- Home

- »

- Medical Devices

- »

-

U.S. Tendon Repair Market Size, Share, Growth Report 2030GVR Report cover

![U.S. Tendon Repair Market Size, Share & Trends Report]()

U.S. Tendon Repair Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Bicep Tenodesis, Rotator Cuff Repair), By Product Type (Implants, Suture Anchor Devices), And Segment Forecasts

- Report ID: GVR-4-68039-955-1

- Number of Report Pages: 86

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

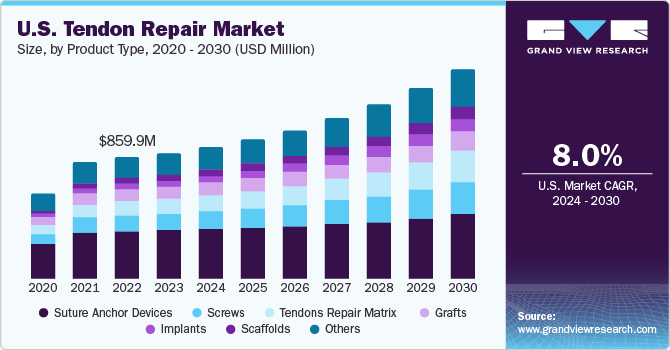

The U.S. tendon repair marke sizet was valued at USD 691.0 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 8.0% from 2024 to 2030. This can be attributed to the rising geriatric population, increasing demand for minimally invasive procedures, and the growing number of tendon-related injuries in sports & other events. In addition, the wear and tear of soft tissues in the elderly or geriatric population, resulting from weakened connective tissues, is anticipated to drive the market growth. Moreover, the increasing number of accidents, particularly road accidents, is further expected to propel the demand for soft tissue repairs, including tendon repair.

Rising adoption of orthopedic robotic platforms in hospitals further accelerated market expansion. For instance, in March 2022, SRV Hospital, with Lokmanya Hospital, Launched a new center for excellence in robotic orthopedics. The newly launched center is equipped with Smith+Nephew’s handheld robotic device for knee surgeries. In addition, several key players such as Smith & Nephew, Stryker, & DePuy Synthes are shifting focus and developing robotic surgery. For instance, in October 2022, THINK Surgical, a leader in orthopedic surgical robots, announced that KDB investment Global Healthcare Korea invested USD 100 million in THINK Surgical to allow faster launch of novel products.

Moreover, shifting landscape of demographics in the U.S., marked by a notable increase in overall life expectancy, is reshaping the healthcare landscape. One significant consequence is the steady growth of the geriatric population. As per the U.S. Census Bureau's 2022 data, approximately 56 million individuals fall within the geriatric demographic. Projections indicate that by 2030, this figure is expected to surpass 73.1 million. This demographic shift is poised to have profound implications on healthcare, particularly in musculoskeletal disorders.

Furthermore, technologies used in orthopedic surgery, especially for tendon and ligament repair, have been continuously improving. Manufacturers in the industry are constantly focusing on development of new and improved versions of existing technologies and improve surgical consequences to achieve durability of the surgical procedure.New technologies such as tissue grafting, use of scaffolds, and other tissue matrices for regeneration of native tissue are being successfully used to impart greater mobility & flexibility to the repaired limb.

Market Concentration & Characteristics

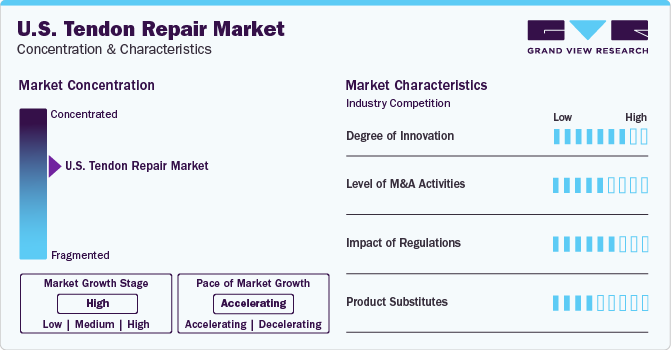

The U.S. tendon repair market is characterized by a high degree of innovation owing to the presence of key players operating in the field of tendon repair technologies that constantly focus on introducing and changing existing product lines that enhance patient outcomes and substantially increase the efficiency and effectiveness of healthcare in the U.S. For instance, in February 2022, Smith+Nephew launched next generation robotics system in Japan. Hand-held robotics platform, CORI Surgical System is set to further reduce time in robot assisted surgeries.

