- Home

- »

- Homecare & Decor

- »

-

Stemware Market Size And Share, Industry Report, 2030GVR Report cover

![Stemware Market Size, Share & Trends Report]()

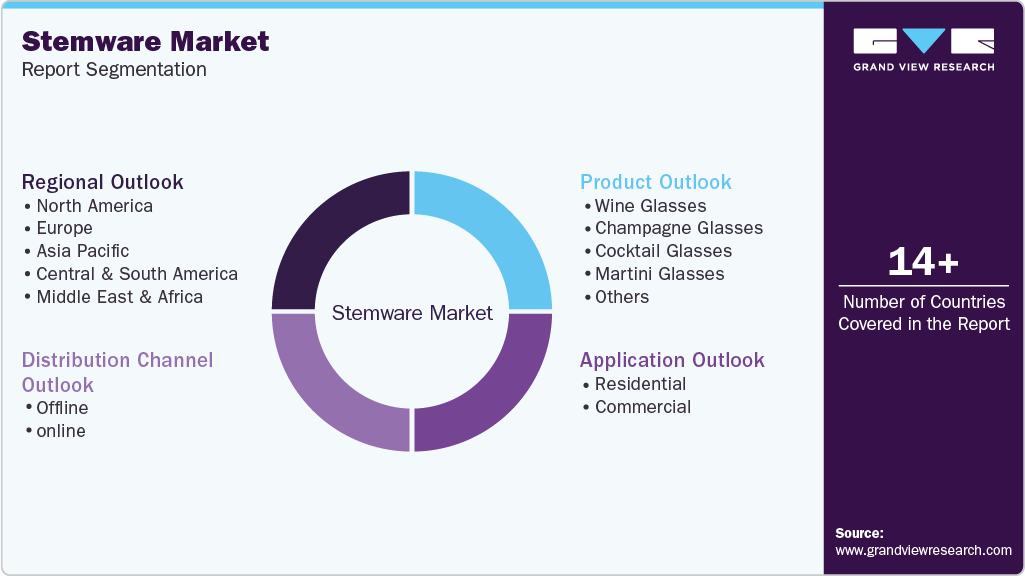

Stemware Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Wine Glasses, Champagne Glasses, Cocktail Glasses, Martini Glass), By Application (Residential, Commercial), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-609-2

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Stemware Market Summary

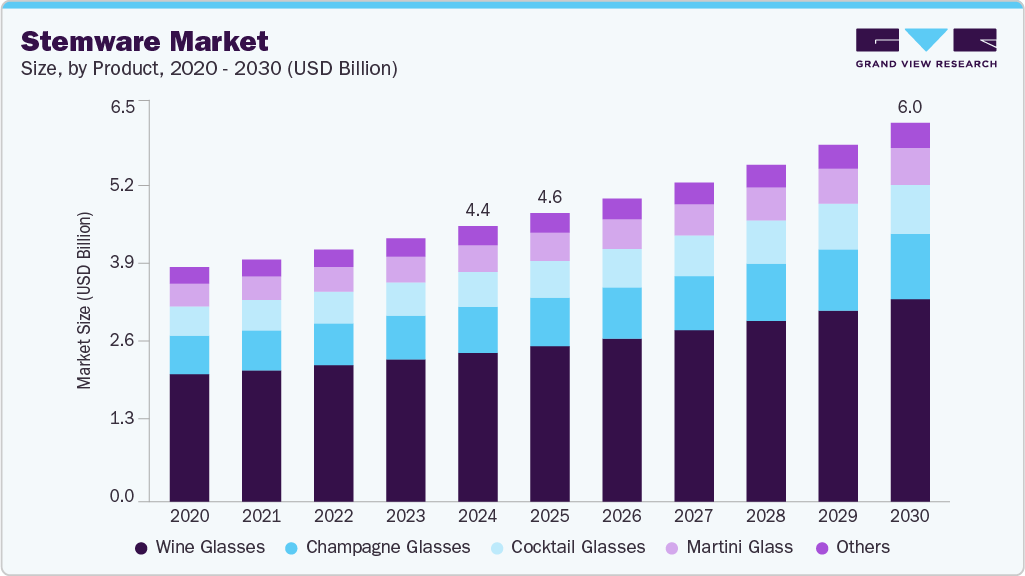

The global stemware market size was estimated at USD 4.37 billion in 2024 and is projected to reach USD 6.01 billion by 2030, growing at a CAGR of 5.6% from 2025 to 2030. The increasing global consumption of wine, champagne, and premium spirits contributes to the growing demand for stemware.

