- Home

- »

- Clinical Diagnostics

- »

-

U.S. STI & Vaginitis PCR Testing Market Size Report, 2030GVR Report cover

![U.S. STI & Vaginitis PCR Testing Market Size, Share & Trends Report]()

U.S. STI & Vaginitis PCR Testing Market (2025 - 2030) Size, Share & Trends Analysis Report By Condition (Sexually Transmitted Infections (STIs), Vaginal Infections), By Test Type, By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-615-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. STI & Vaginitis PCR Testing Market Trends

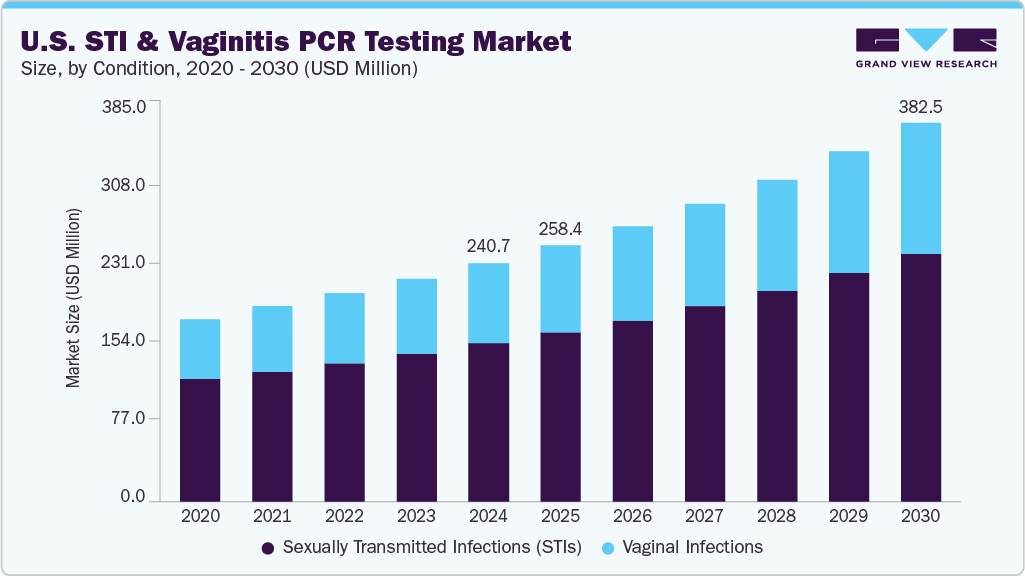

The U.S. STI & vaginitis PCR testing market size was estimated at USD 240.72 million in 2024 and is projected to grow at a CAGR of 8.2% from 2025 to 2030. The increasing prevalence of sexually transmitted infections and growing patient awareness are driving demand for advanced diagnostic tools. The Centers for Disease Control and Prevention (CDC) continues to report millions of new STI cases each year, with chlamydia, gonorrhea, and trichomoniasis among the most reported. This rise in infections has created a pressing need for early and accurate detection methods. Polymerase chain reaction (PCR) tests provide high sensitivity and specificity, offering a reliable alternative to traditional diagnostics. As patients and clinicians prioritize quick and accurate results, PCR testing is gaining widespread preference in urban populations, with better access to healthcare facilities and higher testing frequencies, further supporting market expansion. The gradual decline in stigma related to STI screening also plays a vital role in encouraging timely diagnosis.

The integration of PCR testing into routine gynecological and sexual health evaluations in clinics and hospitals is another key driver. Many healthcare providers now recommend regular testing for at-risk populations, enhancing demand for PCR-based solutions. The growing trend of point-of-care testing and at-home sample collection kits has made STI and vaginitis testing more convenient. These innovations support early detection and reduce barriers associated with clinic-based testing. As a result, diagnostic labs and biotech firms are investing in developing user-friendly, rapid PCR kits tailored for the U.S. market. Rising partnerships between diagnostic companies and telehealth platforms expand access to PCR testing services. Increased healthcare spending by private insurers and employers also supports wider adoption of advanced diagnostic technologies.