The U.S. market is also characterized by the leading players' high level of merger and acquisition (M&A) activity. Several market players such as CONMED Corporation, DePuy Synthes, Aevumed, Inc. and Smith+Nephew adopt this strategy to strengthen their position in the market. For instance, in February 2022, Stryker announced the acquisition of Vocera Communications, Inc. the acquisition is anticipated to add Vocera’s innovative and complementary portfolio to Strykers’s Advanced Digital Healthcare product line.

Key market players invest substantial resources in clinical trials and regulatory submissions to obtain regulatory approval for pipeline products. This may result in increasing the cost of developing novel tendon repair technologies. Presence of tight regulatory rules and documentation mandates is projected to hinder market expansion.

A limited number of product substitutes are available for tendon repairs. A wide range of synthetic prosthetic devices have been utilized as tendon and ligament tissue substitutes. This substitute has advantages linked to limited disease transmission, better host tissue integration, large-scale manufacturing, and controlled degradation. These products can be used as substitutes for tendon repairs in certain applications.

Application Insights

Rotator cuff repair segment held the largest revenue share of 37.6% in U.S. tendon repair in 2023, owing to a high incidence of rotator cuff injuries because of various physical activities. Sports players and athletes commonly suffer such types of injuries. For instance, according to statistics provided by Great Basin Orthopedics, around 200,000 people in the U.S. require surgery to repair rotator cuffs yearly. This signifies the growth potential of the market. Furthermore, introducing newer cuff rotator procedures is expected to facilitate surgery rates, thereby reducing invasion and surgery time. For instance, in February 2022, UAB Orthopedics introduced a newer approach to rotator cuff repair by launching the subacromial balloon spacer procedure. With this procedure, patients can safely rehabilitate their shoulders with the help of physical therapy.

Achilles tendinosis repair segment is expected to witness the fastest growth rate over the forecast period. The Achilles tendon has become a major concern for athletes and other active individuals with chronic conditions. Thus, managing and repairing this condition is important to avoid complications like tendon rupture and chronic pain. Healthcare organizations, hospitals, and manufacturers in the tendon repair market are taking collaborative measures to tackle the situation. For instance, in October 2022, physiatrists in the Department of Rehabilitation Medicine and surgeons at HHS at Weill Cornell Medicine collaborated to manage Achilles tendinopathies, offering proper diagnosis and surgical & nonsurgical treatment options for tackling this condition. In addition, in March 2022, Acumed LLC, using Acu-Sinch Knotless technology, launched Ankle Syndesmosis Repair System to stabilize injuries or laxity in the tibiofibular syndesmosis.

Product Type Insights

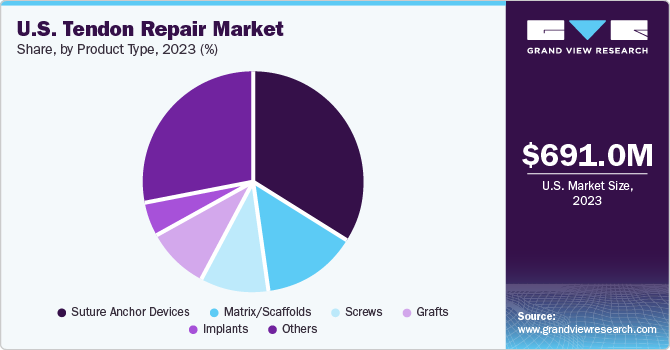

Suture anchor devices segment dominated the market regarding revenue share in the U.S. tendon repair market in 2023. The segment's dominance is due to the increasing use of anchor devices in tendon repair surgeries. They are a primary choice in arthroscopy procedures due to their higher strength. Suture anchors can be knotless or knotted based on the type of injury used. Moreover, key players are focusing on developing sutures to provide better surgical procedures to the target population. For instance, in September 2022, Mesh Suture, Inc. received FDA approval for a non-absorbable polypropylene mesh suture, which can be used for soft tissues, including tendons, ligaments, fascia, and muscles.

Implants segment is expected to show the fastest growth rate over the forecast period. The growth of the tendon implants market is due to increased sports injuries and a rise in the geriatric population. Implants are routinely preferred over allografts and autografts because use of implants is usually associated with faster recovery time, lesser compatibility issues, and reduced surgical procedure time. Moreover, increasing demand for tendon repair techniques is further propelling the need to introduce and develop newer products by key manufacturing with high mechanical capabilities. In January 2023, Arthrex, Inc. received FDA approval for an ACL TightRope implant used in the surgical treatment of orthopedic injuries for pediatric use. Furthermore, the increasing research on tendon repair techniques and solutions has made them more accessible to patients.

Key Companies & Market Share Insights

Some of the key players operating in the market include Integra LifeSciences; Stryker, Smith+Nephew; and Arthrex, Inc.

