- Home

- »

- Medical Devices

- »

-

U.S. Sex Reassignment Surgery Market Size Report, 2030GVR Report cover

![U.S. Sex Reassignment Surgery Market Size, Share & Trends Report]()

U.S. Sex Reassignment Surgery Market (2023 - 2030) Size, Share & Trends Analysis Report By Gender Transition (Female-to-male, Male-to-female), By Procedure (Mastectomy, Vaginoplasty, Scrotoplasty, Hysterectomy, Phalloplasty), And Segment Forecasts

- Report ID: GVR-4-68039-258-0

- Number of Report Pages: 89

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The U.S. sex reassignment surgery market size was estimated at USD 2.1 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 11.25% from 2023 to 2030. The rising prevalence of gender dysphoria and the increasing number of individuals in the U.S. opting for gender affirmation surgeries are expected to boost market growth over the forecast period. As per the study conducted by Cedars Sinai in June 2020, approximately 78% of transgender males in the U.S. reported signs of gender dysphoria by the age of 7 years. In addition, the mean age to experience gender dysphoria in transgender males was around 6.2 years, comparatively less than that in transgender females.

Moreover, sex reassignment surgery is gaining popularity among the young transgender population in the U.S., as it helps people with gender dysphoria transition to their self-identified gender. Some individuals opt for Sex Reassignment Surgery (SRS) to align their physical characteristics with gender identity. The 2021 annual report of Mount Sinai Center for Transgender Medicine and Surgery indicated that approximately 41.7% and 25.8% of the transfeminine population aged 25 to 34 and aged 15 to 24, respectively, underwent SRS.

The increasing awareness of transgender issues and the availability and accessibility of gender reassignment surgical centers are significant factors contributing to the SRS market growth. Moreover, government reimbursement policies have also significantly contributed to market growth. The Affordable Care Act, formerly known as Obamacare, expanded insurance status and coverage for millions of U.S. citizens, including Lesbian, Gay, Bisexual, & Transgender (LGBT) individuals. In addition, the increasing transgender population had a positive impact on the market, resulting in significant growth of the SRS market.

Improving the reimbursement scenario is also anticipated to positively impact the market growth over the forecast period. Insurance providers such as Unicare and Aetna provide insurance coverage for surgical procedures, such as hysterectomy, salpingo-oophorectomy, orchiectomy, or ovariectomy. The Williams Institute at UCLA School of Law estimated that around 2.76 million individuals in the U.S. are enrolled in the Medicaid program. Among the transgender beneficiaries of Medicaid, approximately 60% have access to gender-affirming care due to specific policies outlined in state laws.

The COVID-19 pandemic led to a decrease in the number of SRS. A survey of American Council of Academic Plastic Surgeons (ACAPS) members conducted for a Plastic and Reconstructive Surgery publication in August 2020 revealed that 32% of the transgender population underwent gender affirmation surgery. In addition, it stated that no face, breast, or genital surgeries were available during the pandemic. With the adoption of telehealth, the number of consultations has been increasing and is expected to drive the growth of the market in the post-pandemic times.

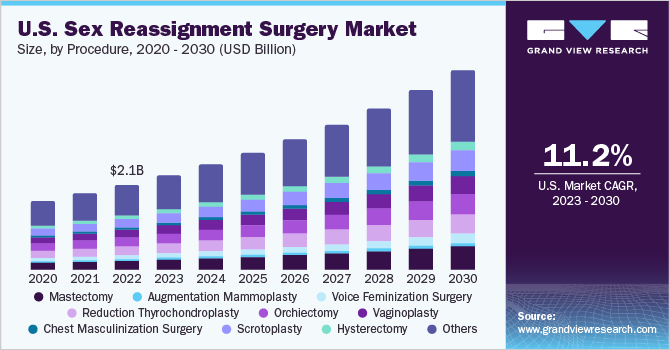

Procedure Insights

Based on procedure, the market is segmented into augmentation mammoplasty, voice feminization surgery, reduction thyrochondroplasty, orchiectomy, vaginoplasty, chest masculinization surgery, scrotoplasty, hysterectomy, phalloplasty, mastectomy, metoidioplasty, and facial feminization surgery. The mastectomy segment held the largest market share of 20.1% in terms of revenue in 2022. Gender-affirming mastectomy is a surgical procedure that creates a more masculine chest appearance by removing breast tissue.

Recently, there has been a significant rise in the number of children in the U.S. who openly identify as a gender different from their assigned sex at birth. This increase can be attributed to the growing recognition of transgender identity and rights. A study conducted by Komodo revealed that, between 2018 & 2021, at least 776 mastectomies were performed on individuals between the ages of 13 and 17 who had been diagnosed with gender dysphoria.

The augmentation mammoplasty segment is expected to witness the fastest CAGR of 12.98% over the forecast period. The availability and affordability of breast implants have increased, providing individuals with a wide range of options in terms of shapes, sizes, textures, and fillers to meet their specific preferences and needs. According to the ASPS, breast augmentation ranked among the top five cosmetic surgical procedures performed in the U.S. in 2020, with a staggering 193,073 procedures conducted.

