- Home

- »

- Homecare & Decor

- »

-

U.S. School Furniture Market Size And Share Report, 2030GVR Report cover

![U.S. School Furniture Market Size, Share & Trends Report]()

U.S. School Furniture Market Size, Share & Trends Analysis Report By Product (Seating Furniture, Storage Units), By Application (Classroom, Library & Labs), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-423-5

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

U.S. School Furniture Market Size & Trends

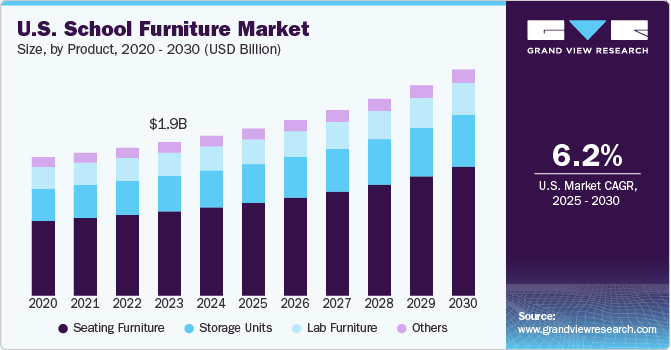

The U.S. school furniture market size was estimated at USD 2.06 billion in 2024 and is projected to grow at a CAGR of 6.2% from 2025 to 2030. The market is driven by factors such as global population growth, educational reforms across various nations, and a focus on ergonomic seating designed for students' comfort and health. Technological advancements to support digital devices, such as laptops and tablets, are also reshaping furniture needs in modern classrooms. In the U.S. alone, there were 98,577 public schools and 30,492 private schools in the academic year 2021-22, according to the National Center for Education Statistics. This steady increase in the number of schools is expected to significantly boost the demand for school furniture in the years to come, emphasizing adaptable, durable, and technology-friendly designs.

Government funding programs and grants play a crucial role in driving market growth by providing the necessary financial resources for schools to upgrade and modernize their infrastructure. These funds are often allocated to improve educational facilities, which includes purchasing new furniture that aligns with current teaching methodologies and technological requirements. With access to government grants, schools can invest in ergonomic, durable, and technology-friendly furniture that supports collaborative learning and hybrid models, essential for today’s evolving education systems. This financial support ensures that even budget-constrained schools can replace outdated furniture, thus enhancing the learning environment and boosting overall demand.

As students spend more time on laptops, tablets, and other electronic devices, furniture that promotes good posture becomes essential for their health and well-being. Ergonomic chairs and desks are designed to support the natural curves of the body, allowing for adjustable heights, lumbar support, and appropriate desk angles that accommodate prolonged sitting. This focus on comfort enhances student concentration and productivity and helps prevent long-term health issues such as back pain and repetitive strain injuries. Consequently, schools are prioritizing ergonomic furniture as a critical investment in student welfare and academic success, favoring market growth.

Furthermore, key players in the market are driving innovations in response to the increasing demand for versatile and functional educational environments. Manufacturers are developing modular and flexible furniture solutions that can be easily reconfigured to support various teaching styles and classroom layouts, fostering collaborative learning. For instance, in June 2023, the MillerKnoll, Inc. subsidiary brand NaughtOne unveiled two new products: the Pippin mobile lounge chair and the Morse Table System. The Pippin chair combines comfort and support while featuring wheels for effortless mobility. On the other hand, the Morse Table System offers versatile functionality, seamlessly transitioning between a dining table, solo worktable, or teamwork bench, making it adaptable for various purposes.

Product Insights

Seating furniture accounted for a market share of around 55% in 2024. As educational institutions seek to enhance student comfort and focus, there is a demand for seating that provides adequate lumbar support, is adaptable to various body types, and supports long periods of use. In addition, the push toward creating multifunctional spaces that accommodate different teaching methods is encouraging the adoption of mobile and modular seating options that allow for easy reconfiguration. The integration of materials designed for durability and easy maintenance is also a priority, given the high-use nature of school environments, likely favoring the market growth.

The demand for storage units in the U.S. market is expected to grow at CAGR of 6.1% from 2025 to 2030. The U.S. has witnessed an increased adoption of personal cabinets for schoolchildren. This trend is projected to positively impact the growth of the market in the foreseeable future. Storage cabinets are used in a variety of spaces, including administrative offices, classrooms, labs, libraries, and activity halls, therefore, the demand for them in schools has increased significantly. In addition, the growing population of schoolchildren is anticipated to contribute to the construction of new schools, subsequently leading to an increased demand for storage cabinets and other related furniture items.

