- Home

- »

- Next Generation Technologies

- »

-

U.S. Smart Manufacturing Market Size, Industry Report, 2030GVR Report cover

![U.S. Smart Manufacturing Market Size, Share & Trends Report]()

U.S. Smart Manufacturing Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Technology, By End Use, And Segment Forecasts, Key Companies And Competitive Analysis

- Report ID: GVR-4-68040-213-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Smart Manufacturing Market Trends

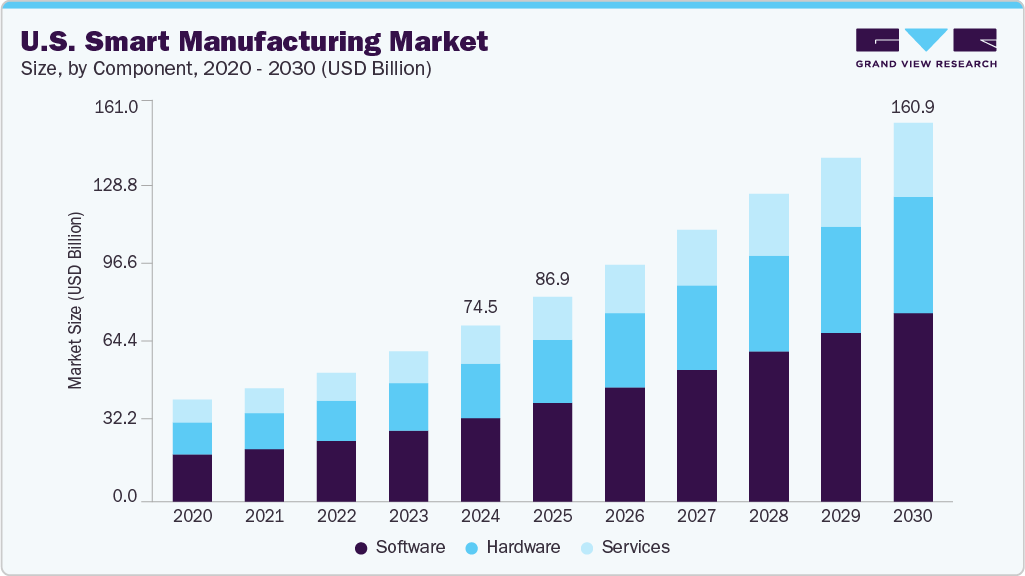

The U.S. smart manufacturing market size was estimated at USD 74.47 billion in 2024 and is projected to reach USD 160.94 billion by 2030, growing at a CAGR of 13.1% from 2025 to 2030. The growth is primarily driven by increasing demand for automation and real-time data analytics, rapid advancements in Industrial Internet of Things (IIoT), robotics, and machine learning technologies. The integration of artificial intelligence (AI), digital twins, and advanced analytics is transforming manufacturing workflows. Growing investments in sustainable manufacturing, energy efficiency, and regulatory compliance are attracting new entrants and expanding the market across sectors such as aerospace, automotive, healthcare, and electronics.

The rapid advancement and adoption of Industrial Internet of Things (IIoT) platforms and advanced analytics are fundamentally transforming the U.S. smart manufacturing industry. Technologies such as AI-driven predictive maintenance systems, real-time data monitoring, and digital twin simulations enable manufacturers to optimize production efficiency, reduce downtime, and improve operational safety. The growing demand for connected equipment and automated workflows across diverse industrial sectors continues to accelerate the expansion of the market.

Additionally, increasing investments in robotics, automation, and advanced sensor networks drive the need for more agile and flexible manufacturing environments. The integration of collaborative robots (cobots), machine vision systems, and automated material handling solutions is helping manufacturers scale operations while maintaining high-quality standards. This shift is further supported by government incentives and private sector initiatives aimed at improving productivity in the global market.

The rising focus on sustainable manufacturing practices and energy efficiency significantly contributes to market expansion. Manufacturers increasingly leverage smart energy management systems, waste reduction technologies, and environmentally conscious supply chain strategies to meet stringent regulatory requirements and corporate sustainability goals. Federal and state-level policies promoting green manufacturing and consumer demand for eco-friendly products encourage companies to integrate smart technologies across their operations.