Key Market Trends & Insights

- Asia Pacific stemware market dominated with revenue share of 35.20% in 2024.

- The stemware industry in the U.S. accounted for a revenue share of 85% in the year 2024.

- By product, wine glasses accounted for a revenue share of 54.00% in the year 2024.

- Based on distribution channel, offline sales for stemware accounted for a revenue share of 74.16% in the year 2024.

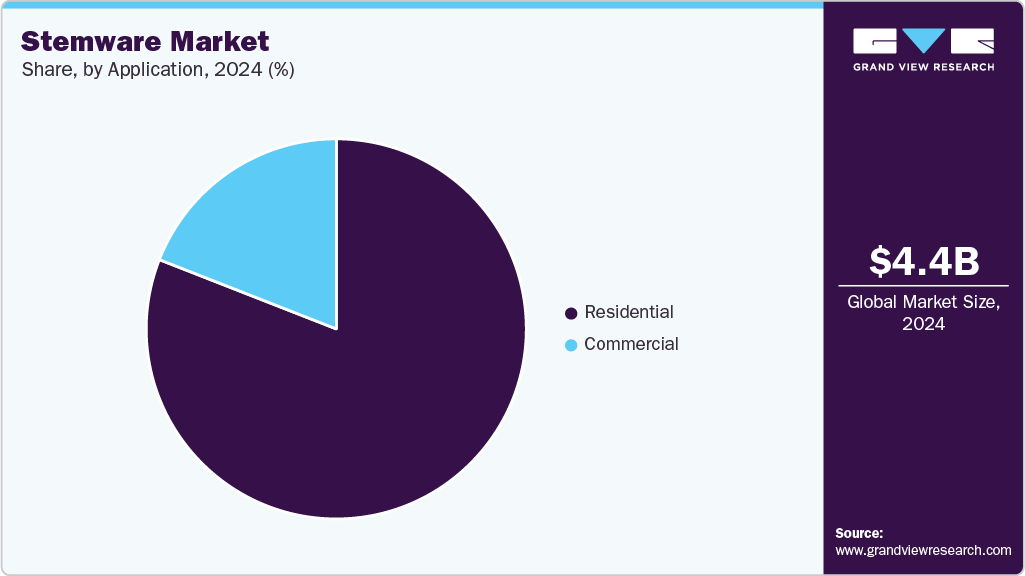

- By application, residential application of stemware accounted for a revenue share of 80.94% in the year 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.37 Billion

- 2030 Projected Market Size: USD 6.01 Billion

- CAGR (2025-2030): 5.6%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

As consumer tastes evolve, particularly in regions Asia Pacific, Latin America, and parts of Africa, more individuals are adopting Western-style drinking habits. This trend is further amplified by rising disposable incomes and a growing aspirational middle class, particularly in countries such as China, India, Vietnam, and Brazil. These consumers are not only purchasing alcohol more frequently but are also becoming more discerning about the glassware they use, associating high-quality stemware with sophistication, hospitality, and elevated social status.

Stemware, which includes wine glasses, champagne flutes, cocktail glasses, and other finely crafted drinking vessels, has traditionally been associated with formal dining and luxury consumption in Western markets. However, this perception is shifting rapidly as the product becomes more integrated into everyday life across developed and emerging economies.

Modern consumers, particularly millennials and Gen Z, are placing greater emphasis on aesthetic value, functionality, and quality when it comes to household items. Stemware is no longer merely a practical item; it has become a lifestyle statement and a reflection of personal taste. This demographic also demonstrates a strong preference for curated home environments, often influenced by social media trends that promote elegant table settings and visually pleasing drink presentations. As a result, consumers are looking for stemware that not only serves its purpose but also aligns with their interior décor and social identity.

In response to growing demand, many established and emerging companies are expanding their offerings in the stemware category. Traditional luxury brands such as Riedel, Waterford, and Baccarat continue to lead the premium segment by innovating on glass shapes and compositions designed to optimize the drinking experience. These companies are investing heavily in research and development, introducing stemware collections specifically engineered for particular wine varietals or cocktail types. In the mid-range and affordable luxury segment, brands such as Crate & Barrel, Williams-Sonoma, and CB2 are offering stylish, trend-aligned glassware that appeals to design-savvy consumers at more accessible price points. Moreover, new entrants and boutique manufacturers are leveraging craftsmanship, artistic flair, and sustainability as key differentiators, creating limited-edition and artisanal products that cater to niche, high-value markets.