-

Integra LifeSciences offers products for foot & ankle, hand & wrist, spine, elbow, shoulder, tendon & peripheral nerve repair & protection along with neurosurgery implants & devices

-

Smith+Nephew is a MedTech company specializing in innovative solutions pertaining to repair and regeneration of soft & hard tissue. The company’s product portfolio includes orthopedic reconstruction, sports medicine, endoscopy, advanced wound management & trauma extremities, and fixation segments

-

TendoMend, CONMED Corporation, BioPro, Inc. are some of the emerging market participants in the U.S market.

-

TendoMend is focused on developing minimally invasive implants and deployment systems to replace traditional tendon repair procedures

- BioPro, Inc. manufactures joint replacements and delves into research by partnering with orthopedic & podiatric surgeons to design new implants & improve the efficiency of the existing models

Key U.S. Tendon Repair Companies:

- Stryker

- Arthrex, Inc.

- CONMED Corporation

- Integra LifeSciences

- Smith+Nephew

- TendoMend

- Alafair Biosciences

- MiMedx

- DePuy Synthes, Inc.

- BioPro, Inc.

- Parcus Medical (Anika Therapeutics, Inc.)

- Aevumed, Inc.

- Amniotics AB

- BioTissue

Recent Developments

-

In March 2023, Smith+Nephew introduces its new UltraTRAC QUAD ACL Reconstruction System. The new technique includes the X-WING Graft Preparation System, ULTRABUTTON Adjustable Fixation Devices, and the latest QUADTRAC Quadriceps Tendon Harvest Guide System. This launch is expected to expand the company’s abilities in addressing surgeon graft preference

-

In November 2022, Arthrex, Inc., announced partnership with Richard Wolf, a global leader offering minimally invasive surgical solutions and technology. The partnership is aimed at expansion of Arthrex’s gynecology, general surgery, and urology offerings

-

In August 2022, CONMED Corporation announced the acquisition of Biorez, Inc. This acquisition aims to upgrade CONMED’s product portfolio by including Biorez’s BioBrace Implant technology

U.S. Tendon Repair Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 1.15 billion

Growth rate

CAGR of 8.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, product type

Country scope

U.S.

Key companies profiled

Stryker, Arthrex, Inc.; CONMED Corporation; Integra LifeSciences; Smith+Nephew; TendoMend; Alafair Biosciences; MiMedx; DePuy Synthes, Inc.; BioPro, Inc.; Parcus Medical (Anika Therapeutics, Inc.); Aevumed, Inc.; Amniotics AB; BioTissue.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Tendon Repair Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the U.S. tendon repair market on the basis of application and product type:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Rotator Cuff Repair

-

Achilles Tendinosis Repair

-

Cruciate Ligament Repair

-

Bicep Tenodesis

-

Others

-

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Implants

-

Suture Anchor Devices

-

Grafts

-

Matrix/Scaffolds

-

Tendon Repair

-

Tendon Protection Matrix/Scaffolds

-

-

Screws

-

Others

-

Frequently Asked Questions About This Report

b. Major players in the market include, Stryker Corporation, Arthrex, Inc., CONMED Corporation, Integra LifeSciences, Smith+Nephew, TendoMend, Alafair Biosciences, and MIMEDX

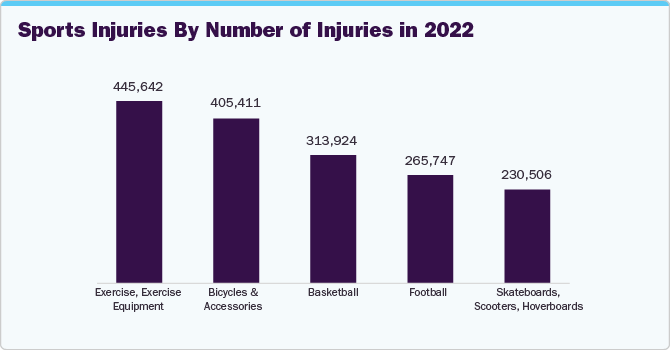

b. The market growth can be attributed to the rapidly growing geriatric population and soft tissue injuries related to advancing age. In addition, the increase in sports related injuries has also contributed significantly to the propulsion of the tendon repair market in the U.S.

b. The U.S. tendon repair market size was estimated at USD 691.0 million in 2023 and is expected to reach USD 723.0 million in 2024.

b. The U.S. tendon repair market is expected to grow at a compound annual growth rate of 8.0% from 2024 to 2030 to reach USD 1.15 billion by 2030.

b. The largest product category as of 2023 was suture anchor devices, with a revenue share of 34.1%. These are increasingly preferred due to their strength of fixation as well as rigidity and support they provide to the injury site.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.