- Home

- »

- Advanced Interior Materials

- »

-

U.S. Terrazzo Market Size, Share & Growth Report, 2030GVR Report cover

![U.S. Terrazzo Market Size, Share & Trends Report]()

U.S. Terrazzo Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Cement (Sand Cushion, Bonded, Monolithic, Polyacrylate, Rustic), Epoxy), By Application, And Segment Forecasts

- Report ID: 978-1-68038-946-3

- Number of Report Pages: 162

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

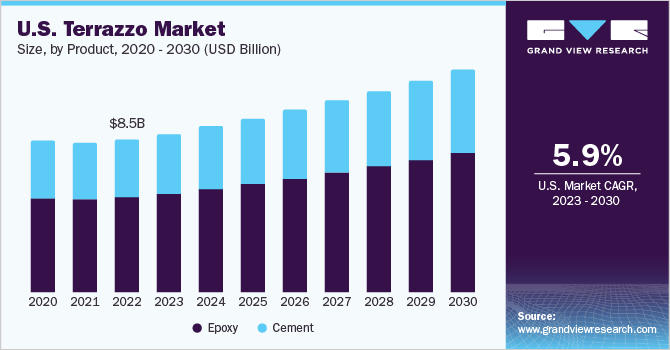

The U.S. terrazzo market size was estimated at USD 8.50 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.9% from 2023 to 2030. The market is anticipated to be driven on account of the high-performance characteristics of terrazzo, which include high durability, easy maintenance, impact resistance, negligible bacteria growth, and higher stain resistance. The COVID-19 pandemic severely impacted U.S. trade and restricted the growth of the construction industry. The unavailability of labor, funds, and raw materials were the primary factors affecting the construction industry, thus hampering market growth. However, the market is expected to advance at a faster pace with a high recovery rate in the country.

The U.S. government announced a COVID-19 relief stimulus of USD 1.9 trillion in January 2021, which is expected to aid the market recovery. Moreover, the steady growth of small market players in terrazzo products is anticipated to drive the terrazzo market in the U.S. over the forecast period.

The demand for terrazzo is anticipated to surge from the housing industry of the U.S. in the coming years, owing to its strong anti-slip characteristics and scratch-resistant properties. The rising number of single-family homes and the growing consumer disposable income in the country are among several factors that are expected to fuel the usage of terrazzo in residential buildings in the U.S.

Increasing consideration given to green credentials such as Leadership in Energy and Environmental Design (LEED) in green homes, new construction, retail offices, hospitals, and schools in the U.S. owing to their ability to retain desired temperatures fuels the demand for green floors and green interiors such as terrazzo that are durable and use recycled materials.

Ceramic tile flooring is a major competitor for terrazzo flooring. The costs of ceramic tiles are lower than terrazzo. The increased prices of terrazzo materials, tools, and labor lead to high installation costs. The cost of this flooring can vary significantly based on the type of aggregate chosen by customers. Simple stone aggregates are reasonably priced. Technological advancements in the flooring industry have led to the development of next-generation flooring systems, including terrazzo, that are witnessing surged demand in the U.S. owing to their unique long-lasting design & finishing, chemical resistance, and low maintenance costs.

Product Insights

The epoxy product segment led the market and accounted for over 66.3% share of the total revenue in 2022. Epoxy terrazzo flooring systems are more durable and sustainable than cement terrazzo floors due to advancements in technology and the introduction of polymers. These are favored by construction professionals for meeting their sustainability and design goals.

Cement terrazzo contains a cement matrix and includes a variety of terrazzo systems, including rustic, sand cushion, bonded, monolithic, and polyacrylate. These systems are typically thicker and heavier than their epoxy counterparts due to the use of a cement-based mix with incorporated aggregates. Bonded terrazzo is anticipated to gain importance in areas where customers require a marble-like glossy effect. The reusability & recyclability of the product is anticipated to fuel its demand in the near future.

Monolithic terrazzo is a combination of marble chips, Portland cement, and water that is designed to be directly bonded to or integrated with a prepared concrete slab. This terrazzo type is often used in large areas such as schools and offices.

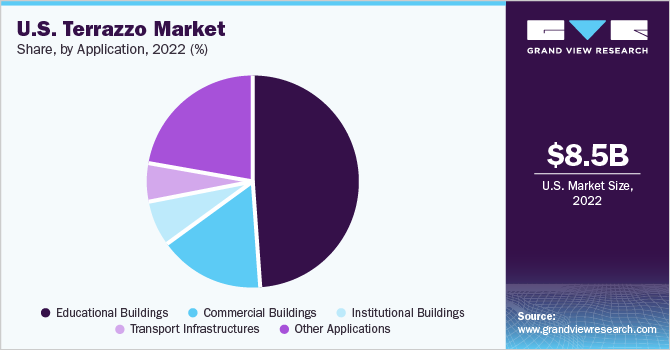

Application Insights

The educational buildings application segment led the market and accounted for more than 48.7% share of the total revenue in 2022. An increase in the number of universities, educational institutions, schools, and auditoriums in the U.S. is projected to be a key factor for the growing penetration of terrazzo in the country’s educational buildings.