Furthermore, online retail platforms have drastically expanded the visibility and accessibility of stemware, enabling consumers to discover, compare, and purchase products from a wide range of global suppliers. The COVID-19 pandemic further accelerated this digital transformation as consumers increasingly turned to e-commerce to furnish and elevate their home environments during lockdowns. Many online retailers have enhanced the customer experience through virtual product visualization, augmented reality features, and user-generated content such as reviews and social media posts. Digital marketing strategies, particularly those involving visual platforms such as Instagram, Pinterest, and TikTok, are proving exceptionally effective in driving consumer engagement and product discovery. As a result, stemware is often positioned not only as a functional purchase but also as an aspirational lifestyle accessory.

Consumer Insights

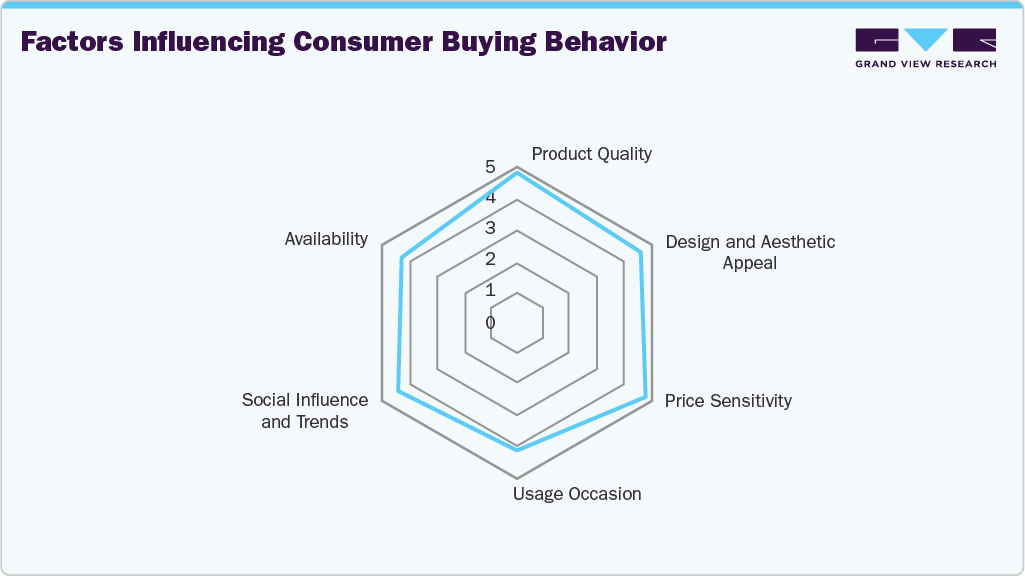

Consumers typically seek stemware made from high-quality materials such as crystal or fine glass that provide clarity, durability, and an enhanced drinking experience. The craftsmanship involved, whether hand-blown or machine-made, also plays a vital role, as consumers associate superior craftsmanship with elegance and value. Alongside quality, the design and aesthetic appeal of stemware heavily impact purchasing decisions. Buyers are drawn to shapes and styles that not only complement the beverage but also reflect their personal taste and home décor. For instance, wine enthusiasts may prefer glasses designed specifically to enhance the aroma and flavor of certain wines. In contrast, others may opt for trendy or minimalist designs to match contemporary settings. The visual appeal of stemware, including details like etching or color tinting, adds to its desirability, as consumers often view these items as decorative as well as functional.

Brand reputation further influences consumer preferences, with established brands commanding greater trust and loyalty. Consumers tend to invest in stemware from reputable manufacturers to ensure quality and reduce the risk of dissatisfaction. Luxury brands, in particular, attract buyers looking for exclusivity or special occasion pieces, leveraging their heritage and prestige to justify premium pricing. Speaking of price, cost considerations are central to the decision-making process. Buyers balance their budget with the desire for quality and style, assessing whether the price aligns with the perceived value of the stemware. Price sensitivity varies across consumer segments, with some seeking affordable everyday glasses and others willing to pay more for luxury items. Promotions, discounts, or bundled offers can also make higher-priced products more attractive by increasing perceived affordability.