Technological advancements in multiplex PCR platforms are improving the efficiency of STI and vaginitis testing. These innovations allow the simultaneous detection of multiple pathogens from a single sample, reducing costs and turnaround time. Such developments are particularly valuable for managing co-infections, which are common among patients with STIs. Furthermore, ongoing research into microfluidic PCR devices and automated sample preparation enhances laboratory throughput. This progress benefits large diagnostic networks and independent U.S. labs facing rising testing volumes. The competitive landscape is also evolving, with leading players launching novel PCR assays targeting hard-to-detect organisms. As these advanced diagnostics become more accessible, the overall market will witness consistent revenue growth through 2030.

Trichomoniasis remains a significant concern, especially in women, with recent studies emphasizing its link to adverse pregnancy outcomes, prompting wider use of molecular testing. Herpes Simplex Virus (HSV-1 & HSV-2) continues to see widespread testing due to its recurrent nature and asymptomatic shedding, with new rapid PCR assays gaining FDA approval for quicker diagnosis. Human Papillomavirus (HPV) testing is essential for identifying high-risk strains linked to cervical and other cancers, as seen in the adoption of the latest FDA-approved HPV assays like Roche’s Cobas HPV test for early cancer screening. Syphilis and other STIs, though less common, are included in multiplex panels to ensure comprehensive detection and early intervention, with multiplex PCR panels recently validated in clinical studies for improved sensitivity.

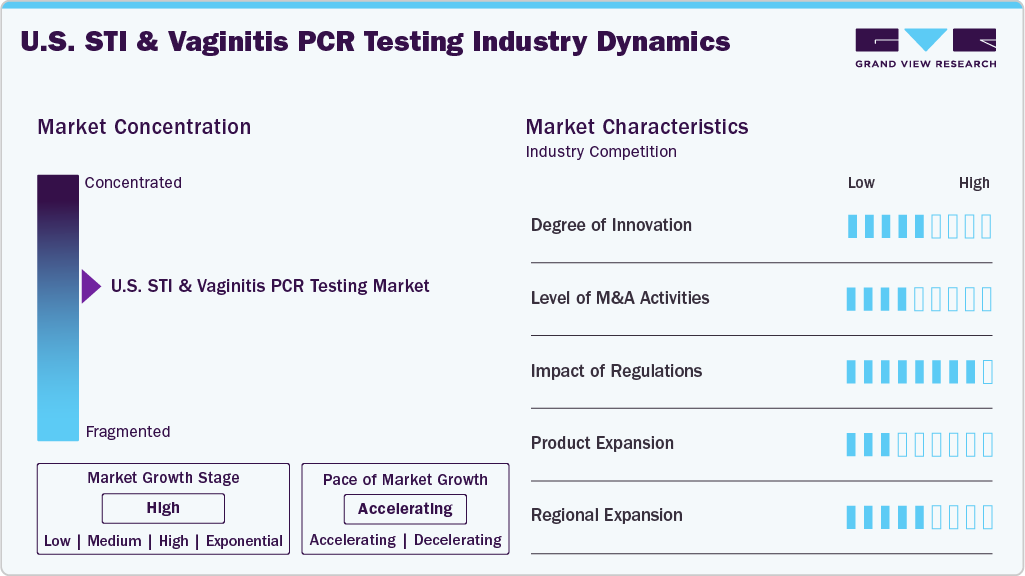

Market Concentration & Characteristics

The U.S. STI & Vaginitis PCR testing market shows moderate innovation driven by advancements in multiplex PCR and rapid point-of-care diagnostics. Companies are integrating AI-based interpretation tools and cloud-connected reporting to enhance clinical decision-making. Innovation also focuses on improving sample collection techniques, particularly for self-testing kits. Several players invest in automation to reduce turnaround time and increase laboratory efficiency. The pace of innovation is influenced by the demand for more accurate, non-invasive, and privacy-sensitive testing options.