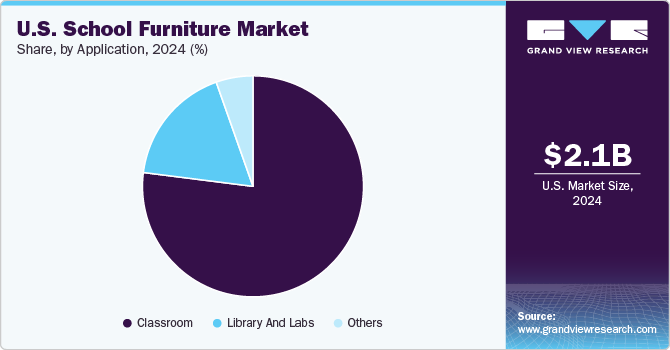

Application Insights

In the U.S., school furniture for classrooms accounted for a market share of around 77% in 2024. As schools increasingly prioritize collaborative learning and student-centered teaching models, there is a shift toward modular, ergonomic, and adaptable furniture that supports a variety of learning styles and activities. In addition, health and wellness considerations, including ergonomics for young students, have heightened the demand for furniture that reduces physical strain and supports long-term student health. Investments in technology integration, such as furniture with power access for digital devices, are also influencing purchasing decisions, especially as more schools adopt hybrid or tech-enhanced learning systems.

The demand for school furniture for library and labs is expected to grow at a CAGR of 5.3% from 2025 to 2030. The growing demand for school furniture in libraries and labs across the U.S. is fueled by the shift toward collaborative and hands-on learning environments. Libraries are being redesigned as interactive learning hubs that support both individual study and group collaboration, necessitating modular and adaptable furniture that can be easily reconfigured. Similarly, STEM-focused curricula have increased the need for specialized lab furniture that accommodates scientific equipment, technology, and tools, enabling safe, flexible, and immersive learning experiences. Schools also increasingly prioritize durable, ergonomically designed furniture that supports diverse learning needs and contributes to a dynamic educational experience.

Key U.S. School Furniture Company Insights

The market for school furniture in the U.S. is highly competitive, with companies focusing on quality, customization, and ergonomic designs to meet the evolving needs of educational institutions. Key players such as Steelcase Inc. and MillerKnoll, Inc. have invested in product innovation and sustainable materials to appeal to a wide range of educational settings, from K-12 to higher education. The demand for versatile, collaborative, and technologically integrated furniture is rising, influenced by a shift toward flexible and adaptive learning environments. In addition, online distribution has become significant, offering virtual showrooms and streamlined purchasing options to meet post-pandemic demand for convenient sourcing. The competition continues to drive improvements in material sustainability, smart features, and customized solutions aimed at enhancing student engagement and comfort.

Key U.S. School Furniture Companies:

- Smith System (Steelcase Inc.)

- MillerKnoll, Inc.

- The HON Company (HNI Corporation)

- Virco

- Fleetwood Group

- VS America, Inc.

- Hertz Furniture

- Paragon Furniture Inc.

- Haskell Education

- Marco Group

View a comprehensive list of companies in the U.S. School Furniture Market

Recent Developments

-

In July 2023, MillerKnoll, Inc. announced the opening of Knoll’s retail showroom and contract showroom space in the spring of 2024 in New York. The first-floor retail space for Herman Miller is scheduled to undergo renovation and refreshment in addition to Knoll opening premises in the building, offering a new perspective on the product line.

-

In June 2023, MillerKnoll, Inc., in collaboration with its subsidiary Vitra, partnered with the Eames Office to introduce a special limited edition of Eames Fiberglass Armchairs. This exclusive release, restricted to just 500 units, showcases the hand-painted cat design originally created by the renowned midcentury artist Saul Steinberg.

U.S. School Furniture Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.15 billion

Revenue forecast in 2030

USD 2.91 billion

Growth rate

CAGR of 6.2% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application

Country scope

U.S.

Key companies profiled

Smith System (Steelcase Inc.); MillerKnoll, Inc.; The HON Company (HNI Corporation); Virco; Fleetwood Group; VS America, Inc.; Hertz Furniture; Paragon Furniture Inc.; Haskell Education; Marco Group

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. School Furniture Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. school furniture market report based on product, and application.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Seating Furniture

-

Storage Units

-

Lab Furniture

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Classroom

-

Library and Labs

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. school furniture market was estimated at USD 2.06 billion in 2024 and is expected to reach USD 2.15 billion in 2025.

b. The U.S. school furniture market is expected to grow at a compound annual growth rate of 6.2% from 2025 to 2030, reaching USD 2.91 billion by 2030.

b. Classroom application type dominated the U.S. school furniture market with a share of over 77% in 2024. This is owing to the increasing number of schools, rising rates of student enrollment, and the growing trend of mobile and ergonomic furniture, coupled with the trend of using sustainable products.

b. Some key players in the U.S. school furniture market include Smith System, Hertz Furniture, Virco, VS America, Inc., Paragon Furniture Inc., The HON Company, Haskell Education, Marco Group, Fleetwood Group, and Knoll, Inc.

b. Key factors that are driving the U.S. school furniture market growth include the focus on improving the availability of education across the country, government initiatives driving the building up of schools, product innovations boosting the comfort of furniture, and the trend of using sustainable products.

b. The classroom segment dominated the U.S. school furniture market, with a share of over 77% in 2024.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."