Consumers consider whether the glasses can be used daily, for entertaining guests, or as collectibles, which affects their preferences for durability, style, and specialization. For instance, stemware designed specifically for tasting certain wines or cocktails appeals to enthusiasts and collectors, while versatile designs appeal to more casual users. Social influences and market trends also shape buying behavior. Recommendations from peers, experts, and social media influencers can guide consumer choices, while lifestyle trends such as home entertaining or eco-consciousness drive demand for innovative, sustainable products. Stemware that aligns with current fashions in tableware or supports ethical values gains popularity among certain consumer groups.

Product Insights

Wine glasses accounted for a revenue share of 54.00% in the year 2024. Wine remains one of the most widely consumed alcoholic beverages globally, prompting both casual drinkers and connoisseurs to invest in appropriate glassware that enhances flavor and aroma. Manufacturers also capitalized on this trend by offering a wide range of wine glass designs tailored to different types of wine, from red and white to sparkling varieties. Moreover, the gift and luxury homeware markets increasingly featured wine glasses as elegant and functional products, further contributing to their substantial market share.

Champagne glasses are projected to grow at a CAGR of 6.1% over the forecast period of 2025-2030. As consumers become more inclined toward premium beverages for special occasions, the need for specialized glassware that enhances the visual appeal and effervescence of champagne has grown. Additionally, the expansion of the hospitality and event management industries, along with the influence of social media trends showcasing elegant table settings, is encouraging both individuals and businesses to invest in sophisticated stemware. Innovations in glass design and growing awareness of how proper glassware can elevate the drinking experience are further supporting this upward trend.

Distribution Channel Insights

Offline sales for stemware accounted for a revenue share of 74.16% in the year 2024. Stemware is often associated with aesthetics, quality, and fragility, prompting buyers to visit brick-and-mortar stores to assess the look, feel, and craftsmanship firsthand. Department stores, specialty homeware retailers, and luxury outlets continue to attract customers with curated displays, expert assistance, and immediate product availability. Furthermore, in-store shopping remains a dominant channel for gifting and wedding registries, where customers value personalized service and detailed product information. These factors collectively reinforced the strength of offline sales in the stemware industry.

Online sales for stemware are projected to grow at a CAGR of 6.2% over the forecast period of 2025-2030. As digital platforms continue to expand their reach and improve user experience, more customers are opting to shop online for home and lifestyle products, including glassware. The availability of a wide range of designs, competitive pricing, and detailed product reviews has made online shopping more appealing. In addition, advancements in packaging and logistics have reduced concerns over breakage during delivery. The growing influence of social media and home décor trends promoted by influencers also plays a role in boosting online purchases, especially among younger consumers who prioritize convenience and variety.

Application Insights

Residential application of stemware accounted for a revenue share of 80.94% in the year 2024, largely due to increased home dining and entertaining trends. As more people embraced at-home gatherings, especially in the post-pandemic era, there was a growing demand for stylish and functional stemware to enhance dining experiences. Consumers invested in quality glassware not only for practical use but also to complement home décor and reflect personal style. Additionally, the rise in online and offline retail availability made it easier for households to access a wide range of stemware options. Gift-giving occasions such as weddings, housewarmings, and anniversaries further contributed to higher residential purchases, solidifying this segment's dominant position.

Commercial application of stemware is projected to grow at a CAGR of 6.4% over the forecast period of 2025-2030. As dining and travel experiences become more focused on quality and presentation, businesses are increasingly investing in premium glassware to enhance customer satisfaction and brand image. The rise in global tourism, the reopening of event spaces, and the growing number of food and beverage establishments are key factors supporting this growth. In addition, commercial buyers often purchase in bulk and replace stemware regularly due to frequent use, contributing to sustained demand. The emphasis on creating upscale and immersive dining environments further fuels the need for elegant and durable stemware in the commercial space.

Regional Insights

The stemware industry in North America held 24.40% of the global revenue in 2024, driven by strong consumer spending, a well-established hospitality industry, and a growing culture of home entertaining. The region's preference for high-quality lifestyle and dining products encouraged demand for premium stemware across both residential and commercial sectors. In addition, the widespread availability of luxury and designer brands through both retail and online channels contributed to market growth.

U.S. Stemware Market Trends

The stemware industry in the U.S. accounted for a revenue share of 85% in the year 2024. The country’s mature hospitality industry, including a large number of upscale restaurants, hotels, and bars, created consistent demand for high-quality glassware. In addition, American consumers showed a growing preference for premium and aesthetically appealing home products, including stemware, which was further supported by a well-developed retail infrastructure and widespread access to global brands.

