U.S. Safety Helmets Market Size & Trends

The U.S. safety helmets market size was estimated at USD 1.05 billion in 2024 and is expected to grow at a CAGR of 8.2% from 2025 to 2030. The construction sector drives market growth due to the expansion of infrastructure projects and increasing awareness of workplace safety. The U.S. government has implemented various stringent safety regulations to mandate the use of safety helmets by workers in high-risk environments, further fueling the market growth.

Safety helmets, such as hard hats and bump caps, are available in various types and products. They provide head protection to lower the risk of harm in challenging workplaces. The lack of use of safety helmets has resulted in severe head injuries and accidents, which has led to the rising importance of personnel safety during work hours. This is a major factor for the growth of the safety helmet industry in the U.S.

The rise of E-commerce platforms in the U.S. has allowed direct sales to a diverse range of consumers, enabling greater accessibility to safety helmets. These platforms also allow easier access to helmet customization, which promotes customer satisfaction and further encourages more sales. Technological advancements such as sensors and communication system integration in helmets have driven a rise in the safety helmets market among industries that prefer advanced protective equipment.

Safety helmets with improved designs focusing on the comfort, style, and convenience of workers have convinced them to wear them at workplaces, further boosting the market growth in the country. As the U.S. is one of the largest economies in the world, there is rapid urbanization and industrialization, which involves more infrastructural developments and growth in the industry workforce, hence giving rise to the safety helmets market.

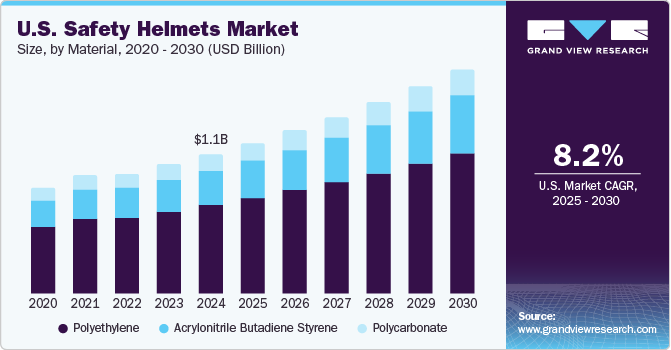

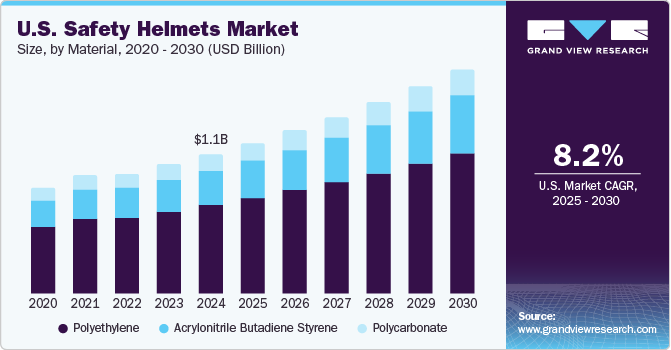

Material Insights

Polyethylene dominated the U.S. safety helmets market and accounted for the largest revenue share of 60.1% in 2024, primarily driven by its high-impact resistance, lightweight nature, and cost-effectiveness. The low production cost of polyethylene helmets makes it affordable for a larger range of consumers, particularly in budget-constrained industries. In addition, its extended lifespan makes polyethylene a better choice for industries, as it reduces the need for frequent replacements. Furthermore, advanced features such as shock-absorbing liners, adjustable straps, and face shields have made polyethylene helmets more popular.

Acrylonitrile Butadiene Styrene (ABS) is expected to grow at the fastest compound annual growth rate (CAGR) of 8.9% over the forecast period from 2025 to 2030 due to its impact resistance, high tensile strength, and lightweight nature. These features make them ideal for construction, mining, and manufacturing industries, where head protection is important. With the rapid development and high demand for resources in the U.S., multiple industries have a higher workforce, further fueling the demand for ABS safety helmets as they require high-quality safety equipment.

Product Insights

Hard hats dominated the U.S. safety helmets market and accounted for the largest revenue share of 83.1% in 2024, primarily driven by the safety regulations and awareness in multiple industries and workplaces to prevent head injuries and accidents. The U.S. Occupational Safety and Health Administration (OSHA) has mandated safety helmets in critical and high-risk workplaces. Furthermore, hard hats offer electric shock protection in workplaces with exposed electrical conductors, which is a driving factor for the hard hats market in the U.S.

The bump caps market is expected to grow at a significant compound annual growth rate (CAGR) of 7.2% over the forecast period from 2025 to 2030 due to the rise in the food and goods industry in the U.S. as these caps can be worn in lower risk environments such as food processing, logistics, and warehousing. Innovation in bump caps, such as lightweight materials, removable liners, and improved ventilation, has enhanced the comfort of workers, hence encouraging more demand for these products. The rise of the e-commerce market in the U.S. has expanded demand for bump caps in logistics and delivery services to prevent head injuries while loading equipment.