Moreover, the expansion of workforce training programs and digital skills development is crucial in supporting smart manufacturing growth. Educational institutions, industry associations, and corporate partnerships are promoting curriculum advancements, certifications, and apprenticeships to prepare the workforce for Industry 4.0 technologies. Initiatives aimed at reducing skill gaps, reskilling workers, and fostering innovation-driven leadership are driving adoption across the U.S. smart manufacturing industry.

Component Insights

The software segment dominated the U.S. smart manufacturing market with the largest share of over 47.0% in 2024. The increasing reliance on advanced software solutions for automation, real-time monitoring, and predictive maintenance has significantly influenced the growth of this segment. Many manufacturers prefer software-driven systems due to their ability to operate robots and other machines with minimal human intervention, thereby reducing operational errors and improving efficiency. The rise of AI-powered analytics, remote-controlled machinery, and organizations prioritizing error-free production drives demand for advanced software solutions.

The hardware segment is expected to witness a significant CAGR of over 12.0% from 2025 to 2030. This segment includes industrial robots, advanced CNC machines, IIoT enabling devices, and AR/VR-enabled manufacturing tools. While these devices are increasingly deployed at the edge of production networks, their demand has surged in recent years due to the growing need for automation, precision, and real-time decision-making. Different types of conventional and smart sensors, such as temperature sensors, vibration monitors, and machine vision cameras, are a critical component of the hardware segment, which has been experiencing rapid demand growth and a significant rise to ensure seamless integration and scalability of their smart manufacturing ecosystems.

Technology Insights

The discrete control system (DCS) segment accounted for the largest share of the U.S. smart manufacturing industry in 2024, driven by its robust control and monitoring capabilities, seamless process management, and real-time operational oversight. DCS technology offers administrators both basic and advanced levels of automation support. The growing demand for remote accessibility and centralized monitoring has further expanded the adoption of DCS solutions, while cloud-enabled platforms and predictive analytics have increased operational efficiency. DCS systems' flexibility, scalability, and interoperability continue to strengthen their role in driving productivity and resilience in the industry.

The 3D printing segment is expected to witness the fastest CAGR from 2025 to 2030. This growth is driven by the large-scale adoption of 3D printing in product design processes, increasing demand for rapid prototyping, and agile product iterations. Advancements in AI and machine learning as design aids enhance manufacturing accuracy and reduce development time, making additive manufacturing more efficient and cost-effective. Automation in 3D printing workflows and integration with cloud-based platforms and simulation tools create new production capabilities and accelerate innovation. These factors make 3D printing one of the fastest-growing segments in the U.S. smart manufacturing industry.

End Use Insights

The automotive segment dominated the U.S. smart manufacturing market and accounted for the largest market share in 2024. The increasing reliance on smart manufacturing solutions for waste reduction, cost optimization, and productivity enhancement has significantly influenced the growth of this segment. The rise of Industry 4.0 technologies, including connected devices, data-driven process controls, and predictive maintenance, drives demand for solutions that enable round-the-clock operations and reduce labor costs in the market.

The chemical & materials solution segment is expected to witness the fastest CAGR from 2025 to 2030. This segment includes advanced monitoring systems, energy management solutions, real-time analytics platforms, and AI-driven process control tools. These technologies are increasingly deployed at the edge of chemical processing and material handling networks, with their demand surging in recent years due to the growing need for regulatory compliance, emissions control, and process optimization. These factors drive rapid growth in the chemical and material segment, making it one of the leading sectors in the U.S. smart manufacturing industry.

Key U.S. Smart Manufacturing Company Insights

Some of the key players operating in the market include Rockwell Automation and Siemens among others.

-

Rockwell Automation offers a comprehensive industrial automation ecosystem through its control systems, software platforms, and connected devices. Its partnerships with leading technology providers and focus on solutions such as FactoryTalk and Integrated Architecture have significantly enhanced its offerings, reinforcing its dominance in the U.S. smart manufacturing market.

