- Home

- »

- Homecare & Decor

- »

-

U.S. Stemware Market Size & Share, Industry Report, 2033GVR Report cover

![U.S. Stemware Market Size, Share & Trends Report]()

U.S. Stemware Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Wine Glasses, Champagne Glasses, Cocktail Glasses, Martini Glass), By End-use (Residential, Commercial), By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-611-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Stemware Market Size & Trends

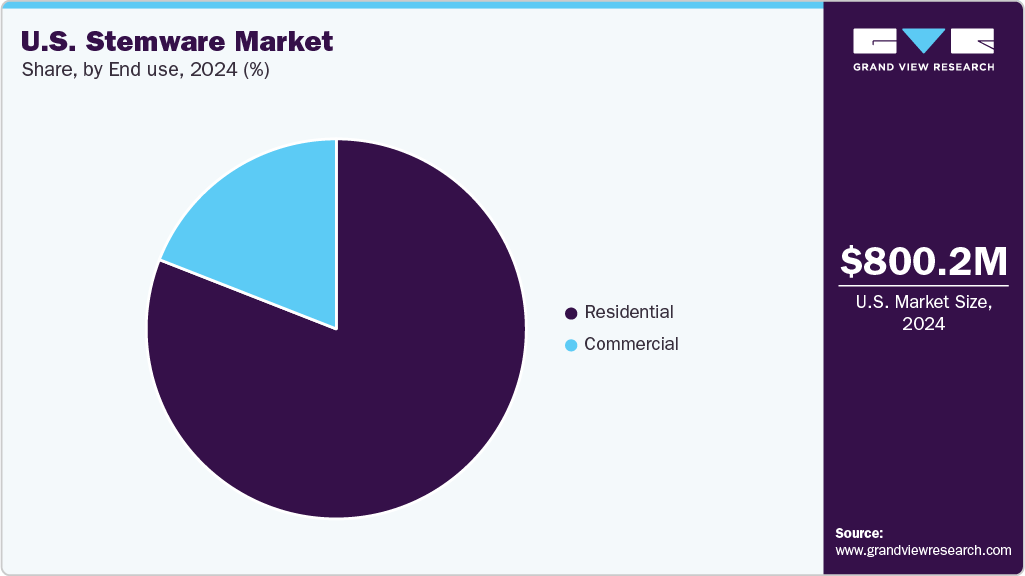

The U.S. stemware market size was estimated at USD 800.2 million in 2024 and is expected to grow at a CAGR of 6.0% from 2025 to 2033. As a result, elegant and purpose-driven glassware such as wine glasses, flutes, and cocktail stems has become increasingly popular. These pieces are no longer viewed merely as functional utensils but as integral elements of interior design and personal expression. For many consumers, choosing the right stemware is as much about style and presentation as it is about utility, signaling a move toward more thoughtful and curated home experiences.

The U.S. wine market is experiencing a noticeable move toward premium products, with consumers showing a clear preference for higher-quality selections. Wines in the price range of USD 13 to USD 19.99 have emerged as particularly popular among buyers seeking both value and sophistication. Well-known labels such as Josh Cellars have reported significant gains in this category, including a 14.1% rise in sales, underscoring this trend toward elevated wine choices.

This growing appreciation for premium wines is having a direct effect on the stemware industry. As people become more selective about the wine they consume, they are also looking for the right glassware to match the experience. The style, shape, and craftsmanship of stemware can play a crucial role in how a wine tastes and smells, making it an important part of the overall experience for both dedicated wine drinkers and casual consumers alike.

In addition, the return of on-premise wine drinking, especially in restaurants, bars, and social venues, contributes to greater awareness and use of specialized glassware. Between 2021 and 2022, the U.S. added approximately 14 million new regular wine drinkers, many of whom are under 40 years old.

Alongside wine, the increased popularity of craft cocktails and high-end spirits has further boosted demand for a variety of drink-specific glasses. As people become more knowledgeable about how the design of a glass can influence the taste and aroma of a beverage, their purchasing behavior reflects a desire for variety and intentionality. Social media, food and beverage influencers, and digital publications have amplified this trend by showcasing curated drinkware collections and stylish table settings. As a result, many consumers are moving away from generic drinkware in favor of purpose-built glassware tailored to different beverages and settings, helping fuel steady growth of the U.S. stemware industry.

Additionally, there's a noticeable trend toward premiumization. Many consumers, especially millennials and younger professionals, are willing to invest in higher-quality, visually appealing products for their homes. Stemware fits perfectly into this shift. Well-designed glassware not only improves the drinking experience but also serves as a decorative piece. For some, stemware purchases are also tied to special occasions, such as weddings, housewarmings, or holiday gifts. This dual function as a practical item and a luxury good has positioned stemware as a desirable product across a range of price points.