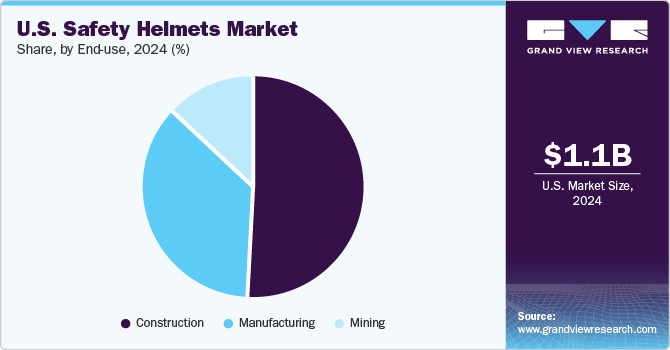

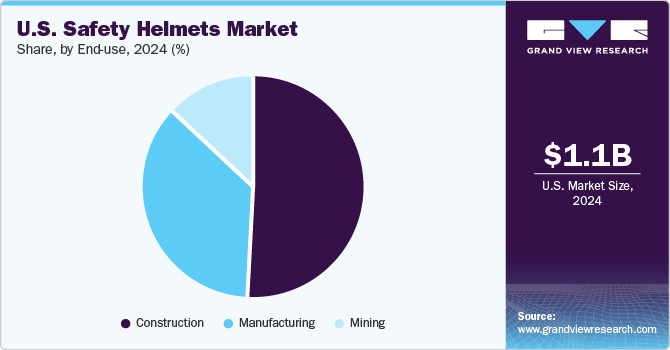

End Use Insights

The construction industry dominated the U.S. safety helmets market and accounted for the largest revenue share of 44.8% in 2024, as it is one of the largest sectors of the economy contributing to the country’s GDP. Several factors, such as population growth, urbanization, technological advancements, and government investments in infrastructure, drive the construction industry. The strict regulations by the government to mandate the use of protective helmets on construction sites have led to the growth of the safety helmet market in the construction industry. Furthermore, construction companies invest in customized helmets with logos or colors for branding.

The demand for safety helmets in the mining industry is expected to grow at a significant compound annual growth rate (CAGR) of 8.4% over the forecast period from 2025 to 2030 due to the increased focus of the government on mine safety for workers. Mining is one of the most critical and dangerous industries in the U.S., further increasing the demand for helmets by employers to reduce workplace injuries and fatalities. The growing demand for essential minerals for further development has led to higher mining activities, increasing the need for safety helmets. Furthermore, safety helmets with communication systems and AR tools are highly effective for monitoring the condition of workers.

Key U.S. Safety Helmets Company Insights

Key U.S. safety helmets market players include Delta Plus Group, Bullard, Honeywell International Inc., 3M, and others. These companies make heavy investments in research and technological development in order to create advanced safety helmets, such as integrated communication systems, shock resistance, and enhanced ventilation. Furthermore, their quality assurance, strong brand presence, and adaptability to maintain competitiveness in the industry make them major players in the U.S. safety helmets industry.

-

Bullard, headquartered in Kentucky with additional offices in Germany and Singapore, is known for manufacturing hard hats and firefighter helmets. They make customizable helmets, considering workers' preferences, which makes them more comfortable, easy to handle, and also provides protection.

-

Delta Plus Group is a French company with additional offices in Shelton, CT, and Woodstock, GA. It is equipped to design, manufacture, and distribute personal protective equipment. They consider the safety and protection of their consumers and provide multiple technological integrations, such as permanent fall protection systems.

Key U.S. Safety Helmets Companies:

- 3M

- Delta Plus Group

- Bullard

- Honeywell International Inc.

- MSA

- JSP Ltd.

- Drägerwerk AG & Co. KGaA

- Schuberth GmbH

- OccuNomix International LLC

- Pyramex

Recent Developments

-

In November 2024, Båstadgruppen’s Guardio, in partnership with Quin, launched an industrial safety helmet equipped with integrated sensor technology known as the Armet PRO helmet. This launch has set a new standard for safety as it detects falls and impacts, reducing the consequences of accidents.

-

In November 2024, Arai Helmets partnered with Triumph Motorcycles and launched a range of co-branded helmets, which are to be available in the summer of 2025. They have a wide range of models, including Concept-XE, Quantico, MX-V Evo, and Tour-X5, featured with protection and comfort.

-

In October 2024, a construction company, Brasfield & Gorrie, adapted to type II safety helmets in partnership with Studson. This helmet is known as the STUDSON SHK-1 full brim type II safety helmet, which is integrated with welded polymer tubes that help in absorbing impacts while improving heat dissipation.

-

In July 2024, MSA Safety, Inc. launched its latest innovation in safety helmets, the V-Gard H2 Safety Helmet. It is integrated with features such as the Mips brain protection system and designed to comply with the government’s safety regulations for helmets in industries.

U.S. Safety Helmets Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 1.23 billion

|

|

Revenue forecast in 2030

|

USD 1.69 billion

|

|

Growth rate

|

CAGR of 8.2% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Volume in kilotons, revenue in USD million, and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Material, product, end use

|

|

Country scope

|

U.S.

|

|

Key companies profiled

|

3M, Delta Plus Group, Bullard, Honeywell International Inc., MSA, JSP Ltd., Drägerwerk AG & Co. KGaA, Schuberth GmbH, OccuNomix International LLC, Pyramex

|

|

Customization scope

|

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Safety Helmets Market Report Segmentation

This report forecasts revenue growth at country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the U.S. safety helmets market report based on material, product, and end use:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Construction

-

Manufacturing

-

Mining

-

Others