Mergers and acquisitions are moderately active in the U.S. STI & Vaginitis PCR testing market, with larger diagnostic firms acquiring specialized molecular diagnostics companies. These activities aim to broaden assay portfolios and enhance technological capabilities. M&A deals often target companies with proprietary PCR platforms or unique detection panels. Consolidation is also driven by the need to improve market reach and scale operations across clinical labs and telehealth channels. While not saturated, the market has seen increased strategic acquisitions post-COVID-19 to strengthen diagnostic resilience.

Regulations significantly shape the U.S. STI & Vaginitis PCR testing market, especially through FDA approvals and CLIA certification requirements. Companies must navigate stringent validation standards to ensure diagnostic accuracy and reliability. Regulatory pathways for home-based or direct-to-consumer testing are evolving but remain tightly monitored. Recent changes supporting telehealth and remote diagnostics have slightly eased compliance burdens for digital health providers. However, new entrants still face considerable time and resource investments to meet all federal and state-level compliance mandates.

Product expansion in the U.S. market focuses on developing multi-pathogen panels that cover STIs and vaginitis-related pathogens in a single assay. Leading companies are introducing enhanced test kits with improved sensitivity and faster processing times. There is a growing emphasis on expanding test compatibility with automated laboratory platforms and digital health tools. Firms are also tailoring products to different user groups, including OB-GYN clinics and urgent care centers. This diversification fuels a broader product landscape and improves access to comprehensive sexual health diagnostics.

Companies in the U.S. STI & Vaginitis PCR testing market are expanding regionally to strengthen diagnostic access and service delivery. Hologic, Inc. focuses on the Northeast and Midwest through clinic and lab partnerships for its Aptima assays. BD is building testing infrastructure in Southern and Western states, often aligning with public health efforts. Roche and Abbott use broad lab networks to ensure coverage in urban hubs and rural communities. Cepheid, Seegene, QIAGEN, BioFire, Thermo Fisher, and Luminex extend reach via regional labs, urgent care centers, and academic partnerships across high-prevalence areas.

Condition Insights

The Sexually Transmitted Infections (STIs) segment dominated the market with the largest revenue share of 66.4% in 2024, driven by rising incidence rates, growing awareness, and expanding screening initiatives across the U.S. Increasing rates of infections such as chlamydia, gonorrhea, and syphilis are prompting healthcare providers to adopt advanced molecular diagnostics. According to the CDC’s 2023 STI Surveillance Report, Chlamydia accounted for over 1.6 million reported cases in the U.S., making it the most commonly reported notifiable disease. The shift toward early and accurate detection has strengthened the demand for STI-focused PCR panels. Growing educational efforts by healthcare organizations have enhanced public knowledge regarding the importance of regular testing. The integration of PCR testing into routine check-ups by primary care providers also supports segment dominance. Healthcare systems are focusing on minimizing false negatives through highly sensitive PCR tests, increasing preference among clinicians. High throughput capabilities and shorter turnaround times further contribute to the segment's leading position.

The vaginal infections segment is projected to grow at the fastest CAGR of 8.8% over the forecast period, fueled by increased diagnostic testing for recurrent and polymicrobial infections. The rising prevalence of bacterial vaginosis and vulvovaginal candidiasis among women is creating substantial demand for accurate and timely diagnosis. The ability of PCR tests to simultaneously detect multiple pathogens is improving clinical decision-making. Women’s health clinics and OB-GYN practices increasingly adopt molecular panels to reduce empirical treatment practices. For instance, In March 2023, BD (Becton, Dickinson, and Company) received expanded FDA clearance for its BD MAX Vaginal Panel, which demonstrated improved diagnostic performance for BV and VVC, reflecting growing regulatory support for PCR-based diagnostics. Hospitals, diagnostic laboratories, and OB/GYN clinics increasingly utilize these tools to guide precise treatment strategies and reduce recurrence. Enhanced patient awareness regarding chronic symptoms and treatment failures encourages more accurate testing methods. Continuous advancements in multiplex technology are expanding test menus and improving diagnostic performance. Broadening insurance coverage for molecular diagnostics is also influencing higher test adoption in this segment.

