- Home

- »

- Medical Devices

- »

-

U.S. Sex Toys Market Size And Share, Industry Report, 2030GVR Report cover

![U.S. Sex Toys Market Size, Share & Trends Report]()

U.S. Sex Toys Market (2025 - 2030) Size, Share & Trends Analysis Report By Products (Vibrators, Masturbation Sleeves), By Distribution Channel (E-commerce, Mass Merchandizers), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-032-1

- Number of Report Pages: 105

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Sex Toys Market Size & Trends

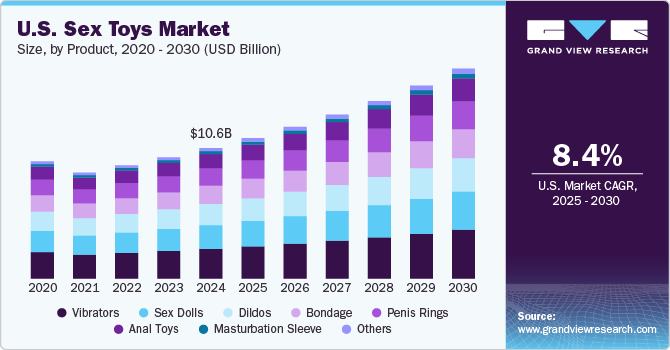

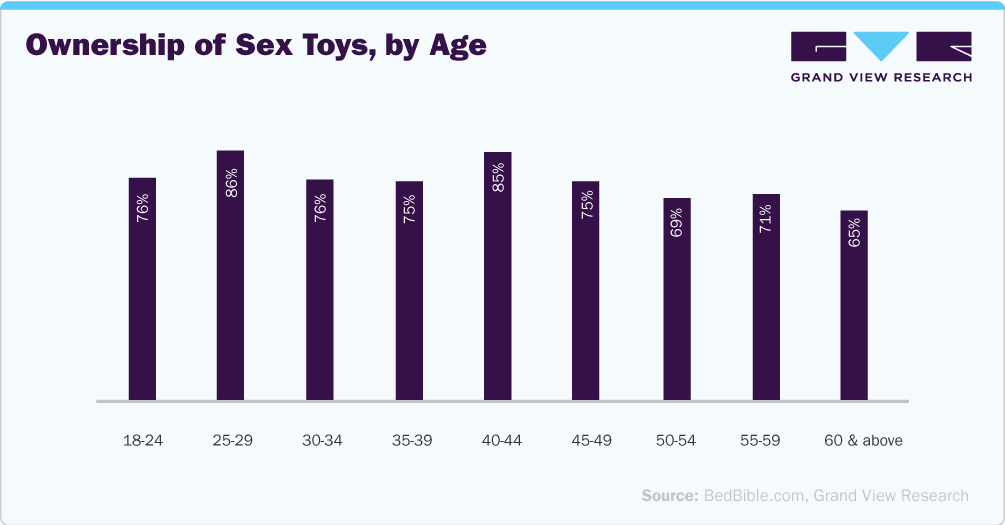

The U.S. sex toys market size was estimated at USD 10.62 billion in 2024 and is expected to grow at a CAGR of 8.38% from 2025 to 2030. Increasing use of sex toy products and rising awareness among adolescents & young adults regarding sexual health are some of the key factors expected to drive the U.S. market over the forecast period. Furthermore, The desire for sexual intercourse declines as people age, yet a considerable number of people engage in sexual activities. According to the AARP national survey, around 40% of older adults reported having an active sex life in the U.S. in 2023, wherein men (67%) were more sexually active compared to women (57%). This is expected to drive the demand for sex toys during the forecast period.

The changing perception of customers toward sex toys is expected to significantly drive the growth of the market. As societal attitudes toward sexuality evolve and the stigma around sexual wellness products is decreasing, the acceptance and demand for sex toys are growing across U.S. This shift in perception can be attributed to several factors such as increasing awareness about sexual well-being, the influence of pop culture, and the rising interest in sexual health among adolescents & young adults. In addition, the market is witnessing a surge in demand as women, couples, and individuals of all genders are exploring a variety of options such as luxury adult toys, Bluetooth vibrators, and other innovative products to enhance their sexual experience.

Furthermore, the e-commerce sector is expected to experience significant growth in the sales of sexual wellness products. This is due to the increasing use of smartphones and people's reluctance to purchase these products in physical stores. The variety of sex toys available on online platforms has led to a higher demand, as customers can compare brands and select products that suit their needs and preferences. This results in the companies facing intense competition to provide high-quality products that meet industry standards.