Europe Stemware Market Trends

Europe's stemware industry accounted for a revenue share of around 32% in the year 2024. Countries such as France, Italy, and Spain, known for their wine production and consumption, significantly influenced demand for high-quality stemware tailored to enhance the beverage experience. In addition, the presence of renowned glassware manufacturers and a preference for artisanal craftsmanship boosted the appeal of premium products.

Asia Pacific Stemware Market Trends

The Asia Pacific stemware industry is projected to grow at a CAGR of 5.1% from 2025 to 2030. As more consumers in countries such as China, India, and Southeast Asian nations embrace Western dining habits and fine dining culture, demand for elegant tableware, including stemware, is steadily increasing.

The growth of the hospitality and tourism sectors in the region further supports this trend, with restaurants, hotels, and event venues investing in quality glassware to enhance guest experiences.

Key Stemware Company Insights

The stemware market consists of both long-standing manufacturers and emerging brands that bring fresh design perspectives and adaptability. Leading companies prioritize innovation, craftsmanship, and material quality to meet evolving consumer preferences for both aesthetics and functionality. By aligning with major retail outlets and online marketplaces, these players leverage extensive distribution networks to strengthen brand presence and access diverse customer bases. Furthermore, strategic partnerships, along with scalable and flexible manufacturing processes, allow key market participants to cater to niche demands such as sustainable materials or specialized glassware for specific beverages and efficiently enter new and developing markets.

Key Stemware Companies:

The following are the leading companies in the stemware market. These companies collectively hold the largest market share and dictate industry trends.

- Tiroler Glashütte GmbH.

- Libbey

- Waterford

- Zwiesel Kristallglas AG

- Bormioli Luigi S.p.A.

- Bayerische Glaswerke GmbH

- Baccarat.

- Stölzle Lausitz

- Cristal d'Arques Paris.

- Glasvin

Recent Developments

-

In August 2024, Lucaris introduced its MUSE Collection in India, a set of premium lead-free crystalline wine glasses designed for luxury hotels. The collection features five types: Bordeaux, Burgundy, Cabernet, Chardonnay, and Sparkling. The glasses combine modern geometric design with functional shapes to enhance wine aroma and flavor. Developed with input from sommeliers, this collection targets the upscale hospitality market in India.

-

In November 2023, Thom Browne launched his first homeware collection in collaboration with French crystal maker Baccarat. The collection features handcrafted crystal pieces, including stemware, glassware, and scented candles, blending Browne’s modern style with Baccarat’s classic craftsmanship. Highlights include the reissued 1925 Yacht glass redesigned with Browne’s signature four-bar motif. These exclusive items are available on Thom Browne’s website and select stores.

Stemware Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.57 billion

Revenue forecast in 2030

USD 6.01 billion

Growth rate

CAGR of 5.6% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; South Africa

Key companies profiled

Tiroler Glashütte GmbH., Libbey, Waterford, Zwiesel Kristallglas AG, Bormioli Luigi S.p.A., Bayerische Glaswerke GmbH, Baccarat., Stölzle Lausitz, Cristal d'Arques Paris., Glasvin

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Stemware Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the stemware market on the basis of product, distribution channel, application, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Wine Glasses

-

Champagne Glasses

-

Cocktail Glasses

-

Martini Glasses

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Offline

-

Home Improvement Stores

-

Hypermarkets/Supermarkets

-

Specialty Stores

-

Others

-

-

Online

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global stemware market was estimated at USD 4.37 billion in 2024 and is expected to reach USD 4.57 billion in 2025.

b. The global stemware market is expected to grow at a compound annual growth rate of 5.6% from 2025 to 2030 to reach USD 6.01 billion by 2030.

b. Asia Pacific dominated the stemware market, with a share of 35.20% in 2024. The regional growth is driven by rising disposable income, changing consumer lifestyles, and increased wine consumption.

b. Some of the key players operating in the stemware market include Tiroler Glashütte GmbH., Libbey, Waterford, Zwiesel Kristallglas AG, Bormioli Luigi S.p.A., Bayerische Glaswerke GmbH, Baccarat., Stölzle Lausitz, Cristal d'Arques Paris., Glasvin

b. Growth of the global stemware market is majorly driven by the rising consumer interest in premium dining experiences and aesthetically refined table settings, which boosts the demand for elegant and high-quality glass stemware.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.