-

Siemens provides an extensive range of automation, digitalization, and process optimization solutions through its Xcelerator portfolio, MindSphere IoT platform, and advanced simulation tools. Its investments in AI, edge computing, and smart factory solutions have expanded its footprint, strengthening its leadership in the U.S. smart manufacturing industry.

PTC and Yokogawa Electric Corporation are some of the emerging participants in the U.S. smart manufacturing market.

-

PTC provides advanced software solutions that enable digital transformation in manufacturing, including its ThingWorx IoT platform and Creo design tools. With its focus on real-time analytics, connected devices, and augmented reality-driven workflows, PTC has rapidly emerged as a key innovator supporting manufacturers’ transition to smart, data-driven operations in the U.S. smart manufacturing industry.

-

Yokogawa Electric Corporation delivers cutting-edge industrial automation and measurement solutions, such as its CENTUM control systems and field instrumentation products. Integrating process control, data analytics, and energy optimization tools, Yokogawa has quickly gained recognition as an emerging player enhancing operational efficiency and sustainability in the U.S. market for smart manufacturing.

Key U.S. Smart Manufacturing Companies:

- Cisco Systems, Inc.

- Emerson Electric Co.

- General Electric Company

- Honeywell International Inc.

- IBM Corporation

- PTC

- Oracle

- Rockwell Automation

- Siemens

- Yokogawa Electric Corporation

Recent Developments

-

In August 2025, Yokogawa Electric Corporation unveiled an AI-powered solution for planning optimization that automates complex planning processes. This advancement boosts operational efficiency and reduces planning time in manufacturing environments, reinforcing Yokogawa’s role as a key innovator in the U.S. smart manufacturing industry.

-

In June 2025, PTC introduced Arena SCI, an AI-driven supply chain risk monitoring solution integrated into product development workflows. This innovation strengthens PTC’s presence in the U.S. smart manufacturing market by enhancing real-time risk detection and improving decision-making within manufacturing processes, positioning the company as a leader in intelligent supply chain management.

-

In March 2025, Siemens announced a strategic investment in U.S. smart manufacturing by establishing new facilities in California and Texas. This initiative aims to enhance manufacturing capabilities and advance AI technologies, strengthening Siemens’s role as a key enabler of innovation and digital transformation within the U.S. smart manufacturing industry.

U.S. Smart Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 86.88 billion

Revenue forecast in 2030

USD 160.94 billion

Growth rate

CAGR of 13.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, end use

Country scope

U.S.

Key companies profiled

Cisco Systems, Inc.; Emerson Electric Co.; General Electric Company; Honeywell International Inc.; IBM Corporation; PTC; Oracle; Rockwell Automation; Siemens; Yokogawa Electric Corporation

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

U.S. Smart Manufacturing Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest technology trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. smart manufacturing market report based on component, technology, and end use:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

MES

-

PLC

-

ERP

-

SCADA

-

DCS

-

HMI

-

Machine Vision

-

3D Printing

-

PLM

-

Plant Asset Management

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Automotive

-

Aerospace & Defense

-

Chemical & Materials

-

Healthcare

-

Industrial Equipment

-

Electronics

-

Food & Agriculture

-

Oil & Gas

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. smart manufacturing systems market size was estimated at USD 62.26 billion in 2023 and is expected to reach USD 72.34 billion in 2024.

b. The U.S. smart manufacturing systems market is expected to grow at a compound annual growth rate of 13.2% from 2024 to 2030 to reach USD 152.11 billion by 2030.

b. The automotive industry accounted for the largest revenue share in 2023, owing to the increasing adoption of robotics and automation products to enhance productivity and streamline supply chain management.

b. The key players in this U.S. smart manufacturing systems market include PTC, Rockwell Automation Inc., Schneider Electric, Honeywell International Inc., Emerson Electric Co., ABB Ltd., Siemens AG, and General Electric (GE) among others.

b. Key factors that are driving the market growth include the proliferation of the Internet of Things and increasing demand for automation, quality, and efficiency across the region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.