In addition, the COVID-19 pandemic boosted the online sales of sexual wellness products due to travel restrictions and fear of contracting the virus. Owing to the increased demand for products online, major supermarket chains are also adding these products to their online stores. For instance, in July 2022, Walmart added bod-bag condoms, d-AZ, and Weinerschleiden lubricants by Fetish Mafia, which were launched in 2018.

Consumer Behavior Analysis

The demand for sex toys has significantly increased over the years by customers of different age groups, sexual orientations, races & nationalities, and financial backgrounds. People have become more expressive and vocal about their sexual needs. Thus, the sale of sex toys significantly increasing, and the market is expected to witness lucrative growth over the forecast period.

According to the TENGA 2021 Self Pleasure Report, over 80% of the U.S. population considers masturbation as a form of self-care, and many of them are using self-pleasure as a coping mechanism to cater to the stress associated with the COVID-19 pandemic. Moreover, the usage of sex toys is rapidly growing in the U.S. and data suggests that around 19% of U.S. adults bought additional sex toys in expectation of self-isolation, and a majority of the population agreed that sexual pleasure acted as a form of self-care and made them feel better during self-quarantine during the pandemic. Moreover, more than 37% of respondents reported an increased frequency of sexual pleasure during self-isolation.

Moreover, vibrators are the most popular sex toys among U.S. adults, with around 55% of U.S. adults buying vibrators in 2022. The impact of online shopping in sex toys market is evident; not all consumers want to go to a physical store due to the sensitive nature of the product. In the past few years, online retailing has been concentrated in the hands of a few big players.

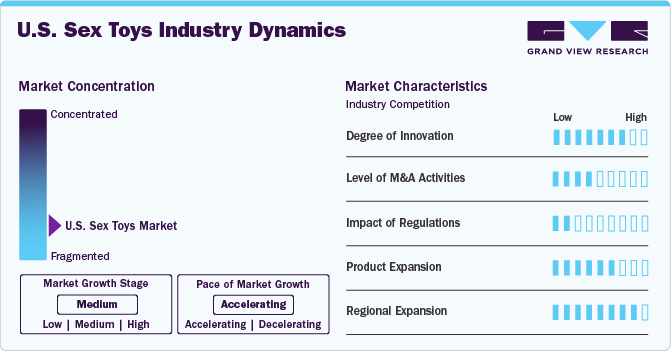

Market Concentration & Characteristics

The chart below represents the relationship between industry concentration, industry characteristics, and industry participants. The x-axis shows the level of industry concentration, ranging from low to high. The y-axis represents various market characteristics, such as degree of innovation, impact of regulations, industry competition, service and product expansion, level of partnerships and collaboration activities, and regional expansion. For instance, the industry is fragmented, with many services and end users entering the market. There is a high degree of innovation, moderate level of partnerships and collaboration activities, moderate impact of regulations, high product expansion, and low regional expansion.

The U.S. market is experiencing a high degree of innovation. The integration of advanced technologies drives technological innovation in the market. Companies have introduced advanced products with augmented reality and remotely connected devices, such as Bluetooth-enabled and Wi-Fi-enabled devices, robots, and others. For instance, in March 2024, LELO introduced the SIRI 3, a vibrator with advanced SOUNDSENSE technology. This feature enables precise, sound-responsive stimulation using two built-in microphones for real-time sound activation and noise cancellation. SIRI 3 offers enhanced vibration settings. The technology allows users to synchronize the vibrator's vibrations with their preferred music, offering a more personalized and intensified experience. The product is focused on providing a more responsive and dynamic clitoral stimulation in line with the user's audio environment.

The market experiences moderate level of partnerships & collaborations, enabling companies to expand their market presence and customer base. For instance, in February 2023, Doc Johnson Enterprises partnered with Lion’s Den to promote its latest line of vibrators, Ritual. This collaboration includes a series of billboards strategically placed throughout Las Vegas, showcasing the Ritual line.

The regulatory framework for sex toys in the U.S. is complex and evolving. Although there are no specific federal regulations governing the industry, sex toys are often classified as novelty items under the Food and Drug Administration's (FDA) quality control. This categorization does not necessarily ensure compliance with safety standards, leading to a patchwork of state and local laws with varying degrees of strictness

The market experiences a high level of product expansion. Several market players are launching new products and acquiring smaller players to strengthen their market position and expand their product reach. For instance, in September 2022, LELO launched an app-controlled massager, TIANI Harmony.