Several companies in the U.S. are actively responding to the rising demand for stemware by launching diverse and innovative collections that cater to a variety of consumer preferences. For instance, Riedel, a renowned luxury glassmaker with a strong presence in the U.S., continues to introduce new lines emphasizing both traditional craftsmanship and modern design, appealing to wine enthusiasts who value precision in glass shape for different varietals. Their Riedel Vinum and Riedel Ouverture series are examples of collections that combine elegance with enhanced functionality.

On the more accessible end, brands like Libbey Inc., a U.S.-based glassware manufacturer, have expanded their portfolio with stylish yet affordable stemware options targeting everyday consumers. Their Impressions and Verre collections focus on durability and contemporary aesthetics, making quality stemware more approachable for a wider audience.

Additionally, startups such as Schott Zwiesel USA have gained traction by blending innovation and sustainability, introducing durable, chip-resistant crystal glassware that appeals to eco-conscious buyers. Their Tritan Crystal technology showcases how advancements in materials are influencing market offerings.

These examples illustrate how both established and emerging U.S. companies are fostering greater variety and accessibility in the stemware market. By addressing different segments, from luxury connoisseurs to casual users, they are driving consistent growth and broadening the market’s reach across the country.

Consumer Insights

The growing interest among younger wine consumers correlates with the rising demand for stemware. As these demographics increasingly participate in wine consumption, they also tend to invest in lifestyle products that enhance the experience, such as specialized wine glasses. Stemware has evolved from being a functional item to a symbol of sophistication and personal taste, making it popular among Millennials and Gen Z, who value aesthetics and quality. The surge in online content around wine pairings, home bar setups, and entertaining at home further drives this demand, positioning premium and well-designed stemware as a sought-after category in the U.S. homeware market.

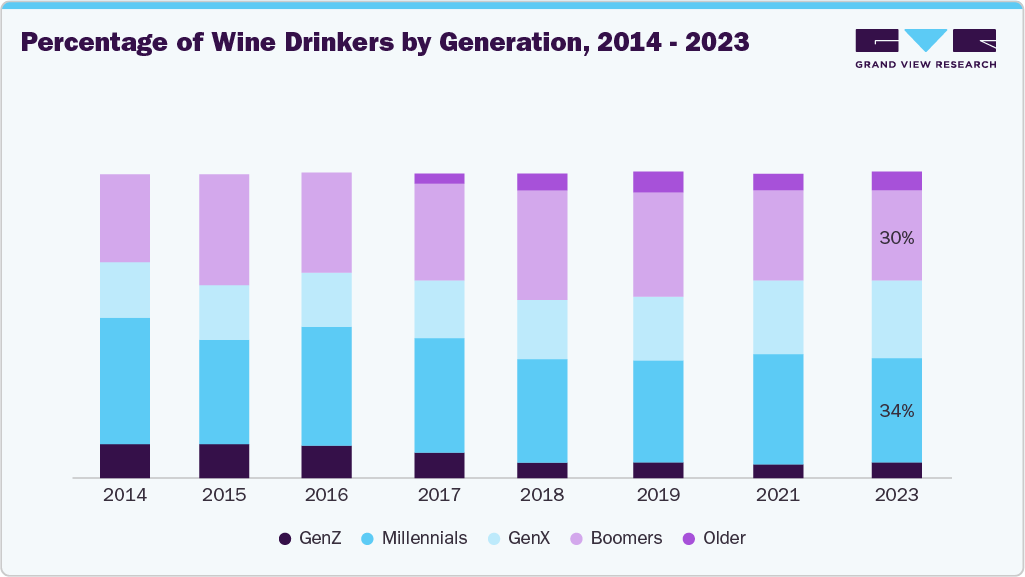

According to the BMO Wine Market Report published in 2024. There has been a consistent increase in the percentage of wine drinkers among Millennials and Gen Z since 2015, with Millennials comprising up to 36% in 2020 and Gen Z rising to 6% by 2023. This generational change suggests that younger consumers are becoming more engaged with wine culture, even though many also view alcohol less favorably from a health perspective. Additionally, although some younger demographics are abstaining more, the steady rise in wine drinkers aged 21-40 indicates a strong, niche consumer base that appreciates the cultural and lifestyle aspects of wine drinking.

