- Home

- »

- Next Generation Technologies

- »

-

U.S. Smart Airport Market Size, Share, Industry Report, 2033GVR Report cover

![U.S. Smart Airport Market Size, Share & Trends Report]()

U.S. Smart Airport Market (2025 - 2033) Size, Share & Trends Analysis Report By Technology (Security Systems, Communication Systems), By Application (Aeronautical operations, Non-aeronautical operations), By Location (Landside, Airside, Terminal Side), And Segment Forecasts

- Report ID: GVR-4-68040-745-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Smart Airport Market Size & Trends

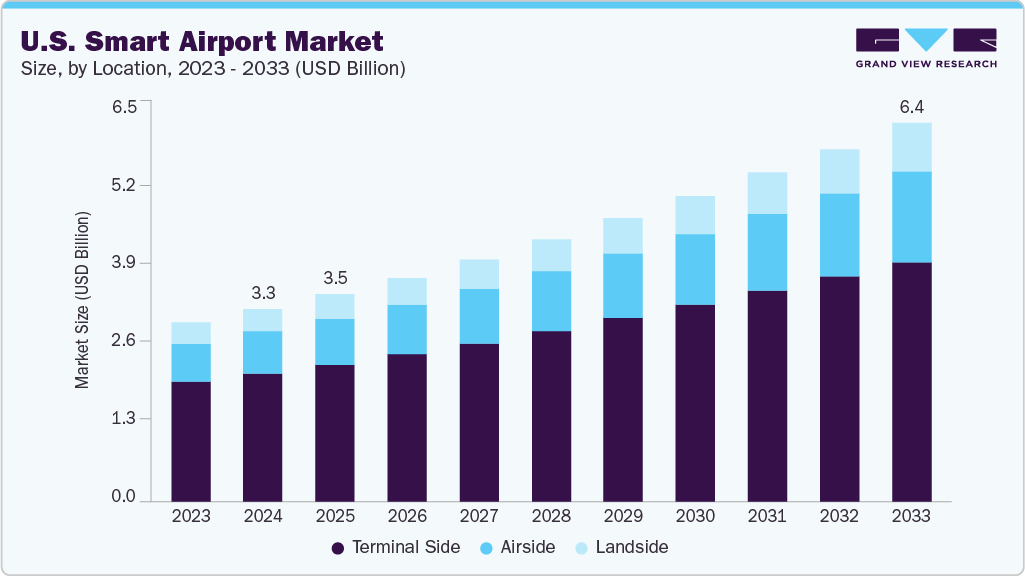

The U.S. smart airport market size was estimated at USD 3.27 billion in 2024 and is expected to grow at a CAGR of 7.8% from 2025 to 2033. The increasing demand for smart airport solutions is prompting U.S. airports to modernize legacy infrastructure with advanced technologies to meet rising passenger expectations. Travelers’ growing preference for faster, contactless, and seamless experiences is driving the adoption of AI, biometrics, and IoT to optimize operations and enhance customer satisfaction. Major hubs, including Atlanta and Chicago, are investing heavily in smart systems to manage growing traffic and sustain global competitiveness. This trend represents a key driver of market growth, pushing airports to innovate and strengthen their leadership in the aviation sector.

The growing focus on seamless passenger experiences is driving investments in biometric and contactless technologies within the U.S. smart airport industry. Airports are deploying facial recognition, fingerprint scanning, and touchless kiosks to accelerate check-in and security procedures. These innovations reduce congestion, enhance security, and meet passengers’ increasing demand for speed and convenience. The adoption of biometric solutions is becoming a key driver of digital transformation across the industry.

The integration of IoT technologies is reshaping the U.S. smart airport market into interconnected ecosystems that enable real-time operational decision-making. IoT sensors track crowd movement, monitor equipment performance, and assess environmental conditions, allowing airports to manage operations proactively. This technology improves efficiency in baggage handling, security screening, and facility maintenance while reducing costs. Airports leveraging IoT are positioned to lead the industry by delivering smarter, data-driven operations.

The deployment of 5G networks is transforming communication capabilities across the U.S. market for smart airports, facilitating faster and more reliable real-time data sharing. These networks support advanced applications, including autonomous vehicles and IoT-enabled systems, boosting operational efficiency and passenger services. Airports with 5G infrastructure can manage rising data demands and provide seamless connectivity. This trend acts as a key enabler of innovation, positioning U.S. airports at the forefront of the global smart airport sector.

