- Home

- »

- Next Generation Technologies

- »

-

U.S. Software Consulting Market Size & Share Report, 2030GVR Report cover

![U.S. Software Consulting Market Size, Share & Trends Report]()

U.S. Software Consulting Market (2022 - 2030) Size, Share & Trends Analysis Report By Application (Enterprise Solutions, Software Security Services, Application Development), By Enterprise Size, By End-use, And Segment Forecasts

- Report ID: GVR-4-68039-980-6

- Number of Report Pages: 184

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

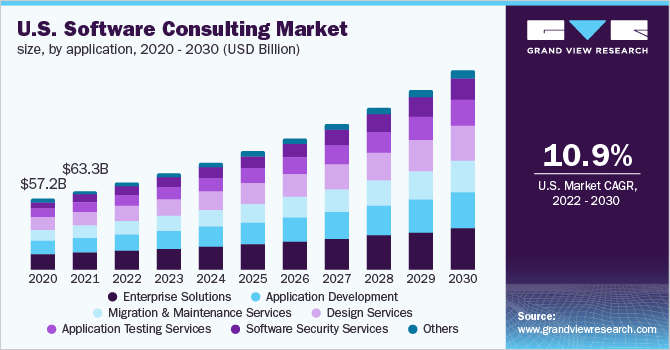

The U.S. software consulting market size was valued at USD 63.32 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 10.9% from 2022 to 2030. The increasing focus of organizations on enhancing their digital transformation processes and the rising need to deploy modernized and smart software solutions to optimize complex business processes are attributed to the growth of the software consulting industry in the country.

Moreover, during the COVID-19 pandemic, several organizations accelerated their transformation initiatives to adapt to the new working culture. As a result, demand for software consulting services increased significantly in the U.S. This factor is, therefore, observed as a key trend contributing to the growth. Additionally, increasing demand for expertise in niche areas owing to growing technological developments is anticipated to provide numerous opportunities to software consulting companies.

The majority of organizations from all industries in the U.S. are heavily investing in technology and enhancing their approach to making data-driven decisions for business growth. Companies of varying sizes have been implementing digital strategies to ensure smooth functioning of business, justify investment for innovation and mitigate risks associated with the businesses.

Thus, building digital strategy and involving smart and advanced software solutions requires strong technical expertise and capabilities. As a result, companies opt for software consulting services that provide the required services and strategy to support companies’ mission towards smooth digital transformation.

As the outbreak of the COVID-19 pandemic caused serious disruptions in the global supply chain, businesses in the U.S. were highly affected by this disruption. The companies are obliged to reduce the losses that occurred during the pandemic by enabling various technological solutions that provide faster results. As a result, demand for software consulting and implementation strategy services increased significantly in the past couple of years.

Moreover, in an evolving competition, companies are considerably seeking new opportunities to make a dominant position in the market. This thrive encourages decision-makers to opt for software consulting services that provide a competitive edge to the companies thereby enhancing their mark in the existing market scenario.

Furthermore, the pandemic crisis also proved to accelerate the adoption of analytics and artificial intelligence technology while is poised to continue over the forecast period. According to a recent study by PwC, approximately 52% of the surveyed organizations in the U.S. accelerated their plans of implementing AI technology amid the pandemic crisis. These organizations believed that AI and analytics technologies supported the shift in new working arrangements that emerged during the COVID-19 crisis.

As a result, several organizations required software consulting services to meet their needs for speedy technological implementations. Thus, with the rise in demand, the U.S market observed considerable growth and is anticipated to grow with more consistency over the forecast period.

Application Insights

The enterprise solutions segment accounted for the largest market share of over 20% in 2021 and is projected to grow significantly throughout the forecast period. Growing demand for Enterprise Resource Planning (ERP), Enterprise Content Management (ECM), and Customer Relationship Management (CRM) software is estimated to drive segment growth.

Moreover, increasing the involvement of customers in understanding the business process to demand for more customization of their required solution is further enabling organizations to adopt advanced enterprise solutions. As a result, with growth in adoption, the enterprise solutions segment is witnessing consistent growth across all the end-use verticals.

The application development segment is anticipated to register a considerable growth rate over the forecast period. The growth can be attributed to the rising adoption of software consulting services to develop software applications that assist businesses in carrying out various tasks ranging from making sales reports to the calculation of daily and monthly expenses to automate business operations and improve efficiency in the business.

Furthermore, the increasing focus of companies on deploying cloud-based software applications that are easy to operate, maintain and provide large data storage capacity is also observed as a triggering factor contributing to the segment growth. Thus, the segment is poised to grow with considerable CAGR throughout the forecast period.

Enterprise Size Insights

The large enterprise segment dominated the U.S. software consulting market with the largest revenue share of more than 60% in 2021. The large share of this segment is primarily attributed to the growth in significant investments carried out by large businesses in setting up their respective IT infrastructure.

Moreover, large-scale adoption of enterprise solutions and software security services is observed across this segment as large enterprises possess vast data that needs to be managed effectively while enhancing data security to avoid potential risks in business. Additionally, large enterprises have also been early adopters of the latest technologies that require software consulting and outsourcing services.

The small & medium enterprises segment is expected to register a considerable growth rate over the forecast period. The increasing focus of SMEs to gain a competitive edge in the developed market and the growing need to stabilize the business operations that were highly affected during the outbreak of the COVID-19 pandemic are factors attributed to driving the growth of the segment.

Moreover, rising advancements in cloud-based SaaS tools and increasing adoption of these solutions due to easy deployment and flexibility have enabled SMEs to deliver a better user experience to their customers. Thus, with a rising focus on delivering optimal customer experience with advanced technologies, the demand for software consulting services is expected to grow in this sector thereby providing numerous opportunities to the stakeholders over the forecast period.