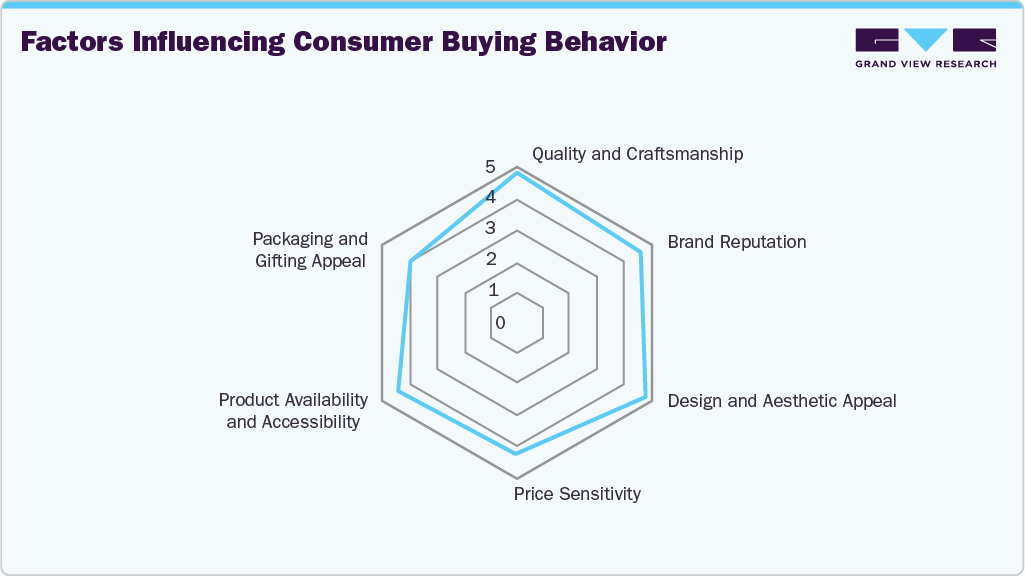

Several distinct factors influence consumer purchasing behavior in the U.S. stemware market, with product quality and craftsmanship remaining at the forefront. Consumers are increasingly inclined to invest in stemware crafted from premium materials such as lead-free glass or crystal, which offer superior clarity, durability, and tactile satisfaction. Design elements such as the weight, balance, and rim profile significantly enhance perceived value and the overall drinking experience.

Furthermore, brand equity continues to be a critical driver of consumer preference. Recognized names like Riedel, Libbey, and Schott Zwiesel benefit from longstanding reputations for quality and sophistication, fostering brand loyalty and trust. Simultaneously, newer and niche brands are gaining market traction by emphasizing differentiated design aesthetics, eco-conscious manufacturing, and small-batch or handcrafted production methods that appeal to a more discerning, values-driven consumer base.

In addition, while affluent consumers prioritize exclusivity and fine craftsmanship, value-conscious buyers seek attractive pricing without sacrificing style or functionality. Promotional strategies, such as bundled offers, limited-time discounts, and widespread availability via both brick-and-mortar retailers and digital platforms, play a pivotal role in influencing final purchase decisions.

Product Insights

Wine glasses accounted for a revenue share of 47.75% in 2024. The U.S. remained one of the largest wine-consuming nations, with a strong presence of both domestic and imported wine brands fueling interest in proper wine presentation. As American consumers became more knowledgeable about varietals and pairing, demand grew for purpose-specific stemware, such as glasses designed for red, white, or rosé wines, to enhance the tasting experience. The rise of at-home entertainment, wine clubs, and vineyard tourism across states like California, Oregon, and Washington further accelerated purchases.

The champagne glasses segment of the U.S. stemware industry is projected to grow at a CAGR of 9.2% over the forecast period, due to the expanding popularity of sparkling wines in everyday celebrations and casual gatherings. American consumers are increasingly embracing champagne and its alternatives, such as prosecco and domestic sparkling wines, not just for formal occasions but as part of routine social and dining experiences. This shift has heightened the demand for specialized glassware that preserves bubbles and enhances flavor.

Distribution Channel Insights

Offline sales for stemware in the U.S. stemware industry accounted for a revenue share of 74.66% in 2024. Many buyers prefer purchasing stemware in physical stores to ensure the product's durability, clarity, and aesthetic appeal before committing to a purchase. Retail formats like home goods stores, department chains, and specialty kitchenware outlets offer curated in-store displays that help customers visualize the glassware in real-life settings, boosting confidence in their selections. Additionally, offline channels benefit from bulk purchases for weddings, restaurants, and hospitality businesses, which often require personalized service and immediate product availability.

Online sales for stemware in the U.S. are projected to grow at a CAGR of 6.2% over the forecast period. As more households turn to online platforms for convenience, especially for home and lifestyle products, stemware purchases have followed suit. Advancements in packaging and delivery services have reduced concerns about breakage, encouraging more consumers to buy fragile items like glassware online. Additionally, the rise of virtual showrooms, influencer marketing, and targeted ads has made discovering and purchasing designer or niche stemware brands easier than ever.