Smart parking and transportation solutions are redefining landside operations within the U.S. smart airport industry, improving traffic flow and reducing congestion. Predictive analytics and automated parking systems enhance convenience for travelers while optimizing resource utilization. Investments in these technologies help airports streamline ground operations and elevate the overall travel experience. This trend supports operational excellence and contributes significantly to the industry’s growth trajectory.

Technology Insights

The passenger, cargo, & baggage ground handling control segment accounted for the highest market share of over 30.0% in 2024, owing to the increasing need for efficient management of passenger luggage, cargo shipments, and ground operations at major U.S. airports. Rising passenger volumes and growing e-commerce shipments are driving airports to adopt automated and IoT-enabled systems to streamline baggage and cargo handling. Airports such as Dallas/Fort Worth and Atlanta Hartsfield-Jackson are investing in advanced tracking, sorting, and automated transport solutions to reduce delays and operational errors. This segment’s dominance is fueled by the critical role of ground handling operations in ensuring timely, secure, and seamless airport services.

The communication systems segment is expected to grow at the fastest CAGR of over 8.0% from 2025 to 2033, driven by the increasing demand for seamless, real-time connectivity across airport operations. U.S. airports are investing in next-generation communication networks, including 5G and IoT-enabled systems, to support efficient coordination between airside, terminal, and ground handling activities. Enhanced communication infrastructure enables faster decision-making, improved safety, and optimized resource management. This growth is propelled by the need for reliable, high-speed communication to handle rising passenger volumes and complex operational demands.

Application Insights

The aeronautical operations segment held the largest share of the U.S. smart airport industry in 2024, primarily driven by the increasing air traffic and the need for efficient flight operations management across U.S. airports. Airports are investing in advanced air traffic management systems, runway monitoring technologies, and IoT-enabled operational tools to ensure safety, punctuality, and optimal resource utilization. Major hubs such as Atlanta Hartsfield-Jackson and Chicago O’Hare are leveraging these solutions to manage growing passenger and cargo volumes effectively. This segment’s prominence is fueled by the critical role of aeronautical operations in maintaining seamless airport functionality and supporting overall aviation growth.

The non-aeronautical operations segment is expected to grow at the fastest CAGR from 2025 to 2033, owing to the increasing focus on revenue diversification and enhanced passenger services at U.S. airports. Airports are investing in retail, food & beverage, parking, and real estate facilities to maximize non-aeronautical income streams while improving the overall traveler experience. Advanced management systems and digital solutions are being deployed to optimize these operations efficiently. This growth is driven by the need to balance operational costs, boost profitability, and deliver seamless end-to-end passenger experiences.

Location Insights

The terminal side segment held the largest share of the U.S. smart airport market in 2024. The increasing demand for enhanced passenger experiences, including faster check-ins, efficient security screening, and seamless wayfinding, is driving investments in advanced terminal technologies at U.S. airports. Airports are deploying IoT-enabled systems, smart kiosks, and automated baggage handling to optimize passenger flow and operational efficiency. This segment’s dominance is fueled by the critical role of terminal operations in ensuring smooth, safe, and satisfying travel experiences for passengers.

The airside segment is expected to grow at the fastest CAGR from 2025 to 2033, driven by increasing investments in runway management, aircraft parking, and apron operations at U.S. airports. Airports are implementing advanced airfield lighting, IoT-enabled monitoring systems, and automated ground support equipment to enhance operational efficiency and safety. Major hubs such as Atlanta Hartsfield-Jackson and Chicago O’Hare are leveraging these technologies to manage growing air traffic and minimize delays. This growth is fueled by the critical need to optimize airside operations and support the increasing volume of passenger and cargo flights.

Key U.S. Smart Airport Company Insights

Some of the key market players include Honeywell International Inc. and Cisco Systems, Inc.

-

Honeywell International Inc. specializes in delivering integrated smart airport solutions, including terminal automation, security systems, and building management. Its technologies streamline passenger processing, baggage handling, and airside operations to improve efficiency. Honeywell’s solutions enable airports to optimize operational performance and enhance traveler experience. The company’s expertise positions it as a leader in modernizing U.S. airport infrastructure.

-

Cisco Systems, Inc. focuses on secure networking, IoT, and communication infrastructure tailored for airports. Its solutions enable real-time operational coordination and data-driven decision-making. Cisco’s technology supports high-speed connectivity, cybersecurity, and digital infrastructure across terminals and airside operations. This specialization makes Cisco a key enabler of connected, efficient, and future-ready U.S. airports.

