- Home

- »

- Homecare & Decor

- »

-

U.S. Stain Remover Products Market Size Report, 2033GVR Report cover

![U.S. Stain Remover Products Market Size, Share & Trends Report]()

U.S. Stain Remover Products Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Liquid, Powder, Spray, Bar), By Application (Household, Commercial), By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-650-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Stain Remover Products Market Trends

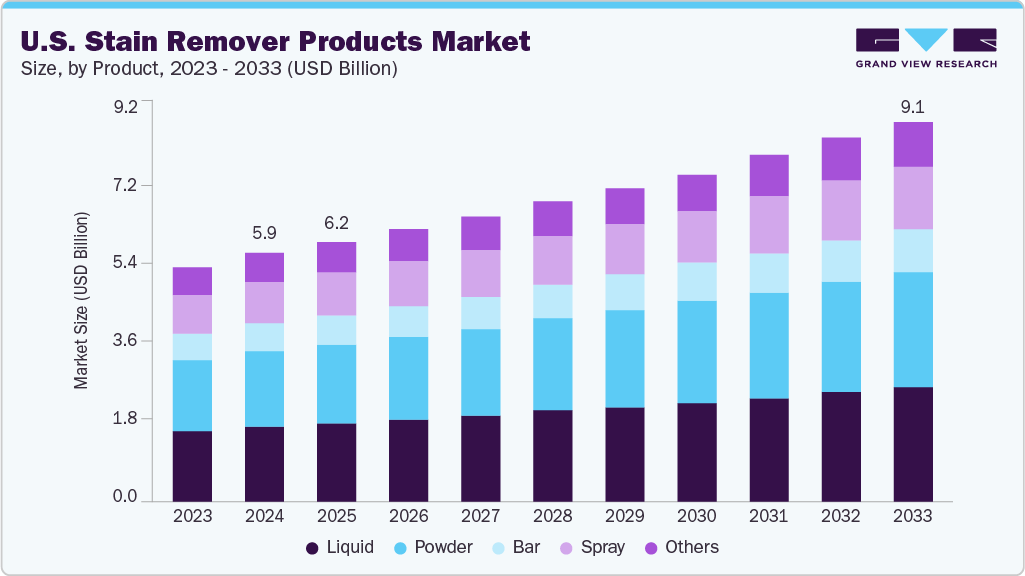

The U.S. stain remover products market size was estimated at USD 5.87 billion in 2024 and is projected to grow at a CAGR of 4.93% from 2025 to 2033. The growth is propelled by a combination of economic, cultural, and technological factors that have reshaped consumer habits and preferences. One of the primary drivers is the high disposable income among American households, which enables consumers to invest in specialized cleaning products beyond basic detergents. This financial capacity, coupled with a strong cultural emphasis on cleanliness and home care, has established stain removers as essential items in both residential and commercial settings.

Another significant factor is the increasing awareness of hygiene and fabric care. American consumers are more conscious than ever about maintaining the appearance and longevity of their clothing and household textiles, particularly as the cost of apparel increases and the popularity of delicate, high-value fabrics rises. This has led to a surge in demand for stain removers that can effectively target specific stains-such as grease, wine, or grass-without damaging fabrics, supporting the market’s expansion.

Innovation within the industry also plays a crucial role. U.S. manufacturers are continuously developing new formulations, including enzyme-based and plant-derived products, to address evolving consumer needs. These innovations not only offer improved stain-fighting capabilities but also cater to the growing segment of environmentally conscious buyers. The introduction of eco-friendly, biodegradable, and odor-neutralizing stain removers has resonated strongly with consumers who prioritize sustainability, further boosting the growth of the U.S. stain remover products industry.

The rapid rise of e-commerce and digital retail channels has transformed how consumers access stain remover products. Online platforms offer a vast selection, transparent pricing, and detailed product information, making it easier for consumers-especially younger demographics-to compare and purchase products conveniently. The surge in online sales, supported by targeted marketing and customer reviews, has become a significant growth engine for the market, with online sales in the U.S. growing by nearly 15% year-over-year in 2024.

Busy lifestyles, particularly in urban areas, have heightened the demand for convenience-oriented cleaning solutions. Stain removers are now available in various forms, including sprays, gels, wipes, and sticks, catering to diverse usage scenarios from pre-treatment to on-the-go cleaning. These versatile formats appeal to working professionals and families seeking quick, practical solutions that fit seamlessly into their routines.

The commercial sector-including hospitality, healthcare, and food service-relies heavily on stain remover products to maintain high standards of cleanliness. The need for efficient and reliable stain removal in these industries ensures steady, large-scale demand, further solidifying the U.S. as a dominant market for stain remover products. Together, these factors-economic strength, cultural values, product innovation, sustainability, digital retail, and commercial demand-are fueling sustained growth.

The U.S. stain remover products market, while experiencing steady growth, faces several notable challenges that could impact its future expansion. One of the primary hurdles is increased regulatory scrutiny over chemical ingredients. The U.S. government has banned or restricted the use of certain chemicals in stain removers, such as 1,4-dioxane and phosphates, due to their links to health risks and environmental harm. Compliance with these evolving regulations complicates product formulation and increases production costs for manufacturers, potentially limiting the range of effective ingredients that can be used.