End Use Insights

Residential end use of stemware in the U.S. stemware market accounted for a revenue share of 78.29% in 2024. As more consumers invested in elevating their in-home dining and social experiences, there was a growing demand for elegant and functional glassware. The popularity of hosting small gatherings, wine tastings, and themed dinners at home encouraged the purchase of specialized stemware suited for various beverages. Additionally, trends in home décor and kitchen upgrades contributed to the appeal of stylish glassware as both a practical and aesthetic addition.

The demand for stemware for the commercial end use is projected to grow at a CAGR of 6.5% over the forecast period. As restaurants, hotels, bars, and event venues continue to prioritize guest experience, there is a growing demand for high-quality, durable, and visually appealing stemware that complements upscale dining and beverage presentations. The resurgence of travel, tourism, and in-person events is also fueling new investments in tableware by commercial establishments aiming to meet evolving consumer expectations. Additionally, the rise of boutique hotels, craft cocktail bars, and wine-focused dining experiences is creating a need for specialized glassware that enhances flavor profiles and presentation, further supporting market growth in this segment.

Key U.S. Stemware Company Insights

The U.S. stemware market is shaped by a mix of established manufacturers and emerging brands that contribute to a dynamic and competitive landscape. Leading players in the country focus heavily on design innovation, high-performance materials, and craftsmanship to cater to evolving consumer preferences centered on visual appeal, durability, and purpose-specific functionality. These companies maintain strong relationships with major retail chains, department stores, and growing e-commerce platforms to ensure broad market reach and visibility. Additionally, many U.S.-based manufacturers are adopting agile production methods and forming strategic collaborations to introduce eco-friendly products, customized collections, and glassware tailored for specific beverages like wine, cocktails, or craft spirits. This adaptability enables them to meet both mainstream and niche market needs while effectively responding to regional trends and expanding into untapped domestic and international segments.

Key U.S. Stemware Companies:

- Arc Holdings (Arc International)

- Libbey

- Waterford

- Riedel Crystal

- Bormioli Luigi S.p.A.

- Crate & Barrel

- Villeroy & Boch Group

- West Elm (Williams-Sonoma Inc.)

- Cristal d'Arques Paris.

- Anchor Hocking Company

Recent Developments

-

In January 2024, Italesse, an Italian glassware brand renowned for its innovative designs, introduced its premium stemware collection to the U.S. market. The launch event took place at Community Wine and Spirits in New York City, marking a significant milestone in the brand's expansion. Italesse's glassware is celebrated for its exceptional design, aiming to enhance the visual and aromatic qualities of wine. Each piece is meticulously crafted to elevate the tasting experience, reflecting the brand's commitment to quality and artistry.

-

In December 2023, St Regis Group formed a strategic partnership with RIEDEL, a prestigious Austrian brand known for its grape-specific wine glasses and decanters. Through this collaboration, St Regis will offer a curated selection of RIEDEL’s high-quality glassware, including wine glasses, flutes, martini glasses, and decanters, to distributors across the U.S. and Canada. This move enhances St Regis’s premium product offerings and aligns with its focus on delivering top-tier, brand-name housewares to the promotional products market.

U.S. Stemware Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 837.9 million

Revenue forecast in 2033

USD 1.34 billion

Growth rate

CAGR of 6.0% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, end use

Country scope

U.S.

Key companies profiled

Arc Holdings (Arc International); Libbey; Waterford; Riedel Crystal; Bormioli Luigi S.p.A.; Crate & Barrel; Villeroy & Boch Group; West Elm (Williams-Sonoma Inc.); Cristal d'Arques Paris.; Anchor Hocking Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Stemware Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. stemware market report based on product, distribution channel, and end use:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Wine Glasses

-

Champagne Glasses

-

Cocktail Glasses

-

Martini Glasses

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Home Improvement Stores

-

Hypermarkets/Supermarkets

-

Specialty Stores

-

Others

-

-

Online

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

Frequently Asked Questions About This Report

b. The U.S. stemware market was estimated at USD 800.2 million in 2024 and is expected to reach USD 837.9 million in 2025.

b. The U.S. stemware market is expected to grow at a compound annual growth rate of 6.0% from 2025 to 2030 to reach USD 1,340.2 million by 2030.

b. Wine glasses accounted for a revenue share of 47.75% in the year 2024 in the U.S. stemware industry. The U.S. remained one of the largest wine-consuming nations, with a strong presence of both domestic and imported wine brands fueling interest in proper wine presentation.

b. Some of the key players operating in the U.S. stemware market include Arc Holdings (Arc International), Libbey, Waterford, Riedel Crystal, Bormioli Luigi S.p.A., Crate & Barrel, Villeroy & Boch Group, West elm (Williams-Sonoma Inc.), Cristal d'Arques Paris., Anchor Hocking Company

b. Growth of the U.S. stemware market is majorly driven by the rising consumer interest in premium dining experiences and aesthetically refined table settings, which boosts the demand for elegant and high-quality glass stemware.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.