Test Type Insights

The STI PCR panels segment dominated the market with the largest revenue share of 66.4% in 2024, which can be attributed to their clinical accuracy, comprehensive pathogen detection, and high utilization in routine screenings. These panels offer simultaneous detection of multiple STIs with a single specimen, improving patient compliance and workflow efficiency. Laboratories and clinics increasingly favor these tests due to their speed, reliability, and ease of integration. Rising case numbers among high-risk groups, including sexually active young adults, are encouraging targeted PCR testing. Growing preference for syndromic testing strategies further boosts demand for comprehensive STI panels. Using automated PCR platforms in large diagnostic settings enhances throughput and test availability. Broad practitioner adoption across sexual health clinics reinforces the segment’s market dominance.

The vaginitis PCR panels segment is projected to grow at the fastest CAGR of 8.8% over the forecast period due to its capability to diagnose overlapping infections with high specificity. For instance, In November 2022, Cepheid announced the U.S. launch of the Multiplex Vaginal Panel (MVP), a rapid PCR test detecting 14 pathogens linked to vaginitis and vaginosis. The test delivers results in about 75 minutes using the GeneXpert system. This launch enhances diagnostic accuracy and speeds up clinical decision-making in women’s health. These panels detect bacterial, fungal, and protozoal pathogens in a single test, streamlining clinical workflows. Providers are increasingly moving away from traditional microscopy and culture methods for faster and more accurate molecular diagnostics. The rising demand for symptom-based diagnosis in women with recurrent infections supports growth. The convenience of sample collection and reduced need for follow-up visits is increasing patient adoption. Technological enhancements in panel design are making tests more cost-effective and accessible. Expanding women’s health-focused diagnostic services across outpatient and ambulatory settings further drives market growth.

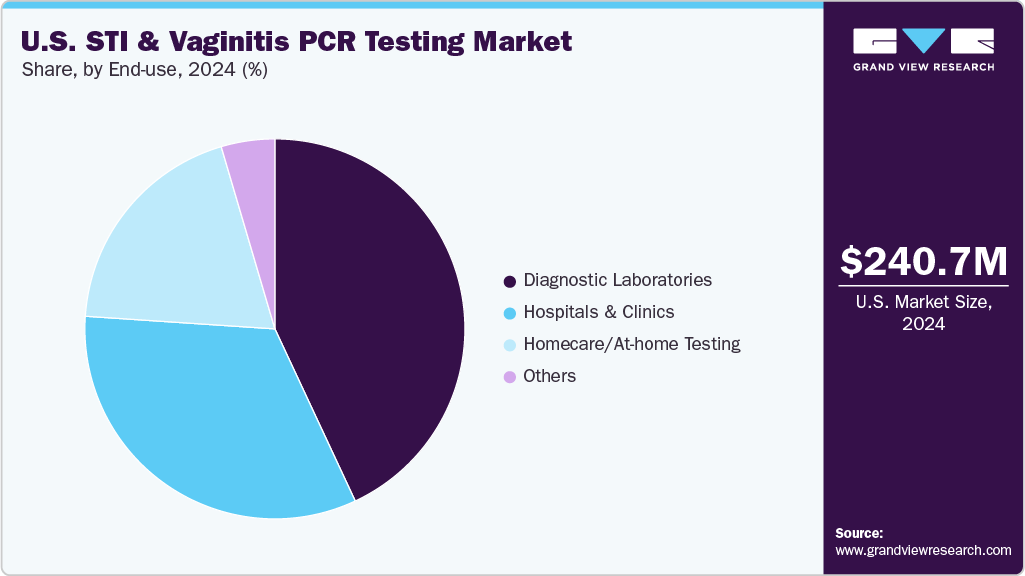

End Use Insights

The diagnostic laboratories segment dominated the market with the largest revenue share of 43.0% in 2024, driven by high sample processing volumes, advanced equipment, and robust PCR infrastructure. These facilities offer centralized testing services for hospitals, clinics, and private practices, ensuring efficiency and accuracy. Their ability to handle multiplex panels with high throughput supports the growing demand for STI and vaginitis diagnostics. Strategic partnerships with test manufacturers are facilitating faster deployment of new PCR technologies. These labs accreditation and quality assurance protocols ensure result consistency, encouraging clinician trust. Large reference laboratories are expanding service menus, integrating syndromic testing for improved patient outcomes. Their central role in national screening programs contributes to the segment's continued market leadership.