A surge in construction and renovation activities, along with increased retrofitting of institutional buildings in the U.S., is expected to contribute to a rise in demand for terrazzo flooring products in the country over the forecast period. In addition, increased emphasis on the use of green and eco-friendly terrazzo flooring is anticipated to lead to the growth of the market in the U.S.

The increasing construction of retail outlets for automobiles, fashion brands, lifestyle brands, etc. has contributed to the growth of the terrazzo market in the U.S. The designs of commercial buildings in the country are anticipated to witness continuous changes. This is expected to lead to changes in the flooring designs of these buildings during the forecast period.

Terrazzo is a perfect solution for transportation environments as it brightens the building area, adds interest, and provides the durability required to handle heavy pedestrian traffic at high-footfall places. Increasing investments in transport infrastructures in the U.S., owing to rapid urbanization, are expected to contribute to the strong demand for terrazzo in the country over the forecast period.

Key Companies & Market Share Insights

Players operating in the U.S. market for terrazzo compete largely based on product quality, customer service, and product pricing. However, product quality is considered the fundamental competing element by market players. Customer service is seen to be the most influential aspect for the players to maintain competition. To meet the growing demand for terrazzo, prominent companies in the U.S. are working on creating a robust distribution network.

Technical advancements and improvements in the terrazzo production process have resulted in better durability, bespoke colors, and low maintenance requirements for terrazzo products. Product advantages over other forms of flooring include elegance and high-end aesthetics, which have increased market competition globally. Numerous domestic and foreign players are striving for dominance in the market. Some of the prominent players in the U.S. terrazzo market include:

-

Terrazzo USA

-

Master Terrazzo Technologies Inc.

-

Doyle Dickerson Terrazzo, Inc.

-

The Venice Art Terrazzo Co., Inc.

-

Krez Group, Inc.

-

Terrazzo and Marble Supply

-

Klein & Co. Terrazzo

-

Concord Terrazzo Company, Inc.

-

American Terrazzo

-

RBC Industries, Inc.

-

F & M Tile & Terrazzo Co., Inc.

-

Angelozzi Terrazzo

-

Key Resin Company

-

EnviroGLAS Products, Inc.

U.S. Terrazzo Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 13.47 billion

Growth rate

CAGR of 5.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Volume in million square feet, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Country scope

U.S.

Segments covered

Product, application

Key companies profiled

Terrazzo USA; Master Terrazzo Technologies Inc.; Doyle Dickerson Terrazzo, Inc.; The Venice Art Terrazzo Co., Inc.; Krez Group, Inc.; Terrazzo and Marble Supply; Klein & Co. Terrazzo; Concord Terrazzo Company, Inc.; American Terrazzo; RBC Industries, Inc.; F & M Tile & Terrazzo Co., Inc.; Angelozzi Terrazzo; Key Resin Company; EnviroGLAS Products, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Terrazzo Market Report Segmentation

This report forecasts revenue and volume growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. terrazzo market report on the basis of product and application:

-

Product Outlook (Volume, Million Square Feet; Revenue, USD Million, 2018 - 2030)

-

Cement

-

Sand Cushion

-

Bonded

-

Monolithic

-

Polyacrylate

-

Rustic

-

Epoxy

-

-

Application Outlook (Volume, Million Square Feet; Revenue, USD Million, 2018 - 2030)

-

Educational Buildings

-

Commercial Buildings

-

Institutional Buildings

-

Transport Infrastructures

-

Other Applications

-

Frequently Asked Questions About This Report

b. The U.S. terrazzo market size was estimated at USD 8.50 billion in 2022 and is expected to reach USD 8,931.1 million in 2023.

b. The U.S. terrazzo market is expected to grow at a compound annual growth rate of 5.9% from 2023 to 2030 to reach USD 13.47 billion by 2030.

b. Epoxy product segment dominated the U.S. terrazzo market with a share of 66.3% in 2022. These flooring systems are more durable and sustainable than cement terrazzo floors due to advancements in technology and the introduction of polymers. These are favored by construction professionals for meeting their sustainability and design goals.

b. Some key players operating in the U.S. terrazzo market include Terrazzo USA; Master Terrazzo Technologies Inc.; Doyle Dickerson Terrazzo, Inc.; The Venice Art Terrazzo Co., Inc.; Krez Group, Inc.; Terrazzo and Marble Supply; Klein & Co Terrazzo; Concord Terrazzo Company, Inc.; American Terrazzo; RBC Industries, Inc.; F & M Tile & Terrazzo Co., Inc.; Angelozzi Terrazzo; Key Resin Company Key Resin Company; EnviroGLAS Products, Inc.

b. Key factors that are driving the U.S. terrazzo market growth include rising demand from end-use segments such as educational and commercial on account of its high-performance characteristics such as high durability, impact resistance, and negligible bacteria growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.