The market is experiencing significant level of regional expansion and is expected to grow in the coming years, resulting in increasing purchases of sex toys. For instance, people of the Midwest region are spending more on sex toys compared to the other regions in the U.S. According to a survey of 2,300 people conducted by Bespoke Surgical in 2020, the people of Illinois spend 12.2% more than the national average on sex products.

Product Insights

The vibrators segment dominated the market with a revenue share of 22.84% in 2024 and expected to witness fastest CAGR during the forecast period. Vibrators are sex toys that are placed on erogenous areas on the body, places that enhance sexual pleasure, for sexual stimulation. The integration of technology in existing products to provide new experiences to users is one of the areas of innovation. For instance, vibrators with a wand on one side & a massage ball on the other and numerous pulsating patterns for each provide users with multiple combinations of simultaneous massage & penetration. Moreover, according to the WebMD study published in June 2021, more than 49.8% of homosexual males and 43.8% of heterosexual males in the U.S. use a vibrator with a partner or alone. In addition, about 52.5% of women aged 18 to 60 years used a vibrator in the U.S. Hence, considering the growing demand, market players are expanding their product lines by introducing new products.

The masturbation sleeve segment is expected to experience significant growth from 2025 to 2030. Rise in acceptance of sexual needs and adoption of toys due to their ability to deliver enhanced sexual pleasure, gradually increasing the adoption of toys & creating opportunities for manufacturers to launch innovative toys. For instance, in October 2021, TENGA Co., Ltd. launched various packs of new WONDER EGG super-stretch sleeves, including EGG WIND, EGG RING, EGG STUD, EGG CURL, EGG TUBE, and EGG MESH.

Distribution Channel Insights

The e-commerce segment dominated the market with a revenue share of 57.00% in 2024 and is expected to grow at the fastest CAGR during the forecast period. In the past few years, e-commerce and online sex stores are the most used platforms for purchasing sexual wellness products in the U.S. Discrete delivery of products and customer anonymity are the key factors responsible for the increasing number of customers preferring these channels over traditional options. Moreover, the convenience of choosing from a vast variety of products on a single platform at discounted prices provides added benefits. Market players such as LELO, We-Vibe, Lovehoney, and Fun Factory are some of the largest online retailers in the U.S., along with emerging sex toys manufacturers, such as Maude, Dame Products, OhMiBod, and UNBOUND, with local & global presence via online sites.

Furthermore, the mass merchandizers segment is expected to grow significantly during the forecast period. In the U.S., mass merchandisers are witnessing increased sales of sexual wellness products. Rising demand for sex toys to fulfill sexual needs is positively impacting the sales of such products across hypermarkets. Hence, supermarket giants are entering the market owing to rising demand for these products. For instance, in February 2022, Sephora, a major beauty company in the U.S., added sex toys from Maude and Dame to its shelves.

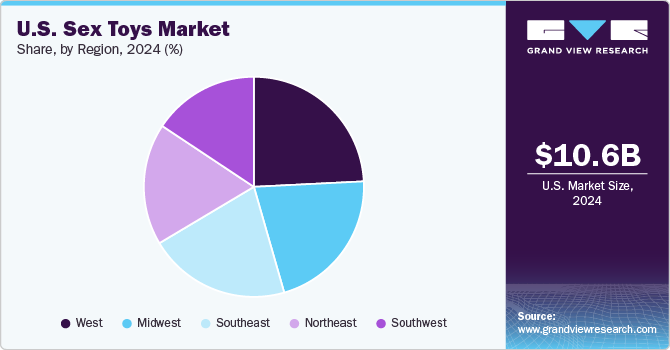

Region Insights

The West region dominated the market with a revenue share of 24.21% in 2024 and is expected to have the fastest CAGR during the forecast period. The Western region of the U.S. includes Alaska, Oregon, California, Nevada, Arizona, New Mexico, Hawaii, Utah, Colorado, Wyoming, Idaho, Washington, and Montana. People are spending more on sex products in the region, which can be attributed to the reduced stigma associated with sexual wellness & health and the fact that sexual health is becoming part of mainstream discussions.

Furthermore, market players are undertaking innovative marketing strategies to strengthen their market positions. For instance, in February 2024, PinkCherry, a prominent online retailer of adult toys, launched a notable billboard campaign related to the annual football event in Las Vegas, Nevada. This initiative includes six visually striking billboards featuring playful and provocative slogans aimed at capturing the attention of football fans and event attendees, based on the year's highly anticipated sporting event.