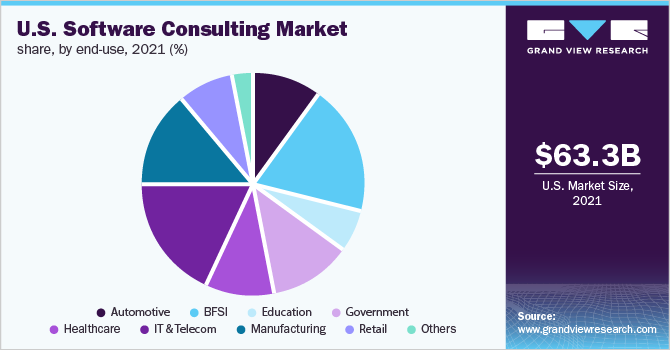

End-use Insights

The BFSI segment accounted for the largest revenue share of over 19% in 2021. As financial service organizations face new challenges concerning globalization, compliance, competition, and consolidation within their industry, the demand from these organizations for business management solutions has increased significantly. To meet their growing demands, these organizations seek for software consulting services that provide several methodologies, strategies, and implementation of advanced technological solutions that help organizations achieve their goals.

As a result, the segment is observed as one of the largest adopters of software consulting services in the U.S. In addition, the rising focus of organizations on making data-driven decisions to enhance profits, engage customers for a longer period, deliver optimized results and streamline business processes is further attributed to increase the adoption of software consulting services in the U.S. market, thereby contributing to the segment growth.

The healthcare segment is anticipated to register a considerable growth rate over the forecast period. Owing to the growing penetration of advanced technologies and rising competition in the market, healthcare facilities are increasingly relying on software consulting services to enhance their operational activities and provide the best services to patients. In addition, during the pandemic, healthcare facilities realized the significance of technologies such as the Internet of Things (IoT) & wearables, product engineering services, integration services, cloud services, and data science and business intelligence solutions.

Thus, several healthcare facilities are ready to invest heavily in technology over the forecast period to avoid potential risks, make data-driven decisions and provide effective service to their patients. As a result, the segment is poised to grow considerably throughout the forecast period.

Key Companies & Market Share Insights

The market is highly competitive with several market players catering to different sectors. The presence of established players is discouraging potential players from entering the market. However, the growing demand for customized solutions and services at affordable rates is expected to create growth opportunities for new entrants. Market players are focusing on expanding their businesses and strengthening their market positions through collaborations and partnerships.

For instance, in January 2022, Deloitte Consulting acquired Dextra Technologies, a product engineering services, and embedded software platform provider. This acquisition helped Deloitte Consulting’s offerings to accelerate the digital transformation from standalone solutions into advanced and connected platforms. It also expanded the company’s services portfolio thereby enabling advanced software engineering capabilities to the portfolio.

The companies are also focusing on delivering innovative solutions to ensure adequate cybersecurity to protect confidential information, support technology transformation, integrate AI with business operations, derive superior business outcomes, optimize organizational operations, and enable proactive remote monitoring. They are also offering various other services to businesses and helping them in sustaining in the digital age. Some prominent players in the U.S. software consulting market include:

-

Accenture PLC

-

Analysys Mason

-

Bain & Company

-

Clearfind

-

Cognizant

-

DuPont Sustainable Solutions

-

Deloitte Touche Tohmatsu Ltd.

-

Ernst & Young LLP

-

International Business Machines Corp.

-

KPMG International

-

Oracle Corporation

-

OC&C Strategy Consultants

-

PricewaterhouseCoopers B.V.

U.S. Software Consulting Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 70.11 billion

Revenue forecast in 2030

USD 160.56 billion

Growth rate

CAGR of 10.9% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Country scope

U.S.

Segments covered

Application, enterprise size, end-use

Key companies profiled

Accenture PLC; Analysys Mason; Bain & Company; Clearfind; Cognizant; DuPont Sustainable Solutions; Deloitte Touche Tohmatsu Ltd.; Ernst & Young LLP; International Business Machines Corp.; KPMG International; Oracle Corporation; OC&C Strategy Consultants; PricewaterhouseCoopers B.V.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Software Consulting Market Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. software consulting market report based on application, enterprise size, and end-use:

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Enterprise Solutions

-

Application Development

-

Migration & Maintenance Services

-

Design Services

-

Application Testing Services

-

Software Security Services

-

Others

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2017 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises (SMEs)

-

-

End-Use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Automotive

-

BFSI

-

Education

-

Government

-

Healthcare

-

IT & Telecom

-

Manufacturing

-

Retail

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. software consulting market size was estimated at USD 63.32 billion in 2021 and is expected to reach USD 70.11 billion in 2022.

b. The U.S. software consulting market is expected to witness a compound annual growth rate of 10.9% from 2022 to 2030 to reach USD 160.56 billion by 2030.

b. The large enterprise segment accounted for the largest market share of more than 60% in 2021. The large share of this segment is primarily attributed to the growth in significant investments carried out by large businesses in setting up their respective IT infrastructure.

b. Key players in the market include Accenture PLC; Analysys Mason; Bain & Company; Clearfind; Cognizant; DuPont Sustainable Solutions; Deloitte Touche Tohmatsu Ltd.; Ernst & Young LLP; International Business Machines Corp.; KPMG International; Oracle Corporation; OC&C Strategy Consultants; PricewaterhouseCoopers B.V.

b. The increasing focus of organizations on enhancing their digital transformation processes and the rising need to deploy modernized and smart software solutions to optimize complex business processes are attributed to driving the U.S. software consulting market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.