The homecare/at-home testing segment is projected to grow at the fastest CAGR of 9.0% over the forecast period, fueled by rising consumer demand for privacy, convenience, and remote access to healthcare services. Increased availability of self-collection kits for STI and vaginal infection testing is empowering individuals to seek timely diagnosis. Online platforms offering direct-to-consumer testing options are expanding rapidly across the U.S. Advancements in sample stabilization and logistics ensure accurate results from home-based collection. Rising digital engagement in healthcare supports the wider use of telehealth consultations and result interpretation. Patients seeking discretion in testing are increasingly relying on at-home solutions. Continued innovation in kit design and mobile integration is accelerating adoption within this segment.

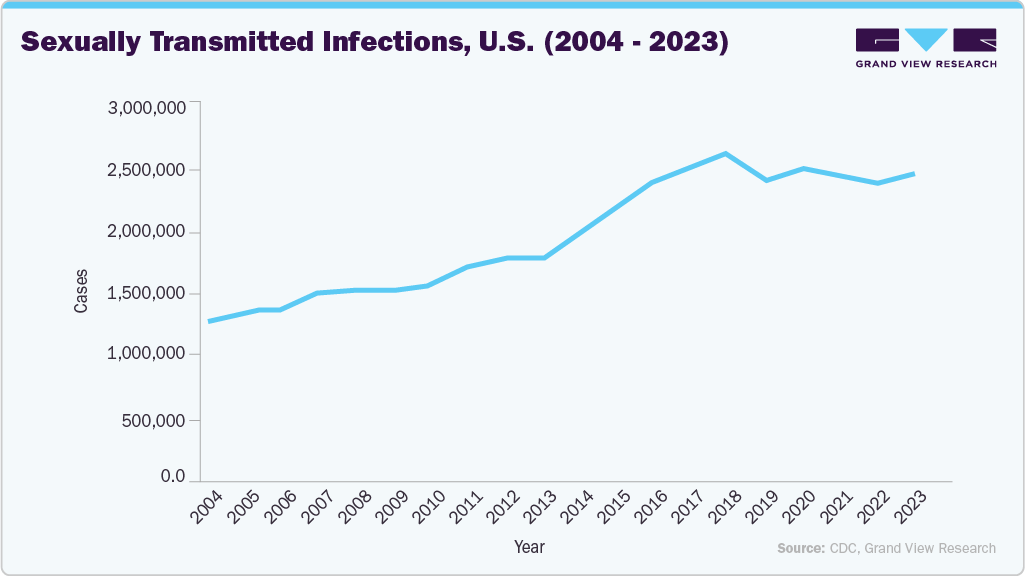

Sexually Transmitted Infections Cases (Chlamydia, Gonorrhea, Syphilis) in the U.S., 2004 - 2023

The reported cases of sexually transmitted infections (STIs), including chlamydia, gonorrhea, and syphilis, in the U.S. have increased significantly over the past two decades. From 2004 to 2023, reported infections rose by approximately 90%, reflecting a substantial public health concern. While the steady climb suggests a real increase in STI transmission, some may also be attributed to enhanced diagnostic tools, broader screening efforts, and more comprehensive reporting practices. Peaks around 2018 and continued high levels through 2023 indicate persistent STI prevention and control challenges. These trends underscore the need for sustained public health initiatives focused on education, early detection, and access to treatment. Continued surveillance and targeted interventions will be crucial to reversing this trajectory and protecting community health.