The Northeast region is expected to experience significant growth from 2025 to 2030. Vermont, New Hampshire, and Maine ranked fifth, sixth, and seventh, respectively, for sex toy sales per capita in 2018, according to a 2018 infographic created by the adult toy manufacturer Adam & Eve. The demand for sex toys, especially sex dolls, in the region rapidly increased during the COVID-19 pandemic. For instance, in December 2020, the sales of Silicon Wives in New York City increased by around 65% compared to 2019. In addition, SexDollGennie, a Miami-based company, reported a 218% increase in sales compared to 2019, which was majorly seen in Brooklyn, Manhattan, Bronx, Queens, and Staten Island

Key U.S. Sex Toys Company Insights

The market is highly fragmented, with the presence of numerous market players offering a variety of products. Several market players are undertaking various strategic initiatives, such as product launches, acquisitions, partnerships & collaboration to strengthen their market position. These strategies enable companies to increase their capabilities, expand their service portfolios, and improve their competencies. Key players engaged in this growth strategy include TENGA Co. Ltd., LELO, Pipedream Products, Doc Johnson Enterprises, BMS Factory, Fun Factory, and Church & Dwight Co. Ltd.

Key U.S. Sex Toys Companies:

- Reckitt Benckiser Group plc

- Church & Dwight Co., Inc.

- Lovehoney Group Ltd.

- LifeStyles Healthcare Pte Ltd.

- LELO

- Doc Johnson Enterprises

- Unbound

- Tenga Co., Ltd.

- Fun Factory

- BMS Factory

- PHE, Inc. (Adam & Eve)

- California Exotic Novelties

- Pipedream Products

- Dame Products, Inc

- ILF, LLC

Recent Developments

-

In September 2024, Just Eat Takeaway.com NV announced a partnership with Lovehoney Group, allowing them to deliver a variety of sexual wellbeing products under various brand names, including Womanizer and Fifty Shades of Grey.

-

In August 2024, Doc Johnson Enterprises announced the launch of 32 new products under their Main Squeeze and Signature Strokers lines.

-

In April 2024, Fun Factory introduced six new sex toys for couples, including Manta Masturbator and Stronic Surf Pulsator.

-

In March 2024, MysteryVibe partnered with Havas Lynx with the aim of showcasing the first sex toy to have been prominently featured on billboards across the U.S. The campaign aims to normalize conversations around sexual wellness and promote a more open dialogue about sexual health.

U.S. Sex Toys Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.44 billion

Revenue forecast in 2030

USD 17.11 billion

Growth rate

CAGR of 8.38% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Reckitt Benckiser Group plc; Church & Dwight Co., Inc.; Lovehoney Group Ltd.; LifeStyles Healthcare Pte Ltd.; LELO; Doc Johnson Enterprises; Unbound; Tenga Co., Ltd.; Fun Factory; BMS Factory; PHE, Inc. (Adam & Eve); California Exotic Novelties; Pipedream Products; Dame Products, Inc; ILF, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Sex Toys Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S sex toys market report based on product, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Vibrators

-

Sex Dolls

-

Dildos

-

Bondage

-

Penis Rings

-

Anal Toys

-

Masturbation Sleeve

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

E-commerce

-

Specialty Platforms

-

Online Portals of Mass Merchandizers

-

-

Specialty Stores

-

Mass Merchandizers

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

West

-

Midwest

-

Southeast

-

Northeast

-

Southwest

-

Frequently Asked Questions About This Report

b. The U.S. sex toys market size was estimated at USD 10.62 billion in 2024 and is expected to reach USD 11.44 billion in 2025.

b. The U.S. sex toys market is expected to grow at a compound annual growth rate of 8.38% from 2025 to 2030 to reach USD 17.11 billion by 2030.

b. The vibrators segment dominated the U.S. sex toy market with a share of 22.84% in 2024. This is attributable to the significantly large consumer base and increasing demand from the youth.

b. Some key players operating in the U.S. sex toys market include Reckitt Benckiser Group plc , Church & Dwight Co., Inc., Lovehoney Group Ltd., LifeStyles Healthcare Pte Ltd., LELO, Doc Johnson Enterprises, Unbound, Tenga Co., Ltd., Fun Factory, BMS Factory, PHE, Inc. (Adam & Eve), California Exotic Novelties, Pipedream Products, Dame Products, Inc, ILF, LLC

b. Key factors that are driving the U.S. sex toys market include increasing demand from customers of different age groups, sexual orientations, races & nationalities, and financial backgrounds and rising awareness regarding sexual wellness.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.