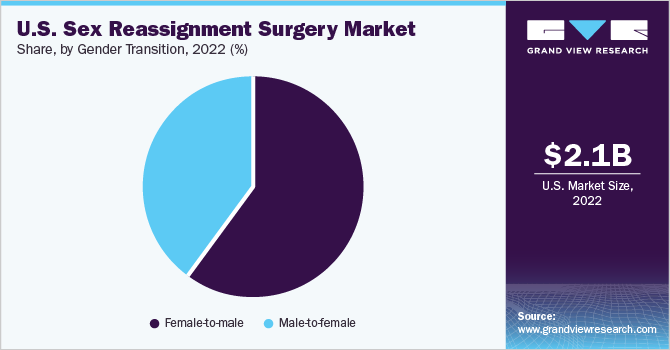

Gender Transition Insights

Based on gender transition, the market is segmented into male-to-female (MTF) and female-to-male (FTM). The FTM segment dominated the market with the largest revenue share of 59.81% in 2022. This is attributed to continuous innovations in metoidioplasty, phalloplasty, scrotoplasty, and chest reconstructing. According to the American Society of Plastic Surgeons (ASPS), there was an overall 14% and 13% increase in breast/chest and facial and transgender female sex reassignment surgeries procedures in 2020, respectively.

The MTF sex reassignment surgery is expected to witness the fastest CAGR of 12.9% during the forecast period owing to the high prevalence of gender dysphoria among males compared to females. According to the 2021 annual report of the Mount Sinai Center for Transgender Medicine and Surgery, approximately 861 sex reassignment surgeries were performed at Mount Sinai Hospital, of which 639 surgeries were performed for feminization. The transmasculine population aged 25 to 34 is more likely to undergo gender-affirming surgeries, which will account for approximately 41% of total transfeminine surgeries.

In addition, according to the ASPS, transgender males in the U.S. underwent 9,985 gender confirmation surgeries in 2020 compared to 8,986 in 2019. Government support is also driving the market. Thus, government support in the form of Medicare coverage and an increase in the number of gender confirmation surgeries are factors expected to boost market growth.

Key Companies & Market Share Insights

The market is fragmented, and the companies are offering advanced and innovative surgeries, including male and female breast reduction, neo-vaginoplasty, tracheal shave (chondrolaryngoplasty), and genital remodeling. The service providers focus on providing services to the LGBTQ+ community by investing in LGBTQ+ healthcare. For instance, in May 2023, Cedars Sinai established an LGBTQ+ Center that comprises a team of specialists in various fields, such as primary care, transgender surgery, reconstructive surgery, pediatrics, and anal cancer screening. This center aims to cater to the needs of patients in an inclusive and culturally sensitive environment. Some prominent players in the U.S. sex reassignment surgery market include:

-

Icahn School of Medicine at Mount Sinai

-

Cedars-Sinai

-

Moein Surgical Arts

-

Cleveland Clinic

-

Transgender Surgery Institute

-

Plastic Surgery Group of Rochester

-

Regents of the University of Michigan

-

CNY Cosmetic & Reconstructive Surgery

-

Boston Medical Center

-

The Johns Hopkins University

-

Kaiser Permanente

-

University of California, San Francisco Center of Excellence for Transgender Health

-

New York Presbyterian Hospital

-

Mayo Clinic (Transgender and Intersex Specialty Care Clinic)

U.S. Sex Reassignment Surgery Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.3 billion

Revenue forecast in 2030

USD 5.0 billion

Growth rate

CAGR of 11.25% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Gender transition, procedure

Country scope

U.S.

Key companies profiled

Icahn School of Medicine at Mount Sinai; Cedars-Sinai; Moein Surgical Arts; Cleveland Clinic; Transgender Surgery Institute; Plastic Surgery Group of Rochester; Regents of the University of Michigan; CNY Cosmetic & Reconstructive Surgery; Boston Medical Center; The Johns Hopkins University; Kaiser Permanente; University of California, San Francisco Center of Excellence for Transgender Health; New York Presbyterian Hospital; Mayo Clinic (Transgender and Intersex Specialty Care Clinic)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Sex Reassignment Surgery Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. sex reassignment surgery market report based on gender transition and procedure:

-

Gender Transition Outlook (Revenue, USD Million, 2018 - 2030)

-

Male-to-female

-

Female-to-male

-

-

Procedure Outlook (Revenue, USD Million, 2018 - 2030)

-

Augmentation Mammoplasty

-

Voice Feminization Surgery

-

Reduction Thyrochondroplasty

-

Orchiectomy

-

Vaginoplasty

-

Chest Masculinization Surgery

-

Scrotoplasty

-

Hysterectomy

-

Phalloplasty

-

Mastectomy

-

Metoidioplasty

-

Facial Feminization Surgery

-

Frequently Asked Questions About This Report

b. Some of the key players operating in the U.S. sex reassignment surgery market are Icahn School of Medicine at Mount Sinai, Cedars-Sinai, Moein Surgical Arts, Cleveland Clinic, Transgender Surgery Institute, Plastic Surgery Group of Rochester, Regents of the University of Michigan, CNY Cosmetic & Reconstructive Surgery, Boston Medical Center, The Johns Hopkins University, Kaiser Permanente, University of California, San Francisco Center of Excellence for Transgender Health, New York Presbyterian Hospital, and Mayo Clinic (Transgender and Intersex Specialty Care Clinic)

b. The rising incidences of gender dysphoria and the increasing number of people opting for gender confirmation surgeries are expected to boost market growth over the forecast period.

b. The U.S. sex reassignment surgery market size was estimated at USD 2.1 billion in 2022 and is expected to reach USD 2.3 billion in 2023.

b. The U.S. sex reassignment surgery market is expected to grow at a compound annual growth rate of 11.25% from 2023 to 2030 to reach USD 5.0 billion by 2030.

b. Female-to-Male (FTM) segment dominated the U.S. sex reassignment surgery market in 2022 owing to the continuous innovations in metoidioplasty, phalloplasty, scrotoplasty, and chest reconstructing surgeries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.