significant market share. These players offer a wide range of certified products tailored to OSHA and ANSI requirements. However, the market also includes regional specialists and niche providers that serve specific applications like wood truss anchors or green roof-compatible models. The market is competitive on durability, compliance, and ease of installation. Vertical integration by larger players and acquisitions of smaller safety equipment firms are further concentrating the market. Distribution channels are well-established, with contractors sourcing through safety equipment suppliers, construction wholesalers, and e-commerce.

There are limited substitutes for certified roof anchors when OSHA compliance is mandatory. In some low-height residential settings, temporary fall protection (like scaffolding or guardrails) can act as a substitute, but they lack the flexibility and permanent safety anchors provide. Non-compliant DIY anchors or makeshift solutions exist in the unregulated sector but are increasingly risky due to legal and liability issues. As awareness grows, reliance on substitutes is decreasing. Technological alternatives like drone inspection reduce some rooftop access needs but cannot eliminate maintenance tasks requiring physical presence. Overall, the threat of substitutes is low in regulated and commercial applications.

Roof Type Insights

The flat roofs segment led the market with the largest revenue share of 62.0% in 2024, due to their widespread use in commercial, industrial, and institutional buildings. These roofs offer a broad, level surface that simplifies the installation of permanent anchor systems and fall protection equipment. Flat roofs often house HVAC units, solar panels, and utility systems that require regular access, necessitating strict safety compliance through certified anchor points. The uniformity of flat roofing also allows for standardization in anchor designs, making installation quicker and more cost-effective. Their dominance is further reinforced by OSHA requirements and maintenance needs, which ensure continued demand for anchors in these roof types.

The pitched roofs segment is expected to grow at the fastest CAGR of 5.1% over the forecast period, especially within the residential and light-commercial sectors. With increasing new home construction and a surge in renovations, more homeowners and contractors are incorporating roof anchors to meet evolving safety standards. Pitched roofs present a greater fall risk due to their steep angles, prompting the adoption of specialized, slope-compatible anchors. Advancements in adjustable, ridge-mounted, and under-shingle anchor systems have made it easier to protect workers without compromising the roof structure. The rise of solar installations and complex roof designs is also contributing to the rapid growth of anchoring solutions tailored for pitched roofs.

End Use Insights

The commercial segment led the market with the largest revenue share of 36.1% in 2024, propelled by rising investment in commercial real estate, retail centers, warehouses, and office buildings. These structures often feature expansive flat roofs that require frequent maintenance, making permanent anchor systems a necessity. Stringent safety regulations, insurance liability concerns, and increased rooftop equipment (such as HVAC, solar, and communication systems) are driving anchor adoption in this segment. Moreover, government-funded infrastructure upgrades and LEED-certified green building initiatives are pushing commercial contractors to integrate advanced fall protection systems, including certified roofing anchors, at the design stage.

The residential segment is expected to grow at the fastest CAGR of 6.4% over the forecast period, driven by widespread new home construction, roof repairs, and retrofits across suburban and rural regions. Homeowners, contractors, and builders are increasingly prioritizing worker safety and OSHA compliance, especially during reroofing and solar panel installation. Roofing anchors-both temporary and permanent-are commonly used on pitched and low-slope residential roofs to provide fall protection during maintenance or installation tasks. The demand is also supported by growing awareness of safety standards among residential builders and a shift toward incorporating safety features into custom and high-end homes.

Key U.S. Roofing Anchors Company Insight

Some of the key players operating in the U.S. market include 3M, Guardian Fall Protection

-

3M (Capital Safety Group) is a global leader in safety solutions, offering fall protection equipment under the DBI-SALA and Protecta brands. Their roofing anchors are widely used across industrial and commercial sectors for both permanent and temporary applications. The company ensures all products meet strict OSHA and ANSI standards, with a focus on innovation and durability.

-

Guardian Fall Protection (Pure Safety Group) specializes in affordable, easy-to-use fall protection systems tailored for residential and commercial roofing. It offers a broad portfolio of anchors, lifelines, and harnesses, designed for fast installation and field flexibility. The brand is known for contractor-focused safety solutions that comply with global safety norms.

Super Anchor Safety and Malta Dynamics are some of the emerging market participants in the U.S. roofing anchors industry.

-

Super Anchor Safety, founded in 1992 and headquartered in Monroe, Washington, specializes in designing, engineering, and manufacturing a wide range of fall protection equipment, most notably permanent and temporary roofing anchors for residential and light-commercial construction. Their flagship ARS Roof Anchor kits and APEX RidgeTop anchors are engineered for OSHA/ANSI compliance, ease of installation, and weatherproof performance across various roofing materials.

-

Malta Dynamics offers permanent roof anchor posts suitable for steel, wood, or concrete substrates. Their lightweight, low-profile anchors are OSHA- and ANSI-certified, featuring threaded-top designs and pre‑drilled holes to ease installation without damaging trussesideal for durable, code-compliant rooftop fall protection

U.S. Roofing Anchors Companies:

- 3M

- Guardian Fall Protection

- Honeywell Miller

- FallTech

- Super Anchor Safety

- Werner Co.

- Malta Dynamics

- Tractel North America

- Safe Approach Inc.

- FrenchCreek Production Inc.

Recent Developments

-

In June 2025, FrenchCreek Production Inc. introduced the APEX Retractable Ladder Anchor Post, a new product designed to improve safety and workflow efficiency during ladder transitions on rooftops.

-

In July 2025, Fall Tech released the 7410M Hinged Reusable Anchor for steel-deck and metal roofing.

Roofing Anchors Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 525.69 billion

Revenue forecast in 2033

USD 848.10 billion

Growth rate

CAGR of 6.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Roof type, end-use

Country scope

U.S

Key companies profiled

3M; Guardian Fall Protection; Honeywell Miller; FallTech; Super Anchor Safety; Werner Co.; Malta Dynamics; Tractel North America; Safe Approach Inc.; FrenchCreek Production Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Roofing Anchors Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. roofing anchors market report based on roof type, and end use:

-

Roof Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Flat Roofs

-

Pitched Roofs

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Residential

-

Commercial

-

Institutional

-

Industrial

-

Frequently Asked Questions About This Report

b. The U.S. roofing anchors market size was estimated at USD 500.27 billion in 2024 and is expected to reach USD 525.69 million in 2025.

b. The U.S. roofing anchors market is expected to grow at a compound annual growth rate of 6.2% from 2025 to 2033 to reach USD 848.10 million by 2033.

b. The Flat Roofs segment held the highest revenue market share of 62.0% in 2024, due to its widespread use in commercial, industrial, and institutional buildings.

b. Some of the prominent companies in the roofing anchors market include 3M, Guardian Fall Protection, Honeywell Miller, FallTech, Super Anchor Safety, Werner Co., Malta Dynamics, Tractel North America, Safe Approach Inc., FrenchCreek Production Inc.

b. Key factors driving the U.S. roofing anchors include stringent OSHA regulations, rising construction activity, increased rooftop solar installations, and growing emphasis on worker safety.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.