Environmental and health concerns are also shaping consumer preferences and market dynamics. Many conventional stain removers contain harsh chemicals that can trigger allergies, sensitivities, or adverse reactions, particularly among vulnerable populations. As environmental awareness grows, consumers are increasingly seeking gentler, hypoallergenic, and eco-friendly alternatives. This shift requires manufacturers to invest in research and development for safer, plant-based, or biodegradable formulations, which often come with higher production costs and can challenge profitability if consumers remain price-sensitive.

Product Insights

The powder stain remover had the largest market revenue, exceeding USD 1.75 billion in 2024. Their growth is primarily driven by widespread availability, consumer familiarity, and cost-effectiveness. Powders are highly versatile, suitable for a broad range of stains and fabrics, and are especially effective on heavy and set-in stains. Their efficiency and affordability make them popular in both household and commercial settings, and they are often favored in regions or demographics where traditional laundry methods are prevalent.

Liquid stain removers represent a significant portion of the U.S. stain remover products industry, particularly valued for their ease of use and high effectiveness across various fabric types. Liquids penetrate fabrics quickly, making them ideal for treating fresh stains and delicate materials. Their popularity is further boosted by ongoing innovations-such as enzyme-based and eco-friendly formulations-that enhance performance while addressing consumer demand for safer, more sustainable products. In North America, liquid stain removers are especially preferred for their quick results and compatibility with modern washing machines.

Spray stain removers are the fastest-growing segment in the U.S. stain remover products market, growing at a CAGR of 5.5% from 2025 to 2033. Their growth is fueled by increasing demand for convenience and instant solutions, particularly among millennials and working professionals. Sprays offer targeted application, allowing consumers to treat stains directly and efficiently without extra tools or mess. The rise of on-the-go lifestyles, coupled with greater awareness of hygiene, has made spray formats beautiful for quick, pre-laundry treatments and spot cleaning. Innovations such as multi-functional and odor-neutralizing sprays are further driving the adoption of this segment.

Type Insights

Household was the largest application segment and accounted for over 70% of the U.S. stain remover products market in 2024. The household segment dominates the market, accounting for the largest share of overall demand. This leadership is primarily driven by rising consumer awareness of hygiene, the need for frequent laundering, and a surge in dual-income households that prioritize time-saving and efficient cleaning solutions. The growing trend of home-based laundry, coupled with busy urban lifestyles, has led consumers to seek products that are easy to use, effective, and compatible with modern appliances. Innovations in liquid and spray formats-such as enzyme-based and eco-friendly formulations-have further fueled household adoption by offering convenience, versatility, and enhanced fabric care. The prevalence of e-commerce and online reviews also makes it easier for households to discover and purchase a wide variety of stain removers, supporting ongoing market growth.

The commercial segment-encompassing laundromats, hotels, restaurants, and the hospitality industry-contributes significantly to overall market demand, though it is smaller than the household sector. Growth in this segment is driven by the need to maintain high standards of cleanliness and fabric care, ensuring customer satisfaction and compliance with health regulations. Commercial users require stain removers that can handle large volumes of laundry and effectively tackle tough, diverse stains. The hospitality and healthcare industries, in particular, are expanding their use of high-efficacy and specialized stain removers to address stringent cleanliness protocols and the need for rapid turnaround of linens and uniforms. In healthcare, the demand is further accelerated by the need for products that can safely remove biological stains without damaging delicate fabrics, supporting infection control and regulatory compliance.