Key U.S. STI & vaginitis PCR testing Companies:

- Becton, Dickinson and Com (BD)

- F. Hoffmann-La Roche Ltd.

- Hologic, Inc.

- Abbott

- Danaher Corporation (Cepheid)

- Seegene Inc.

- bioMérieux (BioFire Diagnostics)

- QIAGEN

- Thermo Fisher Scientific, Inc.

- DiaSorin S.p.A (Luminex)

- R-Biopharm AG

- altona Diagnostics GmbH

- CERTEST BIOTEC.

Recent Developments

-

In February 2025, Roche launched CE-marked molecular point-of-care tests for STIs using the cobas liat system. The portfolio includes tests for chlamydia trachomatis/neisseria gonorrhoeae and trichomonas vaginalis, delivering results in about 20 minutes.

-

In May 2023, BD received FDA 510(k) clearance for its BD Vaginal Panel on the BD COR System, the first high-throughput test for infectious vaginitis. The test detects bacterial vaginosis, Candida species, and Trichomonas vaginalis from a single swab. It automates and scales molecular diagnostics, improving accuracy and lab efficiency.

U.S. STI & Vaginitis PCR Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 258.38 million

Revenue forecast in 2030

USD 382.50 million

Growth rate

CAGR of 8.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Condition, test type, end use.

Key companies profiled

Becton, Dickinson and Com (BD); F. Hoffmann-La Roche Ltd.; Hologic, Inc.; Abbott; Danaher Corporation (Cepheid); Seegene Inc.; bioMérieux (BioFire Diagnostics); QIAGEN; Thermo Fisher Scientific, Inc.; DiaSorin S.p.A (Luminex); Sansure Biotech Inc; R-Biopharm AG; altona Diagnostics GmbH; CERTEST BIOTEC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. STI & Vaginitis PCR Testing Market Report Segmentation

This report forecasts country revenue growth and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the U.S. STI & vaginitis PCR testing market report based on condition, test type, and end use.

-

Condition Outlook (Revenue, USD Million, 2018 - 2030)

-

Sexually Transmitted Infections (STIs)

-

Chlamydia

-

Gonorrhea

-

Trichomoniasis

-

Herpes Simplex Virus (HSV-1 & HSV-2)

-

Human Papillomavirus (HPV)

-

Syphilis

-

Other

-

-

Vaginal Infections

-

Bacterial Vaginosis

-

Vulvovaginal Candidiasis

-

Others

-

-

-

Test Type Outlook (Revenue, USD Million, 2018 - 2030)

-

STI PCR Panels

-

Vaginitis PCR Panels

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals and Clinics

-

Diagnostic Laboratories

-

Homecare/At-home Testing

-

Others

-

Frequently Asked Questions About This Report

b. The global U.S. STI & vaginitis PCR testing market size was estimated at USD 240.72 million in 2024 and is expected to reach USD 258.38 million in 2025

b. The global U.S. STI & vaginitis PCR testing market is expected to grow at a compound annual growth rate of 8.16% from 2025 to 2033 to reach USD 382.50 billion by 2030.

b. The Sexually Transmitted Infections (STIs) segment dominated the market with the largest revenue share of 66.4% in 2024, driven by rising incidence rates, growing awareness, and expanding screening initiatives across the U.S. Increasing rates of infections such as chlamydia, gonorrhea, and syphilis are prompting healthcare providers to adopt advanced molecular diagnostics.

b. Some key players operating in the U.S. STI & vaginitis PCR testing market include Hologic, Inc.; Becton, Dickinson and Company (BD); Roche Diagnostics; Abbott; Cepheid (Danaher Corporation); Seegene Inc; BioFire Diagnostics (bioMérieux); QIAGEN; Thermo Fisher Scientific, In; Luminex Corporation (DiaSorin)

b. Key factors that are driving the market growth include the increasing prevalence of sexually transmitted infections and growing patient awareness are driving demand for advanced diagnostic tools.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.