Some of the emerging players in the market include Infax, Inc. and Verint Systems Inc.

-

Infax, Inc. focuses on digital display and information management systems for airports. Its technologies improve passenger communication, flight updates, and operational workflows. Infax solutions streamline airport operations while enhancing the traveler experience. The company is a key provider of smart information systems in U.S. airports.

-

Verint Systems Inc. specializes in analytics, situational intelligence, and passenger engagement solutions for airports. Its platforms enable real-time monitoring, operational optimization, and data-driven decision-making. Verint’s solutions improve efficiency, security, and passenger experience. The company is a strategic technology partner for modern U.S. airports.

Key U.S. Smart Airport Companies:

- Honeywell International Inc.

- Cisco Systems, Inc.

- L3Harris Technologies, Inc.

- IBM Corporation

- Raytheon Technologies / Collins Aerospace

- Leidos, Inc.

- Infax, Inc.

- Ascent Technology

- Sabre Corporation

- Analogic Corporation

- Rapiscan Systems

- Verint Systems Inc.

Recent Developments

-

In September 2025, The New Terminal One at John F. Kennedy International Airport partnered with Plaza Premium Group to develop and operate two independent lounges. The Plaza Premium First lounge, spanning 9,300 square feet beyond security, will feature à la carte dining, curated menus, and a signature Infinity Room. In contrast, the 4,200-square-foot pre-security lounge will offer restaurant-quality food, a full bar, showers, and a business center. This initiative supports JFK Airport’s USD 19 billion transformation, enhancing passenger experience and establishing a world-class international terminal.

-

In May 2025, Hyundai Motor Group partnered with Incheon International Airport Corporation to introduce AI-powered automatic charging robots (ACRs) at the airport. These autonomous robots are designed to locate electric vehicle (EV) charging ports and carry out the charging process without human intervention. The initiative aims to enhance operational efficiency and provide greater convenience for EV users, supporting Incheon Airport’s goal of becoming a leading digital and sustainable transportation hub.

-

In April 2025, Huawei introduced its Smart Airport Intelligent Operation Center (IOC) at the Passenger Terminal Expo in Madrid. The platform integrates AI, big data, IoT, and cloud technologies to provide real-time, 360° visibility of airside, landside, and ground handling operations. By enhancing efficiency, improving flight punctuality by 5%, and enabling precise forecasting, the IOC optimizes resource allocation and overall airport operations.

U.S. Smart Airport Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.52 billion

Revenue forecast in 2033

USD 6.42 billion

Growth rate

CAGR of 7.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, location

Country scope

U.S.

Key companies profiled

Honeywell International Inc.; Cisco Systems, Inc.; L3Harris Technologies, Inc.; IBM Corporation; Raytheon Technologies / Collins Aerospace; Leidos, Inc.; Infax, Inc.; Ascent Technology; Sabre Corporation; Analogic Corporation; Rapiscan Systems; Verint Systems Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Smart Airport Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. smart airport market report based on technology, application, and location:

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Security Systems

-

Communication Systems

-

Passenger, Cargo, & Baggage Ground Handling Control

-

Air/Ground Traffic Control

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Aeronautical operations

-

Non-aeronautical operations

-

-

Location Outlook (Revenue, USD Million, 2021 - 2033)

-

Landside

-

Airside

-

Terminal side

-

Frequently Asked Questions About This Report

b. The U.S. smart airport market size was estimated at USD 3.27 billion in 2024 and is expected to reach USD 3.52 billion in 2025.

b. The U.S. smart airport market is expected to grow at a compound annual growth rate of 7.8% from 2025 to 2033 to reach USD 6.42 billion by 2033.

b. The passenger, cargo, & baggage ground handling control segment dominated the U.S. smart airport market with a share of over 30% in 2024, owing to rising investments in automation and advanced tracking systems to enhance efficiency and minimize operational delays.

b. Some key players operating in the U.S. smart airport market include Honeywell International Inc., Cisco Systems, Inc., L3Harris Technologies, Inc., IBM Corporation, Raytheon Technologies / Collins Aerospace, Leidos, Inc., Infax, Inc., Ascent Technology, Sabre Corporation, Analogic Corporation, Rapiscan Systems, Verint Systems Inc.

b. Key factors that are driving the market growth include the increasing adoption of biometric and contactless technologies, the integration of IoT for real-time operational efficiency, and rising investments in automation for passenger, cargo, and baggage handling.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.