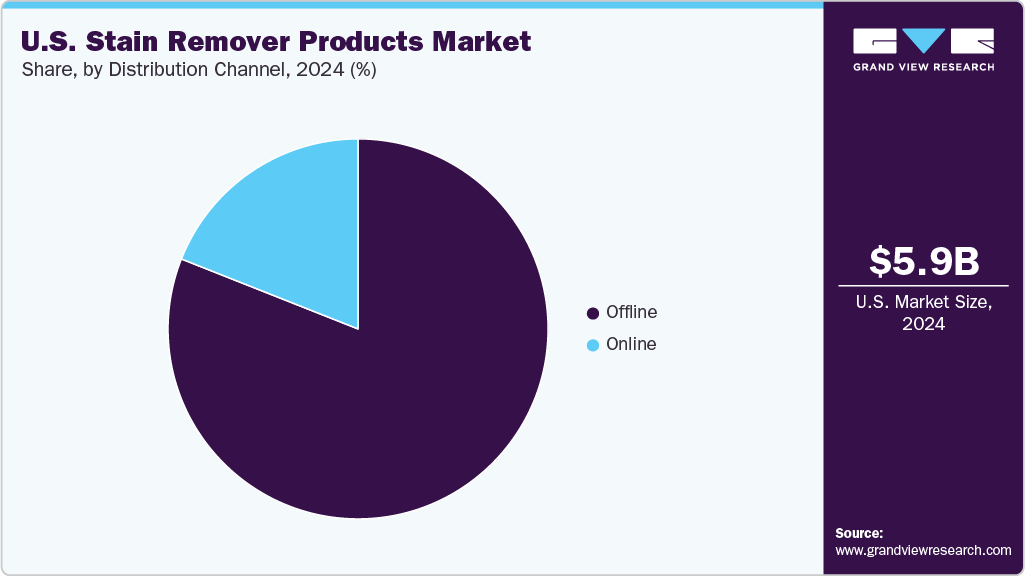

Distribution Channel Insights

Offline distribution was the most significant sales medium and is expected to reach a revenue of over USD 7.28 billion by 2033. This preference is largely due to consumers valuing the ability to see, touch, and compare products in person before making a purchase. This is especially important for cleaning products, where efficacy and ingredient transparency are key considerations. Physical retail outlets such as supermarkets, hypermarkets, and specialty stores provide consumers with direct access to a wide variety of stain removers, the opportunity to read labels, consult knowledgeable staff, and take advantage of in-store promotions and discounts. These factors contribute to the sustained dominance of offline channels, particularly among consumers who prefer the tactile shopping experience or seek immediate product availability.

The sale of stain remover products through online channels is expected to grow at a CAGR of 5.3% from 2025 to 2033. The growth of e-commerce platforms has made it increasingly convenient for consumers to browse, compare, and purchase stain remover products from home, without the need to visit physical stores. Features such as home delivery, subscription services, and easy access to customer reviews and detailed product information appeal especially to busy consumers and younger demographics who prioritize convenience and time-saving solutions. The COVID-19 pandemic further accelerated the shift toward online shopping, making digital retail a critical avenue for market expansion. Technological advancements and improved logistics continue to enhance the online shopping experience, supporting rapid growth in this channel.

Key U.S. Stain Remover Products Company Insights

The competitive landscape of the U.S. stain remover products market is characterized by the presence of several global and domestic giants, all vying for market share through continuous innovation, brand strength, and expansive distribution networks. Leading players such as The Procter & Gamble Company, Church & Dwight, Henkel, Reckitt Benckiser Group, Unilever, S.C. Johnson & Son, and The Clorox Company dominate the market, leveraging their established reputations, broad product portfolios, and significant investments in research and development to maintain a competitive edge. These companies consistently introduce new and improved stain removal solutions, focusing on enhanced efficacy, sustainability, and user convenience to meet evolving consumer preferences.

Product differentiation is a central strategy in this competitive arena. Manufacturers are developing specialized formulations-such as enzyme-based, plant-derived, and biodegradable stain removers-to address the growing demand for effective yet environmentally friendly products. Packaging innovation and the launch of multi-functional and easy-to-use formats (like sprays and wipes) further help brands stand out on crowded retail shelves. Additionally, companies are increasingly adopting digital marketing and expanding their presence on e-commerce platforms to reach a wider, tech-savvy consumer base and respond to the rapid growth of online retail.

Strategic collaborations, mergers, and acquisitions are also shaping the market landscape. Major players are forming partnerships to enhance their distribution capabilities, enter new geographic markets, and strengthen their product offerings. For instance, Church & Dwight reported an increase in sales and market share in 2025, reflecting the effectiveness of its strategic initiatives and product innovation pipeline. Similarly, Procter & Gamble and Reckitt Benckiser continue to invest heavily in marketing and sustainability efforts, reinforcing their leadership positions.

Key U.S. Stain Remover Products Companies:

- Procter & Gamble (P&G)

- The Clorox Company

- S.C. Johnson & Son, Inc.

- Church & Dwight Co., Inc.

- Henkel AG & Co. KGaA

- Reckitt Benckiser Group PLC

- Unilever PLC

- Kao Corporation

- Amway Corporation

- Seventh Generation Inc.

- LG Household & Health Care

- Tetraclean

- Aaykay Detergents & Chemicals

- Citra Solv

- Greenshield Organic

Recent Developments

- In February 2024, P&G expanded its stain removal portfolio with a new plant-based formula under the Tide brand, focusing on reducing chemical usage while maintaining high cleaning efficiency. Additionally, in January 2025, Tide launched Ultra Oxi Boost Power PODS, promoted as their most powerful clean and best stain removal pods yet, aligning with a major marketing campaign involving Marvel Studios.

U.S. Stain Remover Products Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.15 billion

Revenue forecast in 2033

USD 9.05 billion

Growth Rate

CAGR of 4.93% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2024 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2021 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel

Country scope

U.S.

Key companies profiled

Procter & Gamble (P&G); The Clorox Company; S.C. Johnson & Son, Inc.; Church & Dwight Co., Inc.; Henkel AG & Co. KGaA; Reckitt Benckiser Group PLC; Unilever PLC; Kao Corporation; Amway Corporation; Seventh Generation Inc.; LG Household & Health Care; Tetraclean; Aaykay Detergents & Chemicals; Citra Solv; Greenshield Organic

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Stain Remover Products Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. stain remover products market report based on product, application, and distribution channel.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Liquid

-

Powder

-

Bar

-

Spray

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Household

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Online

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.